Hey there! It's not uncommon to find ourselves in a pinch when it comes to managing our finances, especially when unexpected circumstances arise. If you're currently facing a delay in your salary and are considering an extension on your loan, you're not aloneâmany people navigate these tricky waters. In this article, we'll explore helpful templates and tips on how to effectively communicate with your lender to request a salary loan extension. Join us as we dive into the essentials of crafting the perfect letter!

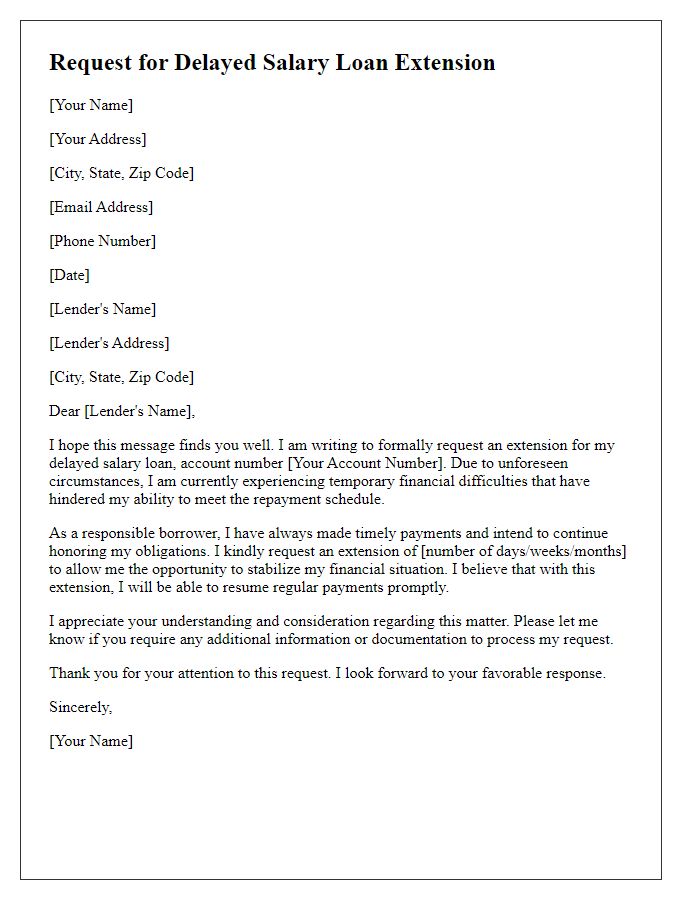

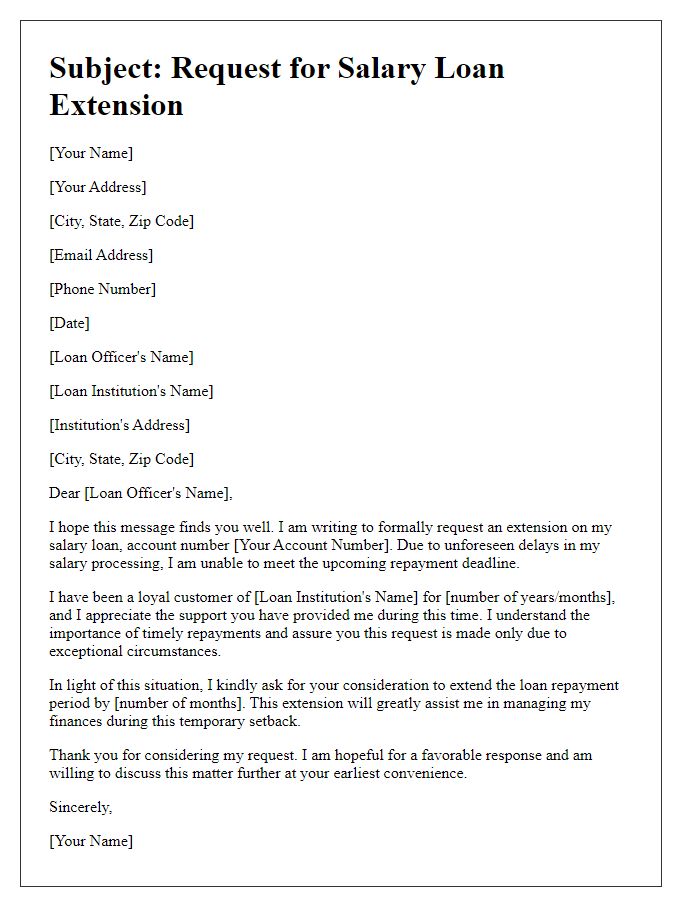

Reason for delay

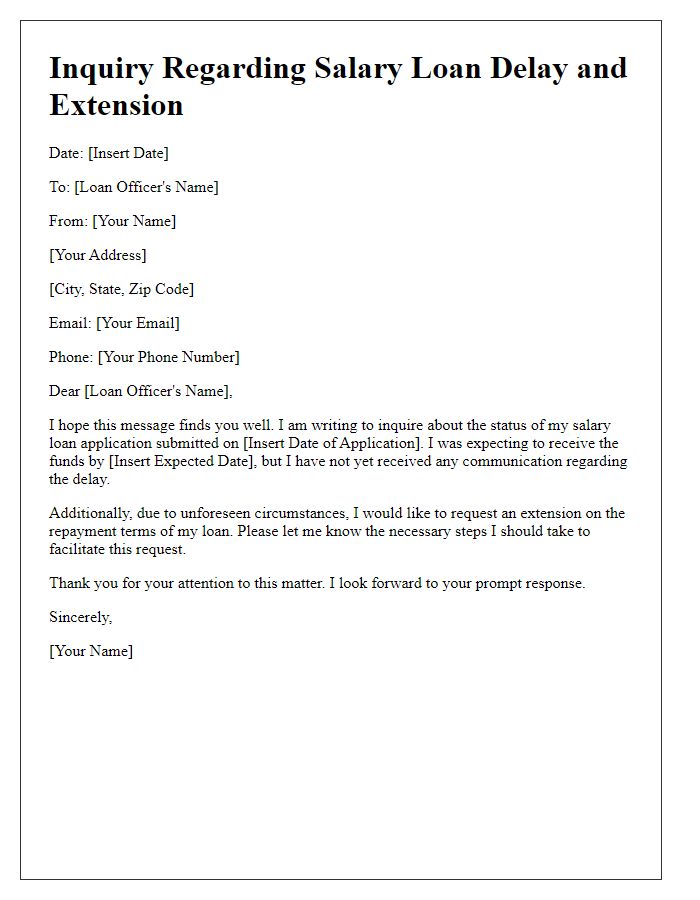

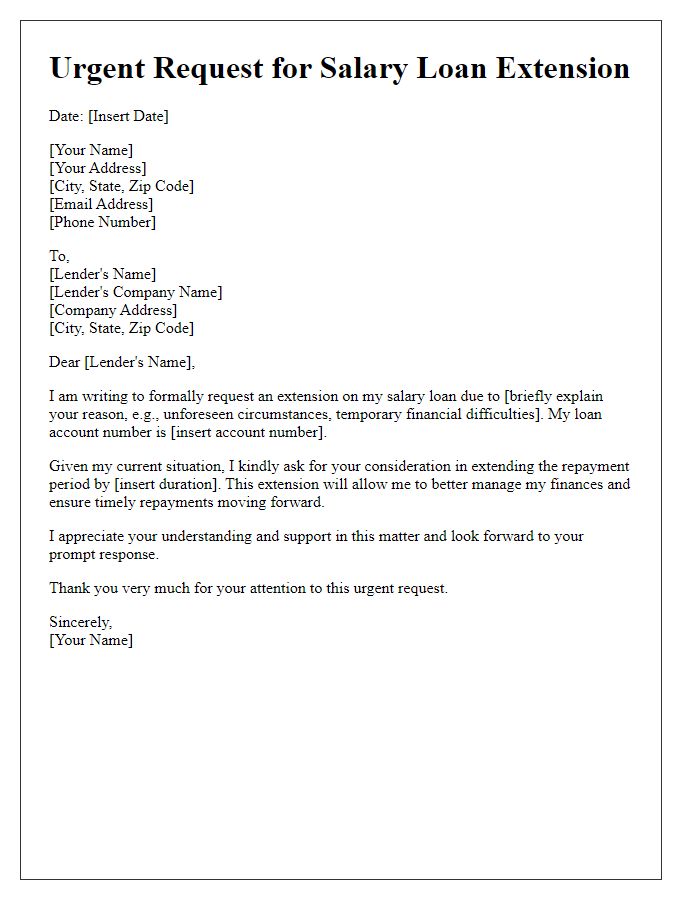

Delayed salary loan extensions often occur due to a variety of factors impacting the financial institution or the borrower. Common reasons for such delays include systemic issues within the payroll department, such as changes in processing software or personnel turnover, which can lead to missed deadlines. Economic downturns may also affect the borrower's employer, causing temporary cash flow issues that result in delayed salary payments. Additionally, unexpected personal emergencies, such as medical expenses or family situations, can hinder the borrower's ability to maintain timely payments. Communication breakdowns between the borrower and the lender regarding requirements for documentation or verification can further complicate the loan process, leading to additional delays in the extension.

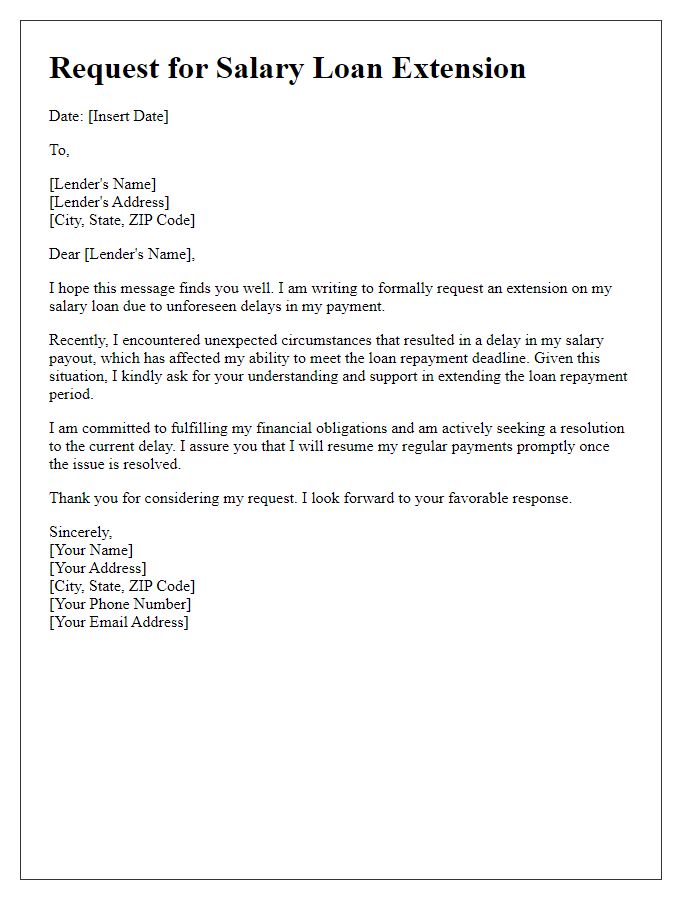

Apology statement

Certain circumstances can lead to a delay in salary disbursement, impacting loan repayments. Employees facing this issue may experience financial strain and stress. Organizations often provide an extension on loan repayment deadlines to alleviate these pressures. However, this requires a formal apology targeting the affected parties, acknowledging challenges, and articulating a proposed timeline for resolution. It is crucial to include details such as the specific loan amount, interest rates, and new repayment schedule to ensure transparency and trust in communication. Providing reassurance of future timely payments can also foster confidence in the employer's capabilities.

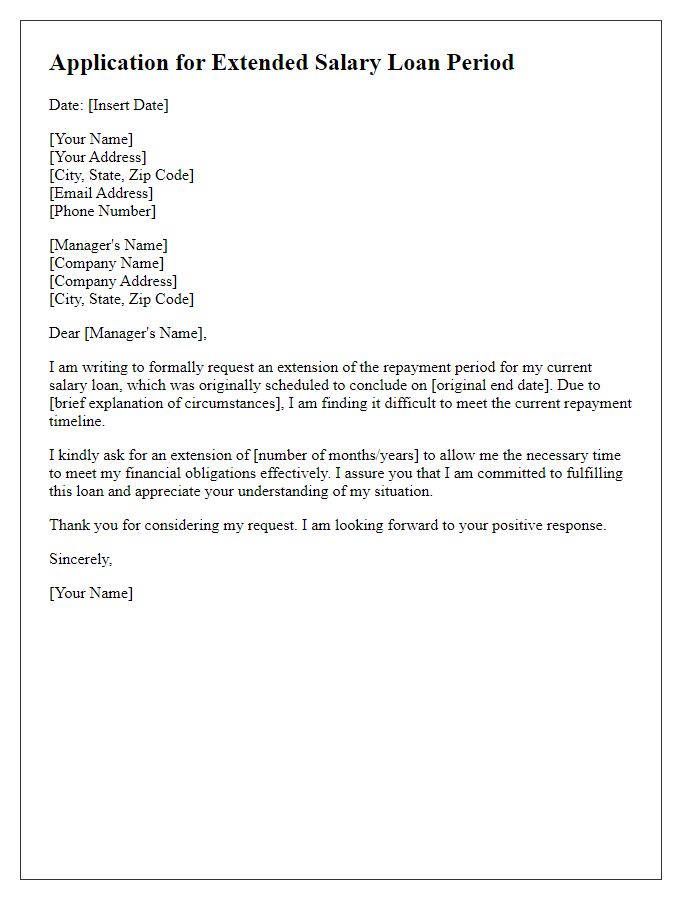

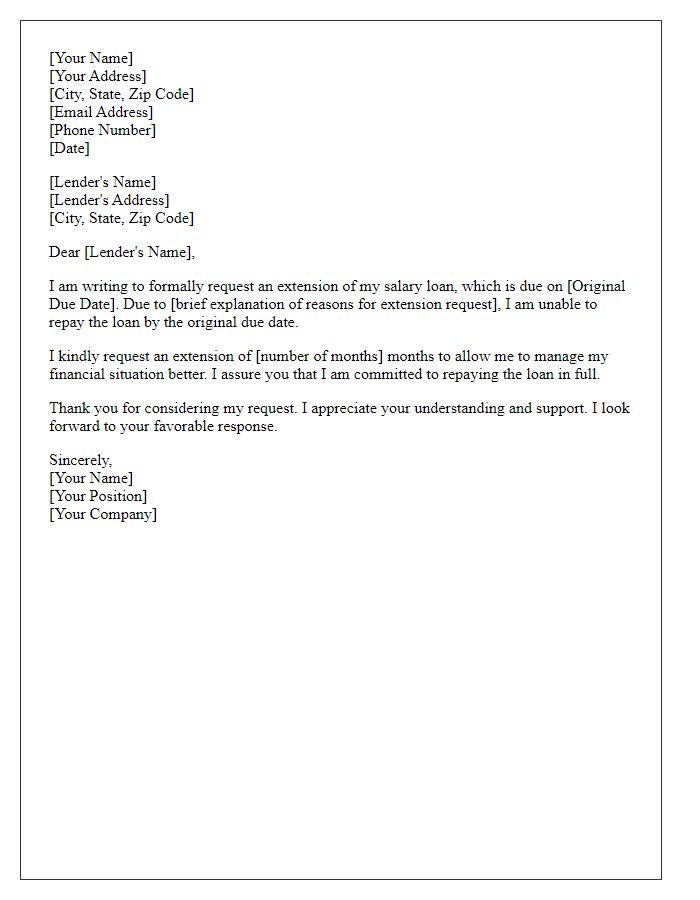

Request for extension

Delayed salary payments can significantly impact financial stability. Employees facing this issue may seek assistance through loan extensions to manage their obligations. Financial institutions often provide options for extending repayment periods, alleviating immediate pressure. Documentation such as recent pay stubs from employers, including detailed salary information, can support the request. Communication with bank representatives should be clear, emphasizing the reason for delay, which may include company financial difficulties or administrative errors. Timely discussions can foster favorable outcomes, ensuring continued access to necessary funds without further penalties or interest hikes.

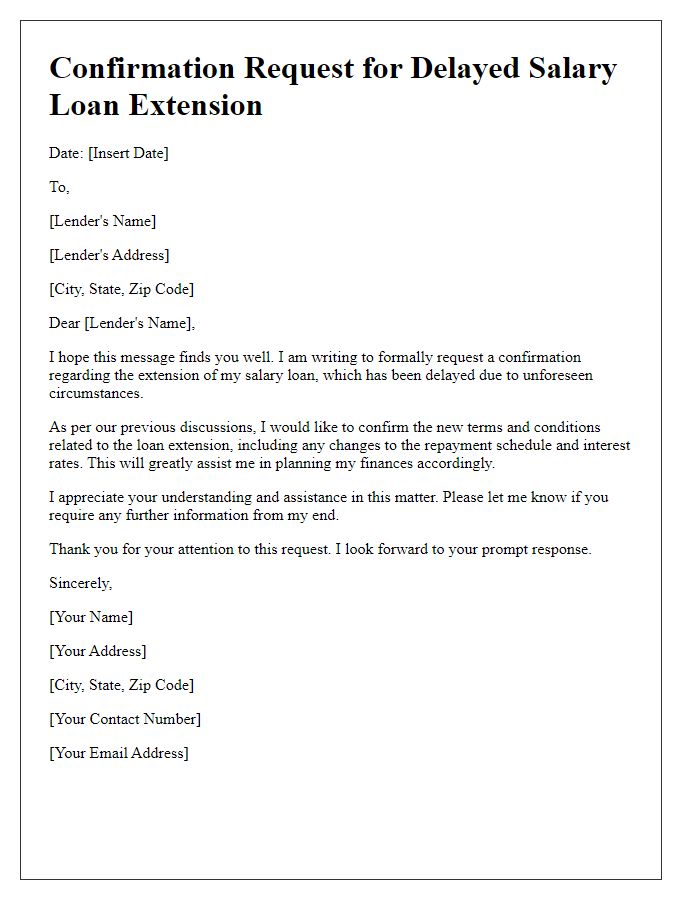

Proposed new payment date

Workers facing delays in salary disbursement often seek extensions on loan payments to manage financial stress. Delayed salary payments, particularly in sectors like manufacturing or services, can lead to the need for a loan extension, typically associated with short-term financial assistance. Borrowers may propose a new payment date, often a few weeks to a month later, depending on the employer's assurance regarding salary timelines. Financial institutions may require documentation evidencing the delay, along with a detailed repayment plan. This extension not only helps maintain credit scores but also alleviates immediate financial burdens during the waiting period for expected income.

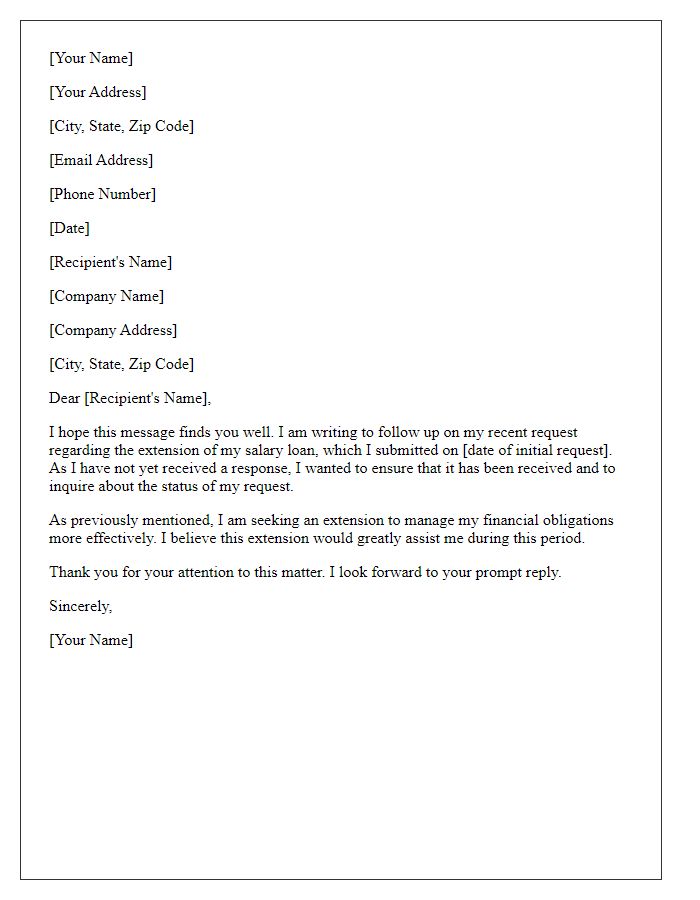

Contact information for follow-up

Salary loan extensions often become necessary due to unforeseen circumstances affecting financial stability. It is advisable to gather pertinent information such as the loan account number to streamline communication with the lender. Collect documentation detailing the reasons for the extension request, including recent pay stubs showcasing salary changes or unexpected expenses, like medical bills or repairs. Effective contact methods include verified email addresses and direct phone numbers to ensure prompt responses from loan processing representatives. Maintaining an organized record of correspondence can facilitate efficient follow-up and expedite the loan extension process.

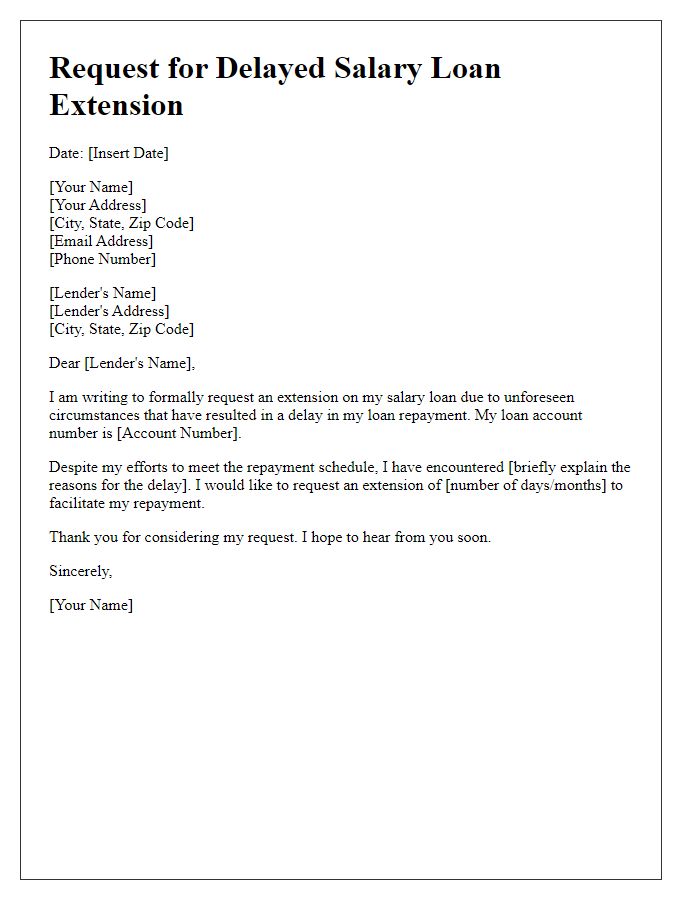

Letter Template For Delayed Salary Loan Extension Samples

Letter template of explanation for salary loan extension due to pay delay

Comments