Are you in the process of revising your loan application and feeling a bit overwhelmed? You're not alone; many people face this challenge, and a well-crafted letter can make all the difference. In this article, we'll explore effective strategies for drafting a compelling loan application revision letter that showcases your financial needs clearly and professionally. So, let's dive in and discover how you can enhance your chances of approval!

Applicant's Information

An applicant's information is a crucial aspect of a loan application revision process. This section typically includes personal details such as the applicant's full name, which is essential for identification purposes. Date of birth, which may be examined to determine age eligibility, often follows. Contact details, encompassing phone number and email address, serve as primary communication channels for lenders. Current residential address is vital for verifying identity and assessing credit risk. Additionally, employment information detailing the applicant's current job title and income level provides insight into financial stability and ability to repay the loan. Financial history, often underscored by credit scores, also plays a key role in loan approval decisions, ensuring lenders have a comprehensive understanding of the applicant's fiscal responsibility.

Clear and Concise Subject Line

A clear and concise subject line for a loan application revision could include essential details such as the type of loan, the applicant's name, and the reason for the revision. For example: "Revision Request for Personal Loan Application - John Doe - Additional Documents Required." This subject line captures the key information, allowing the recipient to quickly identify the purpose of the email, ensuring swift action on the revision process. Including relevant details enhances communication efficiency, facilitating a better response from the lender.

Reason for Revision Request

A revision request for a loan application typically arises from a need to clarify financial metrics, such as annual income (e.g., $75,000), existing debt ratios (e.g., 30% debt-to-income ratio), or changes in personal financial circumstances, such as job loss or unexpected expenses (e.g., medical bills). Additionally, this request can occur due to inaccuracies in documentation, such as discrepancies in credit reports (e.g., FICO score adjustments) or missing paperwork (e.g., W-2 forms) that could impact the approval process. It is crucial to address these revisions promptly to ensure a favorable consideration by lending institutions like banks, credit unions, or mortgage companies, which often require specific documentation to facilitate the loan approval process, such as proof of assets, income verification, and loan history records.

Updated Financial Information

Updated financial information is crucial for a comprehensive loan application revision. Applicants typically need to provide recent income statements, including monthly salaries, bonuses, and any other sources of income, such as rental income or investments. Updated credit scores from agencies like Experian or Equifax are essential as they reflect the applicant's current borrowing capacity. Additionally, a detailed list of outstanding debts, including mortgage balances, car loans, and credit card debt, helps lenders assess financial stability. Changes in employment status, such as new job positions or shifts in hours, alongside relevant financial documents like tax returns, can significantly impact the loan approval process. Ensuring accuracy and transparency in this information fosters lender trust and increases the likelihood of favorable loan terms.

Supporting Documentation Information

A loan application revision often requires comprehensive supporting documentation to demonstrate financial stability and repayment ability. Essential documents typically include recent pay stubs (within the last 30 days) from employers, official tax returns (last two years) showcasing income, bank statements (last three months) reflecting savings and transactions, and a detailed list of monthly expenses that outlines financial commitments. Additionally, a current credit report can provide insight into creditworthiness, while identification such as a government-issued ID helps verify personal details. Other critical documents might include property appraisals or purchase agreements for secured loans like mortgages, highlighting the property's value and collateral for the debt.

Letter Template For Loan Application Revision Samples

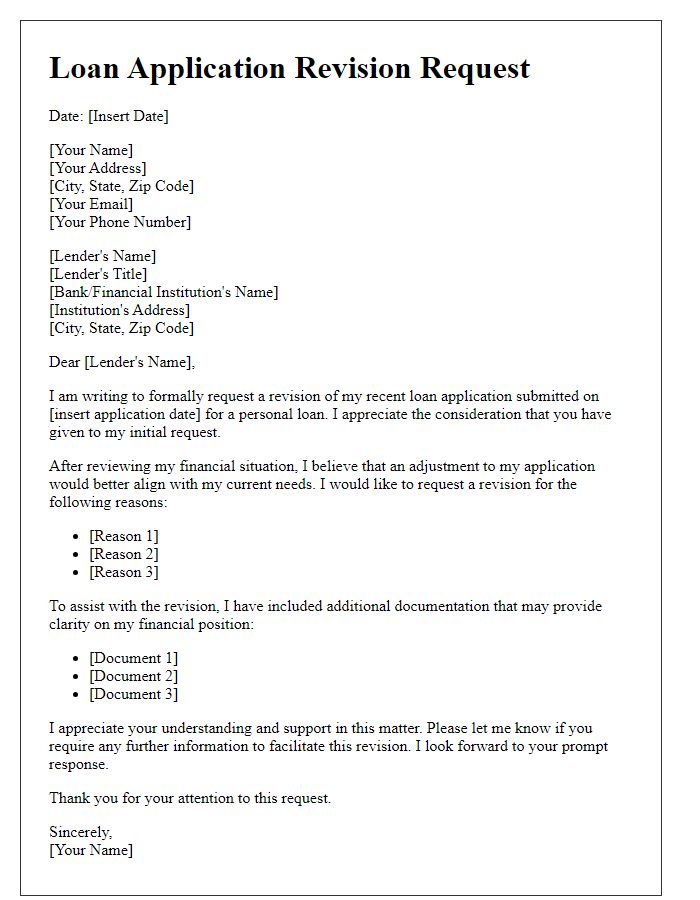

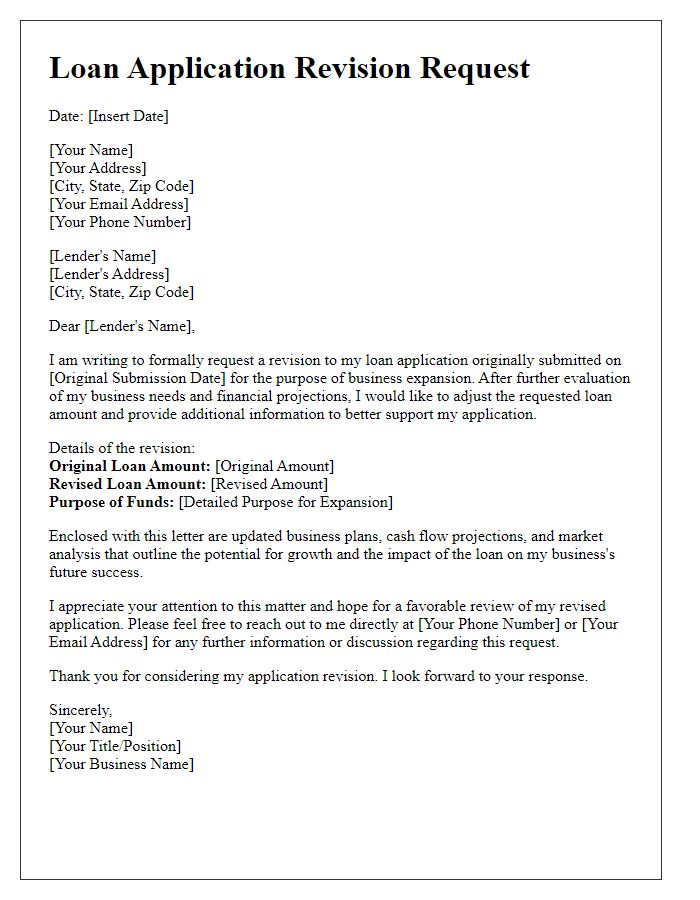

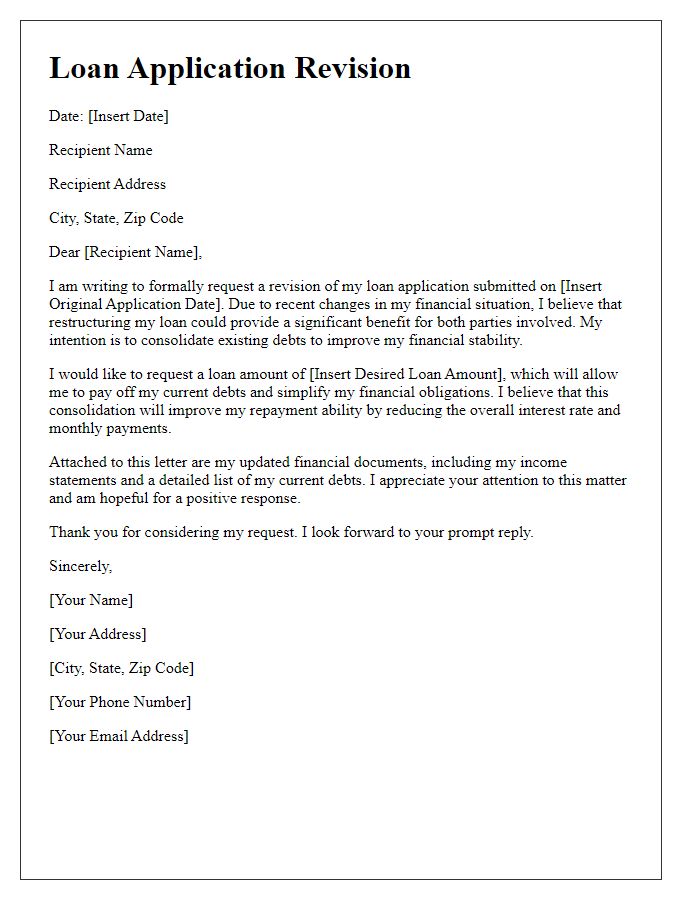

Letter template of loan application revision for personal finance needs.

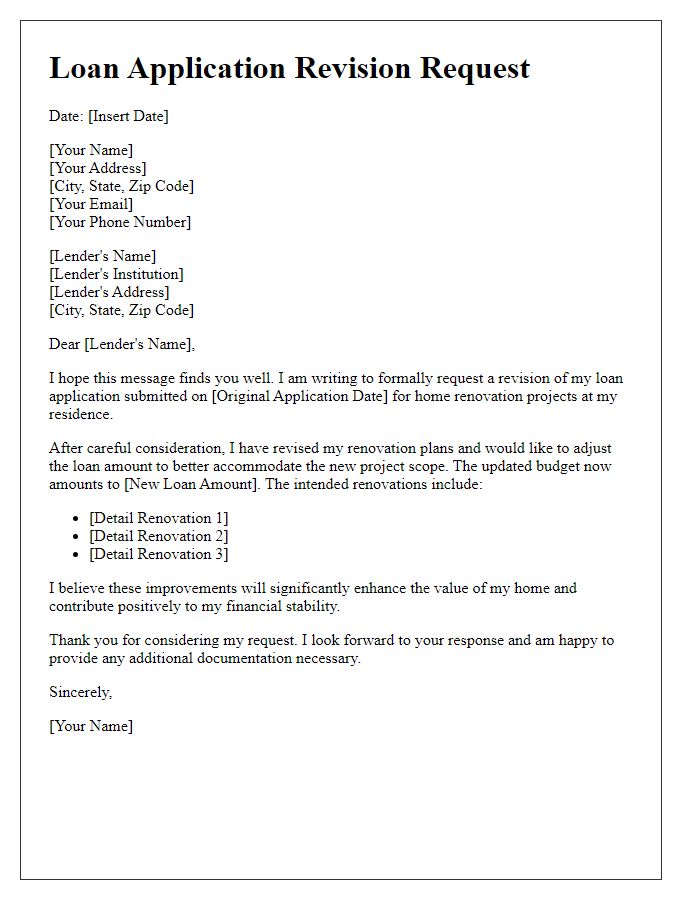

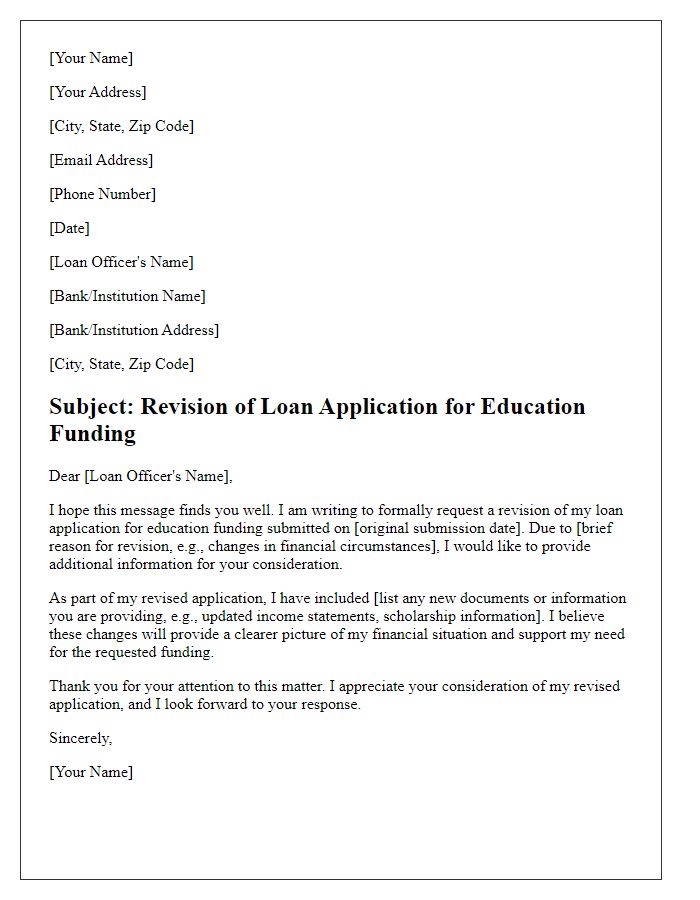

Letter template of loan application revision for home renovation projects.

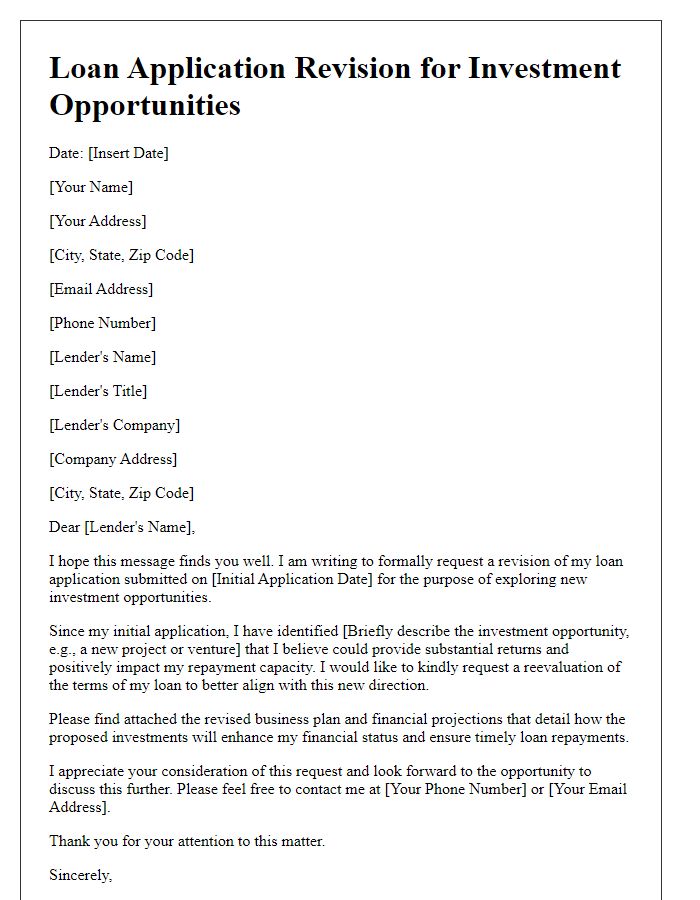

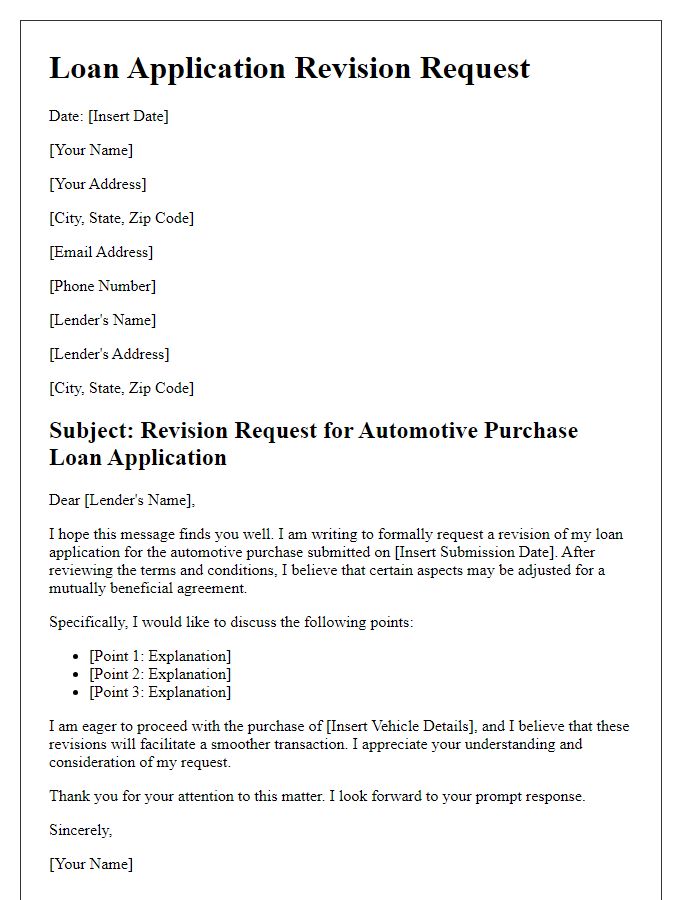

Letter template of loan application revision for investment opportunities.

Comments