Are you looking to confirm your net worth for a loan application, investment opportunity, or personal finance review? Crafting a professional letter can make a significant difference in how your financial standing is perceived. In this article, we'll provide you with a simple yet effective template for a net worth confirmation letter that's sure to impress. Let's dive in and explore how to put your best financial foot forward!

Accurate personal or entity details

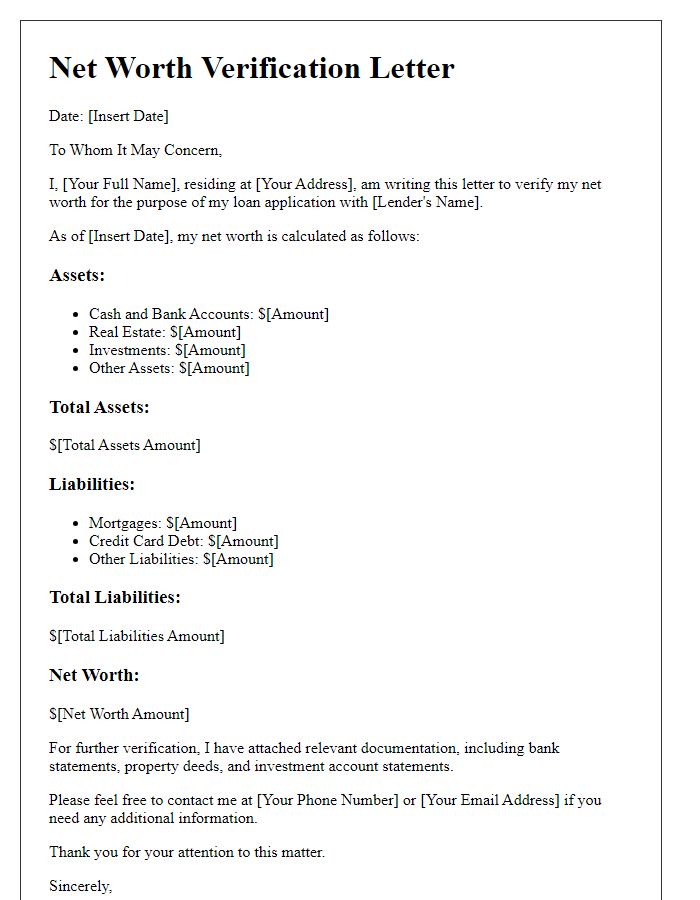

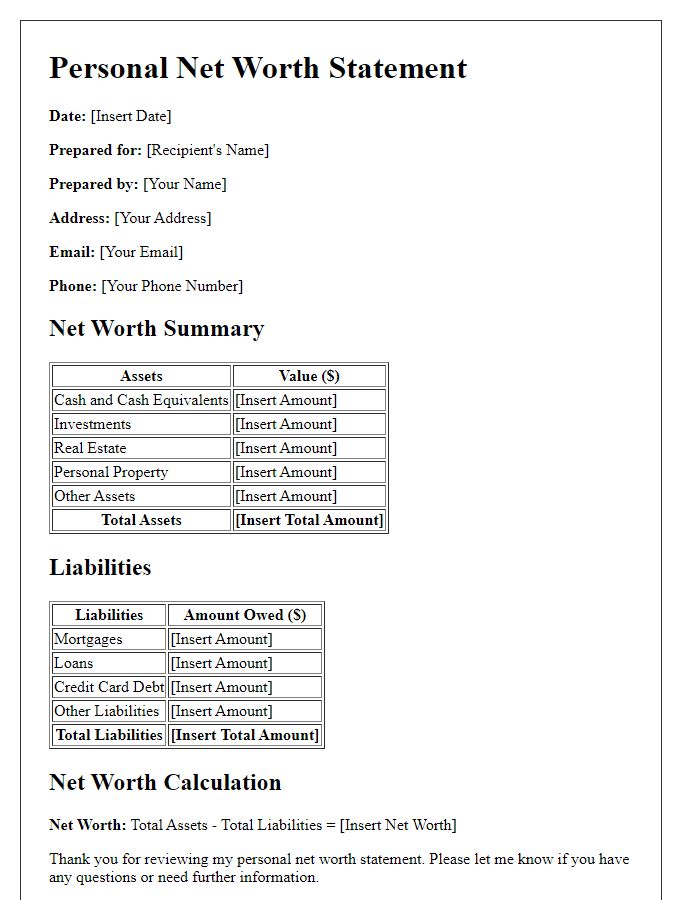

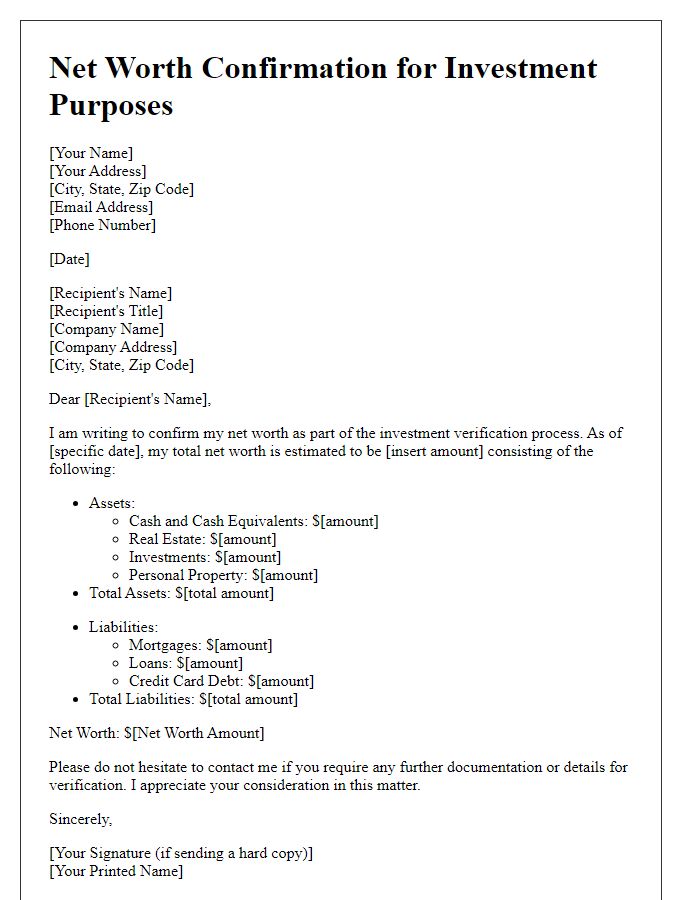

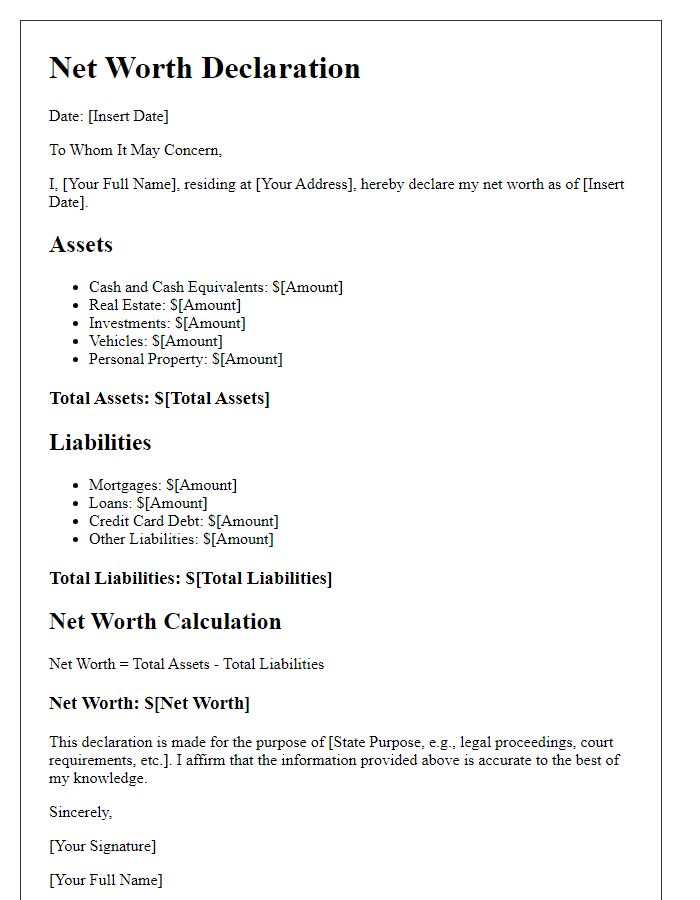

Net worth confirmation serves as a crucial financial document utilized by individuals or entities to verify their financial standing. It typically encompasses detailed information, including assets like real estate properties, investment portfolios, and savings accounts, alongside liabilities such as mortgages, loans, and credit card debts. Accurate personal details such as full name, social security number, and date of birth are vital for identification purposes, while businesses must provide entity specifics, including registered name, tax identification number, and business address. Financial institutions may request supporting documents like bank statements, tax returns, and property appraisals, undertaken over the previous fiscal year, to validate the net worth claim. This comprehensive overview aids in applications for loans, credit, or leases, ensuring transparency and reliability in financial transactions.

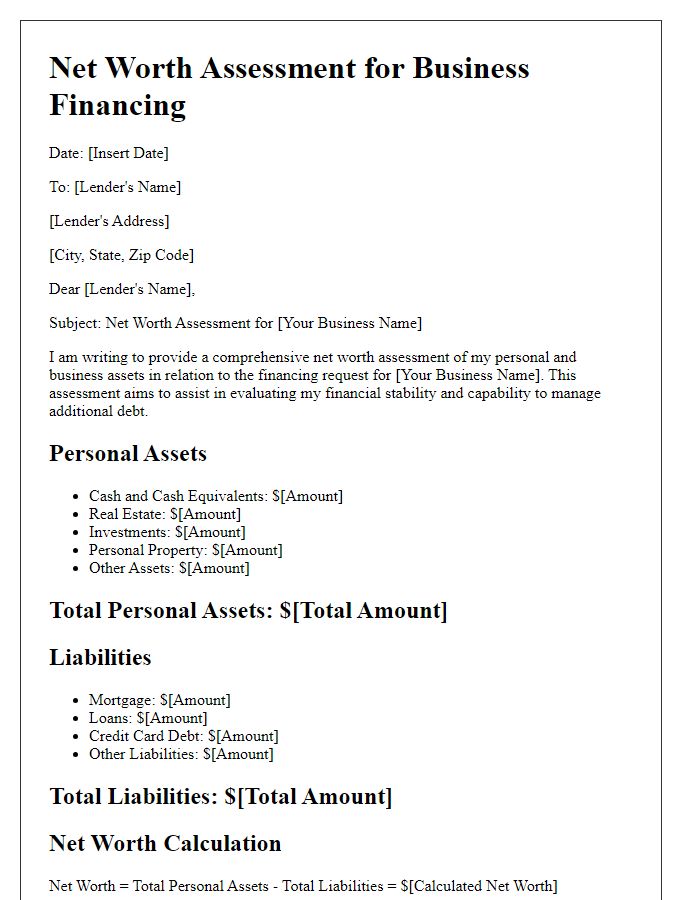

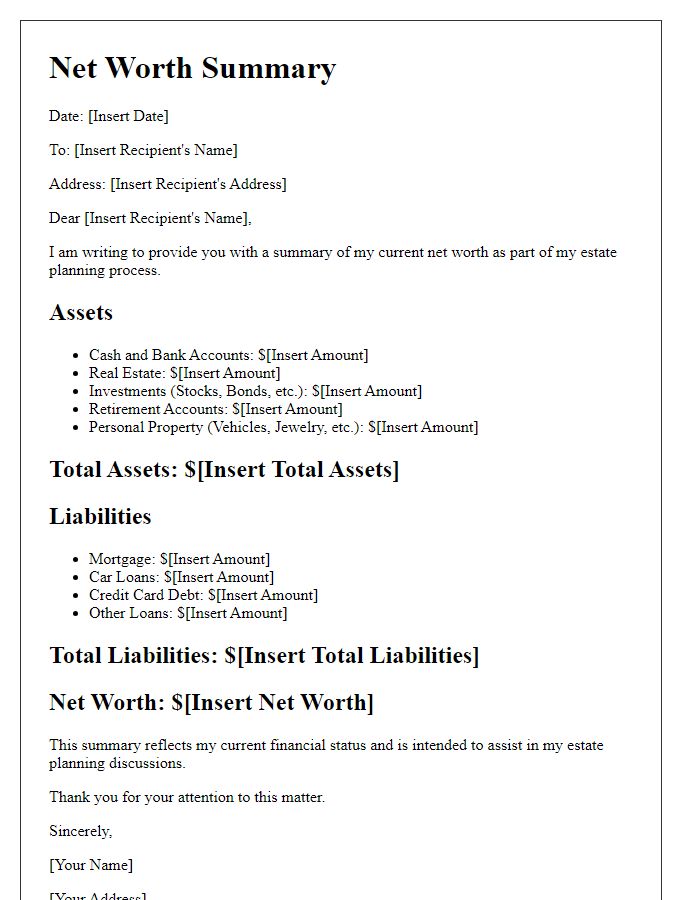

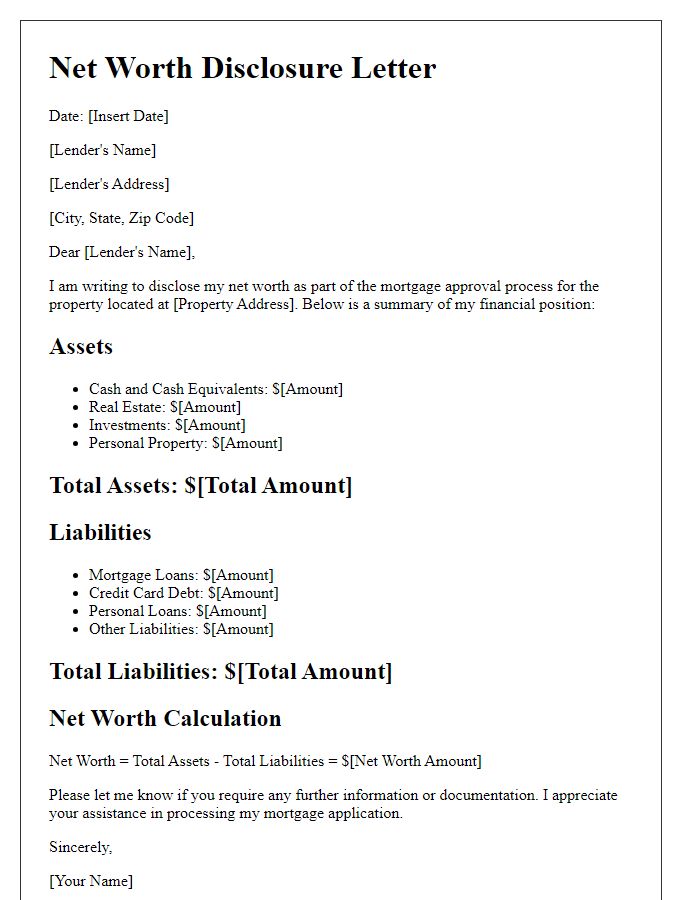

Itemized list of assets and liabilities

The net worth confirmation process requires an itemized list detailing both assets (items of value, including real estate, investments, and personal property) and liabilities (financial obligations such as mortgages, loans, and credit card debt). A comprehensive assets list typically includes high-value items like a primary residence (with market value estimates), vehicles (such as cars, trucks, or boats), savings accounts, retirement accounts like 401(k) or IRAs, stocks or bonds, and any valuable personal property including jewelry or collectibles. Liabilities should encompass current mortgages (with remaining balances), personal loans, student loans, credit card debts, and any other owed amounts. Proper documentation supports these figures, illustrating the individual's financial standing in a clear and organized manner, essential for processes like loan applications or investment planning.

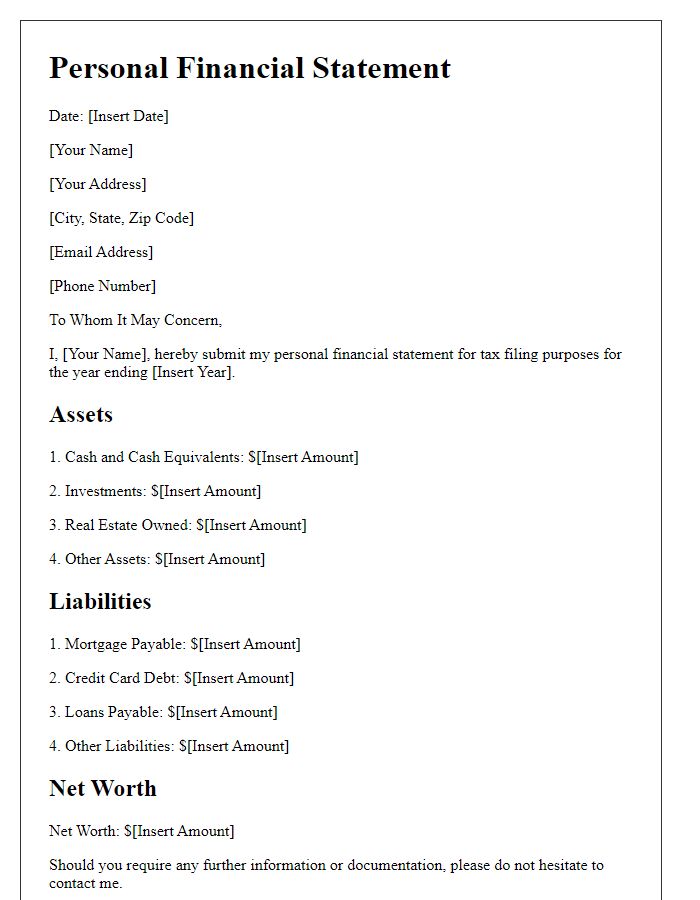

Contact information for verification

Net worth confirmation serves as a critical document in financial assessments, often required during transactions like loan applications or investment opportunities. Individuals seeking verification must provide comprehensive contact information, which may include full name, current address, email address, and phone number. This refers to the individual's residential location, such as a specific city or state, which aids in authenticating identity. Financial institutions typically use this information to cross-check with public records or credit reports, ensuring accuracy in net worth estimation. Accurate details facilitate secure communication between parties, significantly reducing the risk of fraud throughout the verification process.

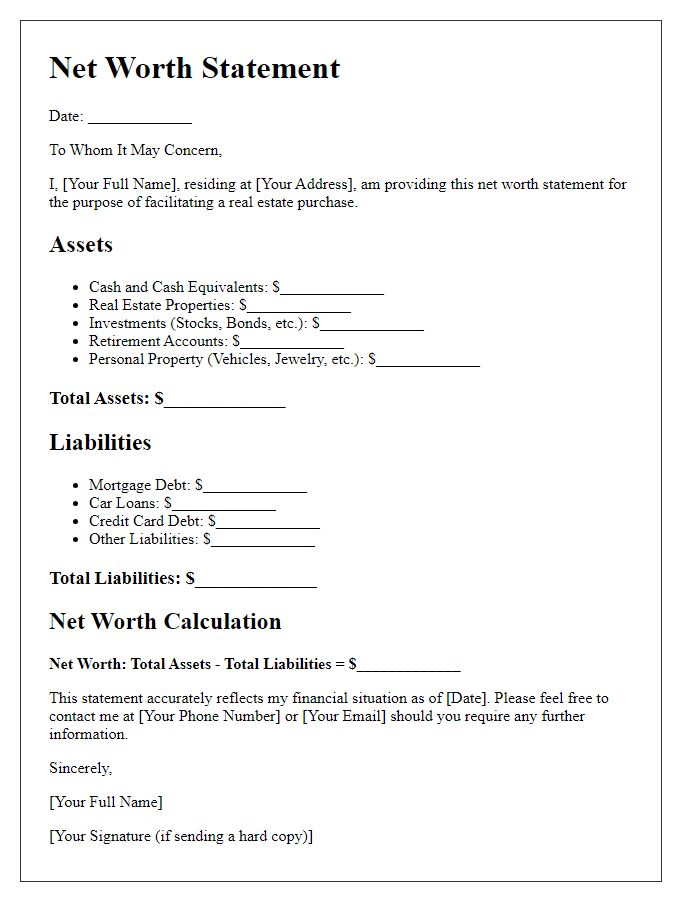

Statement of overall net worth

Net worth confirmation provides a clear snapshot of an individual's financial status, typically outlined through a detailed statement of overall net worth. This financial statement includes major assets such as real estate properties (for example, homes valued at $350,000), vehicles (like a new car worth $30,000), savings accounts (with balances reaching $50,000), investment portfolios (including stocks valued at $100,000), and personal property (like collectibles estimated at $15,000). On the liabilities side, it details outstanding debts, including mortgages ($250,000) and credit card debt ($10,000). This comprehensive overview helps assess an individual's financial health, often required for loan applications or financial planning.

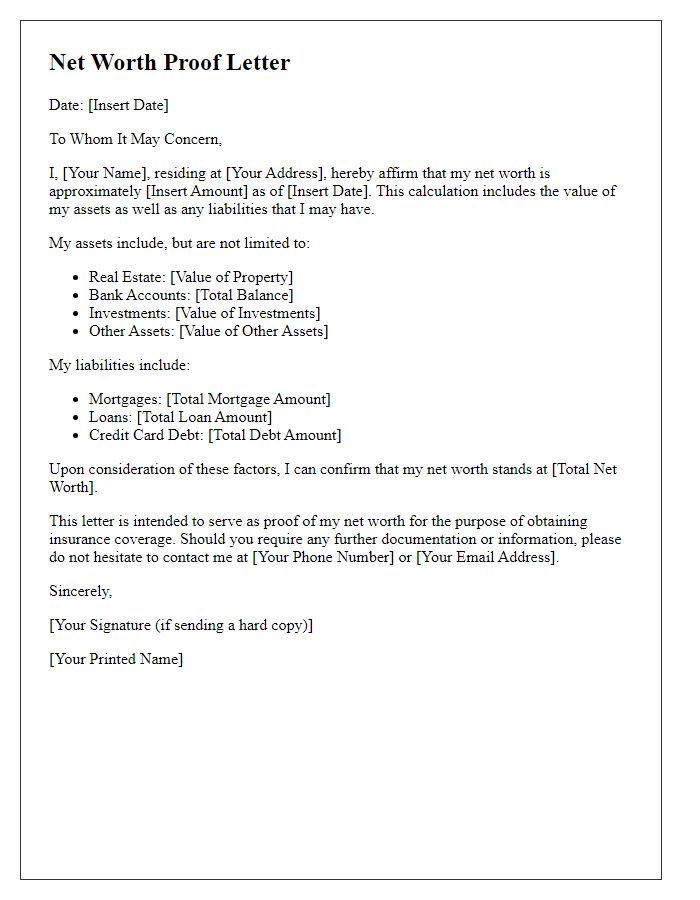

Professional signature and credentials

Net worth confirmation documents, essential in various financial transactions, require verification from certified professionals. Individuals such as Certified Public Accountants (CPAs) hold the necessary credentials to provide accurate assessments of financial standing. These professionals analyze assets such as real estate, stocks, and savings, along with liabilities like mortgages and loans. Their official signatures, accompanied by credentials and firm affiliation, validate the net worth figures presented in the documentation. Typically, net worth statements serve as crucial elements during loan applications, investment opportunities, or estate planning, often necessitating stringent standards of accuracy and accountability.

Comments