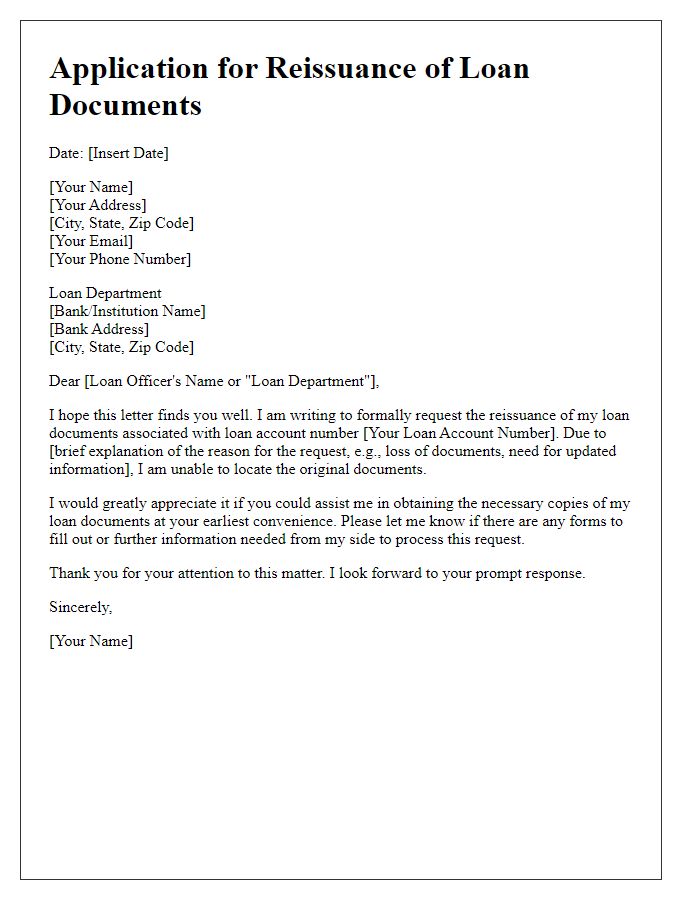

Hey there! We all know that keeping track of important documents can get a bit overwhelming, especially when it comes to loan paperwork. If you've found yourself in a situation where you need duplicate loan documents, don't fretâcreating a request letter is simpler than you'd think. Stick around as we dive into some handy tips and templates to help you craft the perfect letter requesting those crucial duplicates!

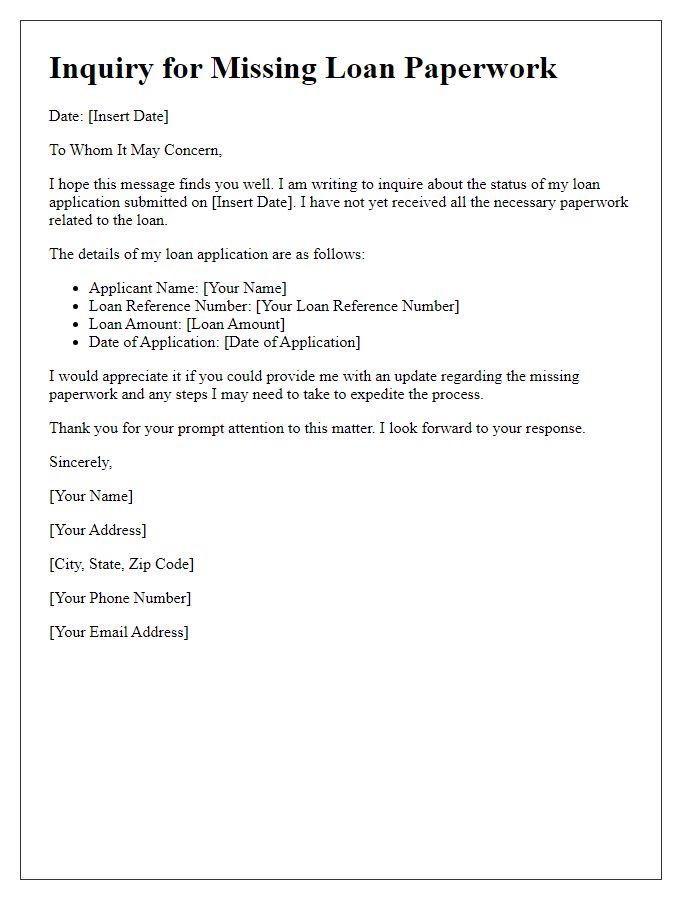

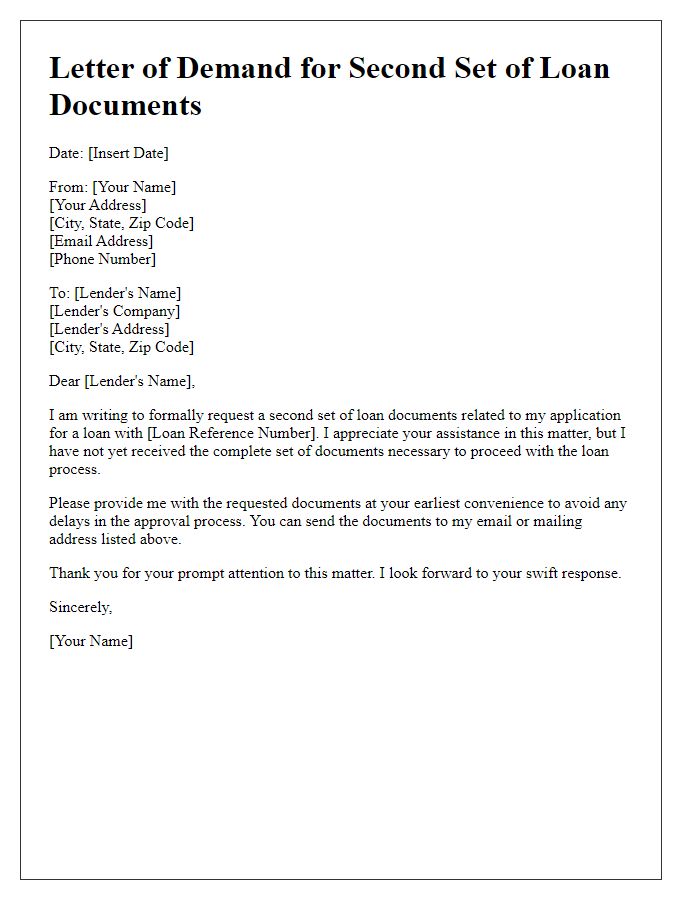

Subject line specificity

Duplicate loan documents can cause significant delays in processing, impacting financial institutions and borrowers. The subject line of a correspondence regarding duplicate loan documents should clearly indicate the purpose, for example, "Request for Duplicate Loan Documents - Account # 123456." This specificity aids in quickly identifying the content and urgency, streamlining communication. Including the account number emphasizes the particular loan involved, helping to avoid confusion among multiple accounts. Furthermore, prompt resolution is crucial, as delays can lead to increased interest payments, affecting overall financial planning for the borrower.

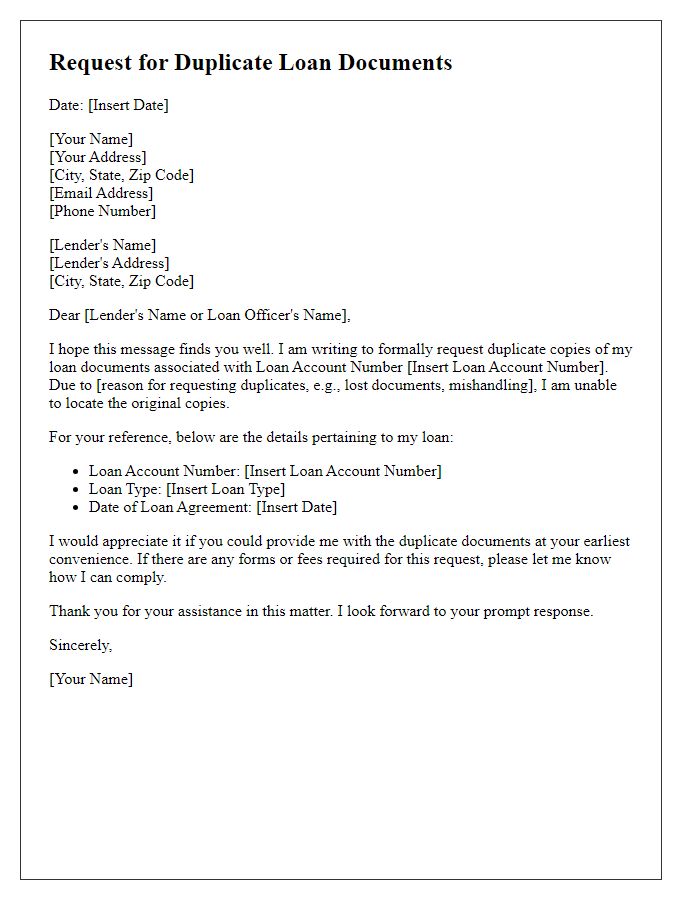

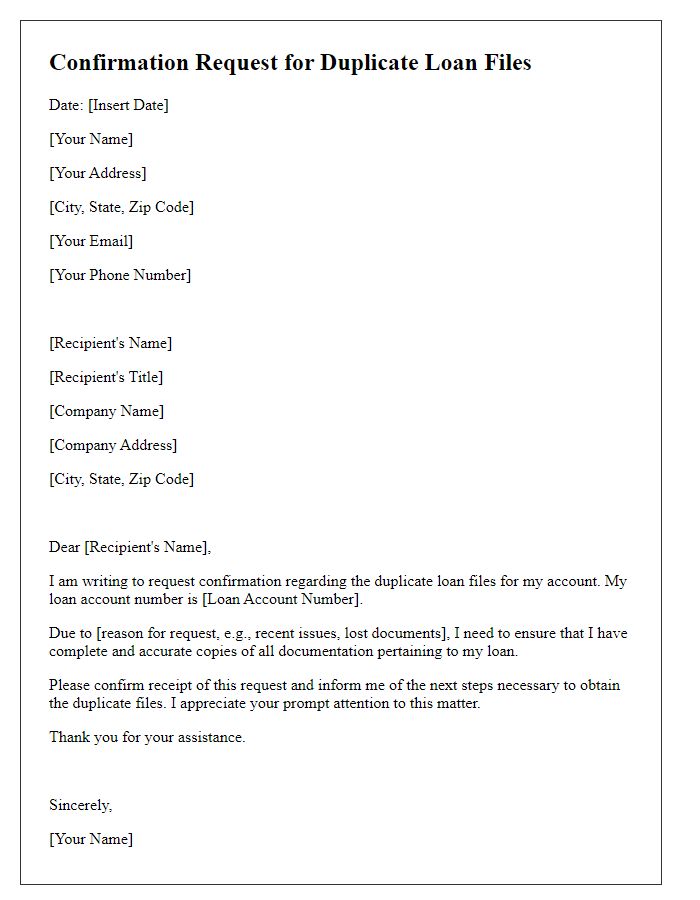

Borrower information

In financial transactions, the accuracy of borrower information plays a crucial role in loan processes, especially in cases requiring duplicate loan documents. Essential elements include borrower names, which must match government-issued identification to prevent identity verification issues. Loan identification numbers serve as unique references, streamlining tracking and administration. Financial details such as credit scores and income levels contribute to the assessment of creditworthiness. The mailing address of borrowers ensures they receive all communications and documentation without delay, particularly for important notifications that could impact loan terms. Moreover, contact information, including phone numbers and email addresses, is vital for timely responses to inquiries or concerns regarding the loan. Each piece of information must be precisely documented to facilitate quick resolution of any discrepancies that may arise during the duplication process.

Loan details

Duplicate loan documents can cause significant issues in financial transactions, especially in residential mortgage loans. Each loan could involve considerable amounts, often exceeding hundreds of thousands of dollars. In the case of conventional loans, it is essential to track important documents like the loan application, promissory note, and closing disclosure. Missing or duplicated versions of such documents can lead to delays in processing, increased scrutiny from lenders, and potential legal challenges. Additional implications may arise if documentation discrepancies occur during audits or refinancing processes, impacting credit scores and interest rates. Institutions often advise borrowers to maintain organized records to streamline handling, aiding in the quick retrieval of crucial files and ensuring proper loan management.

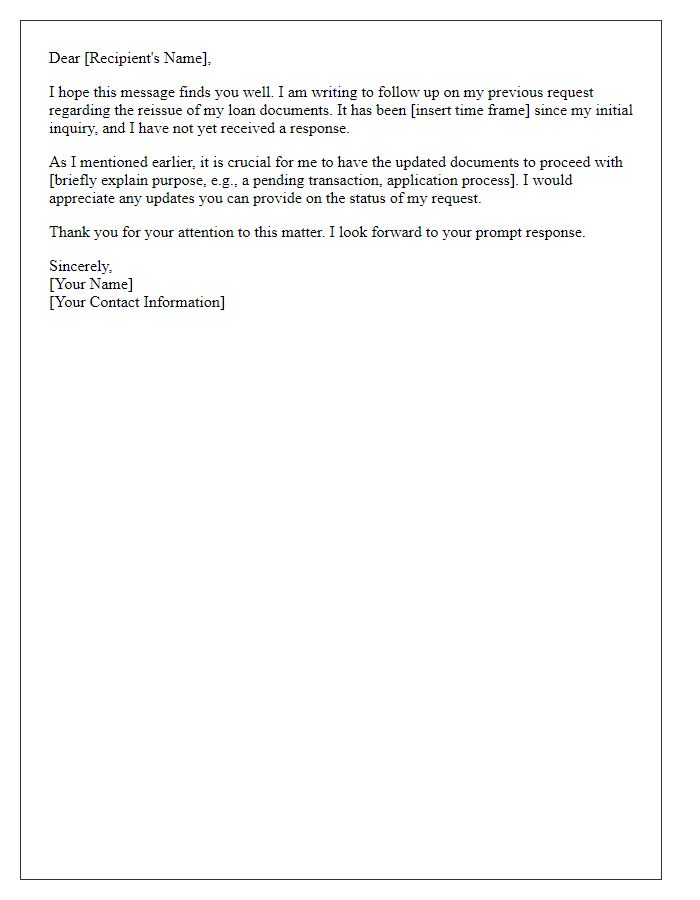

Request explanation

Duplication of loan documents can create confusion and mismanagement of financial accounts. In cases where borrowers receive multiple copies of the same documents, such as promissory notes or loan agreements, clarity regarding the terms and obligations may be compromised. This situation can arise from administrative errors or software glitches in financial systems. Lenders need to verify the authenticity of each document to ensure that borrowers are held accountable for the correct agreement. Inquiries into the specific reasons for duplication can illuminate procedural weaknesses or indicate a need for improved document management practices. Thorough explanations are essential for maintaining transparency in borrower-lender relationships and preventing future discrepancies.

Contact information

Duplicate loan documents often arise due to lost paperwork or administrative errors. Essential details such as the borrower's name, loan number, and loan origination date must be accurately included. The issuing institution, such as Bank of America or Wells Fargo, should be clearly identified to streamline the retrieval process. Contact information, including a telephone number (for example, the institution's customer service at 1-800-432-1000) and email (such as support@bankname.com), facilitates timely communication regarding document requests. Providing a physical address (such as 123 Main St, Anytown, USA) ensures that any mailed documents reach the correct destination efficiently.

Comments