When it comes to securing a loan, understanding the pre-approval process can make all the difference in your home buying journey. Crafting the perfect loan pre-approval request letter not only showcases your seriousness to lenders but also sets the stage for a smoother transaction. In this article, we'll break down the essential components of an impactful request letter, ensuring you make a lasting impression. So, let's dive in and explore how you can elevate your chances of getting that much-needed financial support!

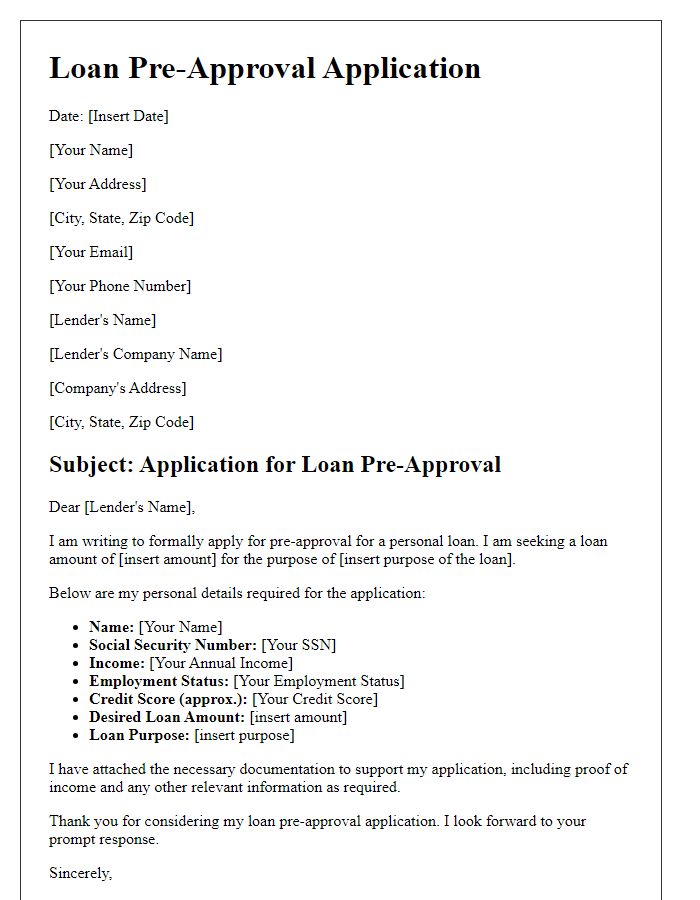

Personal Information

When requesting loan pre-approval, it is essential to include detailed personal information to facilitate a smooth application process. Full name (e.g., Johnathan Smith), Social Security Number (required for credit checks), date of birth (to verify age and credit eligibility), residential address (including city, state, and ZIP code), and current employment details (such as employer's name, job title, and income information) play a crucial role in evaluating the application. Additionally, listing monthly expenses (rent, utilities, and debt payments) helps establish the borrower's financial situation. Providing contact information, including phone number and email address, ensures effective communication with the lending institution during the pre-approval process. These elements contribute to a comprehensive picture of financial standing, essential for loan assessment by financial institutions.

Loan Amount and Purpose

A loan pre-approval request outlines the desired financial amount and its intended use, such as purchasing a home or financing a business. The loan amount typically ranges from thousands to millions, based on factors like creditworthiness and income. The purpose of the loan can vary significantly; for instance, the average home purchase in the United States was approximately $400,000 in 2023, while small business loans often average around $100,000. Detailed documentation may include financial statements, credit assessments, and the reason for the funding need, essential for lenders to evaluate risk and applicant eligibility.

Income and Employment Details

A loan pre-approval request requires comprehensive income and employment details to assess financial stability. For instance, a stable income source, such as a full-time position at a reputable company with at least two years of employment history, significantly improves application standing. Documenting annual earnings (for example, $75,000) along with any bonuses or commissions provides a clearer picture of financial capacity. Additionally, detailing employment benefits, such as health insurance and retirement contributions, showcases long-term job security. Accurate reporting of any side incomes, like freelance work yielding approximately $15,000, enhances overall income credibility. Providing recent pay stubs and tax returns (last two years) solidifies the application, ensuring lenders perceive applicants as a low-risk, reliable borrowers.

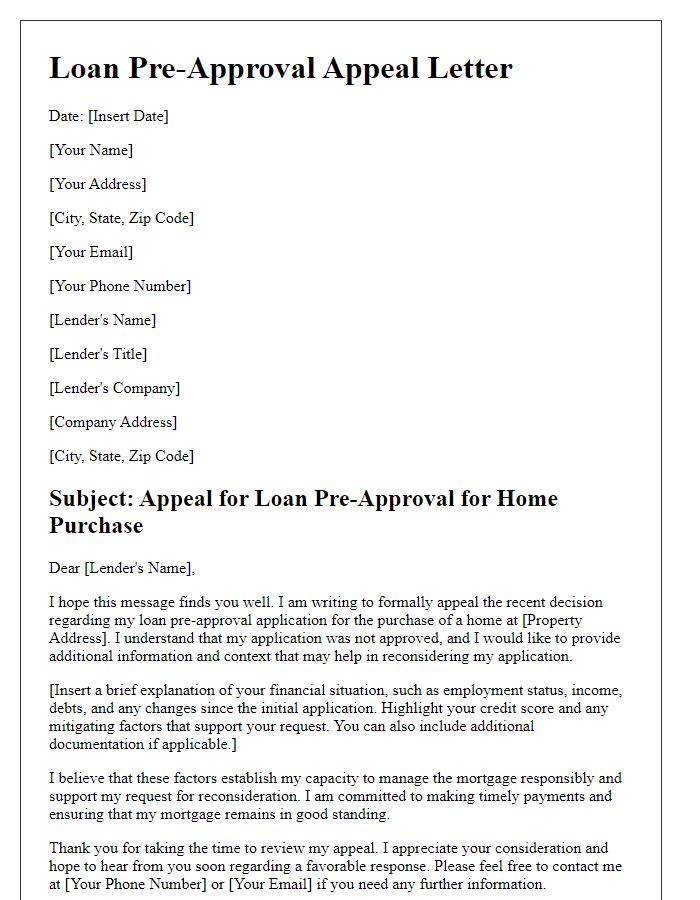

Credit History Overview

A comprehensive credit history overview for loan pre-approval plays a critical role in financial assessments. Individuals seeking mortgage loans or personal loans often provide detailed records from credit bureaus, such as Experian, Equifax, or TransUnion. These records typically include credit scores, which range from 300 to 850, reflecting an individual's creditworthiness. Lenders examine various factors, such as payment history (accounting for 35% of the score), credit utilization ratios (ideally below 30%), and the length of credit history. Additionally, recent inquiries, such as hard pulls from financial institutions--especially those performed within the last 12 months--can influence the overall evaluation. Notes on any bankruptcies, foreclosures, or delinquencies in the last seven years carry significant weight, impacting the likelihood of loan approval and potentially influencing interest rates. Overall, a thorough understanding of the credit history aids in presenting an accurate financial portrait to lenders.

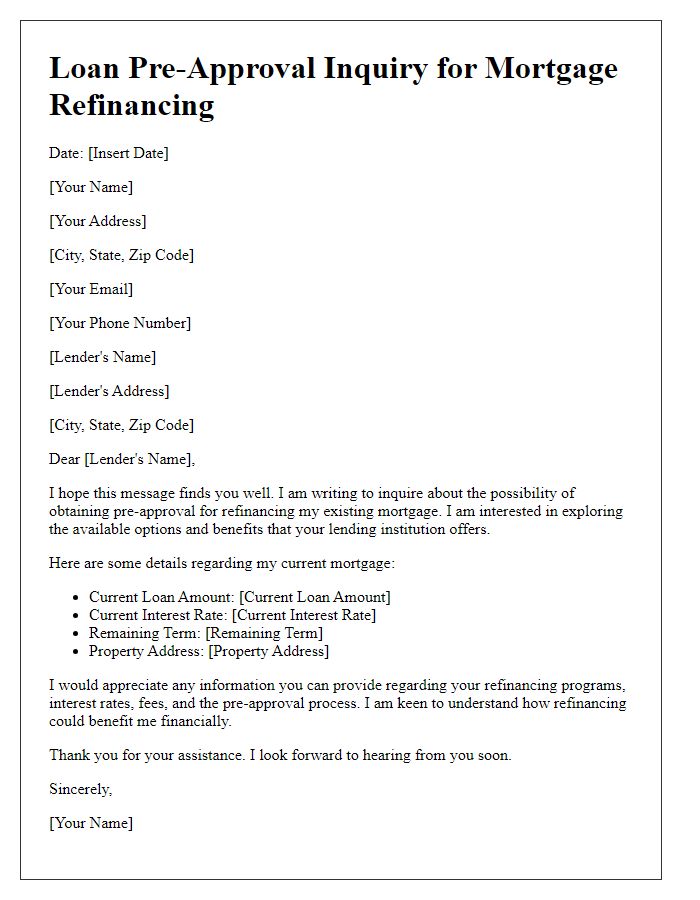

Property Details (if applicable)

Requesting loan pre-approval for real estate transactions requires detailed property information. Include specifics about the property type, such as residential, commercial, or multifamily units. Specify the location, mentioning the city or neighborhood, to provide context for potential market values. Include the property address, including street name, number, and zip code, to facilitate accurate assessments. Describe property features like square footage, number of bedrooms and bathrooms, and any unique amenities such as a swimming pool or garden. Mention the asking price, which serves as an essential factor for the lender's evaluation. Providing detailed property characteristics aids in the overall loan assessment process.

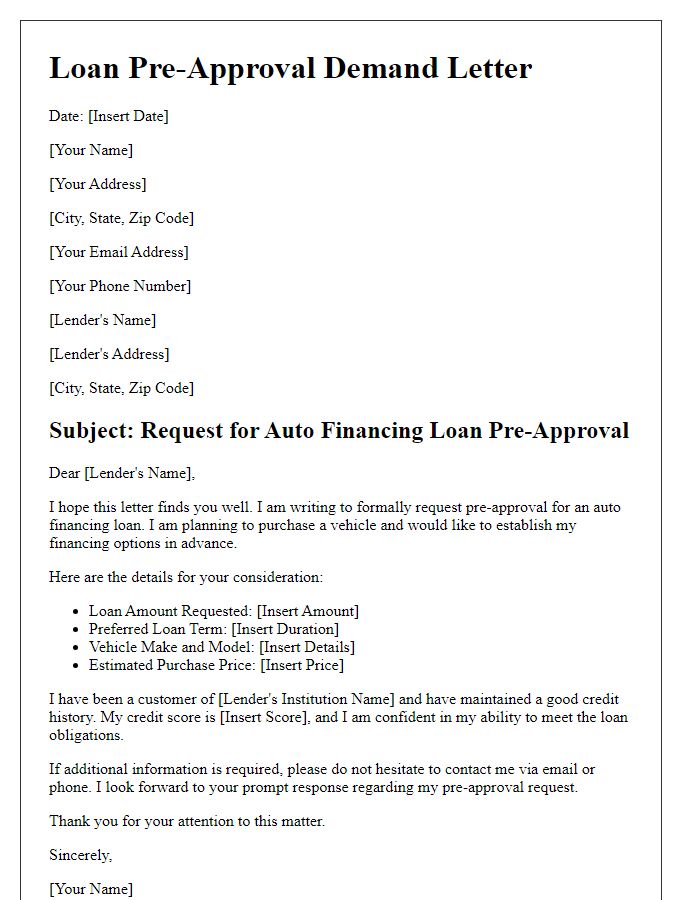

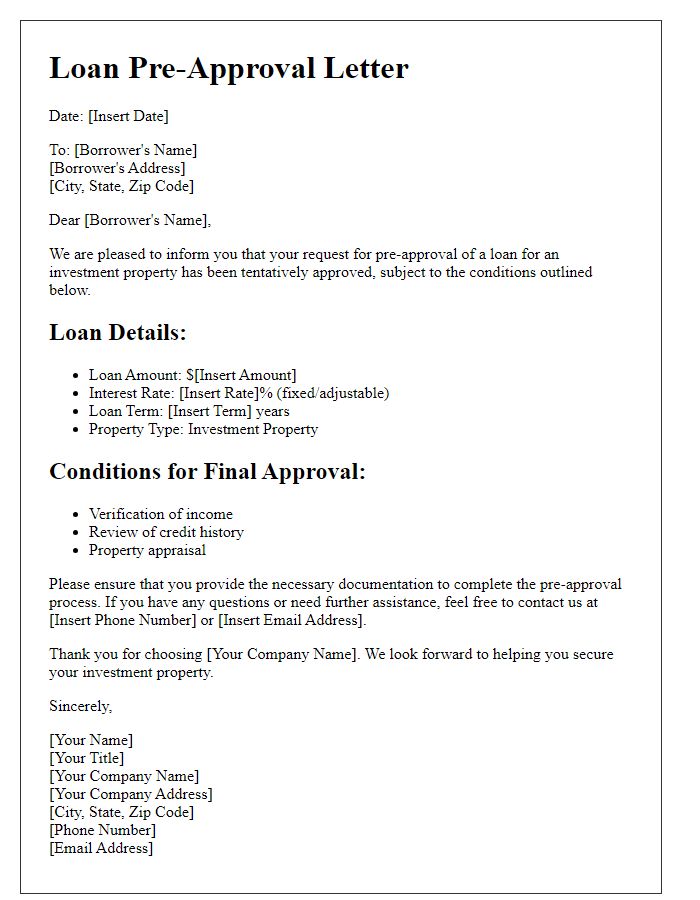

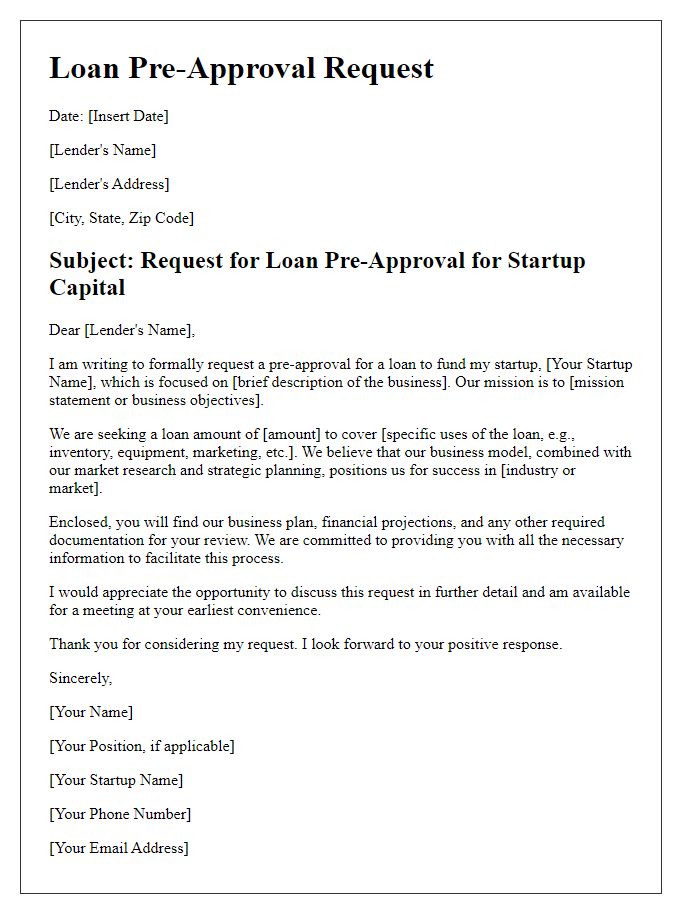

Letter Template For Loan Pre-Approval Request Samples

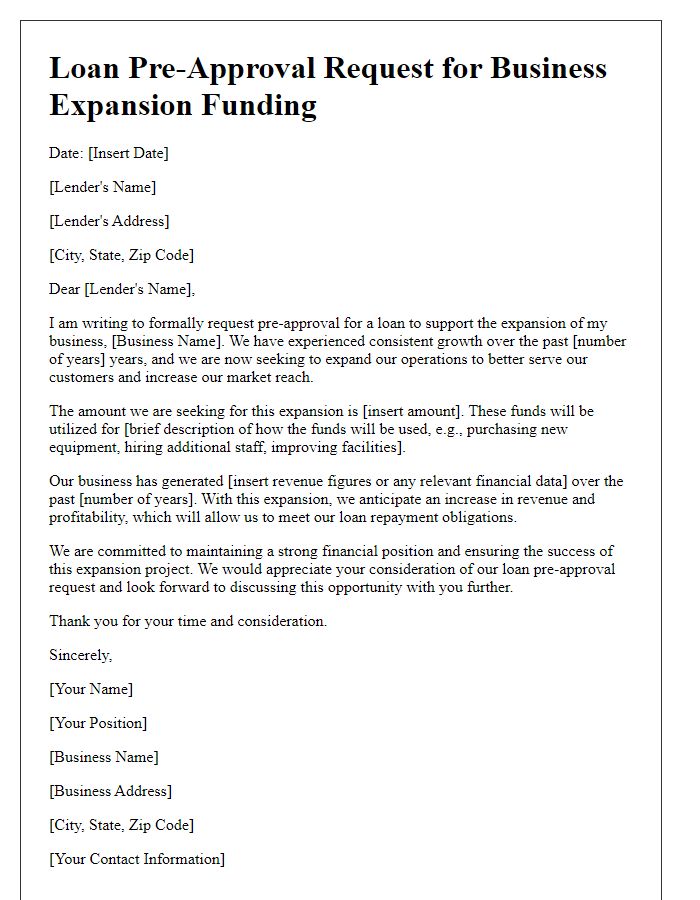

Letter template of loan pre-approval request for business expansion funding.

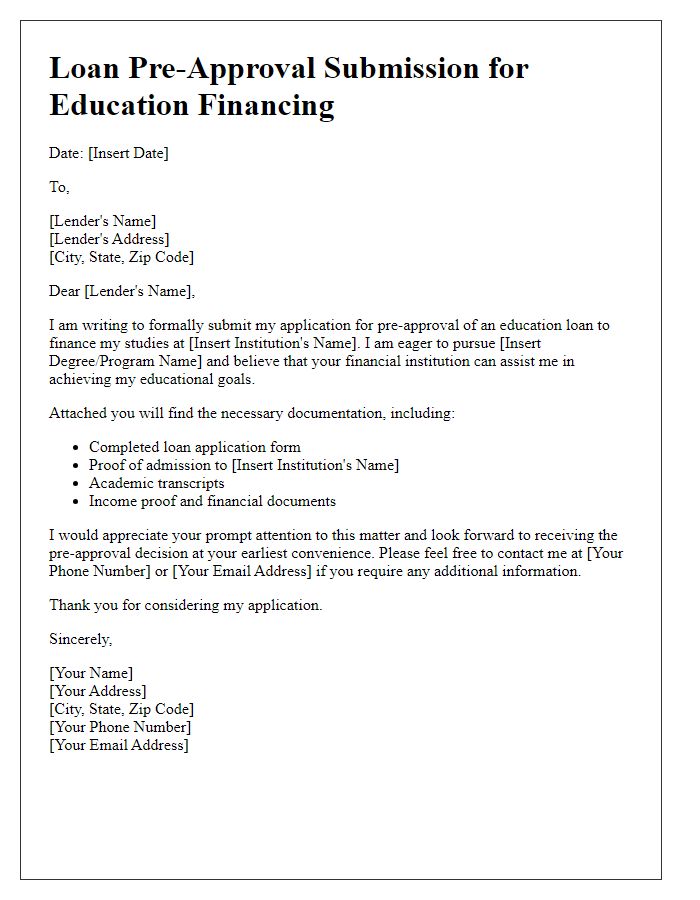

Letter template of loan pre-approval submission for education financing.

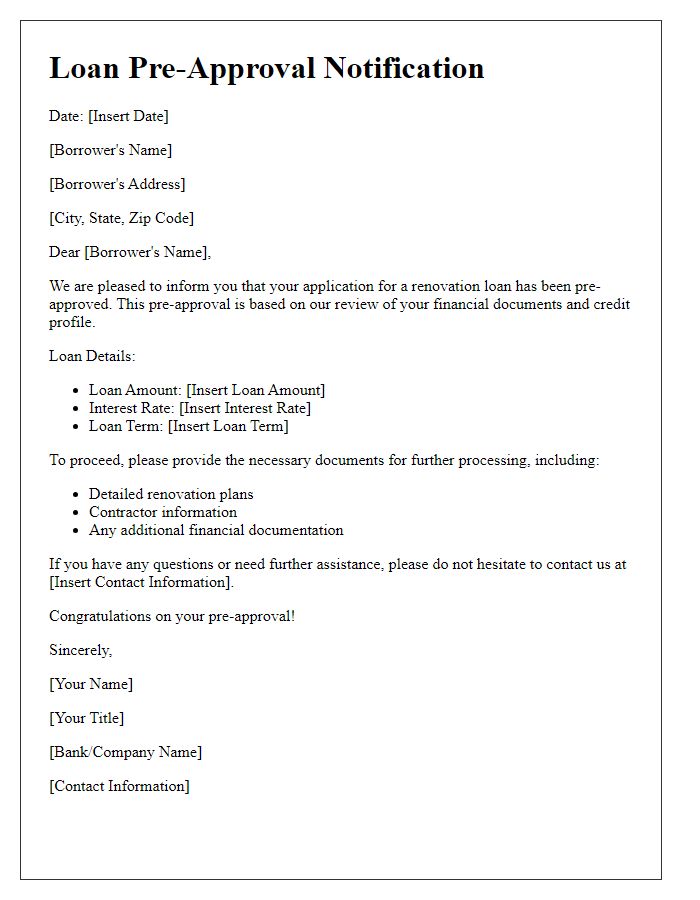

Letter template of loan pre-approval notification for renovation project.

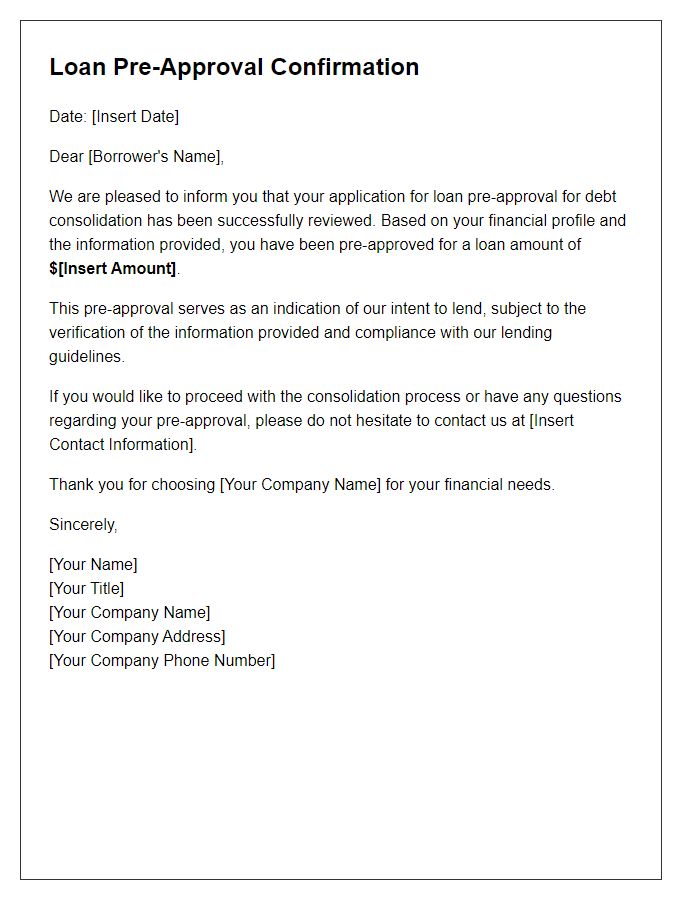

Letter template of loan pre-approval communication for debt consolidation.

Comments