In today's fast-paced world, managing finances can often become overwhelming, especially when it comes to loan repayments. A well-structured loan payment agreement can serve as a crucial tool, ensuring that both partiesâthe lender and the borrowerâare on the same page. This agreement not only outlines the terms but also fosters transparency and accountability in the repayment process. Curious to learn more about creating an effective loan payment agreement? Read on!

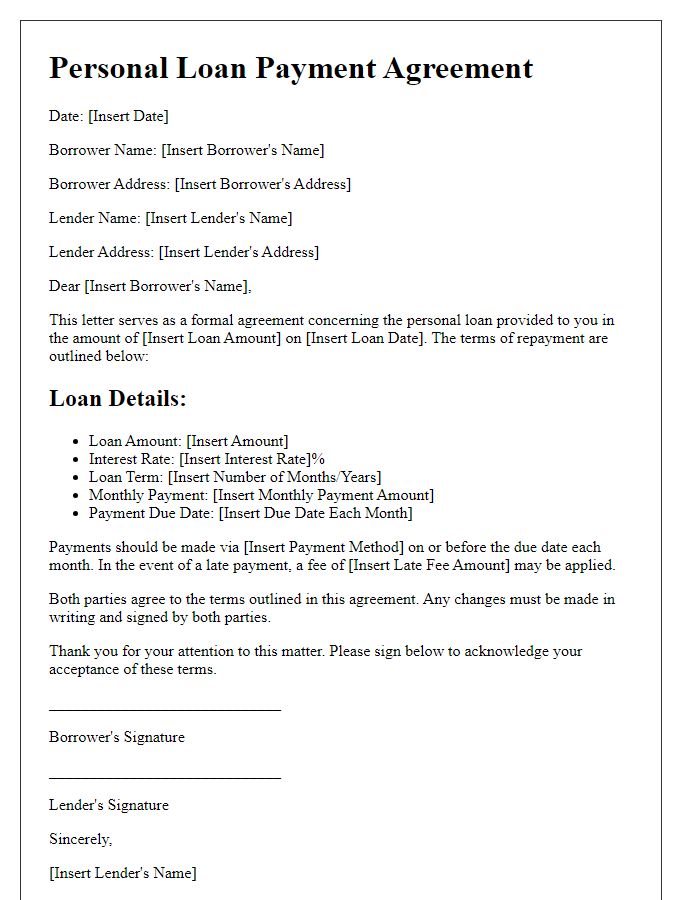

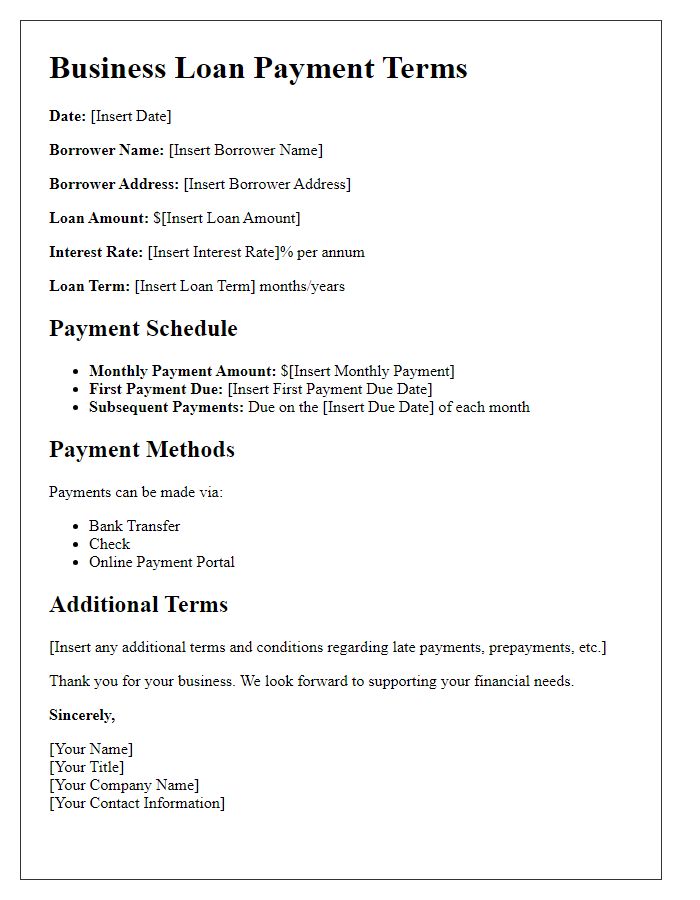

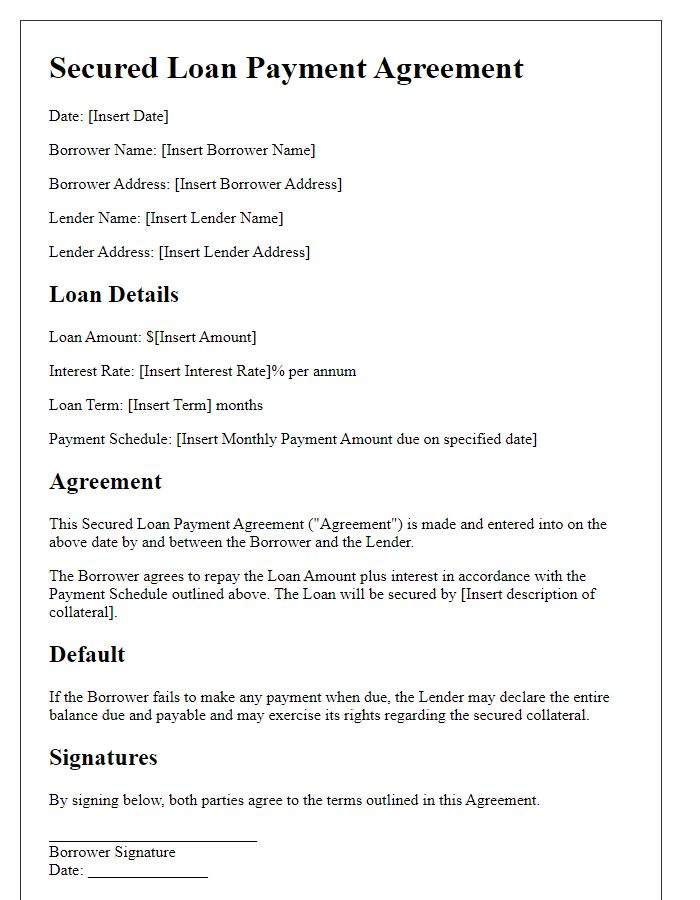

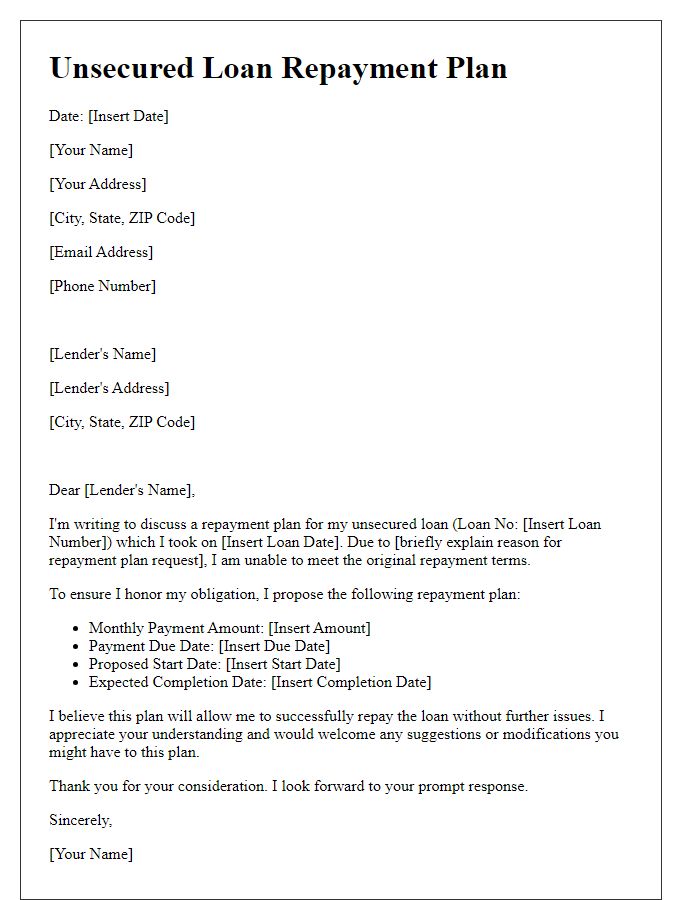

Terms and Conditions

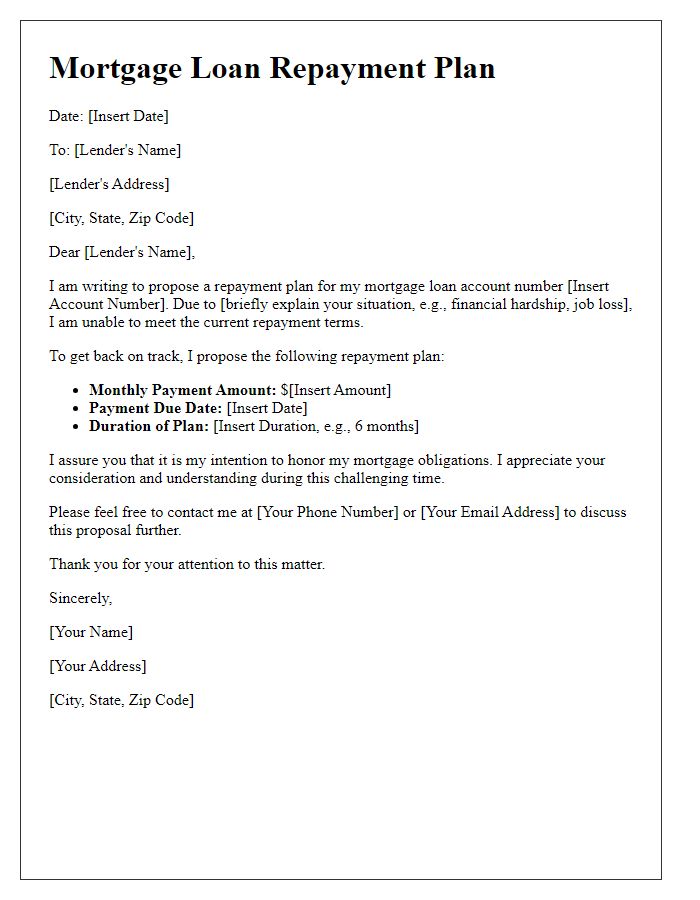

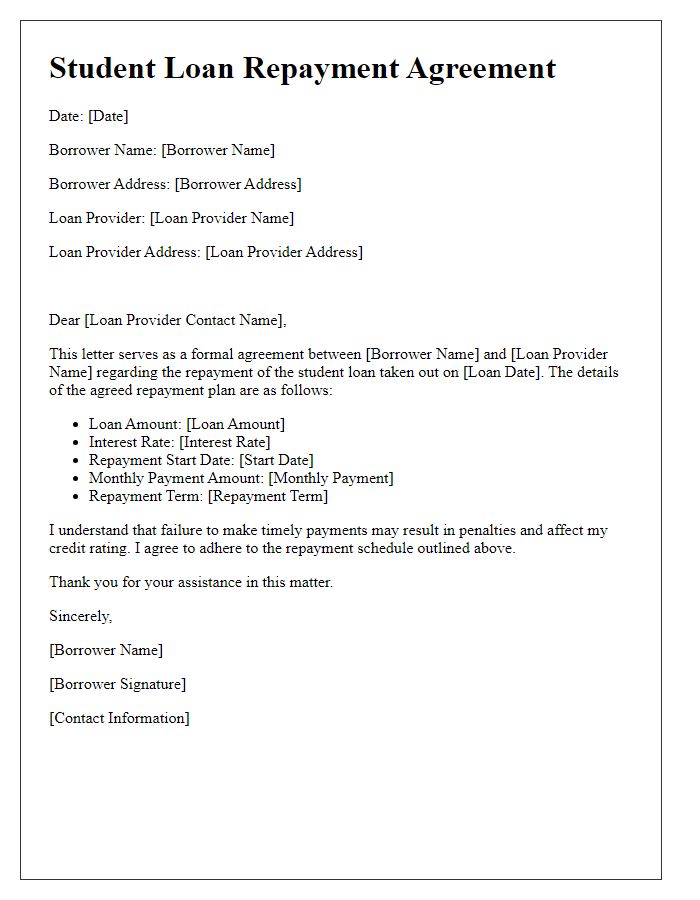

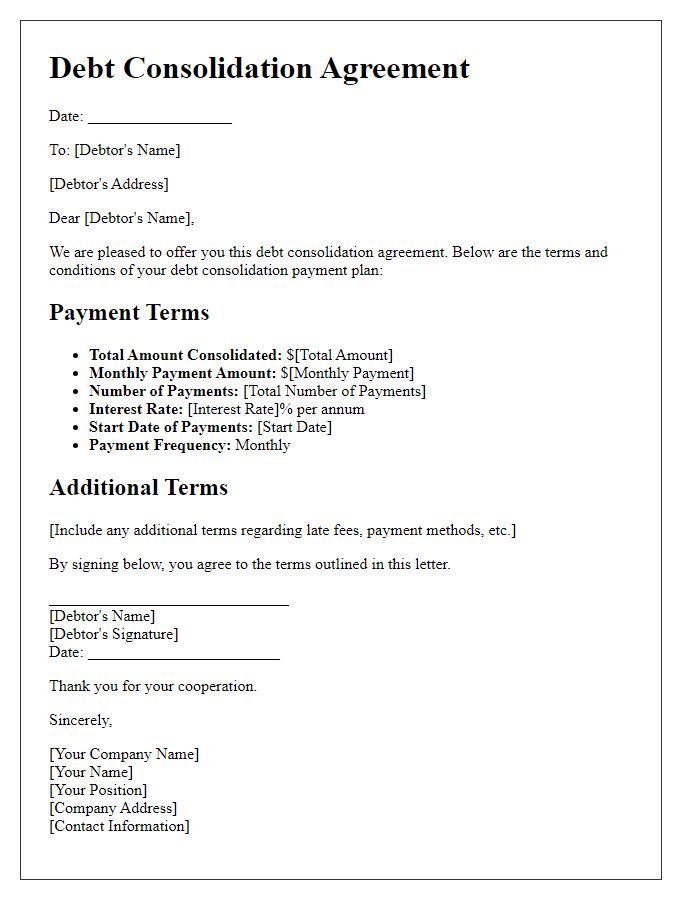

A loan payment agreement establishes clear terms and conditions for borrowing funds, typically involving a borrower and a lender. The agreement specifies the loan amount, often detailed in thousands of dollars, alongside the interest rate percentage, usually ranging from 3% to 10% annually. Payment schedules may be outlined, indicating monthly or quarterly payments, with clearly defined due dates. Late fee penalties could be included, potentially around $25 or more, if payments exceed a grace period. The agreement may also detail collateral requirements, such as property or vehicles, to secure the loan. Furthermore, default consequences, including potential legal action, should be clearly explained to protect both parties, ensuring a mutual understanding of the obligations involved.

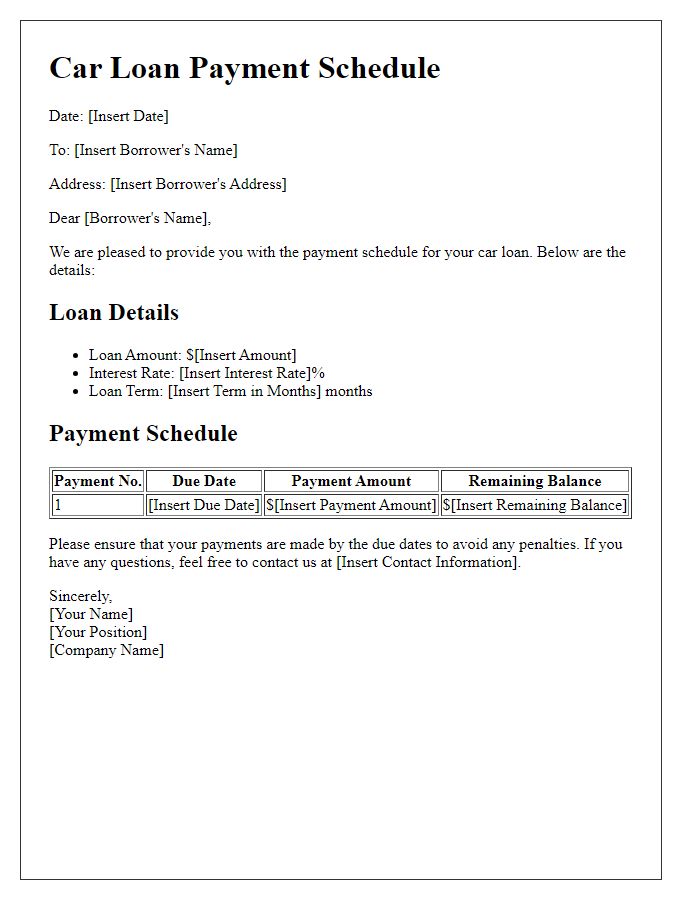

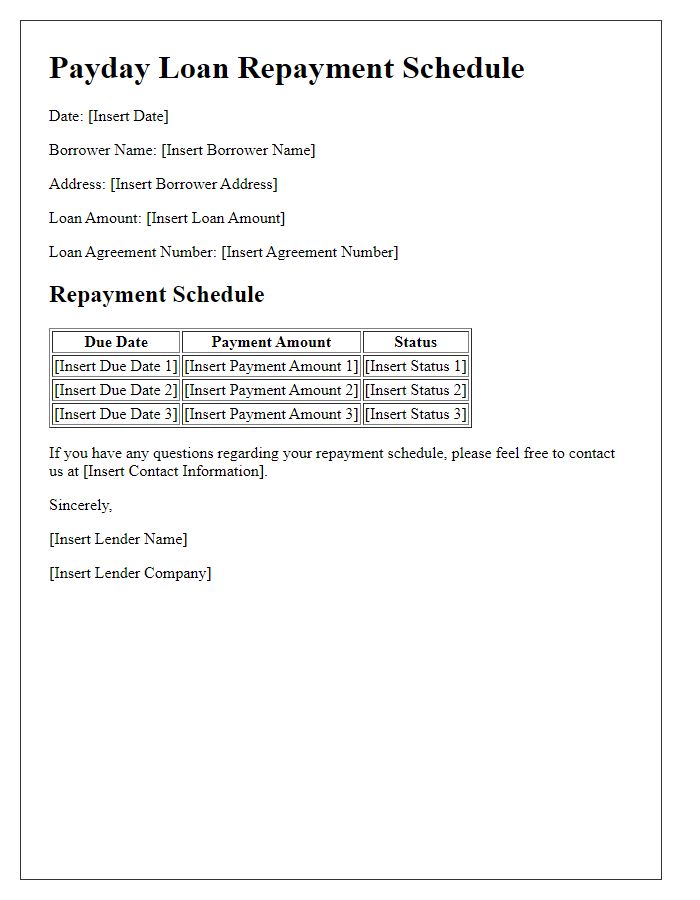

Payment Schedule

A clear loan payment agreement outlines the specific terms for repayment of borrowed funds, detailing monthly installments, interest rates, and total repayment duration. The payment schedule typically includes important dates, such as the initial payment due date and the last scheduled payment date, often spanning months or years, depending on the loan amount. For instance, a personal loan of $10,000 with a 5% annual interest rate may stipulate monthly payments of approximately $188.71 over a period of 60 months. This agreement also specifies consequences for late payments, including additional fees or interest penalties, and potential impacts on credit scores. Borrowers must carefully review the terms to ensure understanding and compliance throughout the repayment process.

Interest Rate

A loan payment agreement outlines the terms between the lender and borrower regarding financial repayment. The interest rate, which can significantly affect the total amount repayable, is typically expressed as a percentage of the loan amount. For example, a fixed interest rate of 5% may apply to a personal loan of $10,000, resulting in a total repayment of $12,000 over five years, excluding any additional fees or conditions. Borrowers should be aware of how this percentage impacts monthly payments and overall cost. In addition, the agreement should specify the duration of the loan, any potential penalties for late payments, and options for early repayment, ensuring clear expectations for both parties involved in this financial transaction.

Default Consequences

Defaulting on a loan payment can lead to serious consequences for borrowers and lenders alike. A missed payment can result in late fees, typically ranging from 5% to 10% of the overdue amount, depending on the lender's policy. If payments remain outstanding for 30 days or more, lenders may report defaults to credit bureaus, negatively impacting credit scores (often lowering them by 100 points or more). Legal actions may also initiate, leading to collection efforts and potential court proceedings. In severe cases, collateral seizure can occur if secured loans are involved, resulting in loss of valuable assets such as homes or vehicles. Maintaining communication with lenders is crucial to avoid these ramifications and seek possible solutions, such as payment plans or loan modifications.

Signatures and Date

The signature section in a loan payment agreement is crucial for validating the document's terms and confirming both parties' (the lender and borrower) readiness to uphold their obligations. Typically, this section includes spaces for the printed names of both parties (to ensure clarity on who is involved), the signatures (providing legal acknowledgment), and the date of signing (indicating when the agreement became effective). This reinforces the legal enforceability of the agreement in accordance with state laws (for instance, New York contract law or California's Uniform Commercial Code). Proper documentation helps prevent misunderstandings or disputes regarding payment schedules, amounts, or other contractual obligations.

Comments