Are you an aspiring entrepreneur seeking financial support to launch your startup? Crafting the perfect loan request letter can make all the difference in securing the funding you need. In this article, we'll guide you through essential components and tips to articulate your vision, business plan, and financial needs effectively. So, let's dive in and help you get that much-needed startup loan!

Business Summary

A startup loan request typically includes a comprehensive business summary, detailing the business model and financial projections. This startup, named Greenleaf Innovations, focuses on eco-friendly home products and aims to reduce carbon footprints while promoting sustainable living. Established in 2023 in Austin, Texas, the company plans to launch a product line comprising biodegradable cleaning agents and reusable kitchenware. Market research indicates a potential customer base of 500,000 environmentally-conscious consumers in the region. Initial funding of $100,000 is sought to cover manufacturing costs, marketing campaigns, and operational expenses. Financial projections estimate a break-even point within 18 months, with anticipated revenues of $1 million in the first year, driven by a growing trend towards sustainability and conscious consumerism. The target demographic encompasses millennials and Gen Z, who are expected to drive the demand for eco-friendly alternatives.

Financial Projections

Financial projections are essential for demonstrating the expected performance of a startup business. They typically encompass a three to five-year forecast detailing key figures such as revenues, expenses, profits, and cash flow. Startups should include assumptions underpinning these projections, such as market trends, pricing strategies, and target customer demographics. Profit margins, typically ranging from 10% to 25% depending on the industry, can significantly impact long-term sustainability. Additionally, including a break-even analysis, which indicates when a business will begin to generate profit, is crucial for investors. This analysis relies on fixed costs, variable costs, and sales volume projections. Overall, detailed financial projections provide a roadmap for growth and a basis for loan decisions.

Loan Amount and Purpose

The startup's financial requirements typically include an estimated loan amount, essential for establishing operations. A common figure for initial funding could be around $50,000 to $500,000, depending on the business scale and industry. Key purposes for requesting the loan may involve acquiring essential equipment, securing inventory, or financing marketing initiatives aimed at customer acquisition. For example, a tech startup might allocate $100,000 towards developing a minimum viable product (MVP), while a retail venture could use the funds to lease a physical location in a high-traffic area. Additionally, operational costs like employee salaries and utility bills may require a portion of the loan to ensure smooth business continuity during the initial months after launch.

Repayment Plan

A well-structured repayment plan is essential for demonstrating the ability to meet financial obligations associated with a startup loan. The plan outlines specific terms including loan amount, interest rates, repayment duration, and monthly payment amounts. Starting with an estimated loan amount of $50,000, an interest rate of 7% per annum, and a repayment period of five years, the monthly payment is approximately $1,000. Key milestones such as revenue projections indicate expected income growth, aiming to reach $200,000 in annual revenue within three years of operation. Additionally, contingencies for unforeseen circumstances feature a buffer of 10% in monthly expenses, ensuring loan repayments remain manageable. The overall strategy incorporates reinvestment of early profits for business growth, reducing reliance on external financing over time. Documentation such as cash flow forecasts and profit-loss statements strengthens the repayment strategy's credibility.

Supporting Documents

Supporting documents play a critical role in the startup loan request process, providing lenders with essential information to assess the viability of the business proposal. These documents typically include a well-structured business plan outlining the mission, vision, and objectives of the startup, along with financial projections for at least three to five years. Additionally, founders should provide personal financial statements, showcasing their creditworthiness and financial stability, including assets and liabilities. Resumes of key team members highlight their expertise and relevant experience, further establishing credibility. Legal documents such as incorporation papers and licenses indicate compliance with regulations in specific jurisdictions like the U.S. Small Business Administration or state-level requirements. Lastly, market analysis data reveals research on competitors, target customers, and industry trends, lending insight into potential growth and profitability.

Letter Template For Startup Loan Request Samples

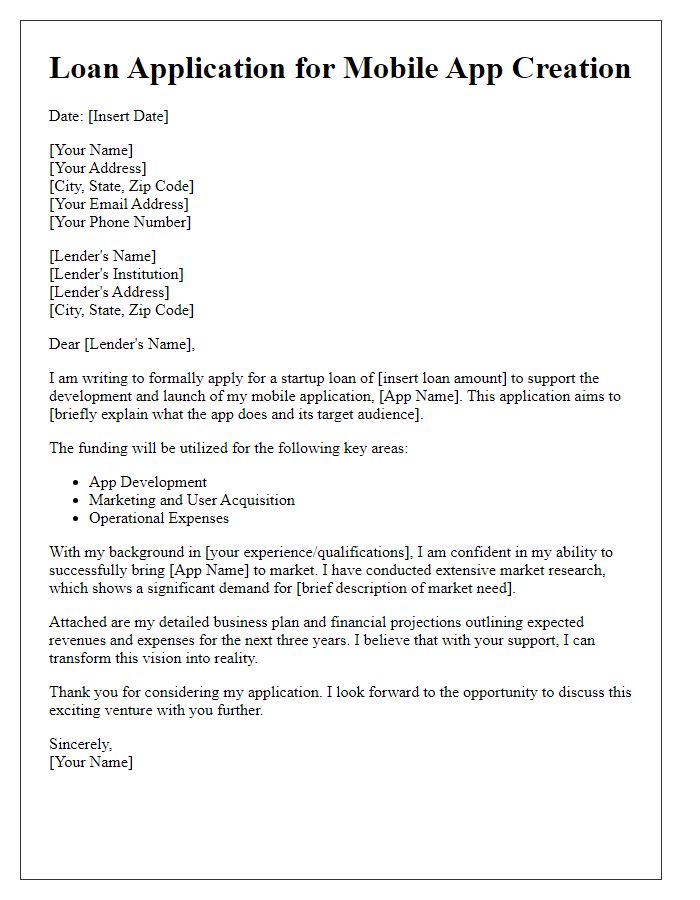

Letter template of startup loan application for technology business expansion.

Letter template of startup loan appeal for e-commerce platform development.

Letter template of startup loan solicitation for health and wellness venture.

Letter template of startup loan application for hospitality industry project.

Letter template of startup loan request for sustainable product initiative.

Comments