Are you considering applying for a foreign loan but are unsure where to start? Navigating the complexities of international financing can feel overwhelming, but having the right letter template can simplify the process. A well-crafted letter outlines your needs and intentions clearly, making a positive impression on lenders. Curious to learn how to structure your application letter effectively? Read on for tips and insights!

Loan Purpose and Project Description

The foreign loan application describes a renewable energy initiative aimed at installing Solar Photovoltaic (PV) systems in rural areas of Tanzania, specifically targeting villages like Magomeni and Kihonda. The project, estimated to cost $2 million, aims to provide sustainable electricity to approximately 5,000 households, significantly enhancing their quality of life and productivity. This initiative aligns with Tanzania's National Development Vision 2025, focusing on improving energy access and promoting environmentally friendly solutions. The implementation phase, scheduled for 2024, involves collaboration with local agencies and international partners specializing in solar technology. By harnessing abundant solar energy, the project aspires to reduce dependency on fossil fuels, support community development, and contribute to achieving the UN Sustainable Development Goals, particularly Goal 7 on affordable and clean energy.

Borrower's Financial Health and Creditworthiness

A borrower's financial health and creditworthiness are crucial factors in securing a foreign loan, particularly from international lenders such as banks or financial institutions. Key financial metrics include the borrower's credit score (usually ranging from 300 to 850), which reflects their repayment history and outstanding debts. Debt-to-income ratio, typically expressed as a percentage, assesses the borrower's monthly debt payments against their monthly income, with a lower ratio indicating better financial stability. Additionally, liquidity ratios like current ratio (current assets divided by current liabilities) help ascertain short-term financial viability, while net worth is derived from total assets minus total liabilities, offering insights into overall financial condition. Consistent cash flow, demonstrated by financial statements over the past three to five years, is essential for evaluating the ability to service debt. Furthermore, a strong business plan, detailing projected revenues and expenditures, coupled with an established repayment strategy significantly strengthens the application.

Loan Amount, Terms, and Repayment Plan

Loan applications for foreign financing typically outline essential details such as loan amount, repayment terms, and structured repayment plans. The loan amount can range from thousands to millions of dollars depending on project scale, usually defined in USD (United States Dollar) for international agreements. Terms often specify duration, such as 5 to 15 years, with interest rates varying based on market conditions; for instance, fixed rates can stabilize payments while variable rates may fluctuate. A repayment plan may include monthly or quarterly installments, detailing the amortization schedule which affects principal reduction over time. Legal compliance and financial disclosures play crucial roles in these agreements, emphasizing the importance of thorough documentation and clear communication with lending entities such as international banks or financial institutions.

Collateral and Security Details

Foreign loan applications require comprehensive collateral and security details to ensure the lender's investment is protected. Collateral may include assets such as real estate (commercial properties valued at $500,000 or more), inventory (goods worth at least $100,000), or equipment (machinery and tools used in manufacturing, typically valued above $50,000). Security details, such as the loan's term (usually ranging from 5 to 20 years) and interest rates (which may vary between 3% to 7% depending on the borrower's creditworthiness), must be clearly stated. The borrower's financial history (including credit scores above 700) and revenue projections (anticipated to reach $250,000 annually) play crucial roles in the evaluation process. Additionally, legal documentation verifying ownership of collateral assets, along with insurance coverage details (minimum coverage amount of $100,000), ensures both parties are safeguarded throughout the loan period.

Compliance with Foreign Financial Regulations

Compliance with foreign financial regulations is crucial for ensuring the legitimacy of loan applications from international lenders. Regulations typically include guidelines established by entities such as the International Monetary Fund (IMF) and the World Bank, often focusing on aspects like anti-money laundering (AML) and know your customer (KYC) protocols. Specific countries, such as the United States with the Office of Foreign Assets Control (OFAC) and the European Union with its financial directives, impose strict measures for transparency in financial transactions. Documentation required may include proof of identity, financial statements, and evidence of the source of funds. Adherence to these regulations facilitates smoother processing, reduces risks of legal repercussions, and contributes to maintaining the integrity of the international financial system.

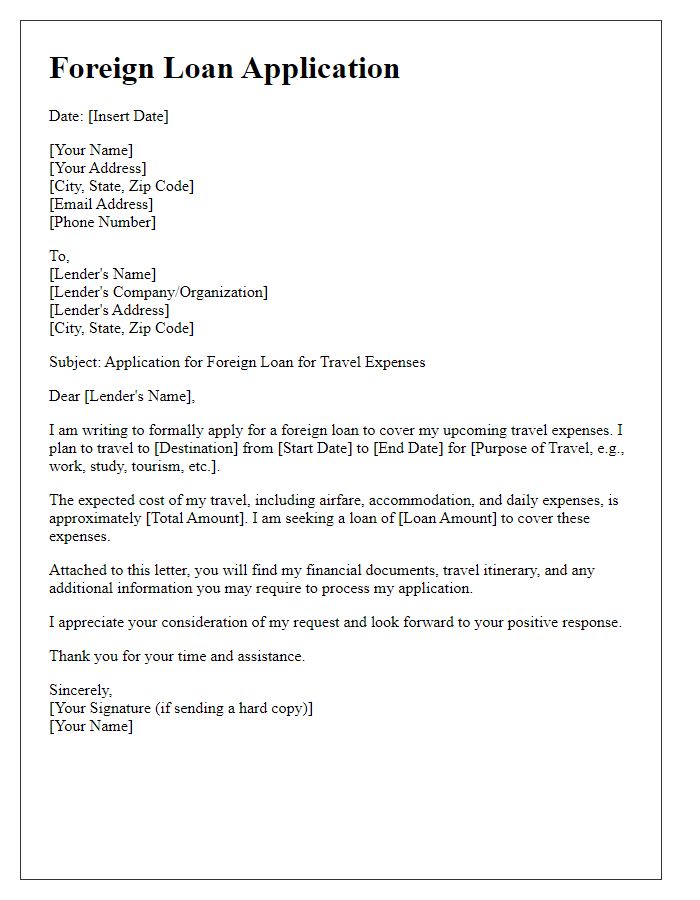

Letter Template For Foreign Loan Application Samples

Letter template of foreign loan application for investment opportunities

Comments