Are you feeling overwhelmed by your current loan situation? It's a common challenge many face, and knowing how to navigate the process can make all the difference. In this article, we'll walk you through a simple yet effective template for drafting a loan cancellation request letter, ensuring you cover all essential points. Ready to take control of your financial future? Let's dive in!

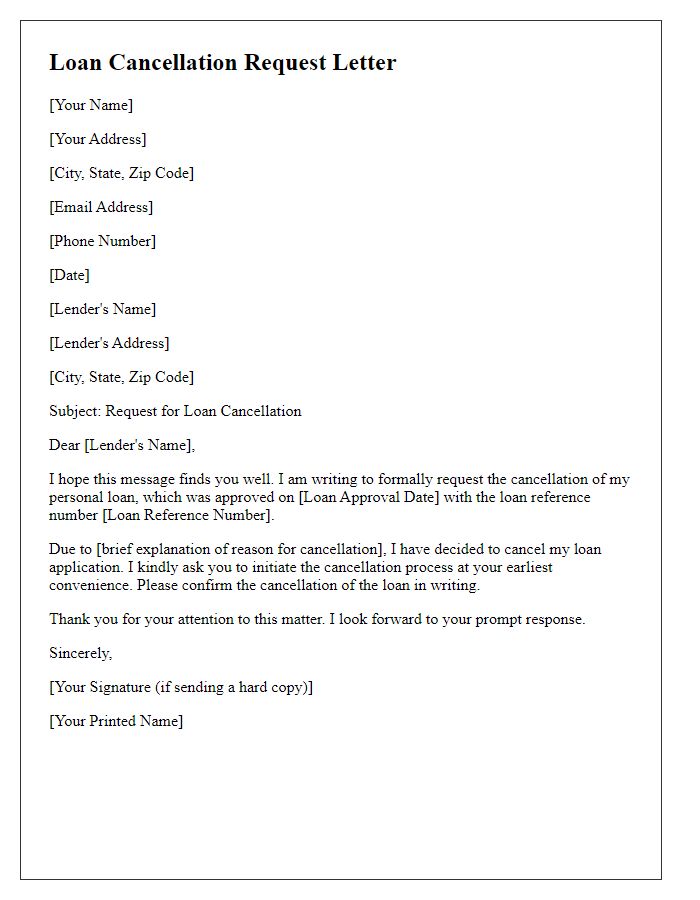

Clear Subject Line

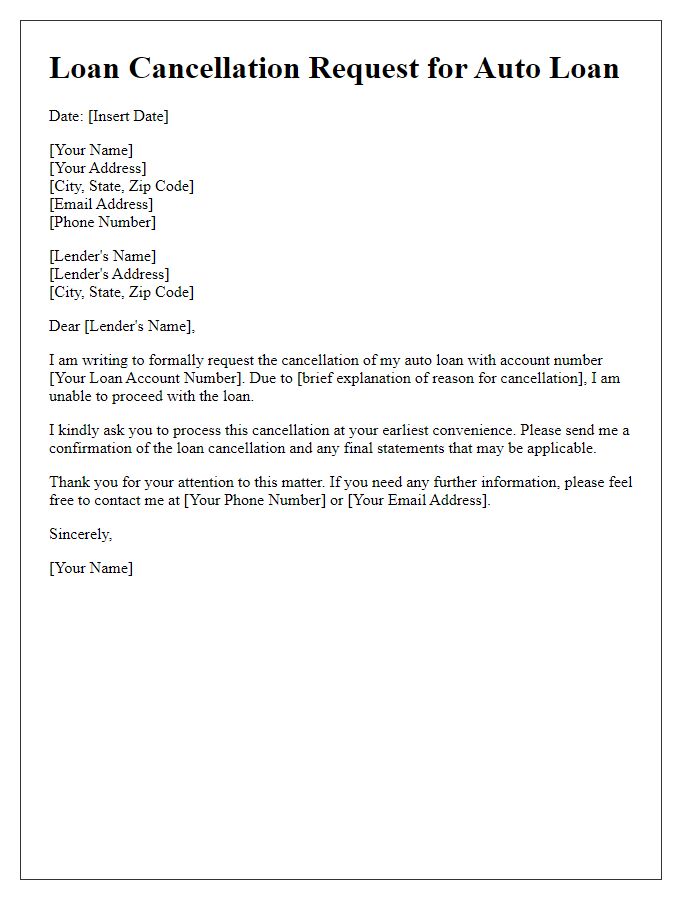

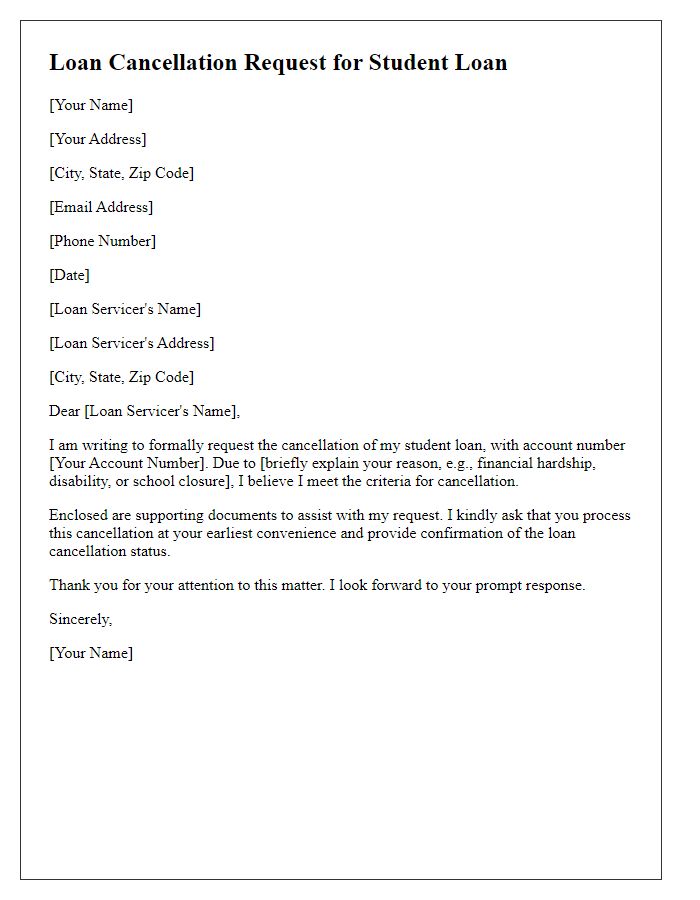

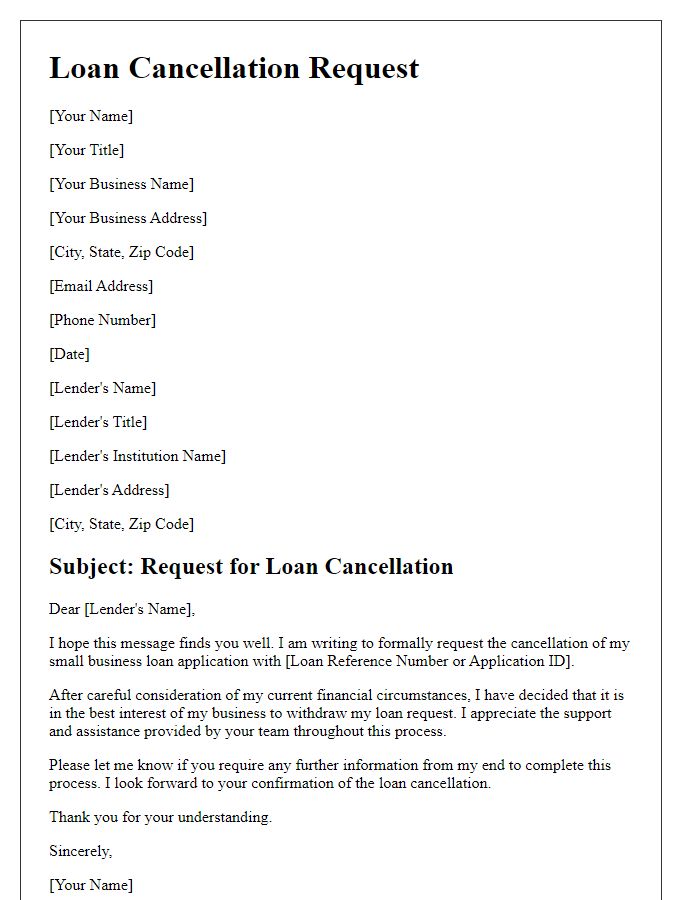

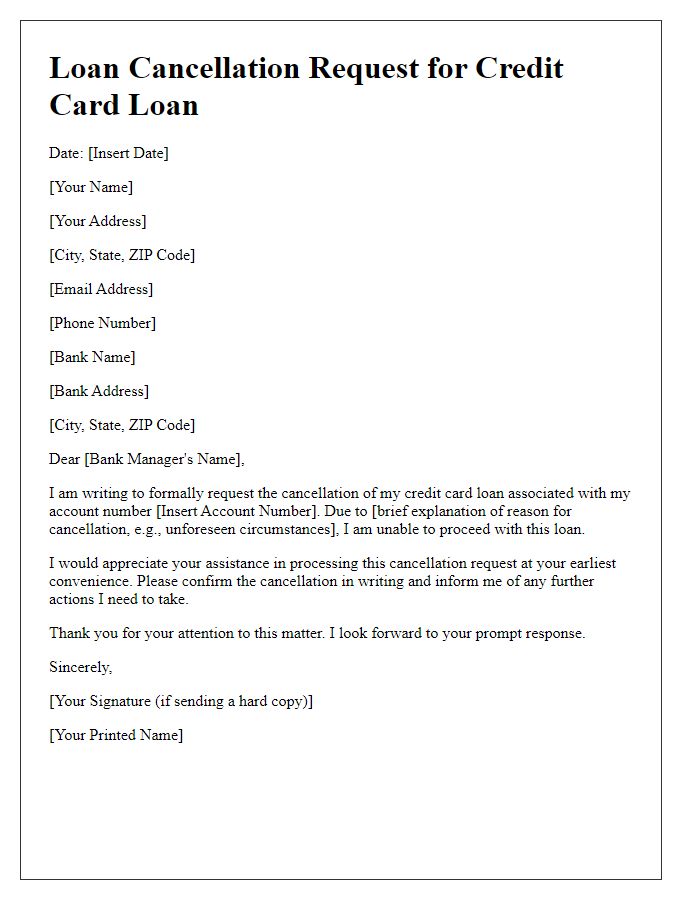

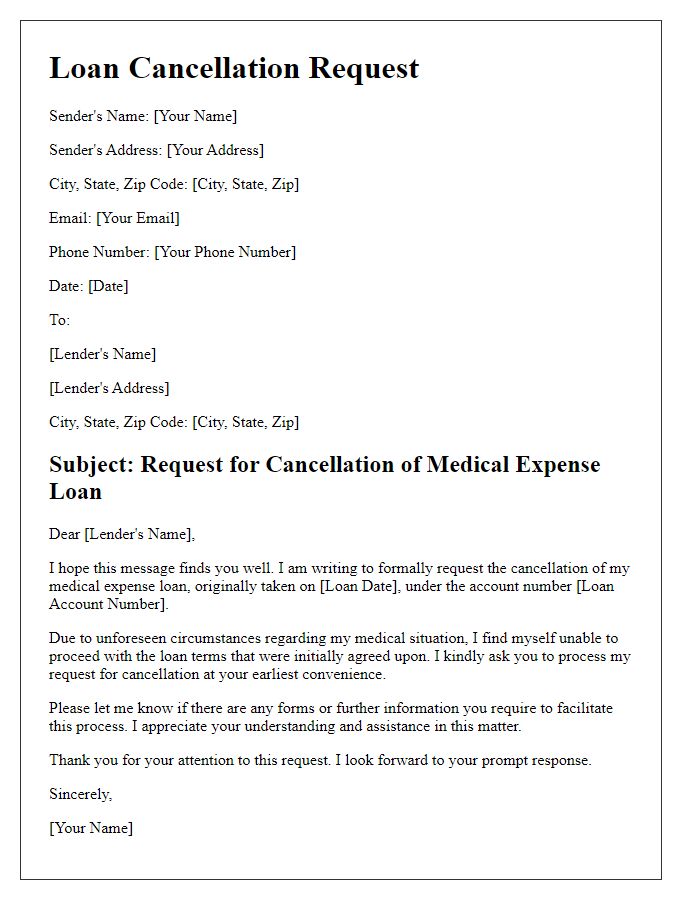

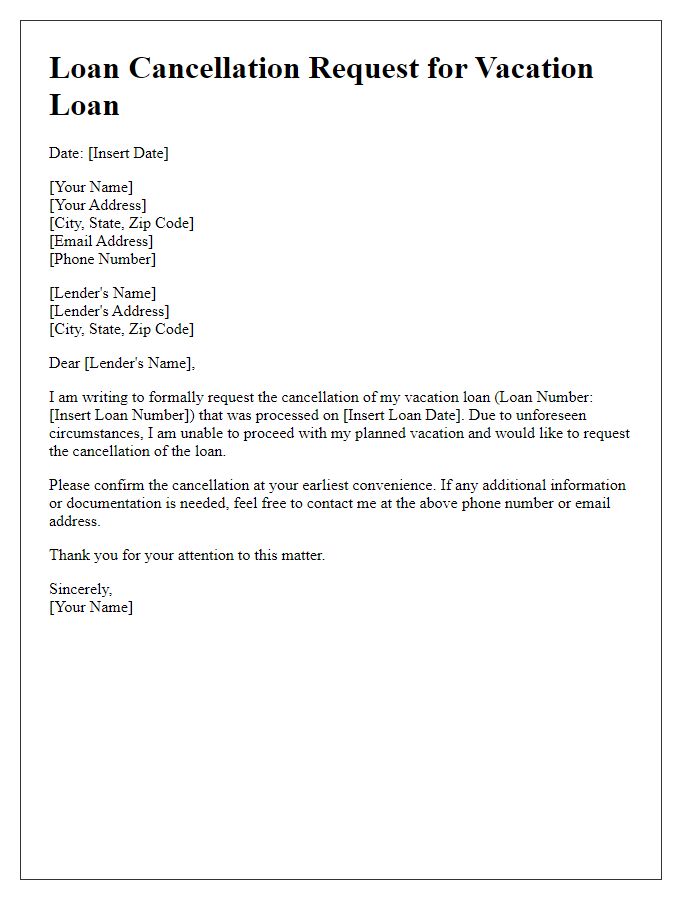

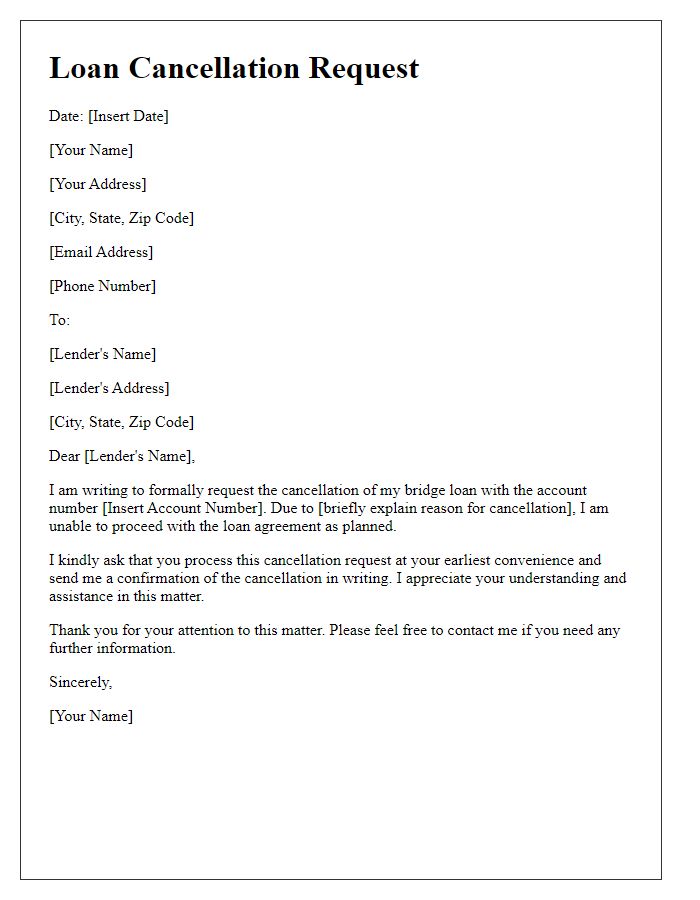

Loan cancellation request letters should be straightforward and concise, addressing the specific loan details. Begin with a clear subject line indicating the purpose, such as "Request for Loan Cancellation - [Loan Number/Account Number]". In the body, specify the loan type, original amount, and the financial institution's name. Mention any relevant dates, such as application or disbursement dates, to provide context. State the reasons for the cancellation clearly, whether due to financial difficulties, a change in circumstances, or other personal reasons. Ensure to include your contact information for any follow-up. Always complete the letter with a polite closing, expressing gratitude for their attention to the matter.

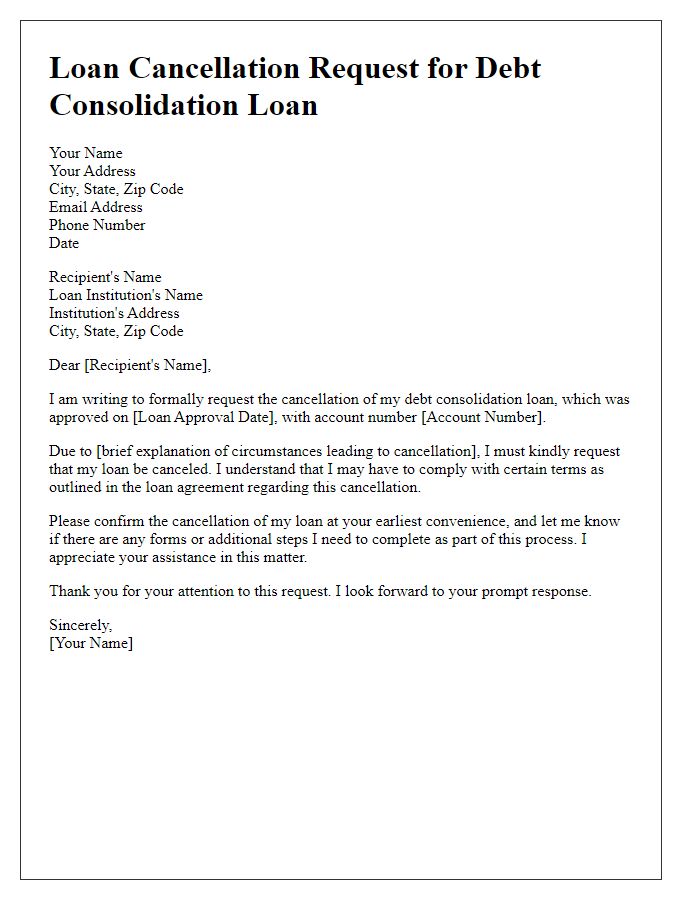

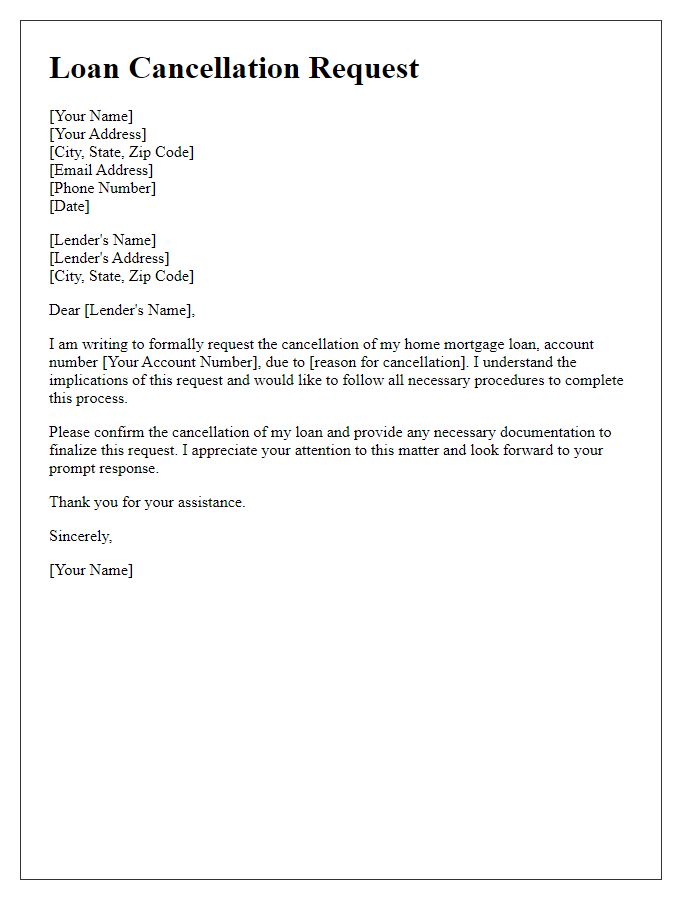

Borrower's Personal Information

A loan cancellation request requires precise documentation of the borrower's personal details to ensure proper identification and processing. The Borrower's Name should include both first and last names as recorded on the loan agreement. The Address needs to be comprehensive, specifying the street number, street name, city, state, and zip code, ensuring accurate correspondence. The Loan Account Number is crucial, serving as the unique identifier assigned for tracking the specific loan in question. Contact Information must include a valid phone number and email address to facilitate communication regarding the cancellation process. Including additional details like the Date of Birth can assist in verifying identity and preventing any potential mix-ups in processing cancellation requests. Clear and accurate personal information helps streamline the request and reduces processing delays.

Loan Details and Account Number

Loan cancellation requests must include important details for clarity. Relevant loan details include the loan amount of $15,000, associated interest rate at 5%, and the loan type, which may be a personal loan or auto loan. The account number, a unique identifier like 123-456-7890, should be provided to ensure accurate processing of the request. Additionally, including the lender's name, such as XYZ Bank, along with any specific cancellation policy statement, informs the lender of the intention to initiate the cancellation process as per their guidelines, which can facilitate a smoother resolution.

Specific Cancellation Reason

Loan cancellation requests often arise due to specific circumstances, such as a change in financial status or a significant life event. Financial institutions like banks or credit unions may require detailed explanations for these requests. For instance, an individual facing unexpected medical expenses can articulate how these costs hinder their ability to repay the loan. Personal loans amounting to thousands of dollars can become burdensome under such conditions. Consistently documenting payment history demonstrates responsible borrowing. Formal communication should include account details like the loan number and the specific amount involved. Clear and concise requests can expedite the processing of cancellation. Utilizing standard cancellation forms may also streamline the procedure, ensuring proper handling by the lending institution.

Request for Confirmation and Next Steps

Loan cancellation requests often require clear communication to ensure understanding and prompt action. The borrower should explicitly detail the loan's identification (loan number, date of disbursement), the reason for cancellation (such as change in financial circumstances, recent job loss), and any relevant deadlines (such as the cancellation window). Additionally, the borrower might request confirmation of the loan's cancellation status from the lender (specific name of the lending institution) and seek guidance on any necessary next steps (documentation to be submitted, additional forms required). Clear articulation of contact details may further facilitate prompt communication.

Letter Template For Loan Cancellation Request Samples

Letter template of Loan Cancellation Request for Debt Consolidation Loan

Comments