Are you in the process of applying for a loan and need a reliable employment verification letter? You've come to the right place! This crucial document can make all the difference in securing the funding you need, ensuring lenders have a clear understanding of your employment status. Join us as we delve into the essential elements of crafting the perfect employment verification letter!

Contact Information (of Employer)

Employment verification letters serve as essential documentation to confirm an individual's employment status for loan applications. The letter typically includes the employer's contact information, which consists of the company's name, business address, phone number, and email address. This information ensures that lenders can reach the employer for any follow-up verification. The employer's name and position (like HR Manager or Supervisor) may also be included to bolster credibility. Accurate and clear communication from the employer serves to expedite the loan approval process, enabling faster access to necessary funds for various needs, such as home purchases or educational expenses.

Employee Details (Name, Position, Duration)

An employment verification letter is a crucial document for confirming an employee's work history for loan applications. This letter typically includes critical details such as the employee's full name, position held in the organization, and duration of employment, which often spans years. For example, the letter may state that John Doe has been employed as a Senior Software Engineer since January 2018, highlighting his role in developing software solutions and projects within the company. Furthermore, specifying the organization's name and address provides official context, reinforcing the credibility of the information presented. Loan officers rely heavily on this verification to assess the borrower's stability and ability to repay the loan, making the accuracy of these details essential in ensuring a seamless financial processing experience.

Employment Status Confirmation

Employment verification plays a crucial role in loan applications, providing lenders with essential information about the applicant's employment history and current income status. Typically required by financial institutions, this verification confirms an individual's job title, duration of employment, and salary details. Lenders often request this information to assess the borrower's ability to repay the loan. Employment status is cross-referenced against documents such as pay stubs or tax returns to ensure accuracy and authenticity. In many cases, the employment verification process involves contacting the employer directly, utilizing standardized forms or letters that comply with lending institution protocols. This verification can significantly influence loan approval rates, making it a vital step in the financial process.

Income Details (Salary, Bonuses)

Employment verification letters for loan applications often require precise salary and bonus information to assess financial stability. A typical salary may range from $50,000 to $150,000 annually, depending on the industry and position, while bonuses can vary widely, averaging 10% to 20% of the salary. The letter should include the employer's name, which could be a prominent corporate entity like Google or JPMorgan Chase, and the employee's position, such as Software Engineer or Financial Analyst. Furthermore, the verification may also state the employment start date, ensuring the lender understands the length of employment, enhancing credibility. Other details might include any additional compensation structures, such as stock options or commissions, to provide a comprehensive overview of the employee's financial situation.

Signing Authority Information

Employment verification letters serve as a formal confirmation of an employee's job status, essential for financial processes like loan applications. Employers often include key details: employee's name, job title, dates of employment, average salary, and work status (full-time or part-time). Additional elements, such as employee identification numbers or department information, provide further verification. The signing authority, typically a human resource manager or company executive, validates the letter's authenticity with a signature, company letterhead, and contact information, all crucial for lenders assessing the employee's reliability and financial stability. Dates included in the letter indicate when the employment began and provide context for income stability, helping lenders make informed decisions.

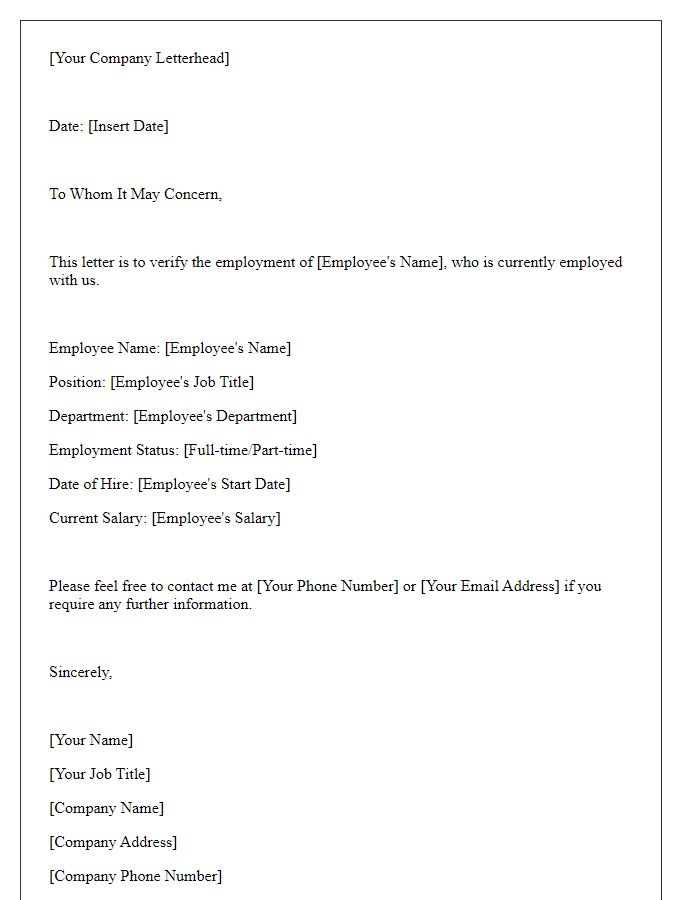

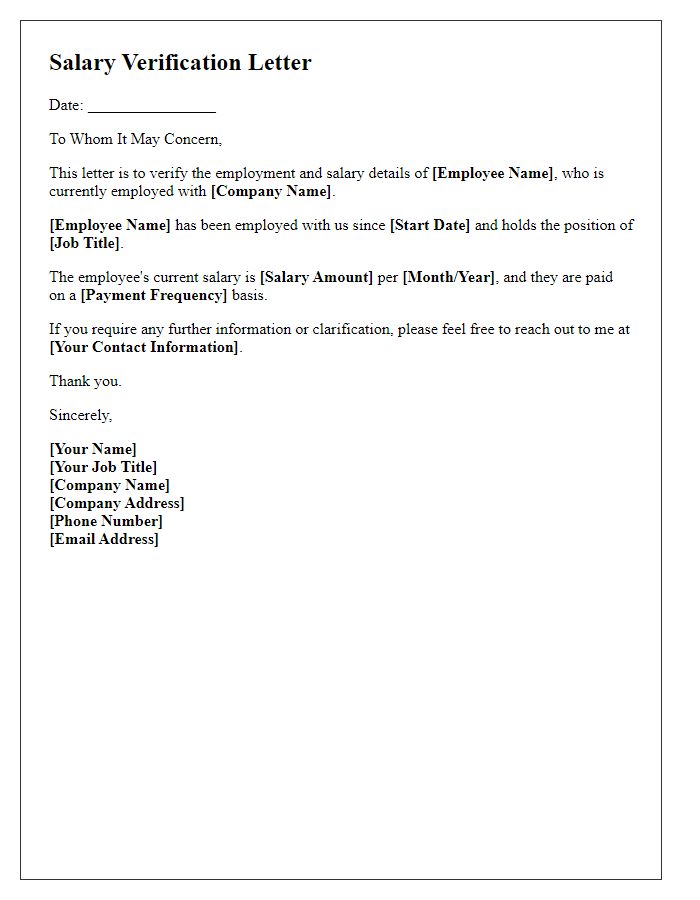

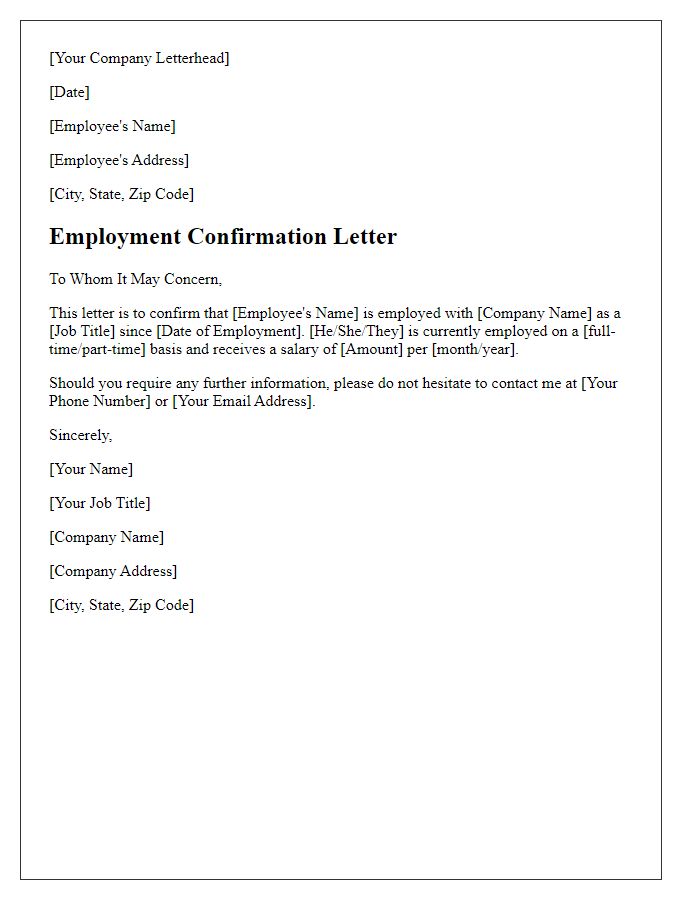

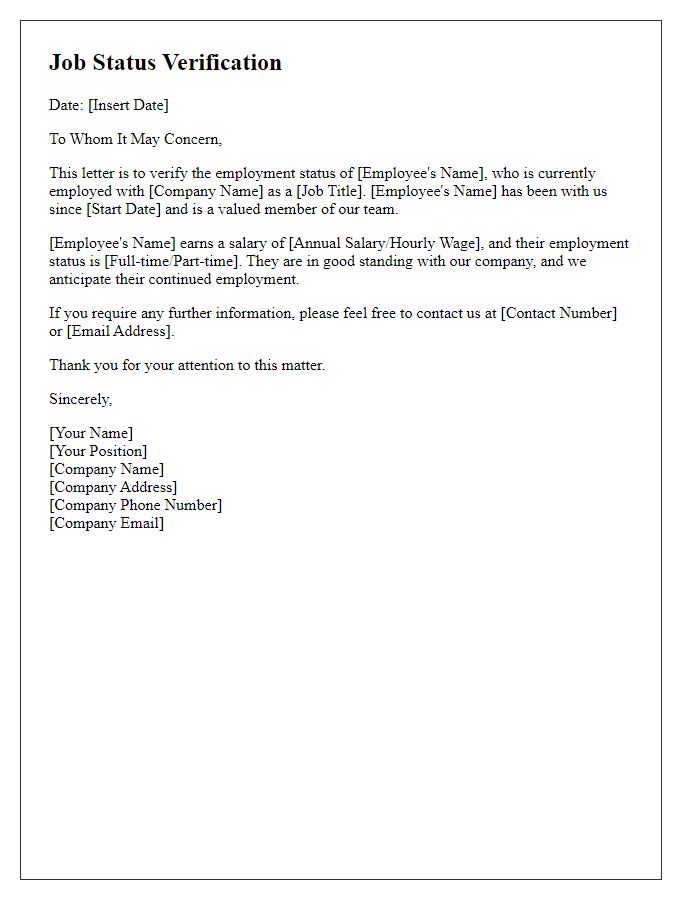

Letter Template For Employment Verification Loan Samples

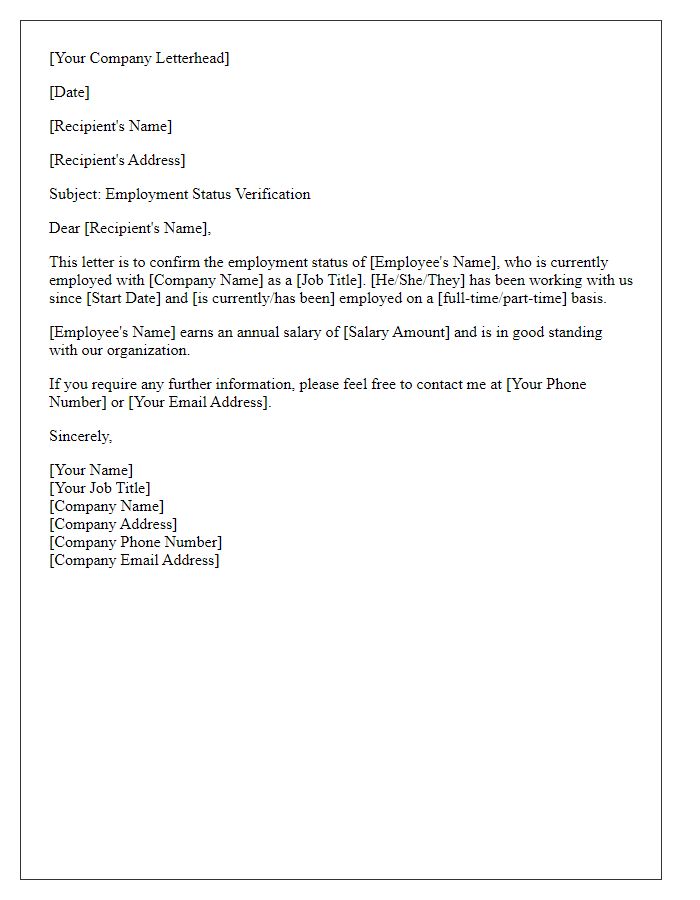

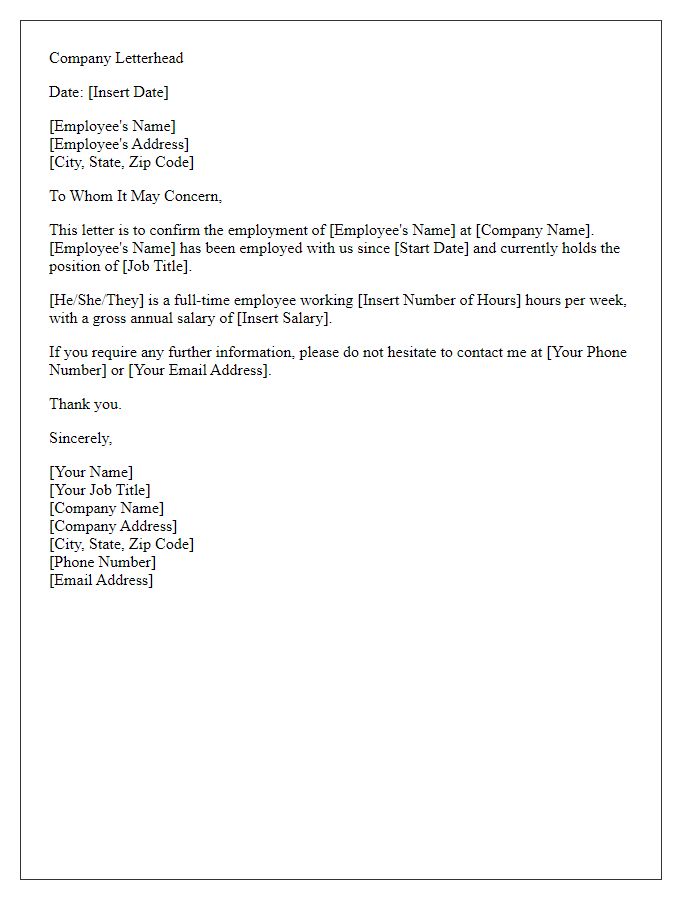

Letter template of employment status verification for credit application.

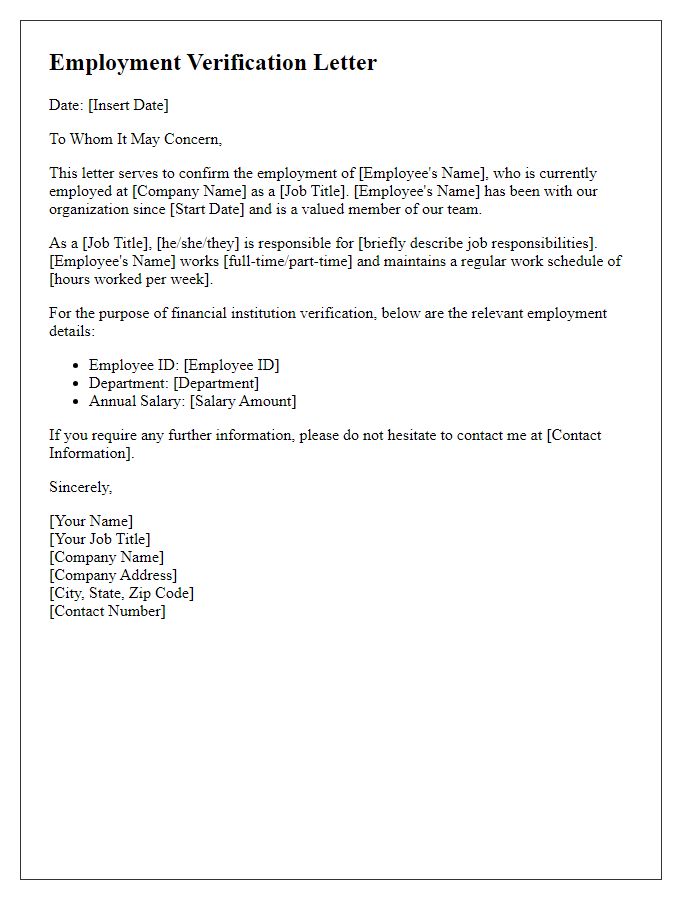

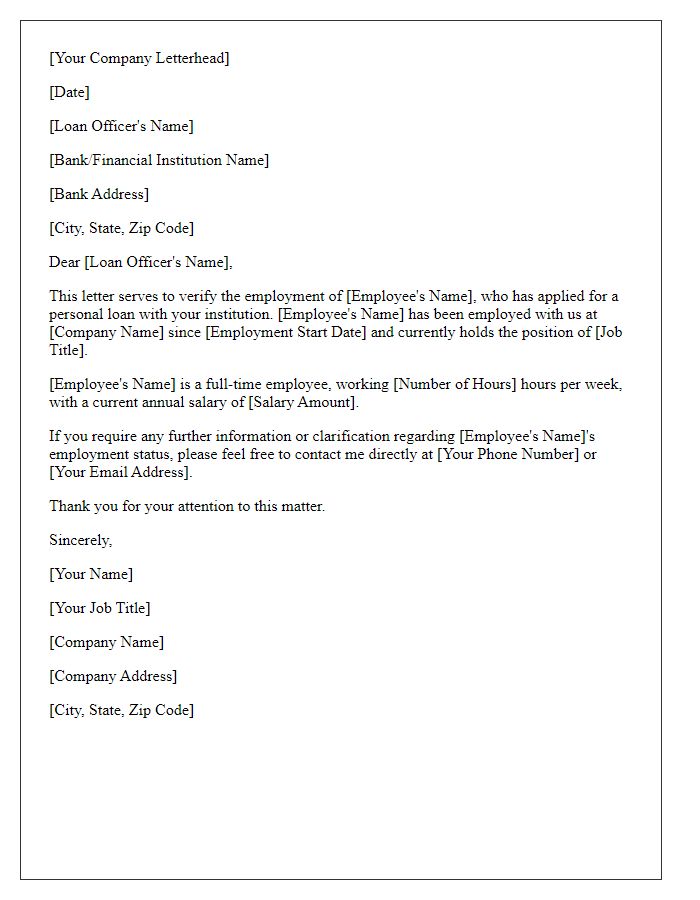

Letter template of employment letter for financial institution verification.

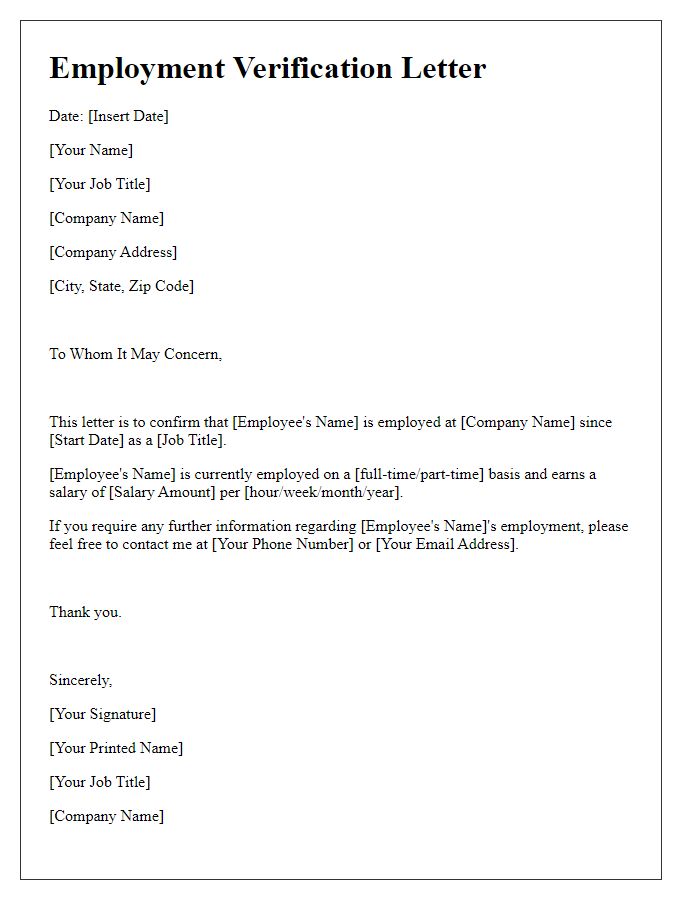

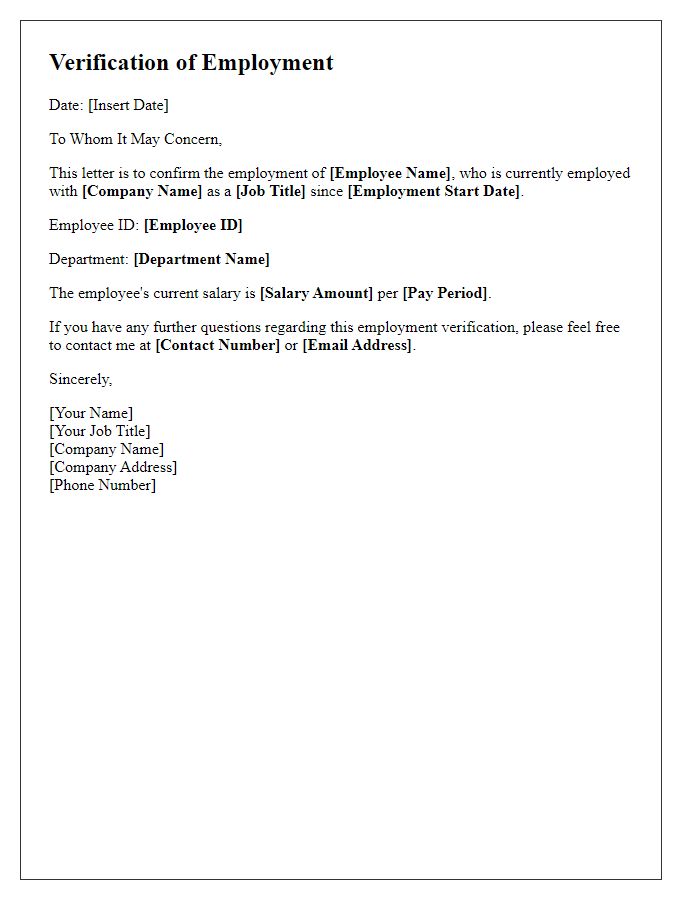

Letter template of employment verification for student loan requirement.

Comments