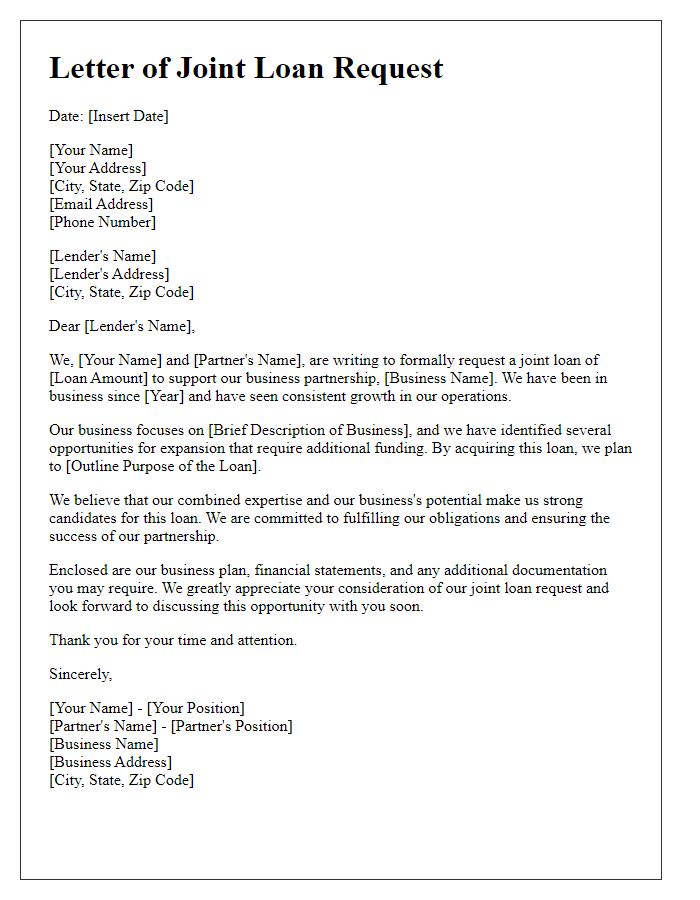

Are you considering applying for a collaborative loan but unsure where to start? You're not alone; many individuals and businesses are navigating the complexities of shared financing. In this article, we'll break down the essentials of crafting the perfect letter for your loan application, emphasizing clarity and transparency in your request. Ready to dive in and learn how to present your joint proposal effectively? Let's get started!

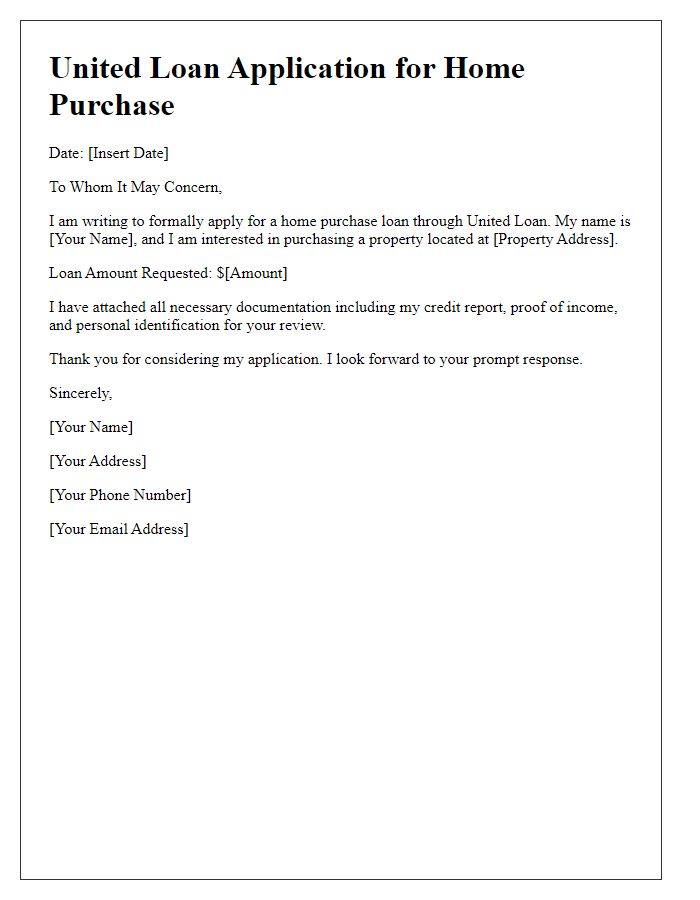

Applicant Information

In a collaborative loan application, the applicant information section plays a vital role in evaluating the financial credibility of the individuals involved. Key elements include full names of applicants, such as John Smith and Jane Doe, alongside social security numbers (tailored to the jurisdiction, typically nine digits in the United States). Important identifiers like addresses (including street names, city, state, and zip codes) must be provided, allowing lenders to confirm residency. Additionally, applicants should disclose financial information, including total income figures (often in annual form, such as $75,000), employment details (company names, roles, and duration of employment), and credit scores (within a scale of 300 to 850, with higher scores indicating better creditworthiness). This section underscores the importance of transparency in financial history and establishes a foundation for trust in the lending process.

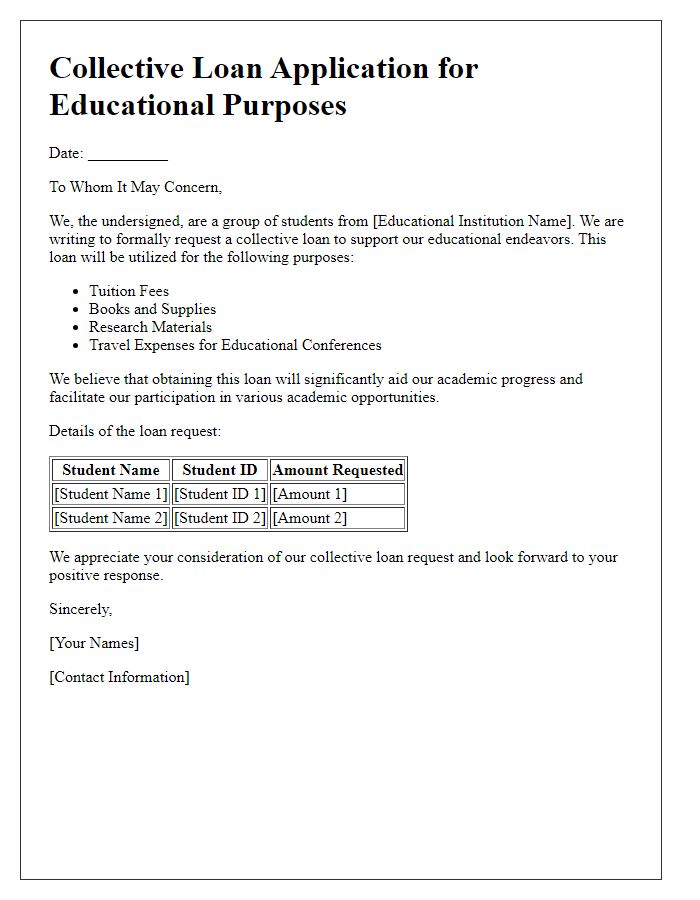

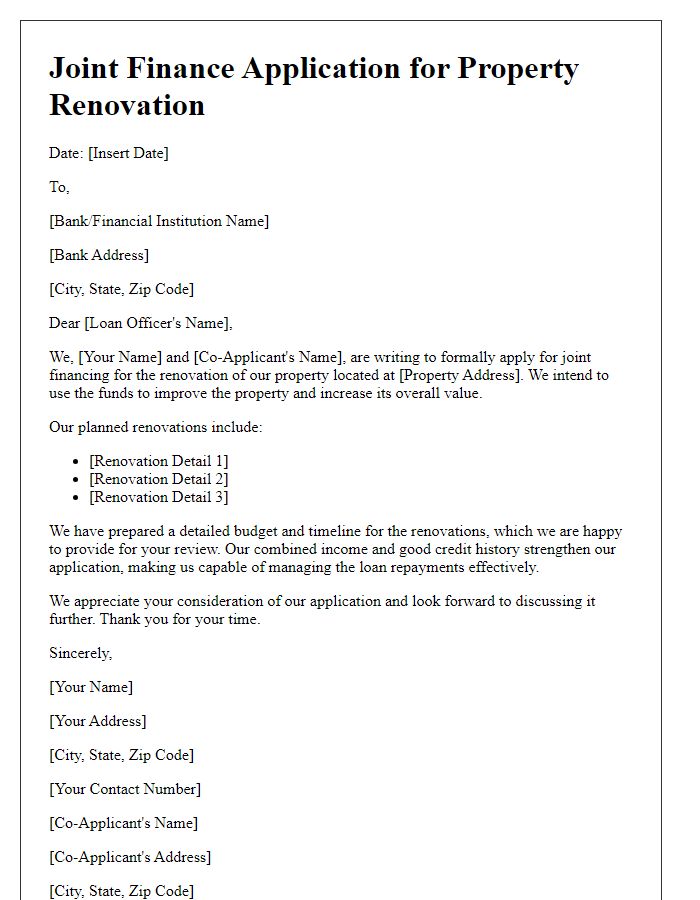

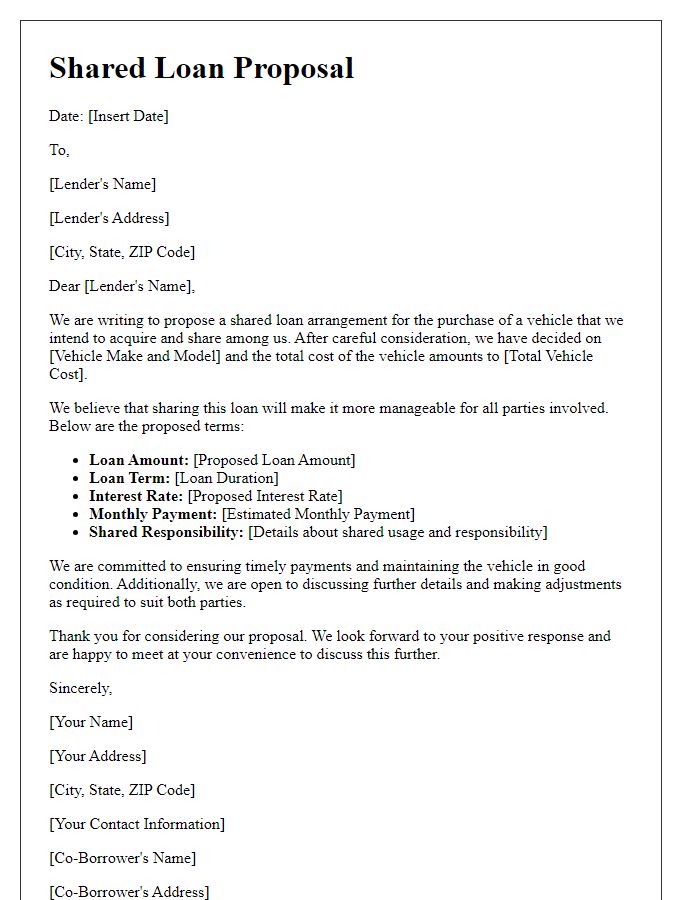

Loan Purpose and Amount

A collaborative loan application requires clear communication regarding the purpose and amount of the loan. Key elements include specifics such as intended use (e.g., business expansion, home renovation, student education), total loan amount requested (e.g., $50,000), and breakdown of costs associated with the loan purpose (e.g., equipment purchases, labor costs, or tuition fees). Stakeholders involved (e.g., co-applicants, business partners) need to acknowledge their roles and financial responsibilities. Clear details about the anticipated timeline for loan repayment (e.g., 5 years) and potential collateral options (e.g., property, equipment) can enhance credibility, fostering a positive outlook on the loan application's success.

Financial Information and Credit History

Collaborative loan applications require detailed financial information and robust credit histories from all parties involved. Borrowers must present their combined income details, including salaries, bonuses, and any additional sources such as rental income or dividends, ensuring transparency about total monthly earnings. Credit histories involve reports from major credit bureaus like Experian, Equifax, and TransUnion, showcasing each individual's credit score, history of debt repayment, and any recorded defaults or bankruptcies. Lenders often seek a minimum credit score (usually above 620 for conventional loans), emphasizing the importance of maintaining low credit utilization ratios and timely bill payments. Other necessary documentation may include tax returns from the past two years, proof of savings, and a breakdown of outstanding debts such as mortgages, car loans, or personal loans, creating a comprehensive picture of the applicants' financial health to secure favorable loan terms and interest rates.

Collateral or Security Offered

In collaborative loan applications, the collateral or security offered typically involves tangible assets, such as real estate properties, vehicles, or equipment that can be used to secure the loan amount. For instance, a residential property located in downtown Chicago, valued at approximately $300,000, could serve as collateral, providing lenders with assurance in case of default. Alternatively, machinery worth around $150,000 in a manufacturing business may also be offered, increasing the likelihood of loan approval. Financial institutions often assess the loan-to-value ratio (LTV), where assets must meet a specific percentage of the loan requested, usually 70-80%. In addition to physical assets, cash savings or investment accounts may also be presented as security to enhance the application's strength and demonstrate the borrowers' commitment to repayment.

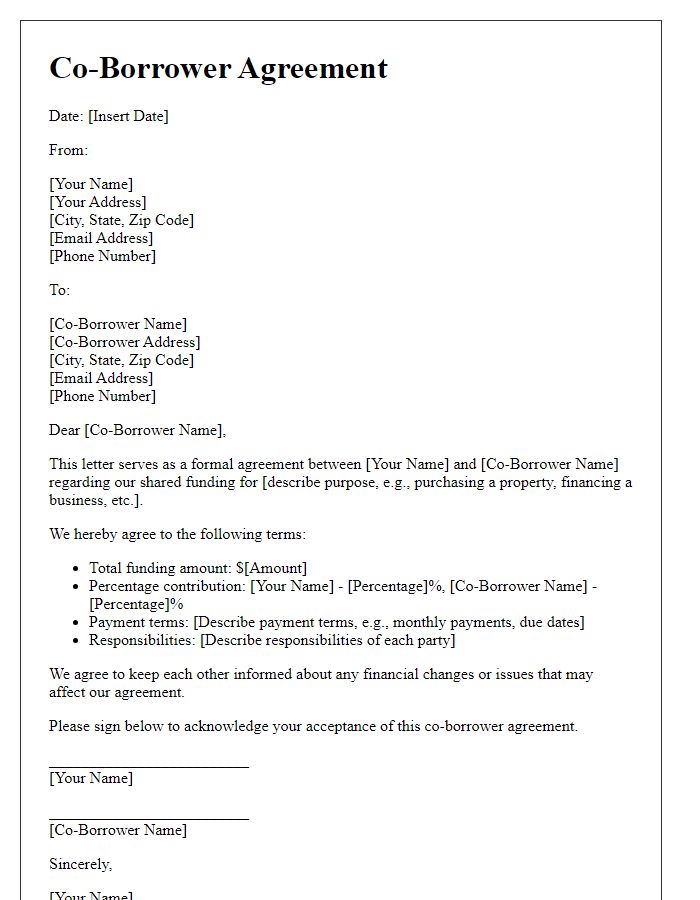

Commitment and Repayment Plan

Collaborative loan applications often outline commitments and repayment plans to ensure accountability among all parties involved. A clear framework is established, detailing each participant's responsibilities regarding loan repayment schedules, interest rates, and principal amounts. Each party typically agrees on specific contributions towards the monthly payment, which ensures consistency and reliability. Furthermore, pertinent financial documents such as income statements from all borrowers, credit reports revealing credit scores and histories, and any collateral information (like real estate or vehicles) are assembled to enhance credibility in the lending process. The loan agreement lays out the timeline for repayment, often spanning several years (commonly 5 to 30 years), with agreements made on whether payments will be made on a monthly, quarterly, or annual basis depending on lender requirements. Adding to the strategy, provisions for early repayment penalties or default consequences are clearly defined to protect lenders and ensure compliance. Such structured commitments demonstrate a collaborative approach, fostering trust and increasing the likelihood of loan approval from institutions such as banks or credit unions.

Comments