Are you ready to sail into your next adventure with the perfect marine loan? Navigating the world of financing can feel overwhelming, but it doesn't have to be. In this article, we'll break down the essentials of writing a compelling letter for your marine loan application, ensuring you make a lasting impression. So, grab your pen and get comfortable, because we'll guide you through this process step-by-stepâlet's dive in!

Applicant's Personal and Financial Information

The marine loan application process requires detailed personal and financial information from the applicant. Key provisions of interest include full name, Social Security number for identity verification, current address to establish residency, and contact information such as phone number and email for ongoing communication. Financial data should encompass annual income figures, employment status, and detailed asset reports, including bank account balances, investments, and property ownership details. Additionally, the applicant must disclose existing debts, which may include credit card balances, loans, and mortgages. This comprehensive financial overview aids lenders in assessing creditworthiness and loan eligibility for marine vessel purchases.

Detailed Vessel Description and Purpose

The vessel, a 2022 Sea Ray SLX 400, measures 40 feet in length, features twin Mercury Verado 350 outboard motors, and is equipped with state-of-the-art navigation systems, including a Simrad NSS 12 evo3 touch screen. Constructed with fiberglass material, the design ensures durability and performance on open waters. Intended for both recreational use and chartering opportunities, the boat accommodates up to 12 passengers and includes luxurious amenities such as an entertainment system, dual sun pads, and a wet bar. This vessel will primarily operate in the coastal waters of Florida, known for their scenic beauty and vibrant marine life, while also participating in local fishing tournaments, enhancing its purpose as both a leisure and competitive asset.

Loan Amount and Repayment Terms

A marine loan application typically involves a request for financial assistance to purchase or refinance boats, yachts, or other marine vessels. Individuals often seek amounts ranging from $10,000 to several million dollars, depending on the value of the vessel and the intended use. Repayment terms can vary significantly, often spanning from five to twenty years, with interest rates fluctuating based on the applicant's creditworthiness and prevailing market conditions. Unique factors such as the vessel's age, type (sailboat, motor yacht, fishing boat), and condition can influence loan approval and repayment schedules. Furthermore, lenders may require collateral, often the vessel itself, to secure the loan.

Financial Projections and Collateral

Financial projections for marine loan applications typically include detailed assessments of future revenue streams derived from specific boating operations, maintenance costs, and expected depreciation of marine vessels. Borrowers should outline clear timelines for repayment, with forecasts covering a period of three to five years, emphasizing profitability metrics and expected cash flow. Collateral considerations involve not only the marine vessel itself, often valued through marine surveys, but also any associated equipment such as trailers, engines, and necessary safety gear. Additionally, relevant documentation such as registration details, ownership history, and any previous financial obligations may be crucial in establishing the collateral value for lenders, particularly in financing scenarios involving recreational boats or commercial shipping vessels.

Legal Compliance and Regulatory Requirements

Legal compliance for marine loan applications involves navigating a complex framework of regulations. The Marine Financing Act of 2000 outlines borrower eligibility, ensuring adherence to maritime and financial laws. Key documentation includes proof of ownership for vessels exceeding 50 feet, and proof of insurance coverage meeting statutory requirements. The compliance checklist mandates a thorough review of state-specific marine regulations, particularly for registrations in states like Florida and California, which have unique maritime laws. Additionally, lenders must comply with the Truth in Lending Act, ensuring borrowers are fully informed of interest rates, fees, and the total cost of financing. Regular audits are crucial for maintaining compliance and avoiding potential legal repercussions, emphasizing the significant role of legal counsel in navigating these requirements effectively.

Letter Template For Marine Loan Application Samples

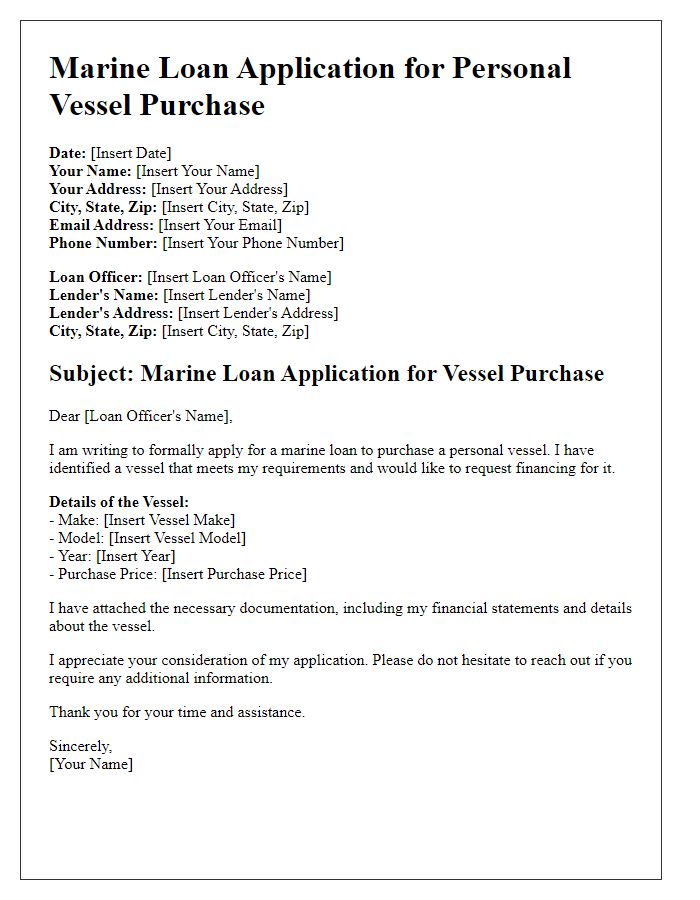

Letter template of marine loan application for personal vessel purchase.

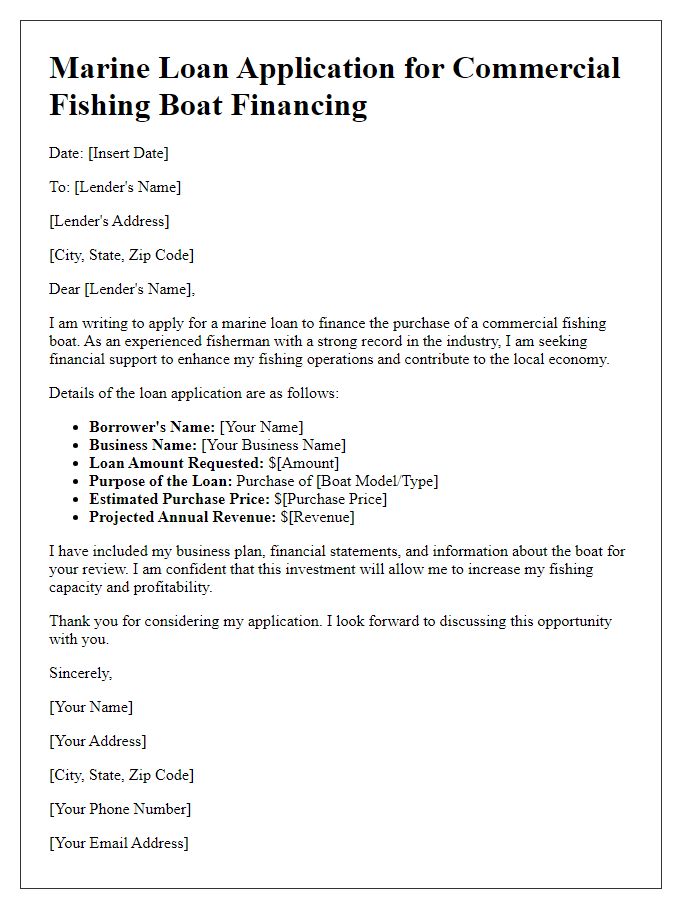

Letter template of marine loan application for commercial fishing boat financing.

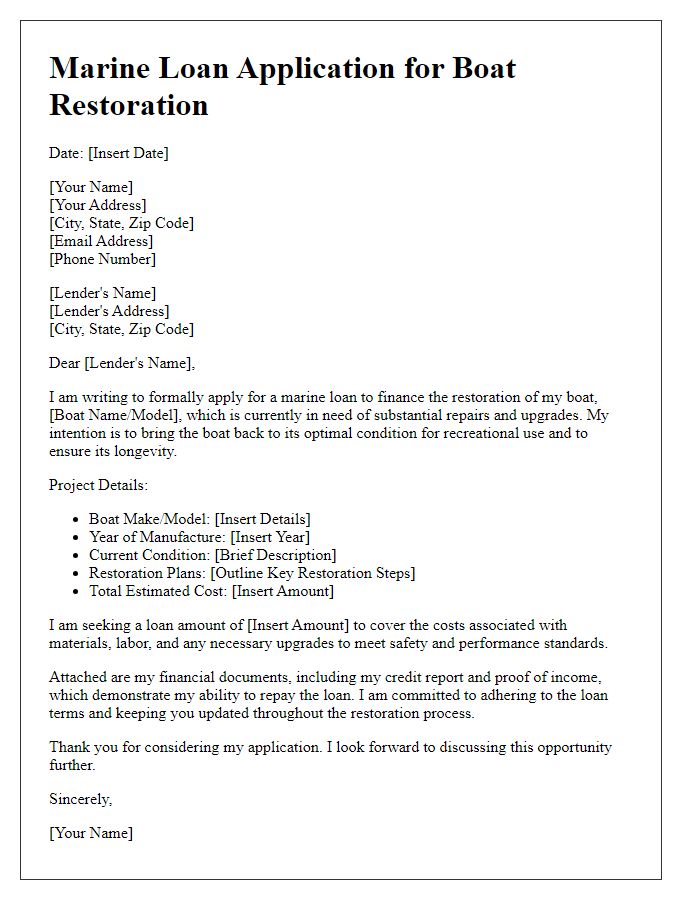

Letter template of marine loan application for boat restoration projects.

Letter template of marine loan application for sailing charter business startup.

Letter template of marine loan application for a marine equipment upgrade.

Letter template of marine loan application for family recreational boat.

Letter template of marine loan application for a fishing tour operation.

Comments