Are you feeling overwhelmed by loan terms that just don't seem fair? You're not aloneâmany borrowers find themselves grappling with unfavorable conditions that can hinder their financial progress. In this article, we'll explore how to effectively appeal those loan terms and advocate for a more manageable solution. Stick around to discover practical tips and a sample letter that can help you make your case!

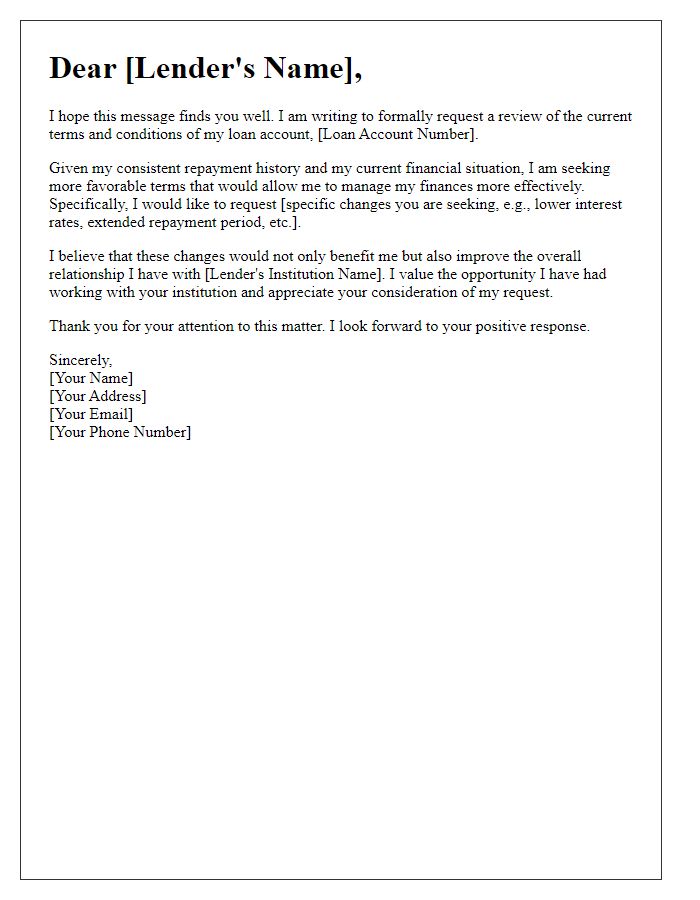

Clear and concise subject line

Request for Review of Unfavorable Loan Terms

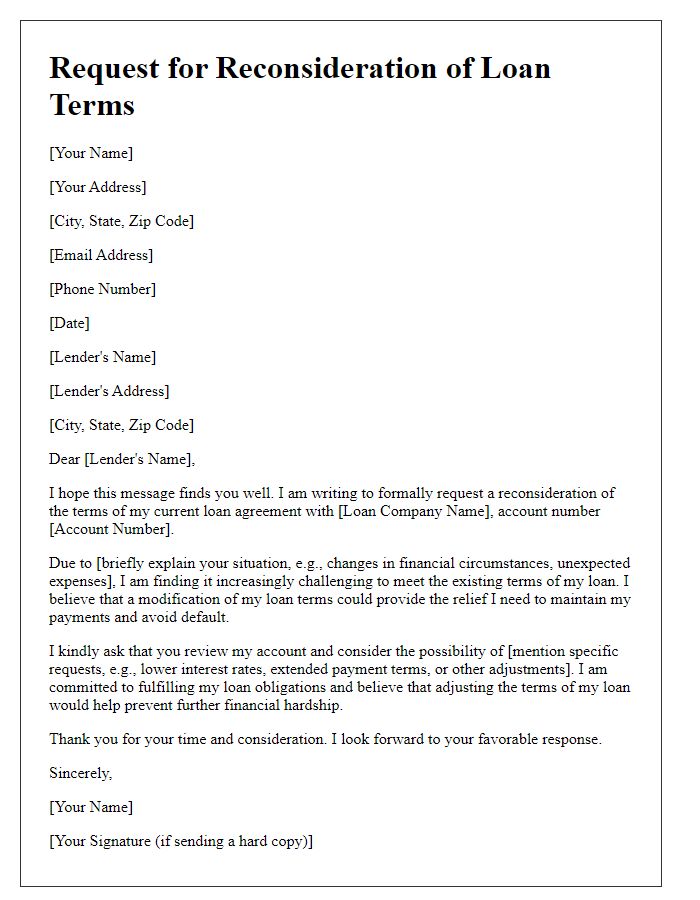

Borrower's personal information and loan details

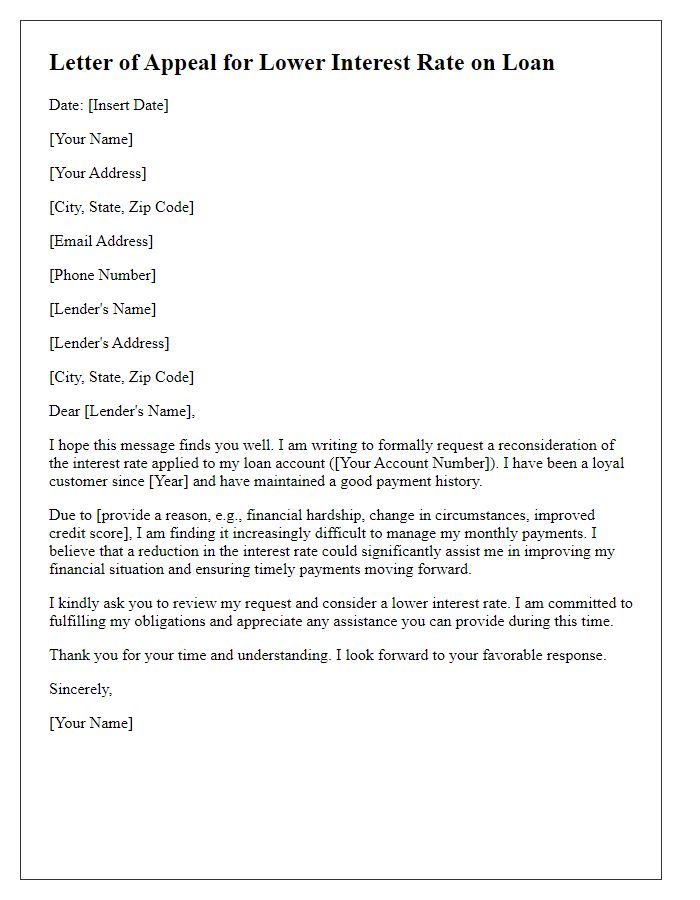

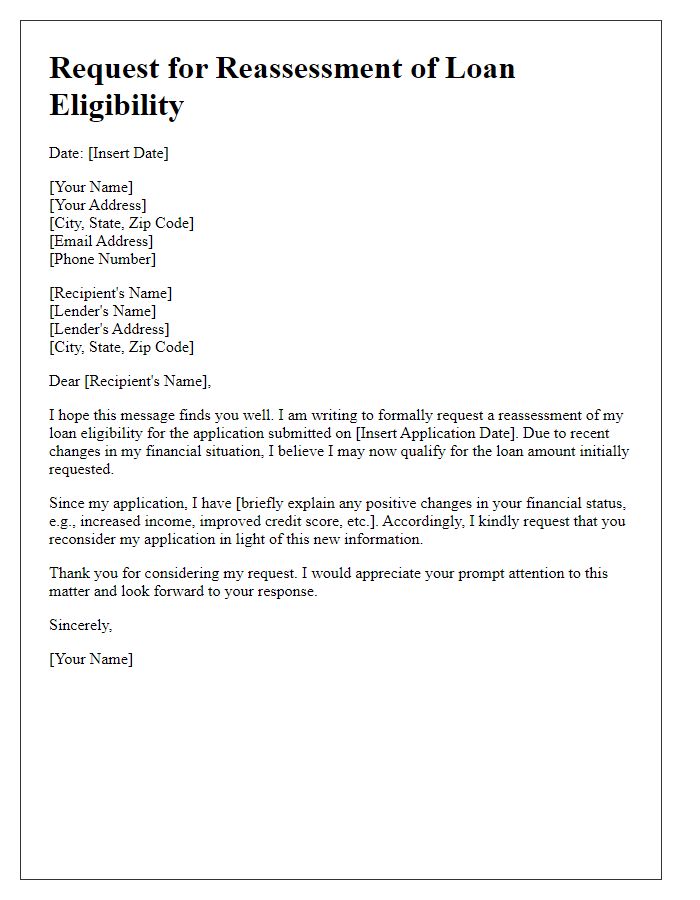

Borrowers often face challenges with unfavorable loan terms, including high-interest rates and restrictive repayment schedules. Essential details such as the borrower's name, address, and contact information, along with the specific loan type (e.g., personal, auto, mortgage), loan amount (for instance, $10,000), interest rate (for example, 8% APR), and repayment period (like 5 years) must be clearly stated. Providing a brief background of financial circumstances, such as unexpected medical expenses or job loss, can lend support to the appeal. Including documentation, such as a recent credit report illustrating improved credit scores or increased income, will help demonstrate eligibility for more favorable conditions. The appeal should articulate the specific changes requested, such as a lower interest rate or extended repayment term, underscoring the potential benefits to both borrower and lender, fostering collaboration for resolution.

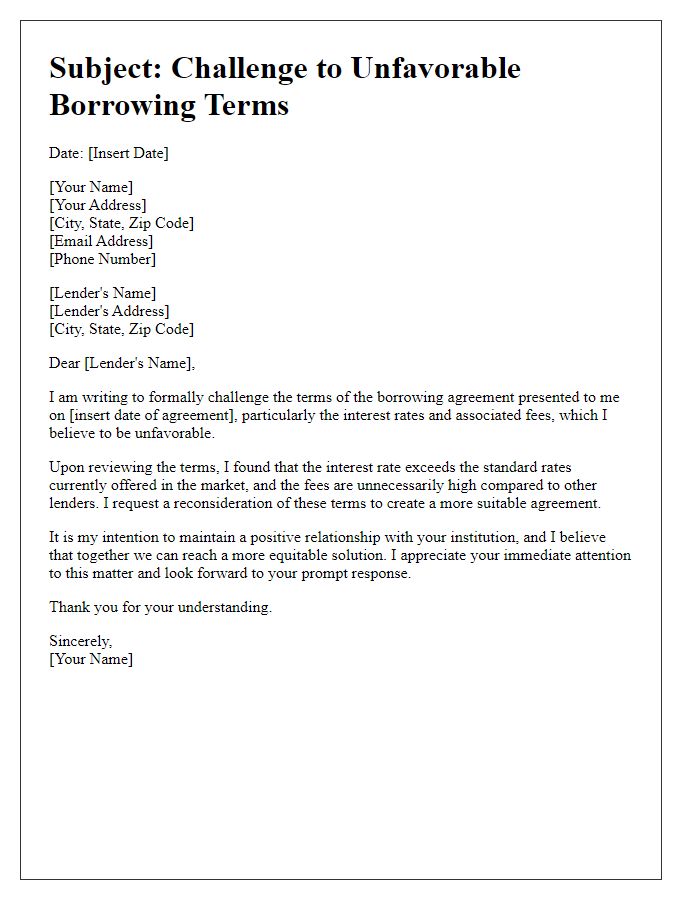

Specific terms being contested

In recent negotiations regarding my loan with the XYZ Bank, I encountered unfavorable terms that I wish to contest. The interest rate set at 7.5% significantly exceeds the current market average of 4.2% for comparable loans in 2023. In addition, the required collateral stipulation mandates an asset worth 150% of the loan amount, which imposes undue financial strain. The repayment period of only 5 years, despite my consistent income as a graphic designer earning $75,000 annually, appears excessively short, straining my budget. Furthermore, the imposed origination fee of $1,000, which is notably higher than typical fees ranging from $300 to $500, greatly impacts my loan affordability. I hope to renegotiate these terms for a fair outcome that reflects better industry practices.

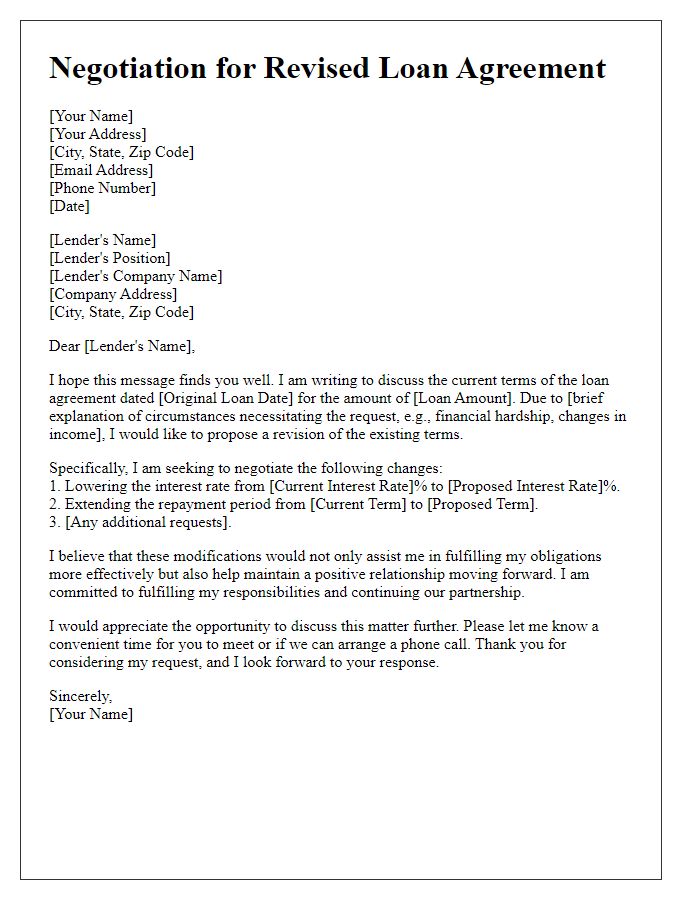

Strong supporting arguments for appeal

When appealing unfavorable loan terms, it is essential to present a compelling case emphasizing key factors that support your request. Potential reasons may include changes in personal financial circumstances, such as job loss or unexpected medical expenses, that hinder repayment capabilities. Highlighting consistent payment history on previous loans or credit obligations can demonstrate reliability and commitment to meeting financial responsibilities. Additionally, referencing current market conditions, including lower interest rates (typically below 4% for comparable loans), can provide a basis for requesting more favorable terms. Citing your credit score, particularly if it has improved significantly since the loan origination--e.g., rising to 720 or higher--can further bolster your argument for renegotiation. Include relevant documentation, such as updated financial statements or letters from employers outlining job stability, to strengthen your appeal.

Professional closing and contact information

In the process of appealing unfavorable loan terms, it is essential to maintain a professional tone while clearly outlining your reasons for reconsideration. The closing statement should reinforce your commitment to finding a mutually beneficial resolution and invite further communication. Include your contact information at the end to ensure accessibility. For instance, a professional closing might look like this: "Thank you for your attention to this matter. I look forward to your prompt response and am hopeful we can reach an amicable agreement regarding the loan terms. Please feel free to contact me at [Your Phone Number] or [Your Email Address] should you need any further information or clarification." Make sure to personalize with accurate contact details and maintain a courteous demeanor to foster goodwill during negotiations.

Comments