Have you ever found yourself in the limbo of waiting for a loan application response? It can be a nerve-wracking experience, especially when you're eager to move forward with your plans. A well-crafted follow-up letter can make all the difference, demonstrating your proactive approach and keeping your application on the lender's radar. Curious about how to structure that perfect follow-up letter? Read on for tips and a helpful template!

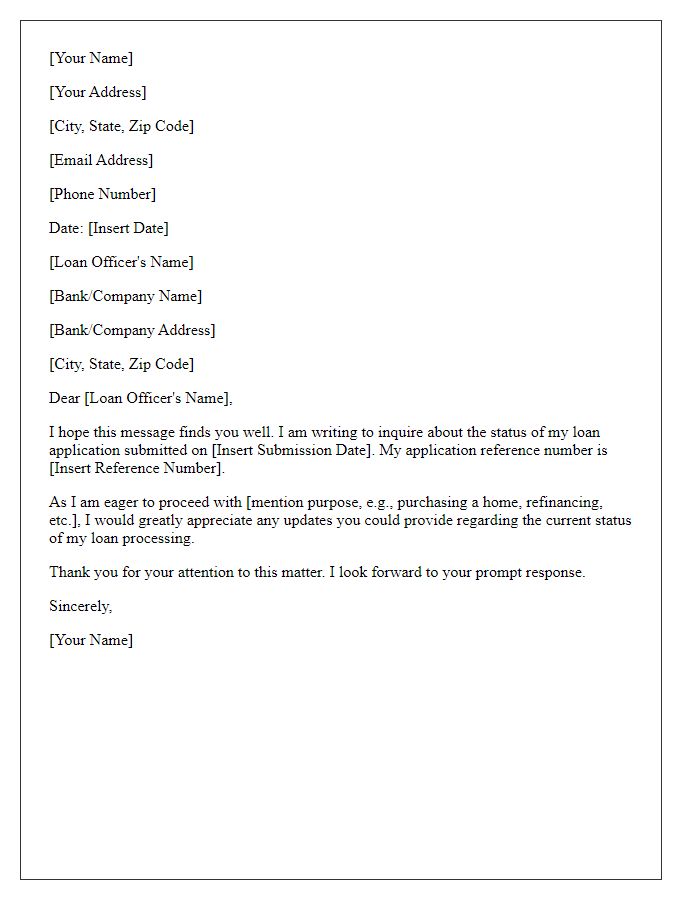

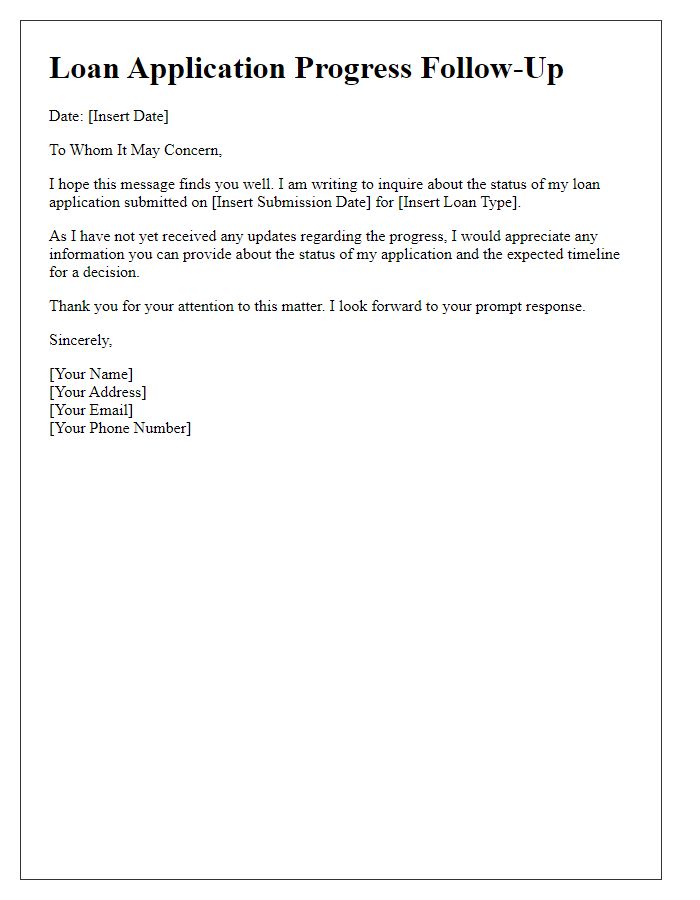

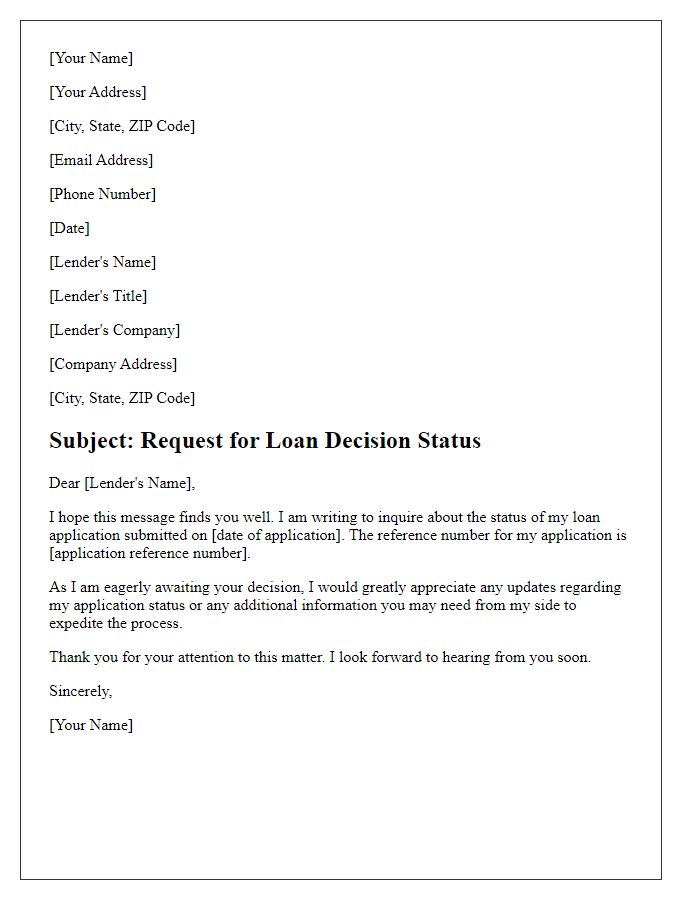

Clear subject line

Following up on the loan application dated September 15, 2023, I would like to inquire about the approval status. The loan amount requested was $10,000 for the purpose of expanding my small business in downtown Denver, Colorado. This expansion is expected to create three new jobs and increase my revenue by approximately 30% over the next year. Any updates or additional information needed for processing would be greatly appreciated, as securing this loan is crucial for meeting my expansion timeline. Thank you for your attention to this matter.

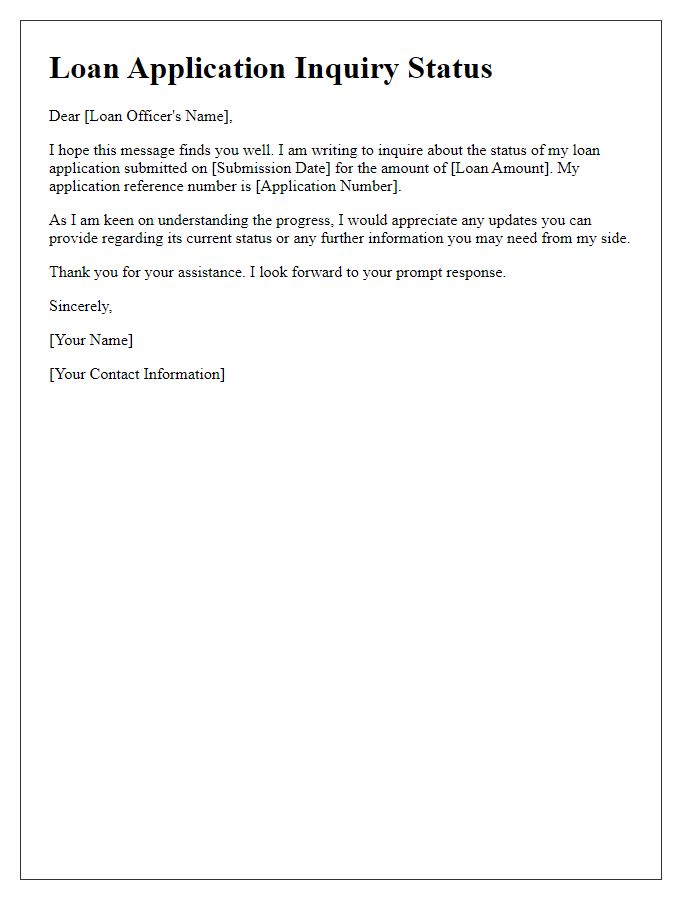

Polite opening statement

Following up on a loan application can be a crucial step in ensuring timely communication with financial institutions. A polite opening statement allows the applicant to express appreciation and maintain a professional tone. It's important to reference specific details, such as the application date (for example, September 15, 2023), the loan type (such as a mortgage or personal loan), and the lender's name (like ABC Bank). A respectful inquiry regarding the current status of the application, coupled with an expression of understanding regarding their processes, reinforces courtesy. The intention is to prompt a response while reflecting the applicant's eagerness for a timely decision.

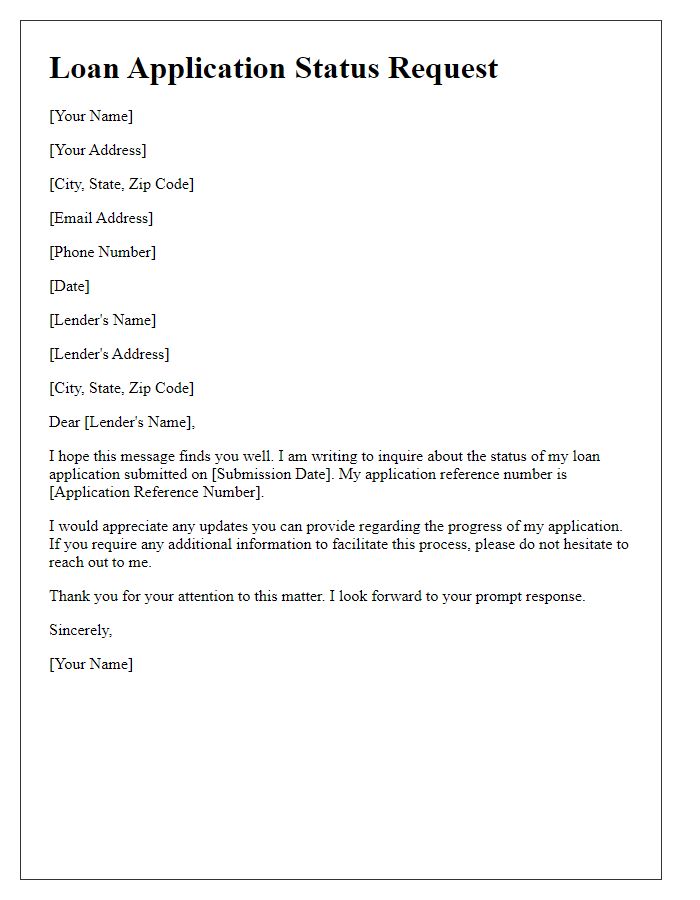

Reference to previous communication

Timely follow-up regarding a loan application may reflect a candidate's dedication and organizational skills when applying for financing through financial institutions. A reference to previous communication can solidify an applicant's commitment to securing funds. Ensuring a concise acknowledgment of the initial application date, typically within a week, allows for a constructive conversation about the loan's status, interest rates, or necessary documentation. Detailed inquiries about potential timelines, underwriting processes, or required adjustments can facilitate clarity. Maintaining a professional tone and reiterating the financial institution's core mission, such as providing exceptional customer service, can enhance the interaction.

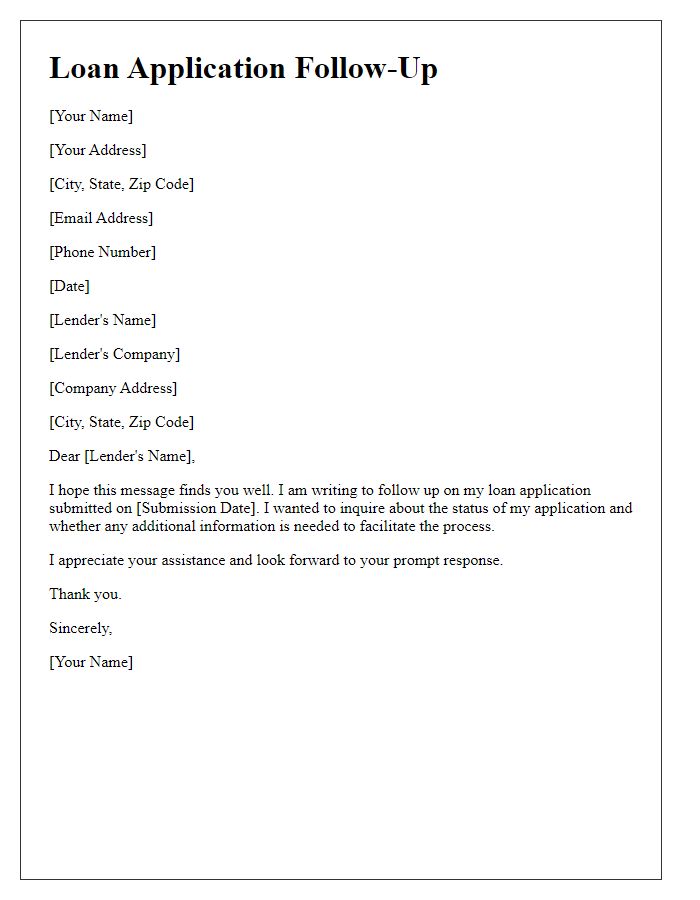

Clarification of request status

The loan application process can often feel lengthy and uncertain, particularly for individuals seeking financial assistance through organizations like banks or credit unions. After submitting a loan request, many applicants experience a heightened need for clarity regarding their application status, especially if several weeks have elapsed since submission. Factors influencing the timeline can include the complexity of the application, required documentation, or the lender's workload. Regular follow-ups can provide crucial updates, ensuring applicants remain informed about necessary steps, further documentation needed, or possible approval timelines. Timely communication can significantly alleviate anxiety, allowing potential borrowers to plan their financial commitments effectively.

Contact information for follow-up

Following up on a loan application is essential for maintaining clear communication and ensuring a smooth processing experience. For example, the lender's office might be located at 123 Main Street, New York City, with a phone number of (555) 123-4567 and an email address of support@lender.com. Providing your contact details, such as your personal phone number (e.g., (555) 987-6543) and email (e.g., applicant@example.com), will facilitate prompt responses. Tracking the application's progress can also lead to timely adjustments or additional documentation requests, influencing approval timelines significantly.

Comments