Are you currently navigating the exciting yet sometimes daunting process of securing a loan? Whether you're looking to buy a new home, finance a car, or consolidate debt, keeping track of your loan application updates can feel overwhelming. In this article, we'll break down essential steps and share helpful tips to ensure your application stays on track. So, grab a cup of coffee, and let's dive into the details together!

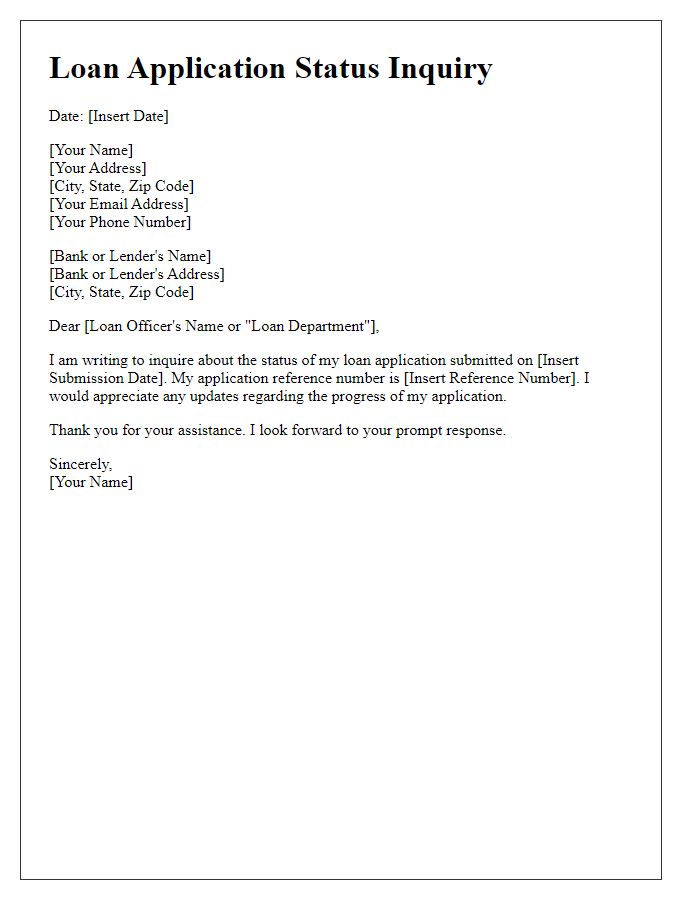

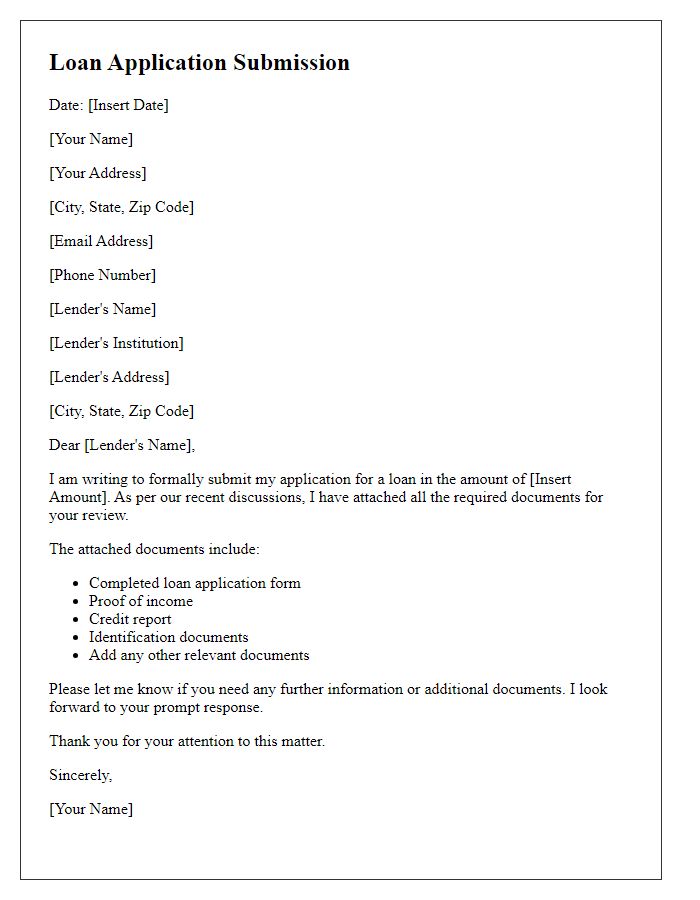

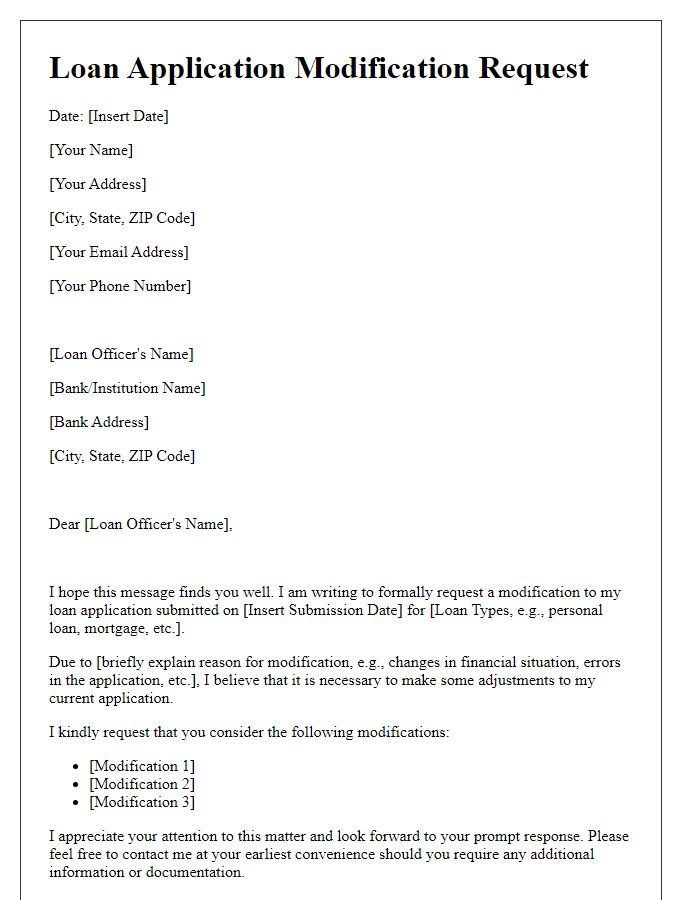

Applicant's personal information

Applicant's personal information, including full name, residential address, phone number, and email address, is crucial in processing loan applications. For example, inaccuracies in the full name may result in legal discrepancies during document verification. The residential address helps in assessing the applicant's financial stability based on local economic conditions and credit history. Contact details such as phone number and email address facilitate communication between lenders and applicants for updates, approvals, or additional information needed. Accurate information submission also enhances the efficiency of loan processing through automated systems.

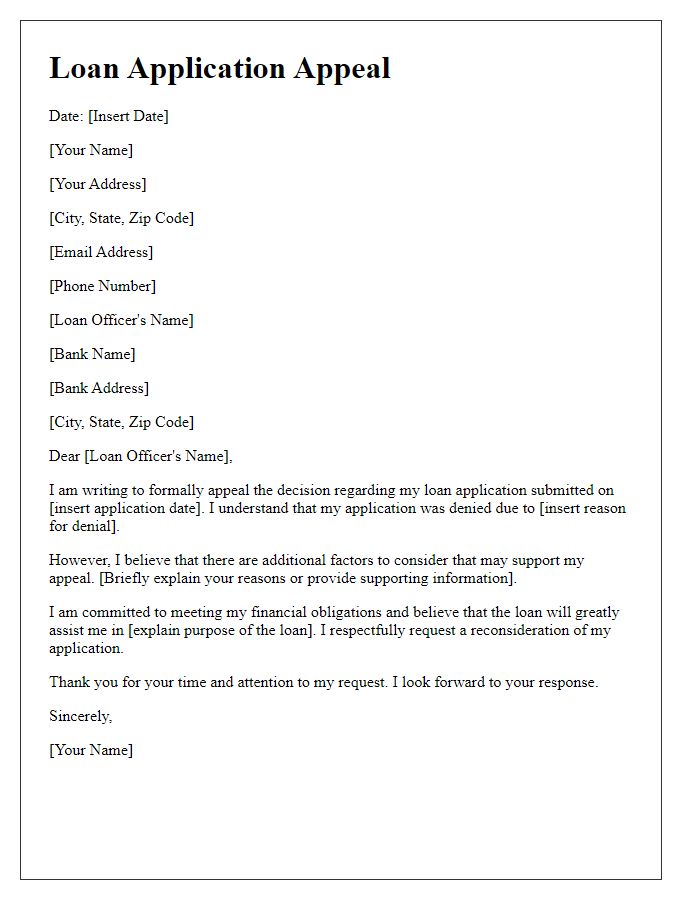

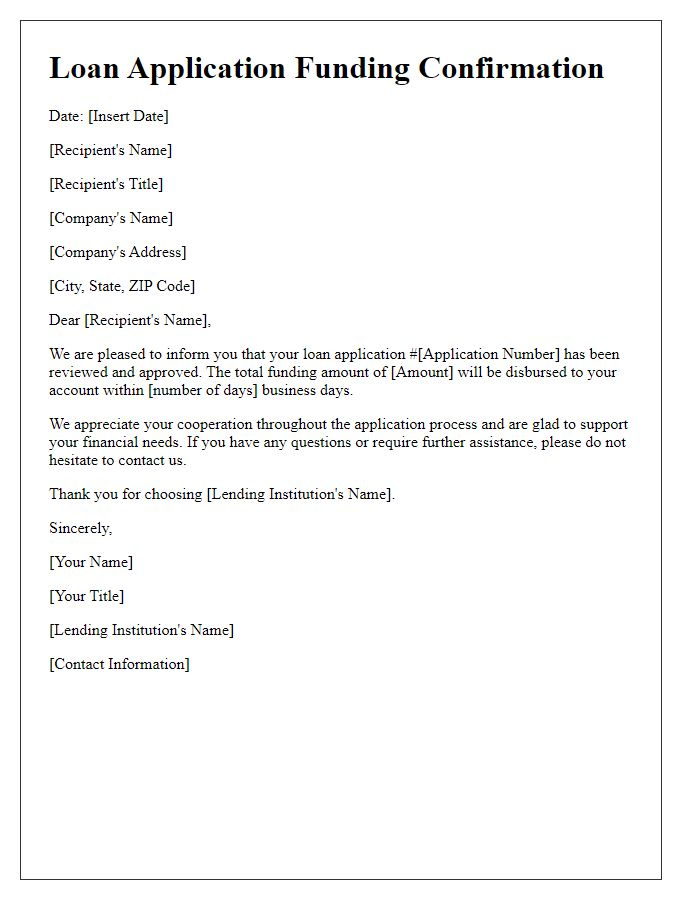

Loan application reference number

The loan application reference number serves as a crucial identifier for tracking and managing loan requests within financial institutions. Typically consisting of a unique alphanumeric code created upon initial submission of the loan application, this reference number allows applicants to easily access their loan status, making follow-ups more efficient. Financial institutions like banks or credit unions utilize these reference numbers to streamline processes related to various loan products including personal loans, mortgages, and auto loans, ensuring that all information is accurately matched to the respective application. An updated application status linked to the reference number may include details on approval stages, additional document requirements, or anticipated timelines for fund disbursement.

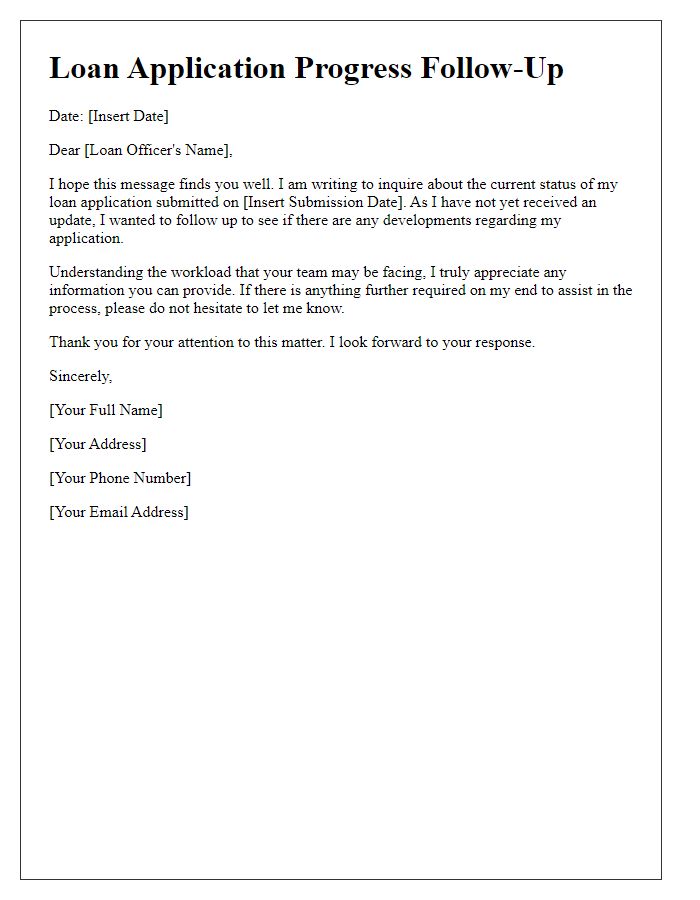

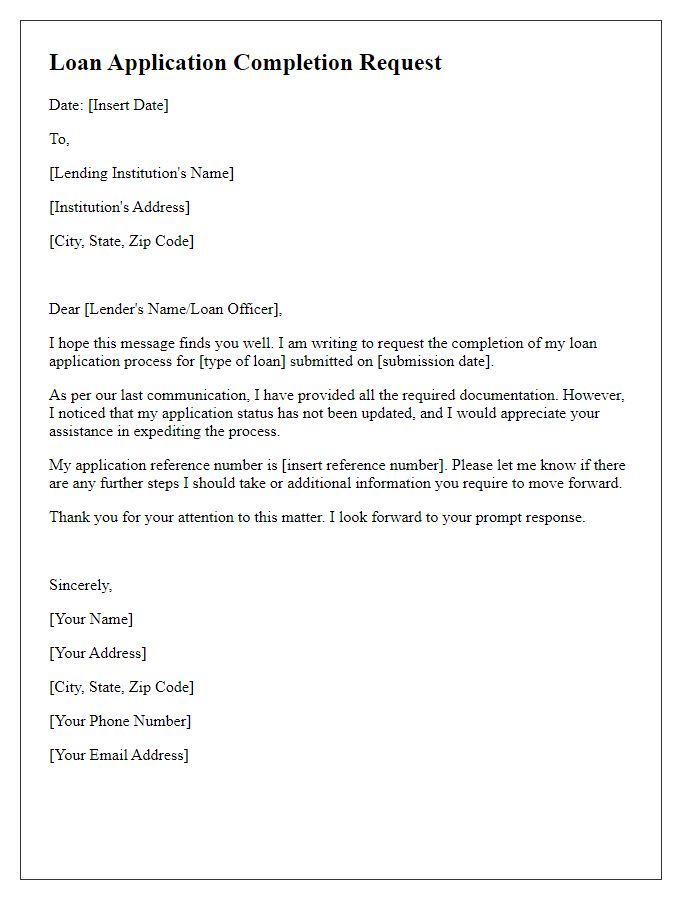

Current loan status

Current loan status indicates the progress of mortgage applications processed by financial institutions, such as banks or credit unions. Reports show that as of October 2023, average approval times range from 30 to 45 days based on lender criteria and borrower documentation completeness. Outstanding documentation, known as conditions, might delay processing; lenders typically require pay stubs, tax returns, and bank statements. Furthermore, market interest rates, which fluctuate around 6.5% for 30-year fixed mortgages, can impact approval likelihood as well as monthly payment amounts. Borrowers should stay informed about their application's status through regular communication with loan officers to ensure timely updates on approval timelines and next steps in the financing process.

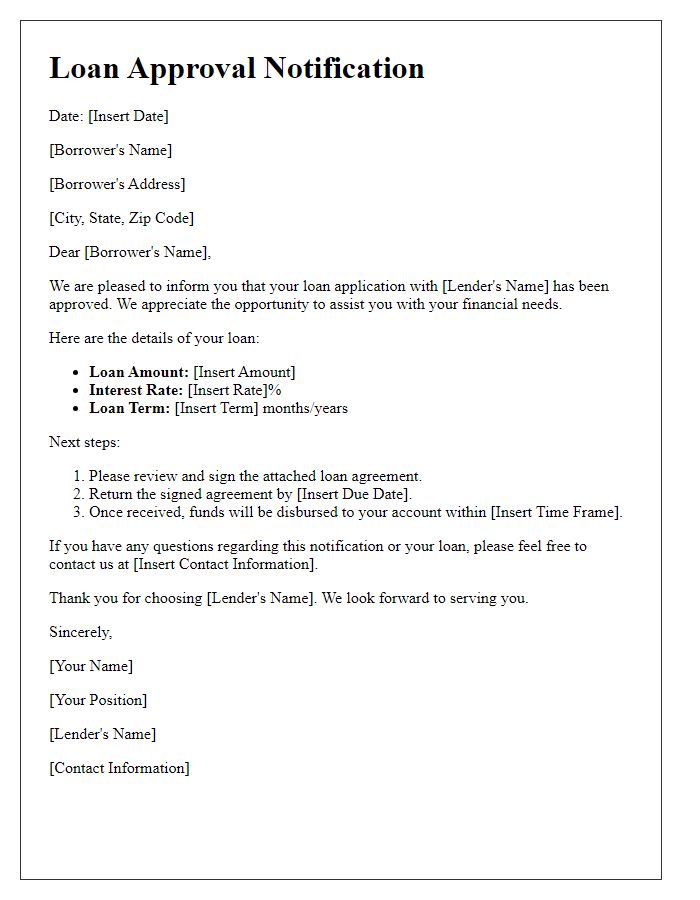

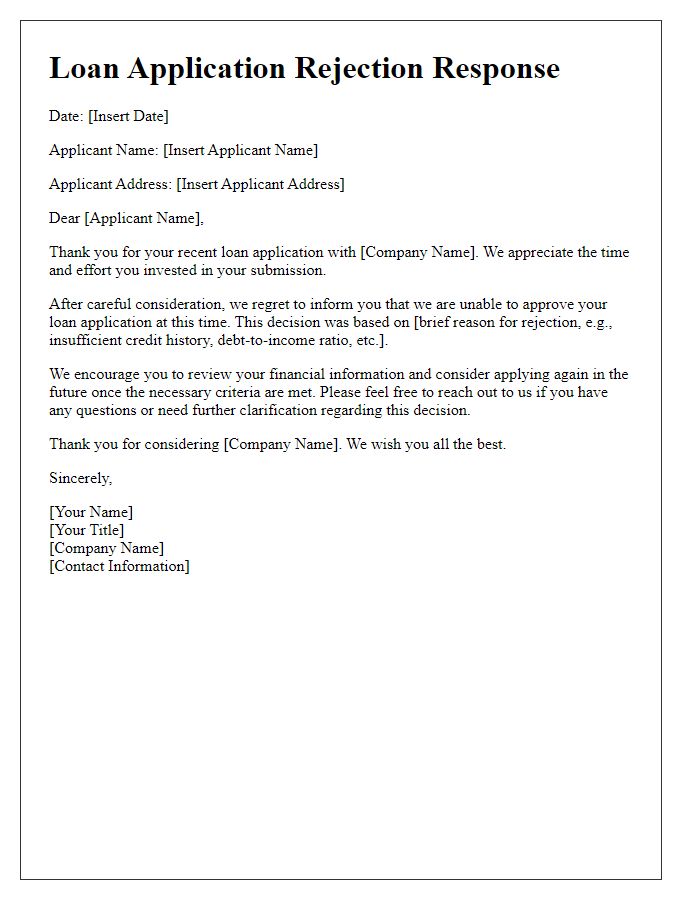

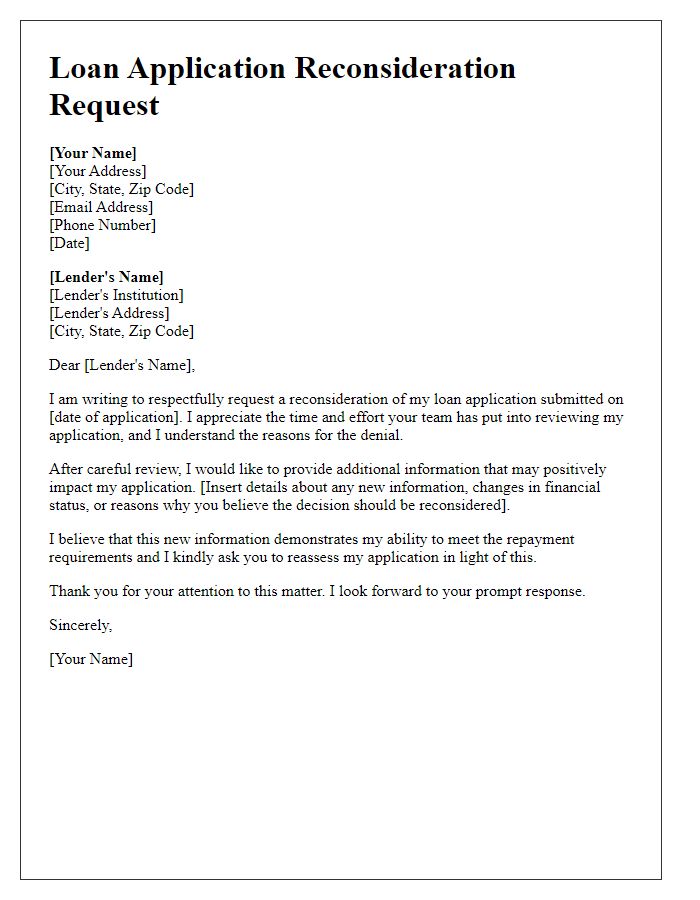

Updated financial information

Updated financial information reveals a significant change in creditworthiness, specifically a decrease in debt-to-income ratio from 40% to 30%. Recent employment increases demonstrate an enhanced capacity to meet repayment schedules, with a steady salary of $75,000 annually at ABC Corporation since January 2022. Current assets include a savings account balance of $20,000 and a 401(k) retirement fund of $50,000, both contributing to overall financial stability. Mortgage obligations on the primary residence in San Diego, California, amount to $300,000, further highlighting the commitment to maintaining up-to-date payments. This updated profile supports the request for a loan approval from XYZ Bank for $50,000 to finance educational expenses at the University of California, Los Angeles, improving future earning potential through advanced degrees.

Clarification of any delays or changes

Delays in loan applications can significantly impact the financing process for individuals seeking assistance from financial institutions, such as banks or credit unions, especially during economic fluctuations. For instance, unforeseen circumstances, including documentation issues or changes in credit scores, may lead to an extension of the approval timeframe beyond the initial estimated duration of 30 days. Furthermore, external factors, such as stricter regulatory policies introduced by government organizations like the Consumer Financial Protection Bureau (CFPB), can alter processing speeds and requirements for applicants. It's essential for borrowers to communicate promptly with loan officers regarding status updates and any necessary adjustments in personal information to ensure a smooth application process.

Comments