Navigating the world of non-recourse loans can be a bit tricky, especially with the various terms and conditions involved. Whether you're a borrower or a lender, understanding the nuances can make a significant difference in your financial decisions. This article will break down the essentials of non-recourse loans, clarifying their benefits and potential challenges. Join me as we delve deeper into this topic and uncover everything you need to know!

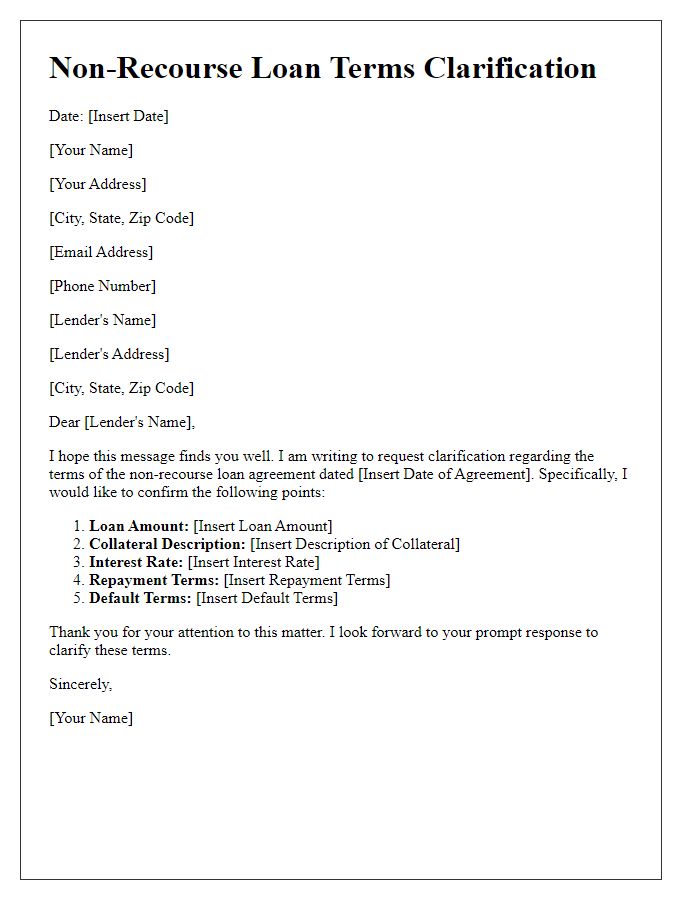

Loan Purpose Explanation

A non-recourse loan is a type of financing secured by collateral, typically real estate properties, where the lender cannot pursue the borrower's other assets in case of default. This financial arrangement is commonly used in commercial real estate transactions and large-scale property developments where project costs exceed initial capital. The primary purpose of this loan is to fund specific projects or acquisitions, such as the purchase of a new industrial facility in Dallas, Texas, valued at $5 million, or to finance the construction of an apartment complex with an estimated budget of $10 million in San Francisco, California. Such strategic funding enables investors and developers to leverage their investments without exposing their personal assets, ensuring a focus on the profitability and success of the designated project, rather than their overall financial stability.

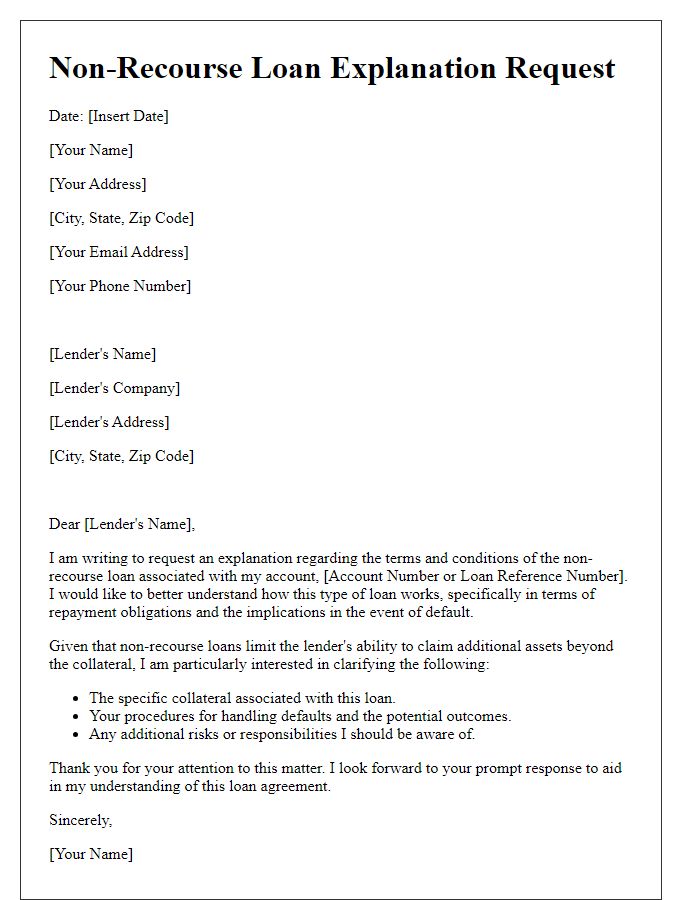

Collateral Description

A non-recourse loan typically involves a specific collateral type, such as real estate properties in urban areas like New York City or Los Angeles, which secures the loan but limits the lender's recourse to that collateral in case of default. For instance, a non-recourse loan secured by a commercial property valued at $5 million offers the lender rights solely to that asset rather than personal assets of the borrower. If the borrower defaults, the lender can seize the $5 million property but cannot pursue collections against the borrower's personal estate, savings, or income. Understanding the exact nature of the collateral description is crucial, as it should detail aspects like the property's location, appraisal value, and legal description to avoid ambiguity in the event of loan non-payment.

Repayment Terms

Non-recourse loans provide borrowers with unique financial flexibility by limiting their liability to the collateral securing the loan, typically real estate or other substantial assets. The repayment terms for such loans generally involve fixed monthly payments over a specified term, often ranging from 5 to 30 years. Interest rates vary based on market conditions and borrower creditworthiness, with the average rate fluctuating between 3% and 7% as of October 2023. In a non-recourse scenario, if the borrower defaults, lenders can only seize the collateral without pursuing additional assets, creating a level of risk protection for borrowers. Specific clauses regarding late payments, prepayment penalties, and potential balloon payments must be clearly outlined to ensure full transparency and compliance with lender requirements.

Liability Clause

Non-recourse loans, often utilized in real estate financing, allow borrowers to limit their liability solely to the collateral securing the loan, such as property. In these agreements, the liability clause specifies that lenders cannot pursue the borrower's other assets in case of default. This legal protection becomes significant in economic downturns, where property values may plummet. Key terms include 'default,' which can trigger foreclosure processes, and 'collateral,' which refers to the specific property backing the loan. Understanding these terms helps borrowers navigate risks associated with investing in properties, especially in fluctuating markets like those found in metropolitan areas, such as New York City or Los Angeles.

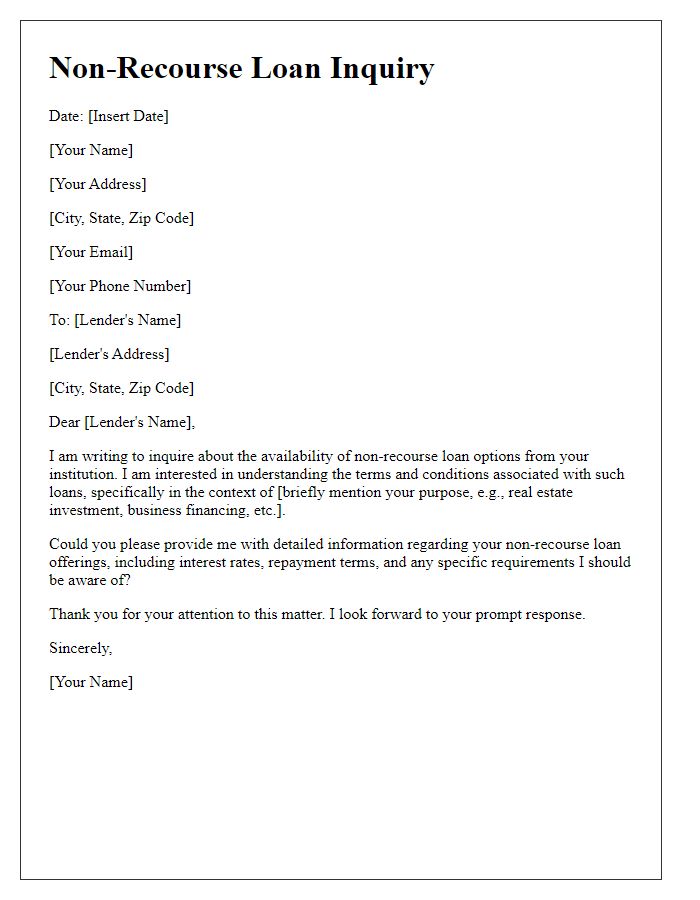

Lender Contact Information

Non-recourse loans, characterized by their unique structure, limit the lender's ability to seek repayment beyond the collateral. The lender's contact information, vital for navigating inquiries, usually includes a direct phone number, email address, and physical mailing address. When dealing with non-recourse loans, understanding key terms like loan-to-value ratio or collateral type is essential. For example, properties appraised at a specific market value often serve as collateral. Proper communication channels ensure clarity on terms, interest rates, or default implications, making it essential for borrowers to have reliable contact details to address potential issues effectively.

Comments