Are you considering tapping into your home's equity with a Home Equity Line of Credit (HELOC)? Understanding the qualification requirements can seem daunting, but it doesn't have to be. From your credit score to your debt-to-income ratio, several factors come into play that could determine your eligibility. Read on to learn more about the ins and outs of HELOC qualification and what you need to prepare for your financial journey!

Borrower's financial stability and credit score

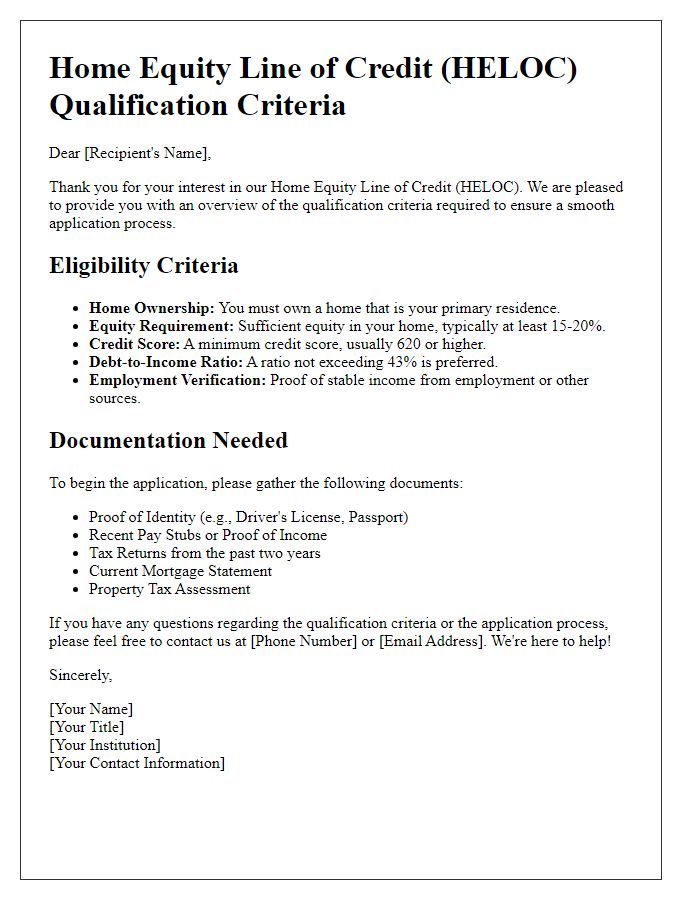

A Home Equity Line of Credit (HELOC) assessment revolves around the borrower's financial stability and credit score requirements. Lenders typically evaluate debt-to-income ratio (maximum 43% recommended), ensuring borrowers maintain sufficient income to cover existing debts alongside the new credit line. Key financial documents like W-2s, pay stubs, and bank statements are analyzed, reflecting income consistency and reserve funds (typically 3 to 6 months of expenses). A borrower's credit score plays a critical role, with scores exceeding 700 often qualifying for favorable interest rates. Additionally, employment history, property value fluctuations, and market conditions in regions like the U.S. housing market (notable areas include California, Texas, and Florida) also influence approval outcomes.

Property value and home equity assessment

Home equity lines of credit (HELOC) qualification criteria heavily depend on property value assessments and home equity amounts. Homeowners can achieve significant leverage when the current market value of their property, often assessed by certified appraisers, exceeds the remaining mortgage balance. Properties in high-demand areas, such as urban centers, typically exhibit higher market values, which can increase available equity. An accurate assessment may include comparable sales data, property condition analysis, and local market trends. Home equity calculations are derived from the formula: current property value minus outstanding mortgage. Lenders often require an equity position of at least 15-20%, ensuring homeowners have sufficient stake in their properties. This analysis establishes eligibility for borrowing, helping homeowners access funds for renovations, education, or debt consolidation.

Income verification and employment status

Home Equity Line of Credit (HELOC) qualification requires a thorough income verification process. Documenting current employment status is essential, typically requiring forms such as W-2s and recent pay stubs, providing a clear view of annual income, which might be at least $50,000 to meet lender requirements. Additionally, for self-employed individuals, a two-year history of income tax returns, along with profit and loss statements, demonstrates financial stability. Employers, particularly those of reputable companies like Google or Ford, may also provide verification forms detailing job title, employment duration, and salary for increased credibility. Maintaining a stable employment status for at least two years can greatly enhance qualification chances.

Existing debts and liabilities analysis

When evaluating qualifications for a Home Equity Line of Credit (HELOC), thorough analysis of existing debts and liabilities is essential. Lenders examine total monthly obligations, including credit card balances, student loan payments, and auto loans, which collectively contribute to the debt-to-income ratio. This ratio, often expressed as a percentage, influences the borrower's capacity to manage additional debt. For instance, a recommended debt-to-income ratio ideally remains below 43%. Beyond standard obligations, lenders may also assess other liabilities, such as mortgages, alimony, or child support, which further shape the financial landscape. A comprehensive understanding of these financial indicators enables lenders to gauge the borrower's creditworthiness while determining the allowable borrowing limit and interest rates applied to the HELOC.

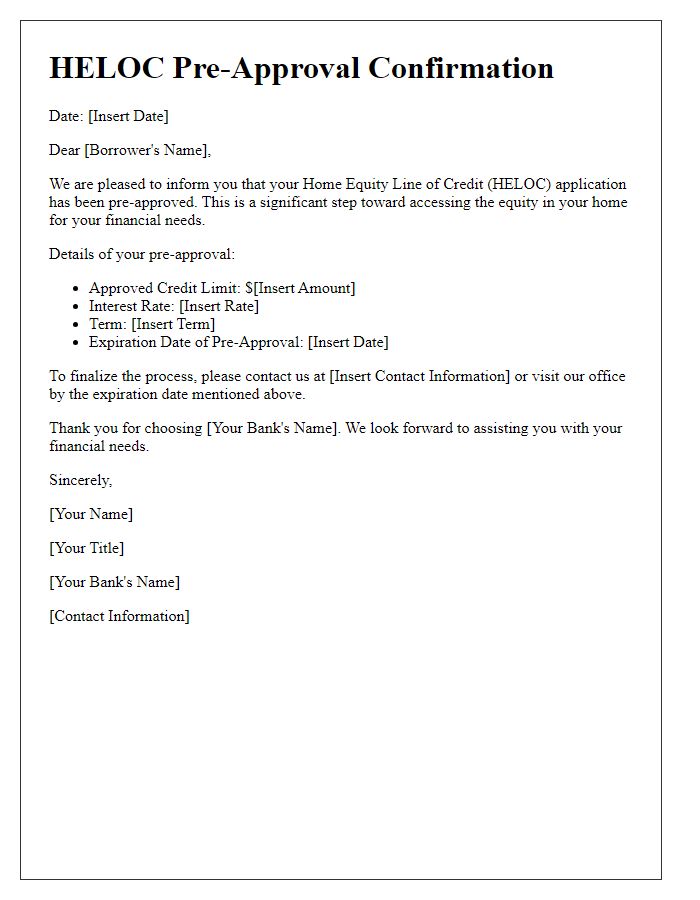

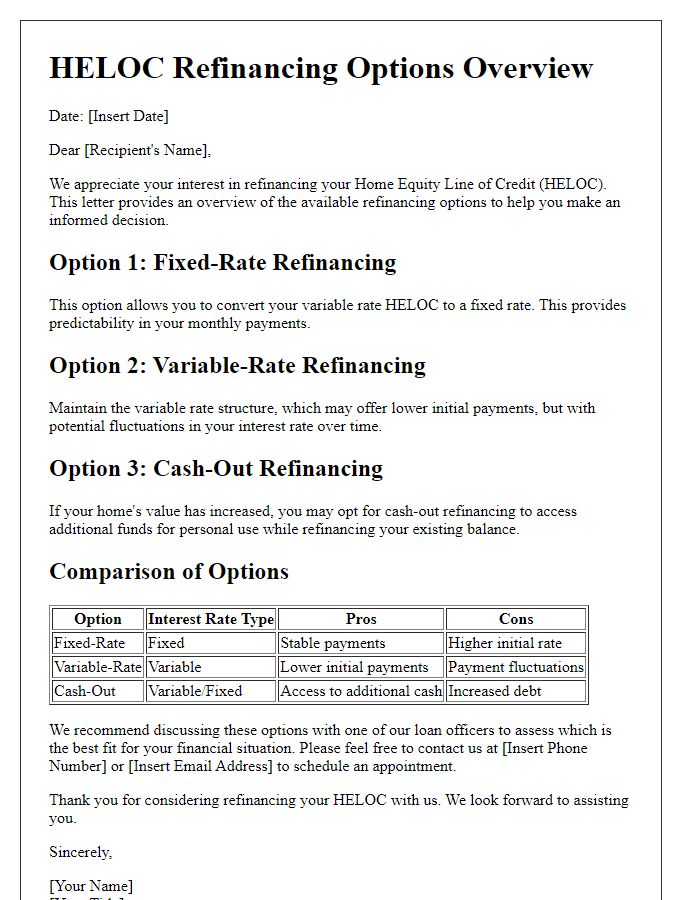

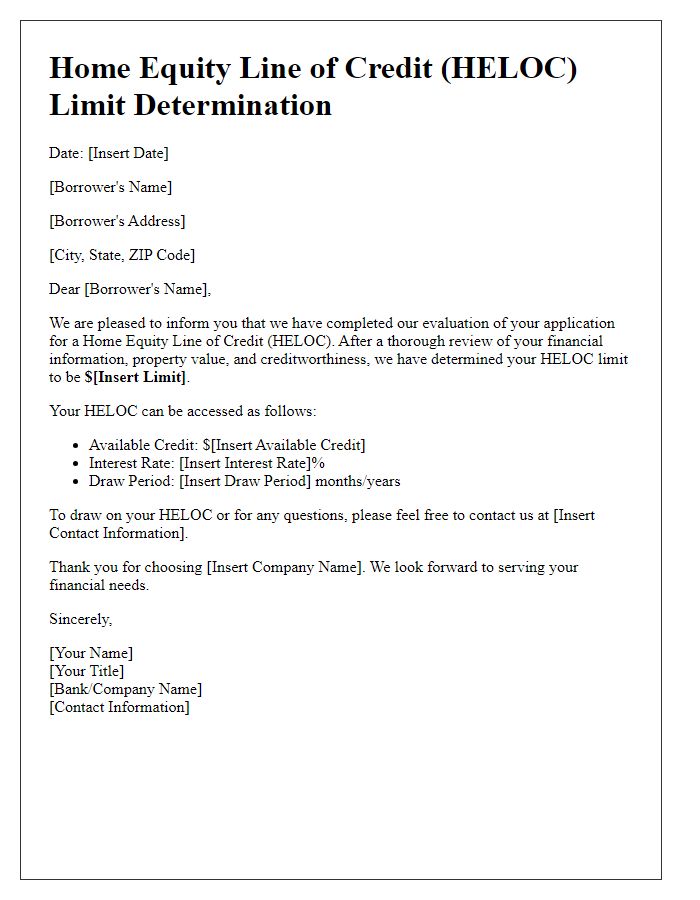

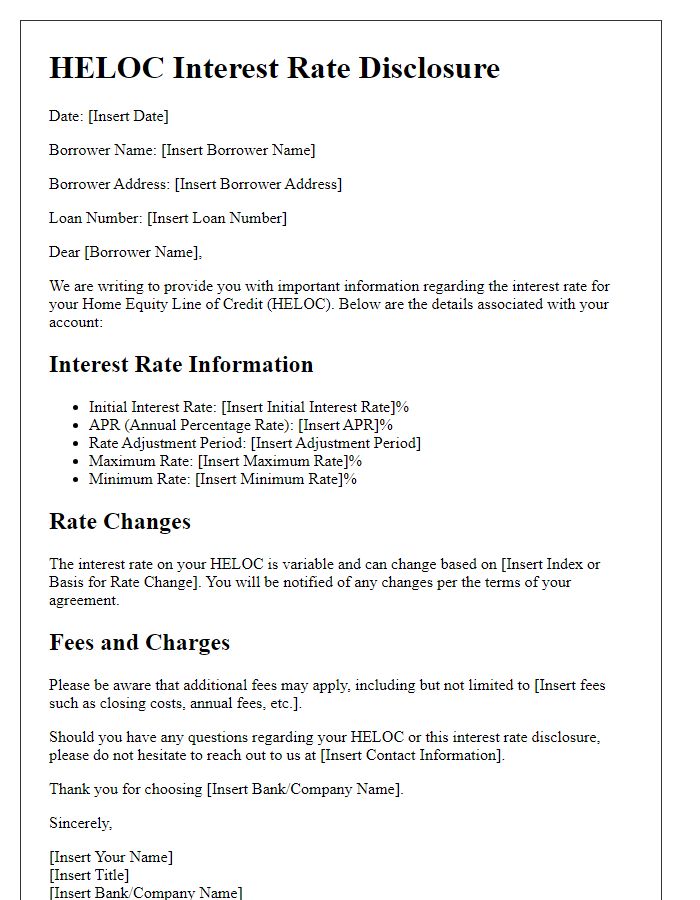

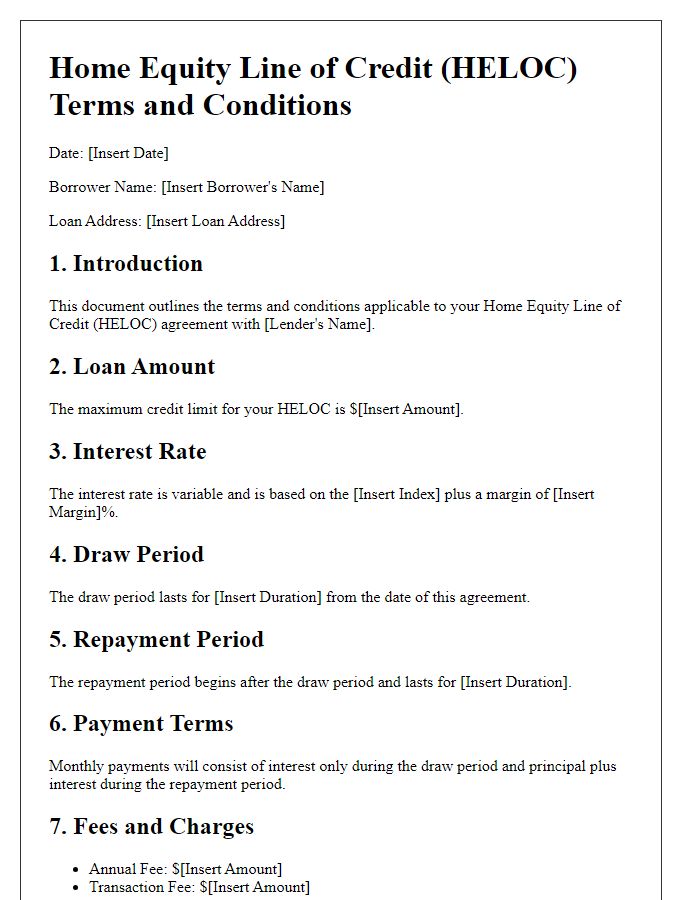

Loan terms and interest rate conditions

A Home Equity Line of Credit (HELOC) provides borrowers access to a revolving credit line secured by the equity in their home. Typical loan terms often range from 10 to 30 years, influencing the duration of repayment and interest rates. Variable interest rates, commonly tied to the prime rate, fluctuate according to market conditions, affecting monthly payments. Initially, many HELOCs feature an interest-only payment period, generally lasting 5 to 10 years, followed by a repayment period where both principal and interest are due. Proper qualification typically requires a minimum credit score of 620, a debt-to-income ratio not exceeding 43%, and at least 15-20% equity in the home, calculated based on the current market value. These terms can vary significantly among lenders, making it essential for borrowers to compare offerings before proceeding.

Comments