Are you gearing up to draft an intercompany loan agreement? Understanding the essential components can make all the difference in ensuring clarity and compliance. In this article, we'll walk you through a comprehensive letter template that covers crucial details like loan terms, interest rates, and repayment schedules, all while keeping your company's best interests in mind. So, let's dive into the specifics that will help you create an effective intercompany loan documentation!

Loan Agreement Overview

An intercompany loan agreement establishes the terms and conditions governing a loan between subsidiaries of the same parent company. It typically includes key elements such as the loan amount (often ranging from thousands to millions of dollars), interest rates (which may align with prevailing market rates or the LIBOR), repayment schedule (often structured monthly or quarterly over a specified period), and default terms (outlining consequences for non-payment). Documentation must also address tax implications, ensuring compliance with domestic regulations in locations such as the United States, Germany, or the United Kingdom. Accurate record-keeping and due diligence are essential for minimizing risks associated with tax audits and transfer pricing issues. Clear communication of responsibilities and expectations among involved parties (such as finance teams or legal departments) is critical for maintaining strong intercompany relations.

Terms and Conditions

Intercompany loans involve financial agreements between affiliated entities within a corporate group, specifying terms and conditions crucial for compliance and transparency. Interest rates often align with prevailing market rates, typically between 2% and 5% depending on jurisdiction, to avoid tax implications under regulations like the OECD Transfer Pricing Guidelines. Loan amounts can range from thousands to millions of dollars, influencing liquidity management. Repayment schedules generally span one to five years, with detailed outlines on installment frequencies, such as monthly or quarterly payments. Default clauses outline remedies for breaches, including potential penalties or interest hikes, safeguarding against financial risk. Additionally, legal jurisdictions, such as the applicable laws of New York or London, dictate dispute resolution procedures, ensuring clear resolution pathways.

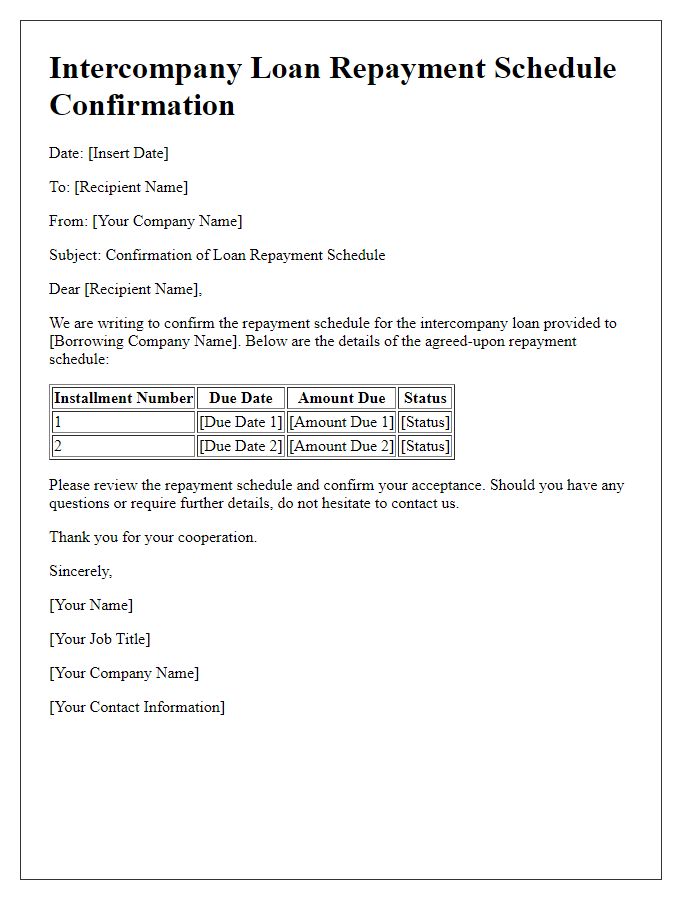

Interest Rate and Repayment Schedule

The interest rate applied to intercompany loans, specified as a percentage, typically ranges from 3% to 10%, largely influenced by market conditions and internal company policies. Repayment schedules for such loans often detail a timeline, with frequent intervals like monthly or quarterly payments spanning several years, commonly up to five or ten years, according to the agreement terms. The principal amount, total loan size, is critical, often exceeding one million dollars in larger corporate transactions, impacting negotiation dynamics. Loan documentation must comply with financial regulations, including transfer pricing guidelines established by organizations like the OECD, ensuring fairness in intercompany lending practices. Timely submission of payments is essential to maintain favorable agreements and avoid penalties, fostering positive business relationships within corporate structures.

Collateral and Security

When establishing an intercompany loan, collateral and security are critical components ensuring financial protection. Collateral often comprises tangible assets such as real estate, machinery, or inventory, which provide assurance against default. For instance, an industrial property valued at $1 million can be pledged to secure a loan agreement. The security agreement should detail the rights of the lender, including specified legal remedies in case of default. Important clauses may reference applicable legal frameworks such as the Uniform Commercial Code (UCC) in the United States. Proper documentation of collateral must include appraisals and relevant financial audits to verify asset value. Establishing clear terms within the loan documentation protects both parties and facilitates smoother transactions in corporate financing.

Legal Compliance and Jurisdiction

Legal compliance is essential for intercompany loans to ensure adherence to applicable laws and regulations, such as tax laws and transfer pricing rules. Each jurisdiction, like the United States or Germany, has specific requirements that dictate the proper documentation and terms, including interest rates and repayment schedules. Furthermore, considerations regarding local legislation, such as the European Union's directives on intra-group financing, can impact the agreement's terms. Detailed records must include loan agreements, payment schedules, and compliance certifications, which serve as evidence during audits or regulatory reviews. Proper jurisdiction delineation is crucial for resolving disputes effectively, ensuring parties are aware of their rights and obligations. Documentation must specify governing law clauses to clarify which legal framework governs the loan agreement, enhancing clarity and reducing potential conflicts.

Comments