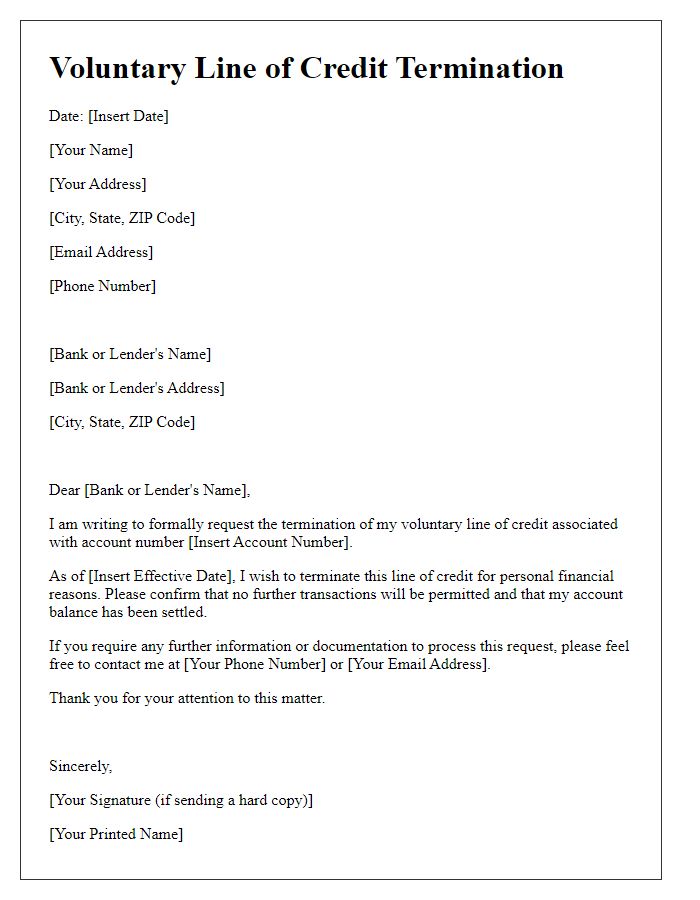

Are you considering writing a letter to terminate a line of credit? It's essential to approach this matter with clarity and professionalism to ensure a smooth process. In this article, we'll guide you through a sample letter template, providing you with the right structure and tone to communicate your intention effectively. So, let's dive in and explore how to craft the perfect termination letter!

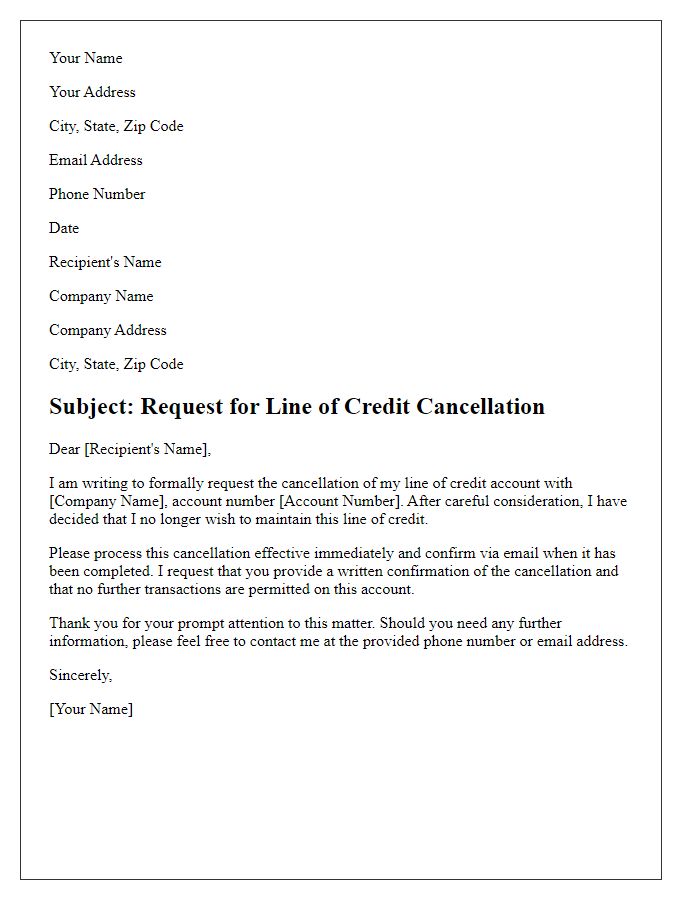

Account Details and Identifier

Termination of a line of credit can significantly impact an individual's financial flexibility, particularly for consumers relying on credit for emergencies or large purchases. For instance, an account identifier (such as an account number like 1234-5678-9012) must be communicated clearly when addressing termination issues, ensuring identification of the correct account in financial institutions like Bank of America or Chase. Furthermore, potential consequences of termination may include reduced credit scores and limited future borrowing potential, especially if the credit lineage spans several years with good payment history. Notably, understanding the terms and conditions of the original credit agreement (including any fees or penalties) is essential in managing transitions from active credit utilization to closure.

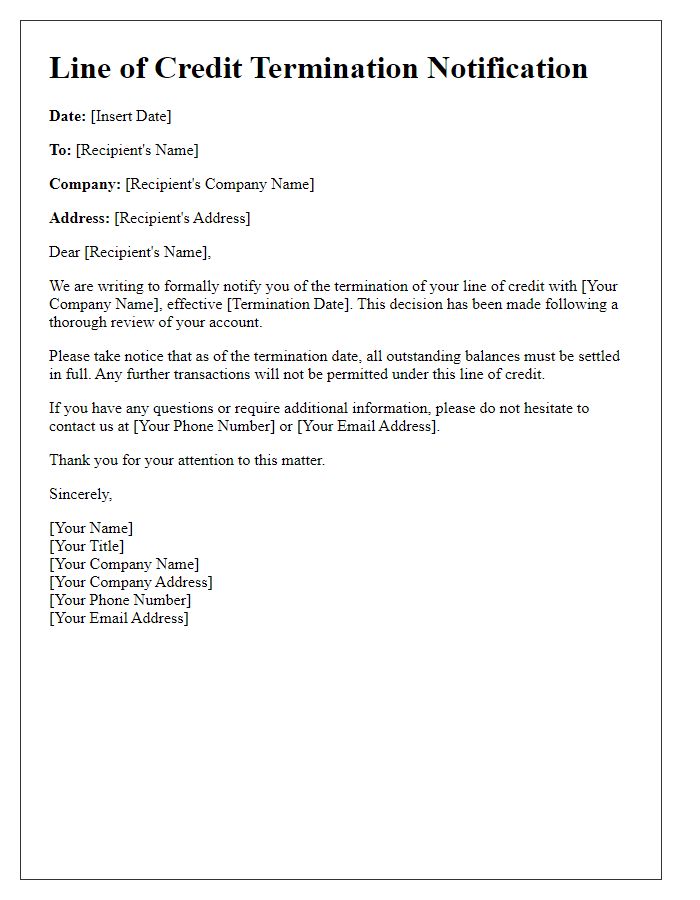

Termination Date and Effective Notice

The termination of a line of credit, also known as a revolving credit facility, involves the formal notification of the end of borrowing privileges. A precise termination date, often stipulated in the credit agreement, must be communicated clearly. Effective notice should be documented, providing essential information such as the total available credit amount at the time of termination, outstanding balances, and any potential fees associated with early repayment or closure. Additionally, the lender's contact information, including the name of the account manager and customer service details, should be included to facilitate any inquiries regarding the termination process.

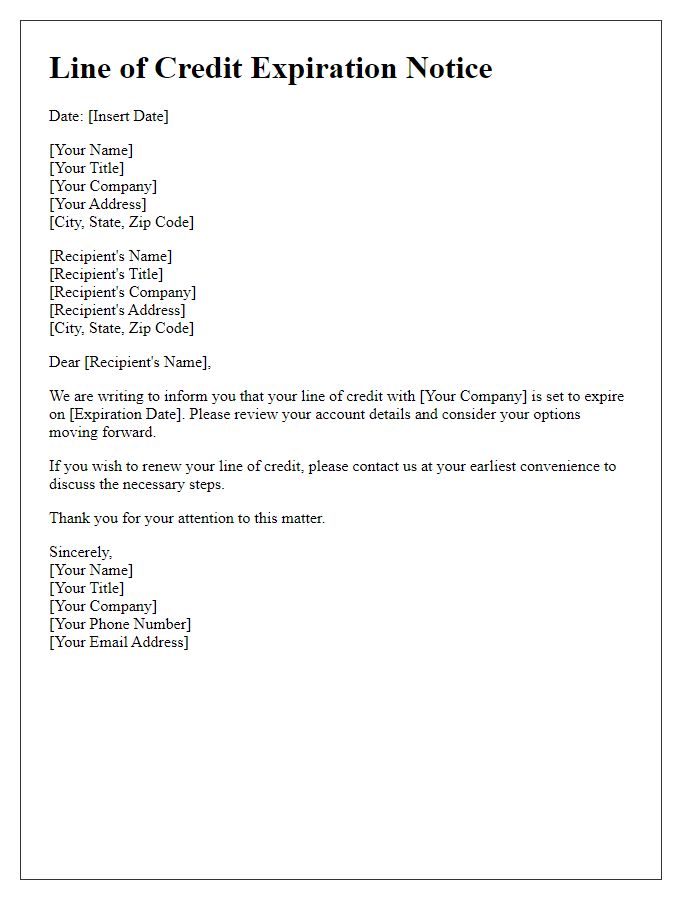

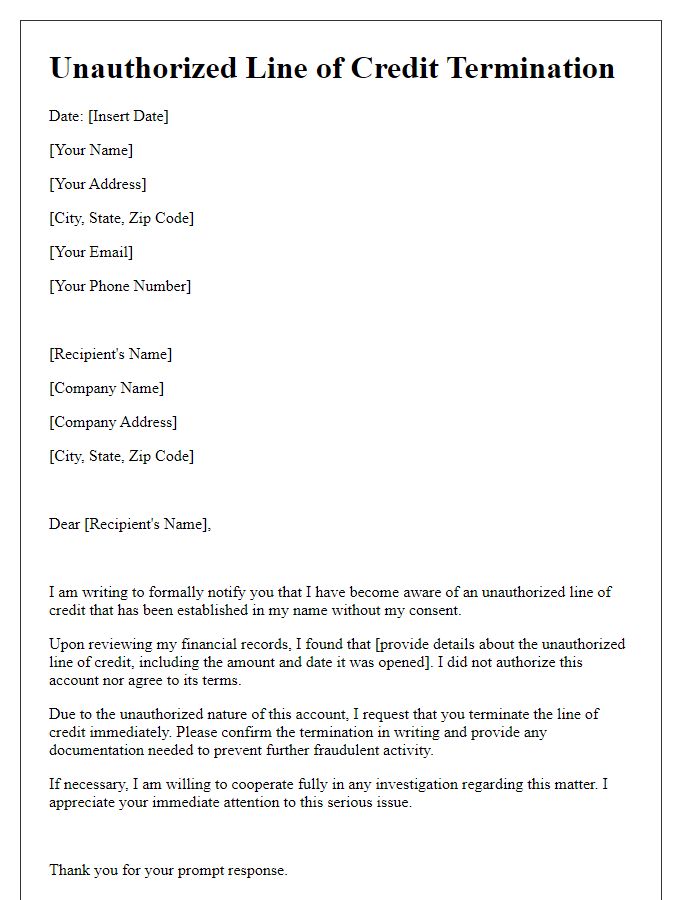

Reason for Termination

Termination of a line of credit can arise from various circumstances, such as consistently missed payments or deteriorating creditworthiness of the borrower. For example, if a borrower defaults on payments for three consecutive months, signifying financial instability, the lender may take action to mitigate risk. Additionally, a significant drop in the borrower's credit score, such as falling below 600, can prompt a line of credit termination. Economic changes, such as shifts in market conditions or lending regulations, can also influence a lender's decision, leading to abrupt cancellations regardless of the borrower's previous standing. In some instances, a borrower may voluntarily close the line of credit to improve financial management or reduce debt exposure.

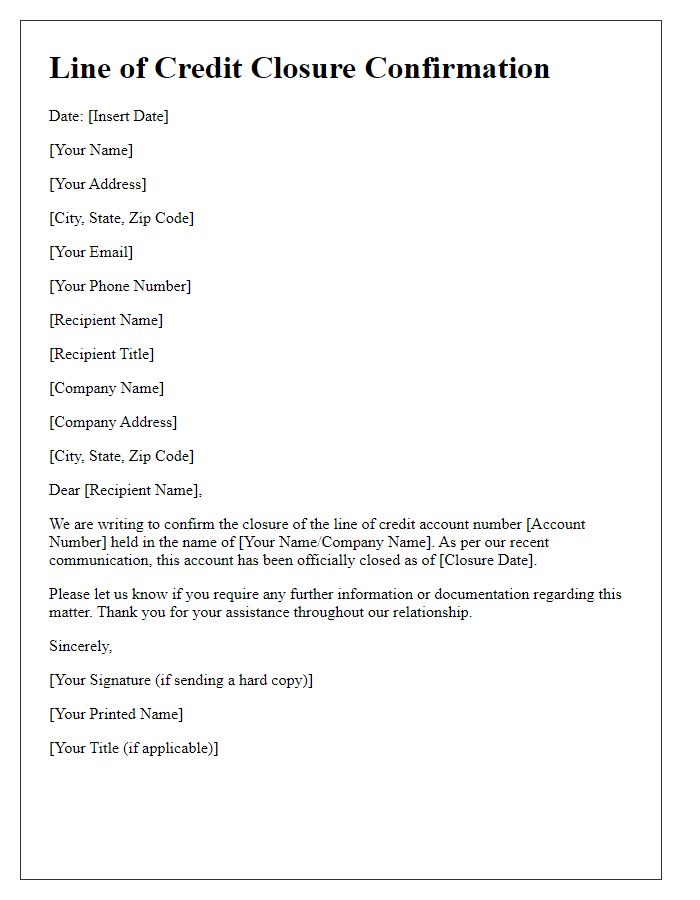

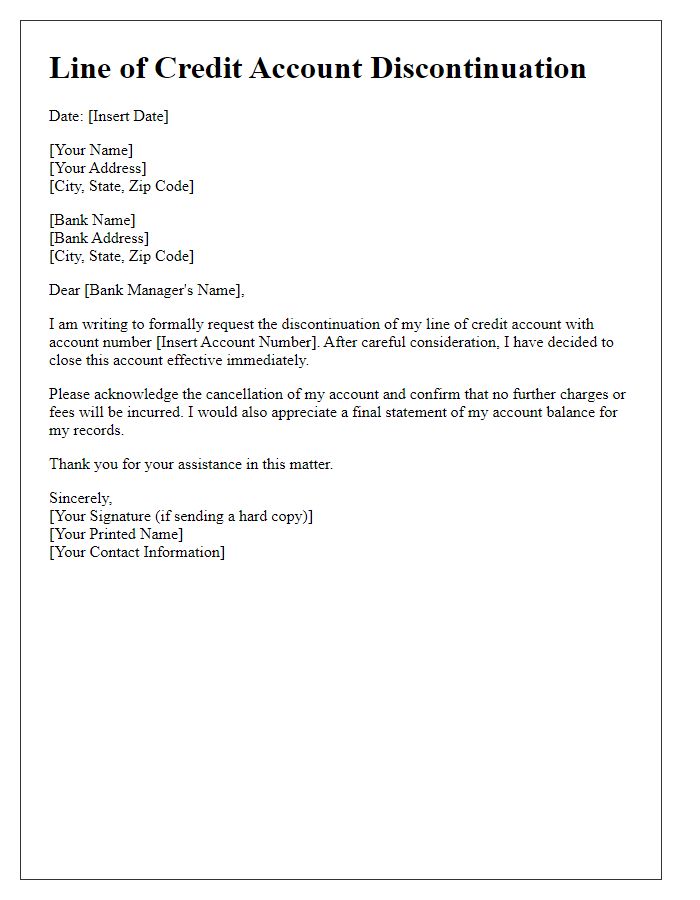

Settlement of Outstanding Balance

The termination of a line of credit refers to the formal process by which a financial institution ceases to extend credit to a borrower, often due to unpaid balances or insolvency. Outstanding balances can lead to settlement negotiations, where the borrower and lender agree on a reduced payoff amount to close the account. This process is crucial for protecting the borrower's credit score and financial stability. It commonly involves direct communication with the lender, documentation of the account history, and legal considerations based on the specific terms outlined in the borrowing agreement. Familiarity with state laws, such as those in California or New York, can significantly influence the outcome of these negotiations, including interest rates, penalties, and timelines for repayment.

Contact Information for Inquiries

The termination of a line of credit can have significant financial implications for borrowers. Entities such as banks or credit unions typically send official notices to clients, detailing reasons for termination, outstanding balances, and potential impact on credit scores. The timely communication often includes contact information for further inquiries, ensuring customers can seek clarification or negotiate terms. This proactive approach can help mitigate misunderstandings regarding the termination process. Additionally, reviewing the account terms outlined in the original agreement, including any associated fees or penalties, becomes essential for financial planning post-termination.

Comments