Are you curious about how to determine the estimated payoff amount of your loan? Understanding this crucial figure can empower you to take control of your finances and plan your future effectively. In this article, we'll walk you through the necessary steps and considerations to calculate your loan payoff amount, ensuring you're well-informed to make the best decisions possible. So, let's dive in and explore the details together!

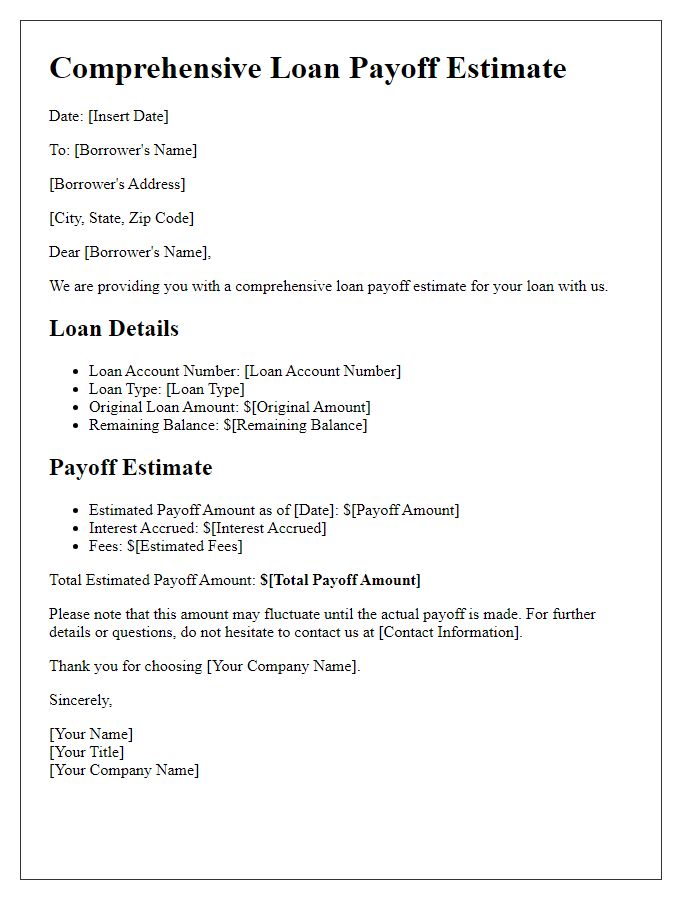

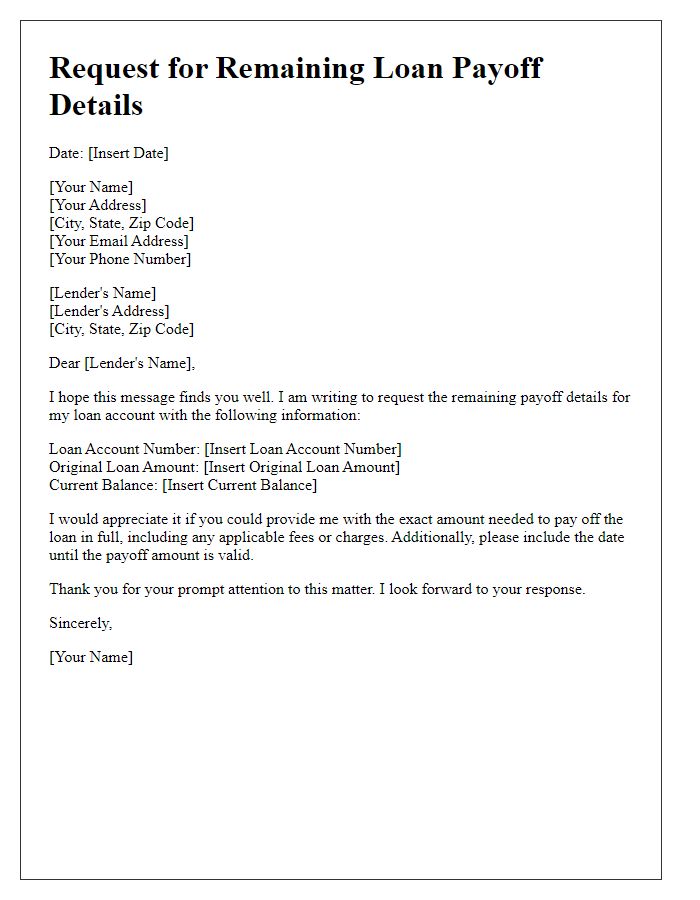

Borrower's Information

Estimating the loan payoff amount provides essential clarity for borrowers. The loan payoff figure includes the outstanding principal balance, accrued interest, possible prepayment penalties, and other fees that may apply. For example, if a borrower has a home mortgage with a principal balance of $150,000, a fixed interest rate of 4%, and a term remaining of 20 years, the total payoff amount can be influenced by recent interest rate fluctuations. Additionally, potential closing costs and state taxation on payoffs can also affect the estimated total. Understanding these components helps borrowers make informed decisions regarding their financial obligations and upcoming payments.

Loan Account Details

Loan account details typically include essential elements such as the total principal borrowed, interest rate percentage, remaining balance, and loan term duration. The payoff amount reflects the total sum required to settle the loan, inclusive of unpaid interest, fees, and possible penalties. For example, if a mortgage of $250,000 was initially secured at a 4% annual interest rate for a 30-year term, the outstanding balance after five years may approximate $230,000, with a final payoff amount fluctuating based on current interest accrual. Timely payments can influence these figures, while fluctuating market conditions may also impact the overall cost of settling the debt early.

Estimated Payoff Amount

The estimated loan payoff amount represents the total balance owed on a borrower's loan, including principal, interest, and any applicable fees. As of today's date, October 9, 2023, for a typical personal loan of $10,000 with an interest rate of 5% over a term of 36 months, the estimated payoff amount may be approximately $5,000, reflecting the remaining principal after 12 months of consistent payments. Factors influencing this calculation include the exact monthly payment schedule and any prepayment penalties stipulated in the loan terms, which may be found in the original loan agreement from the lending institution. Furthermore, additional considerations such as accrued interest and outstanding fees impact the final amount the borrower must pay to completely satisfy the loan obligation.

Payment Deadline

When calculating the estimated loan payoff amount, considerations include total outstanding principal balance, accrued interest, and any applicable fees. The payment deadline typically aligns with the end of the billing cycle or specific loan agreement terms. Borrowers often face penalties for late payments, which can accumulate interest charges, impacting the total payoff sum significantly. Exact payoff amounts may fluctuate daily based on interest rates, so obtaining an updated statement before finalizing payment is advisable. Individuals should consult the lender's guidelines to confirm necessary steps for a successful payoff by the established deadline.

Contact Information

The estimated loan payoff amount refers to the total sum required to fully settle a loan before its maturity date, often including principal, interest, and any applicable fees. This amount can vary significantly based on factors such as the loan type, current interest rates, and remaining balance. Financial institutions, such as banks or credit unions, typically provide this information upon request, ensuring borrowers are aware of their obligations. Accurate calculations are essential for borrowers considering refinancing options or assessing their financial status. Understanding the estimated payoff can aid in managing debt and planning future financial goals.

Comments