Are you tired of worrying about payment delays? In this article, we'll explore a guaranteed payment arrangement letter template that can help streamline your transactions and ensure you get paid on time, every time. By outlining clear expectations and terms, you can foster a smoother financial relationship with your clients or partners. Join us as we delve into the details and provide you with a useful tool that simplifies your payment processes!

Clear Header and Company Information

A guaranteed payment arrangement provides a structured agreement between two parties to ensure timely payments. This arrangement is crucial for businesses to maintain cash flow and foster trust with clients. Detailed terms such as payment amounts, due dates, and acceptable payment methods need to be specified. Including company information such as name, address, phone number, and email establishes credibility. Clear headers indicating the type of document, such as "Guaranteed Payment Arrangement Agreement," will help in organization and retrieval. Key details like payment schedules, penalties for late payments, and consequences of non-compliance should also be outlined to avoid misunderstandings and ensure accountability.

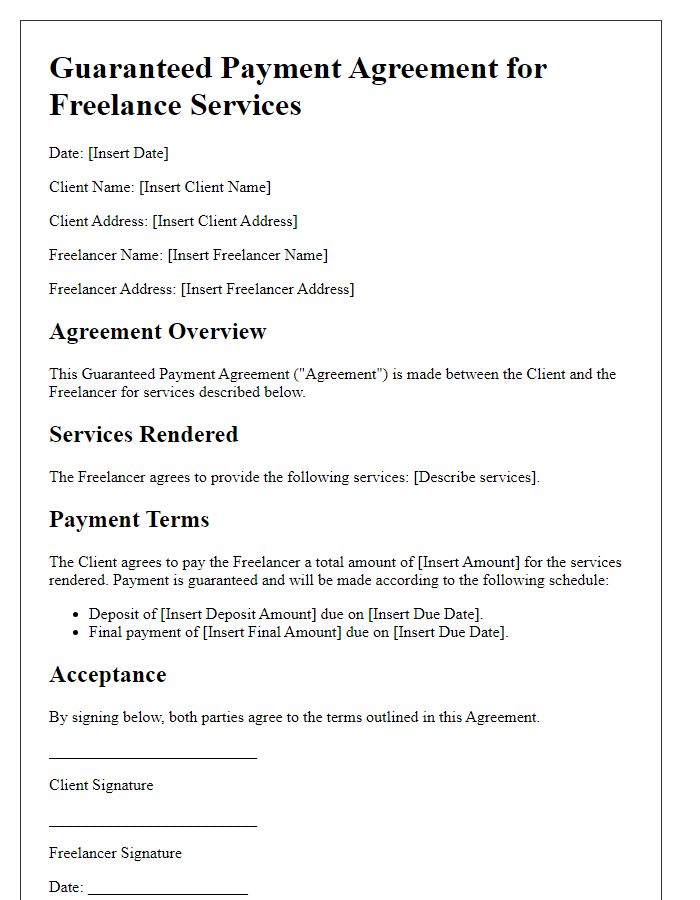

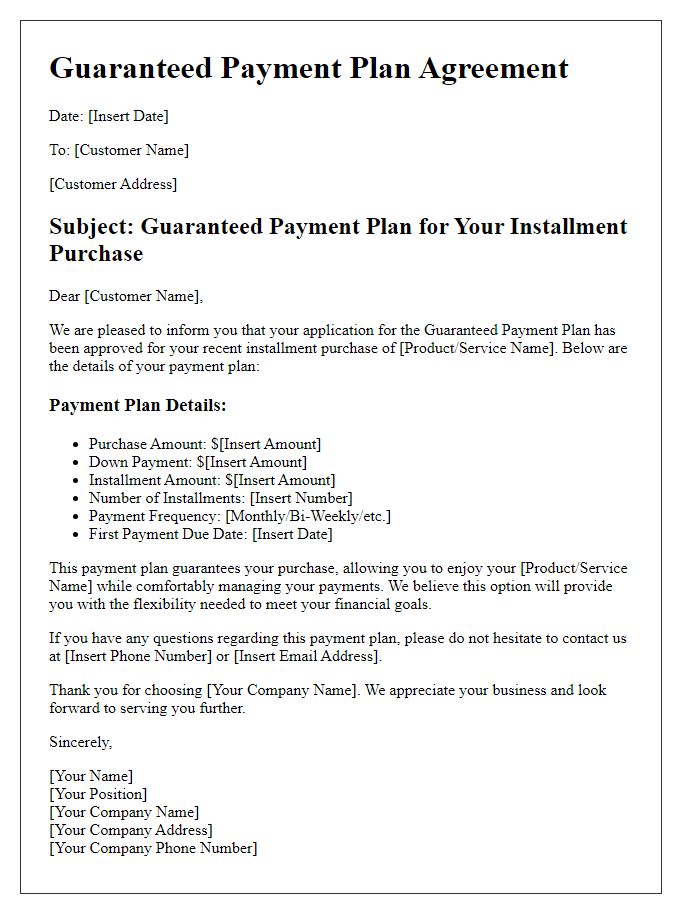

Detailed Payment Terms and Conditions

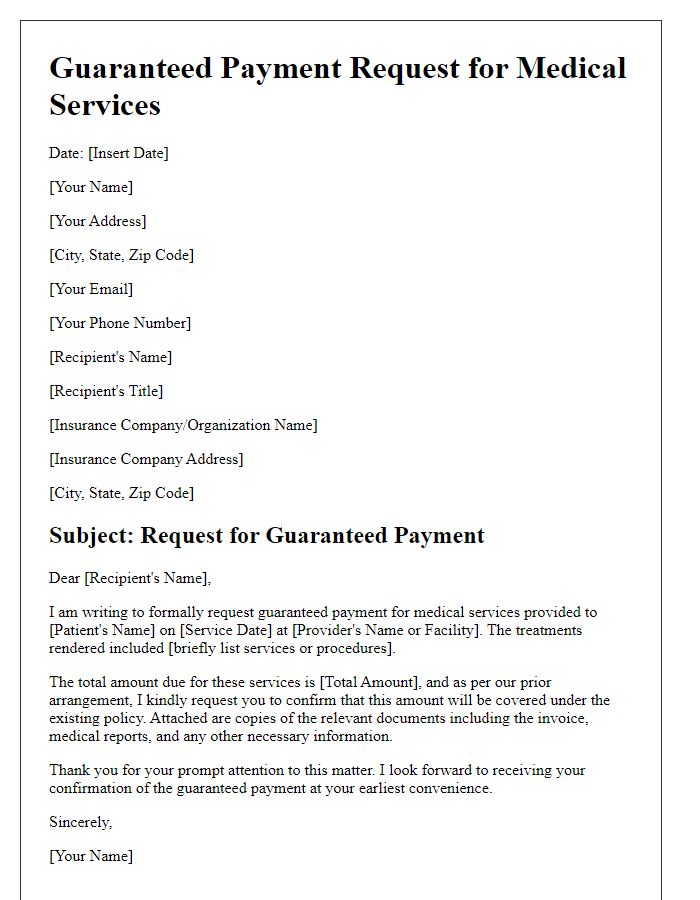

A guaranteed payment arrangement ensures clarity and structure in financial transactions, particularly in agreements involving significant sums, such as real estate purchases or large service contracts. Payment terms typically include a total amount due, such as $50,000, to be paid in installments over a designated period, often outlined in a schedule. For instance, an initial deposit of 20%, or $10,000, might be required upfront, followed by monthly payments of $1,500 for the subsequent three years. Conditions might stipulate penalties for late payments, such as a 5% late fee applied after a grace period of 15 days. Documentation should also include provisions for dispute resolution, indicating that parties will seek mediation before legal action, and the jurisdiction applicable for any disputes, often a specific courthouse in the respective city, such as New York City, New York. Clear descriptions of acceptable payment methods (bank transfer, check, or credit card), along with account information if relevant, will further enhance the structure of the agreement.

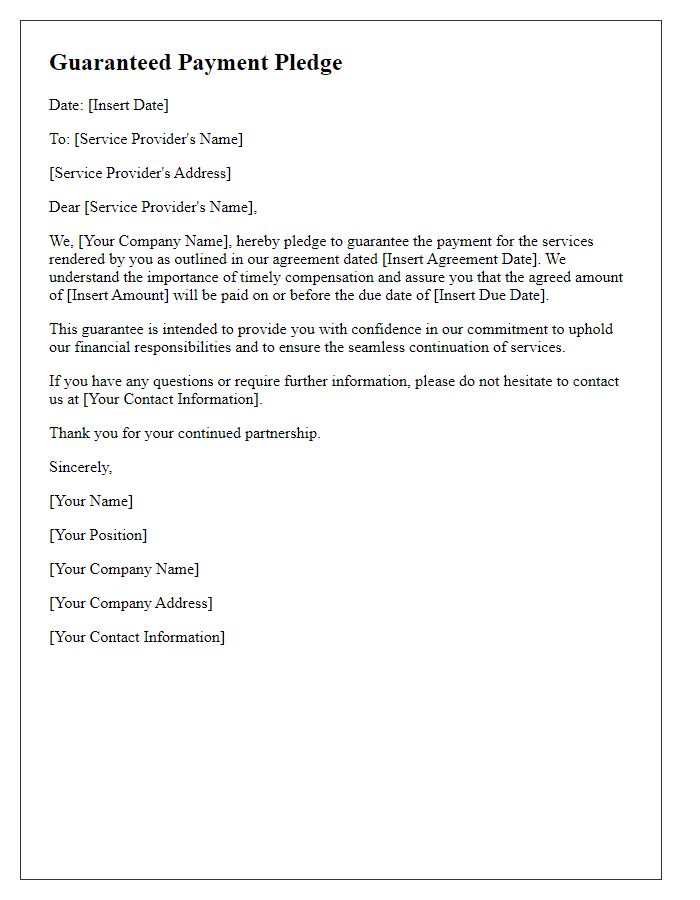

Legal and Financial Obligations

Guaranteed payment arrangements serve as vital agreements between parties to ensure financial accountability and adherence to legal obligations. These contracts typically outline specific terms such as payment schedules, amounts, and due dates, often referencing relevant laws such as the Fair Debt Collection Practices Act. Clear identification of parties involved, such as individual names or business entities, adds legitimacy. Implementation of collateral agreements, where assets are pledged as security, provides additional assurance. Failure to comply can result in legal repercussions including lawsuits or bankruptcy filings, emphasizing the importance of clarity in terms and expectations. Such arrangements are essential in establishing trust and promoting timely financial transactions in business environments.

Contact Information and Communication Protocol

Establishing a guaranteed payment arrangement is essential for ensuring timely transactions in business dealings. Clear contact information is vital, encompassing names, addresses, phone numbers, and email addresses to facilitate seamless communication between parties. Communication protocol should outline the preferred methods of correspondence, such as direct phone calls (available during business hours from 9 AM to 5 PM), emails (to be answered within 24 hours), or scheduled meetings (held at least once a month). Additionally, parties should specify actions to take in case of payment delays, which may include late fees or immediate escalation to management-level discussions to ensure compliance with financial agreements.

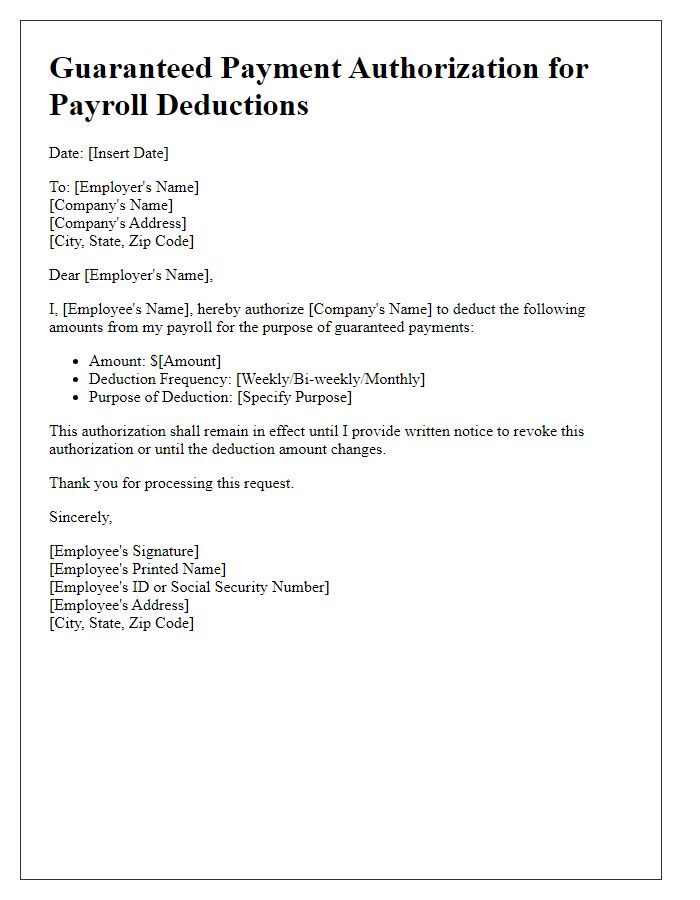

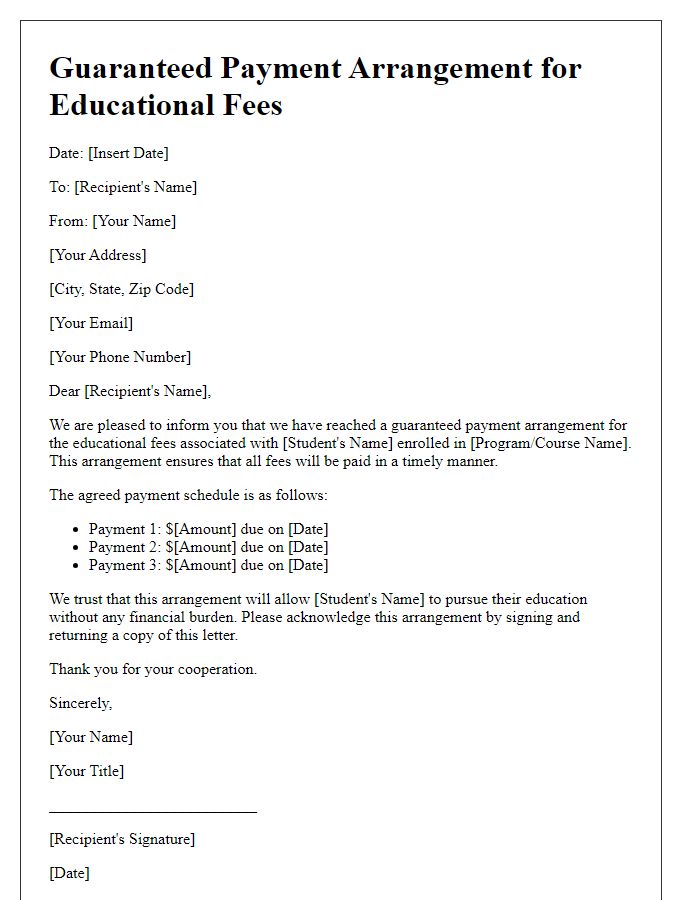

Signature Lines and Authorization

In formal payment agreements, providing clear signature lines and authorization sections is essential for legal validation. Signature lines should be designated for all parties involved, typically including the name and title of each signatory, accompanied by the date of signing for record-keeping purposes. Authorization sections need to clearly outline the responsibilities and commitments of each party regarding the payment schedule, ensuring transparency and accountability. Documentation such as this often requires witnesses or notarization to reinforce its validity, especially in large transactions exceeding significant amounts, such as $10,000. It is advisable to consult legal professionals to ensure adherence to local regulations and best practices in contract formation.

Letter Template For Guaranteed Payment Arrangement Samples

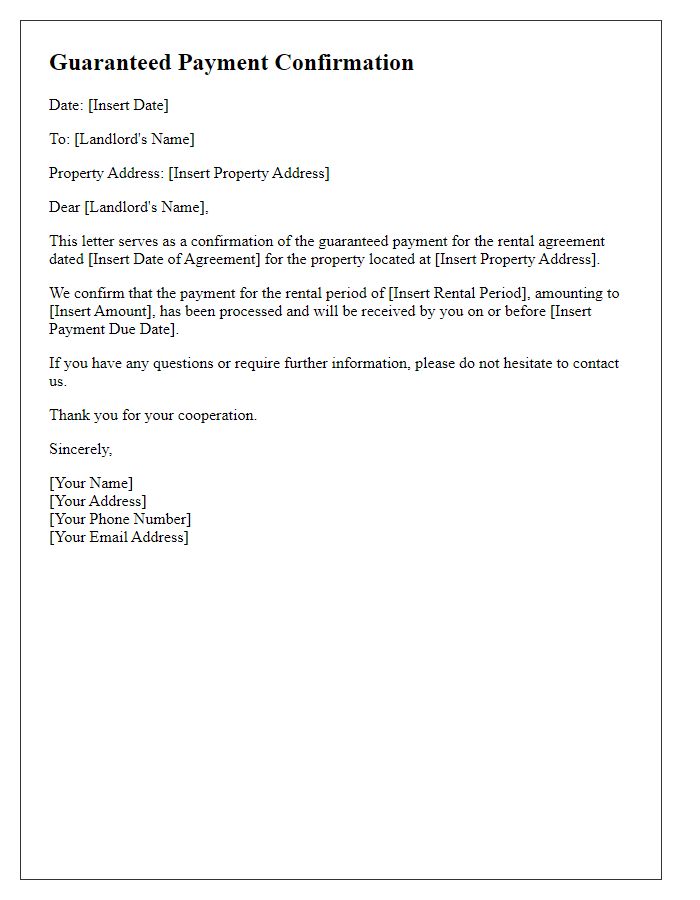

Letter template of guaranteed payment confirmation for rental agreements.

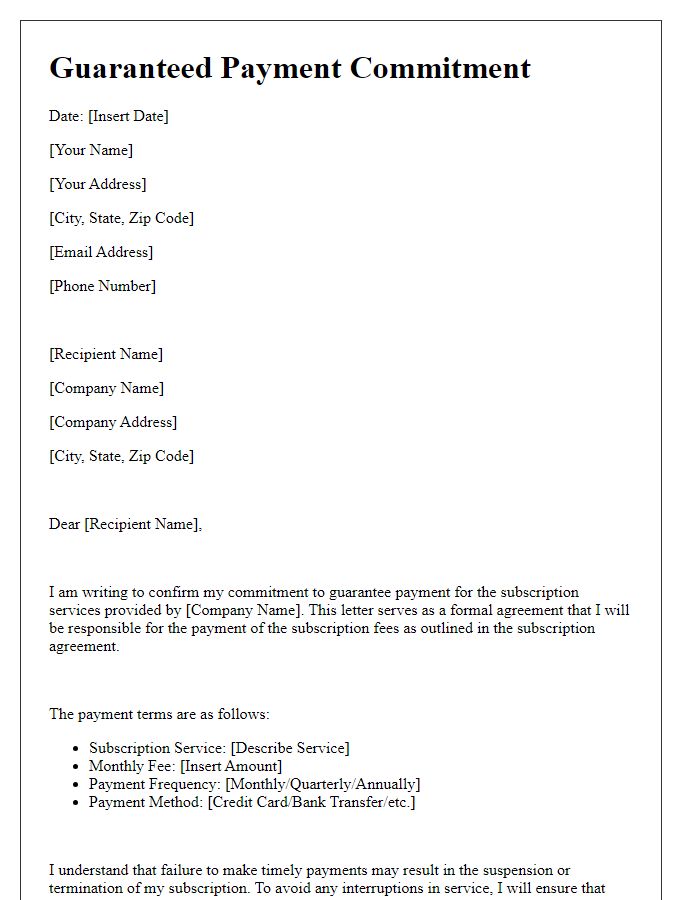

Letter template of guaranteed payment commitment for subscription services.

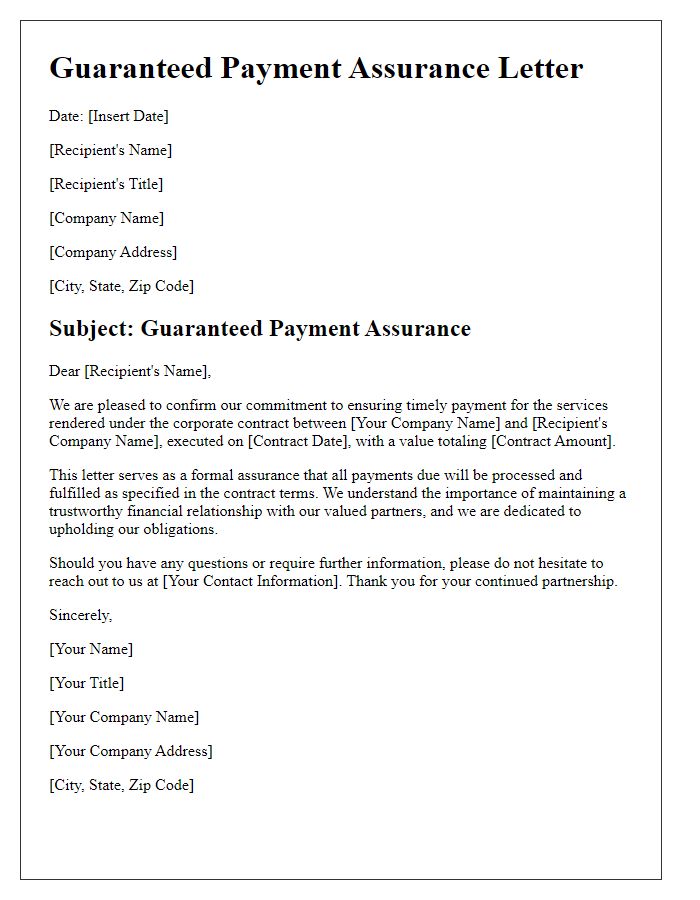

Letter template of guaranteed payment assurance for corporate contracts.

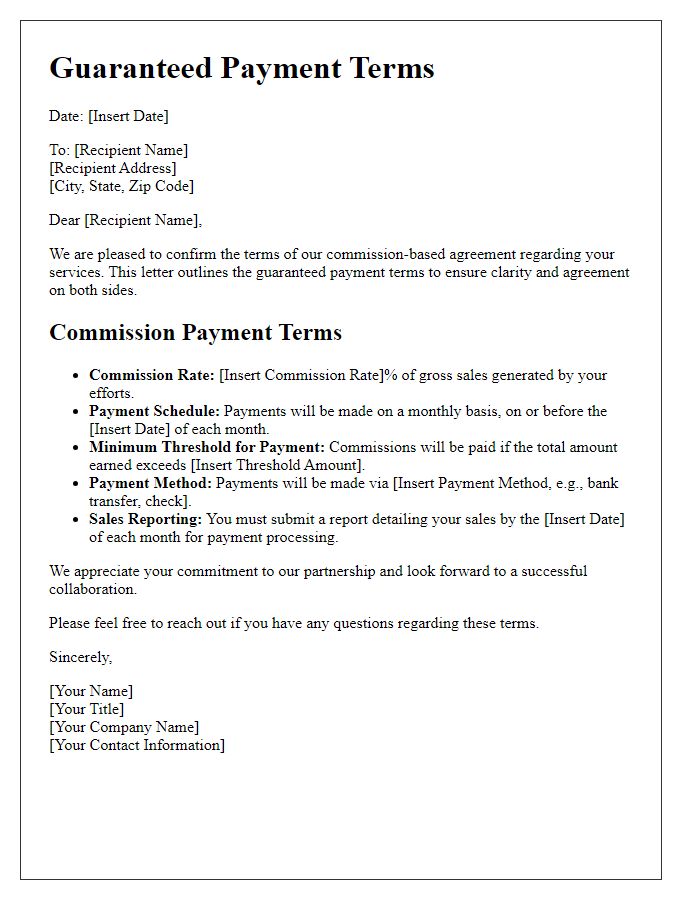

Letter template of guaranteed payment terms for commission-based agreements.

Letter template of guaranteed payment authorization for payroll deductions.

Comments