Are you tired of worrying about unpaid accounts? You're not aloneâmany businesses face this challenge, and the good news is that there's a simple solution. In this article, we'll explore effective strategies to craft a professional yet friendly overdue account notification letter that prompts timely payments while maintaining positive relationships with your clients. So, let's dive in and discover how you can streamline your communication process!

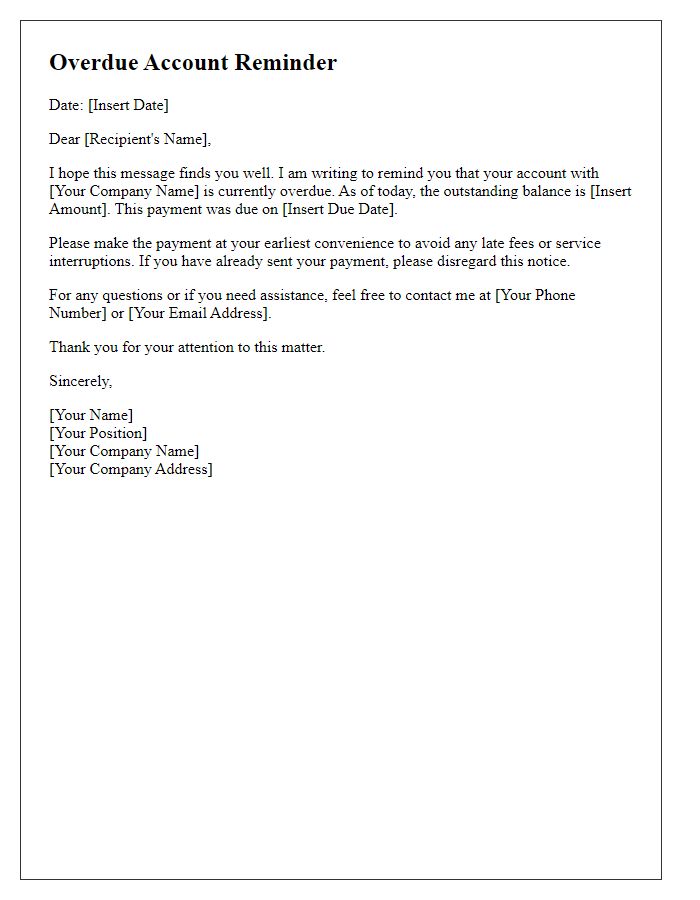

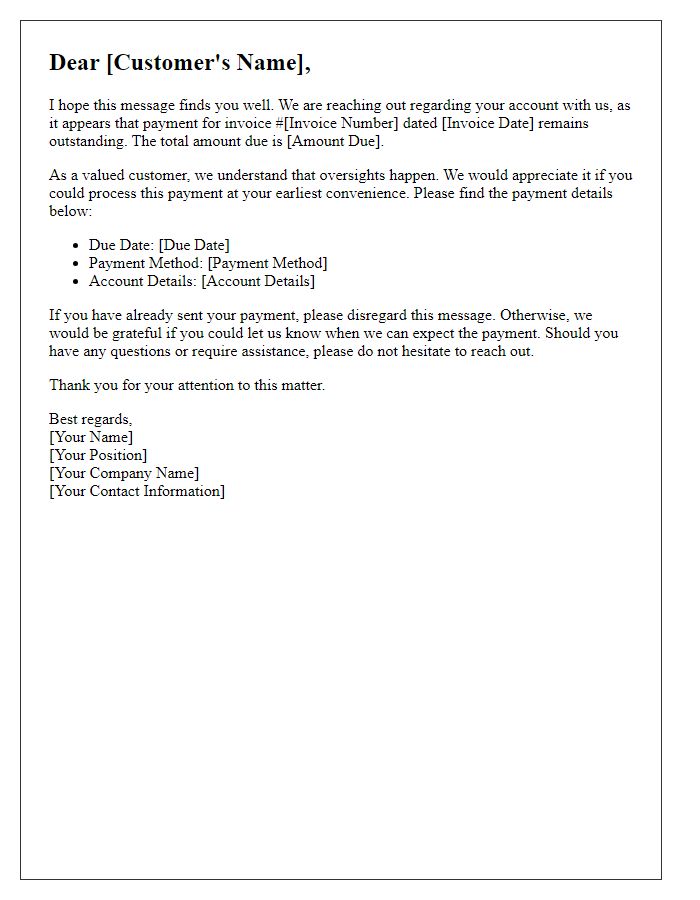

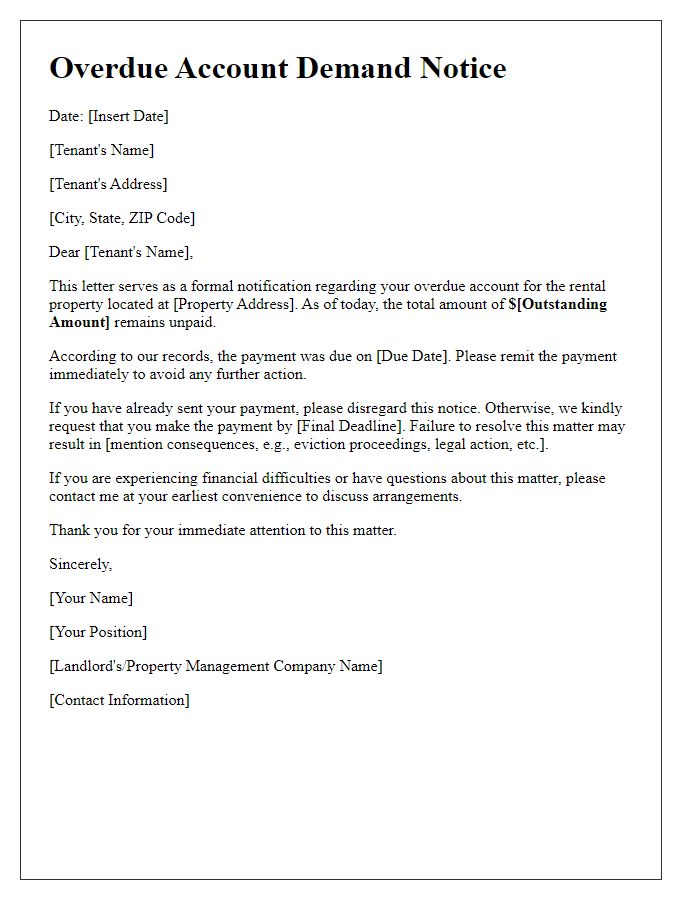

Professional tone

An overdue account can strain business relationships and financial stability. Accounts receivable, often tracked within accounting software, help monitor outstanding invoices. Payment terms (net 30, net 60) define when payments are due, and reminders for overdue accounts should be clear. Effective communication strategies, such as formal notifications via email or postal mail, ensure that clients understand their obligations. Including relevant details like the invoice number, original amount, and due date can enhance clarity. Furthermore, maintaining a professional tone bolsters the company's reputation while addressing payment issues. Legal action may be considered for accounts significantly overdue, demonstrating the importance of timely collections.

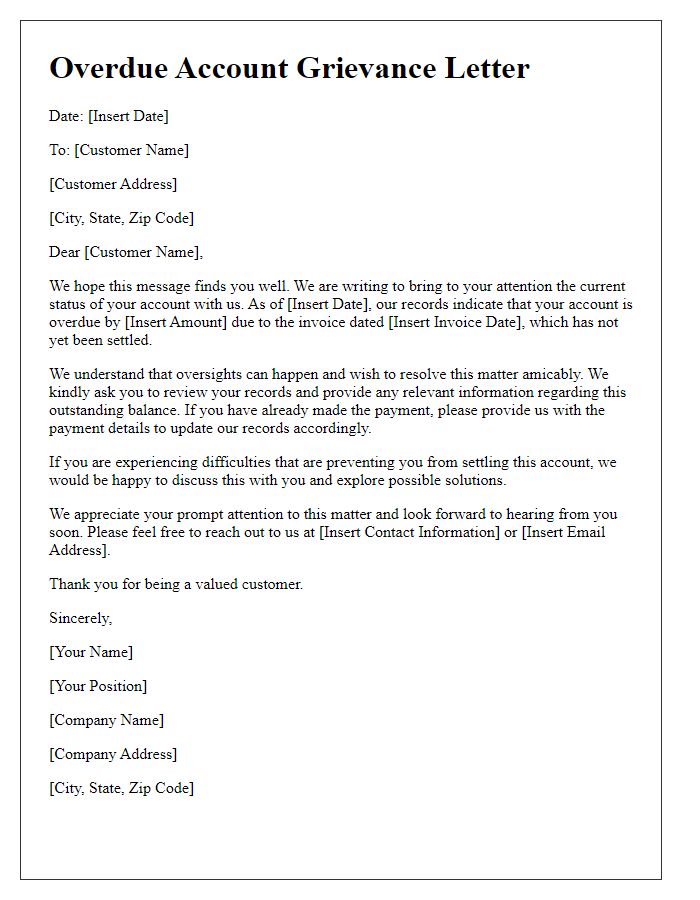

Clear subject line

Overdue accounts can significantly impact the financial health of businesses. A clear subject line, such as "Immediate Attention Required: Overdue Account Notification," can effectively grab the attention of the recipient. This notification typically includes critical details such as the outstanding balance, due date, and account number. For example, if the overdue amount is $850 and the original due date was December 5, 2023, it is essential to highlight these specifics. Additionally, contact information for follow-up, including a dedicated account manager's phone number or email address, should be provided to facilitate prompt communication. Timely notifications play a crucial role in maintaining cash flow and ensuring prompt payment processes are adhered to.

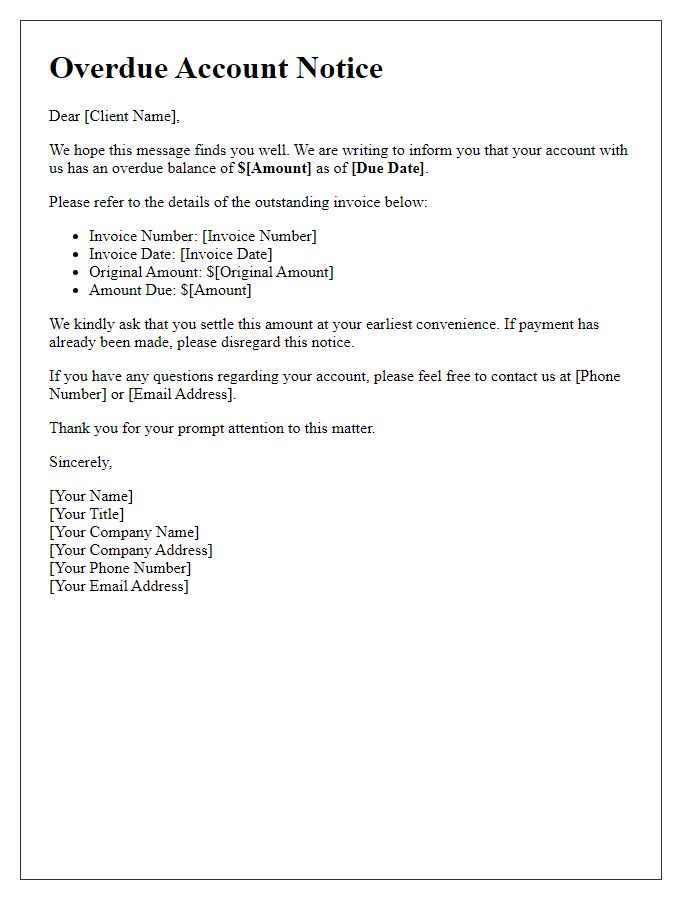

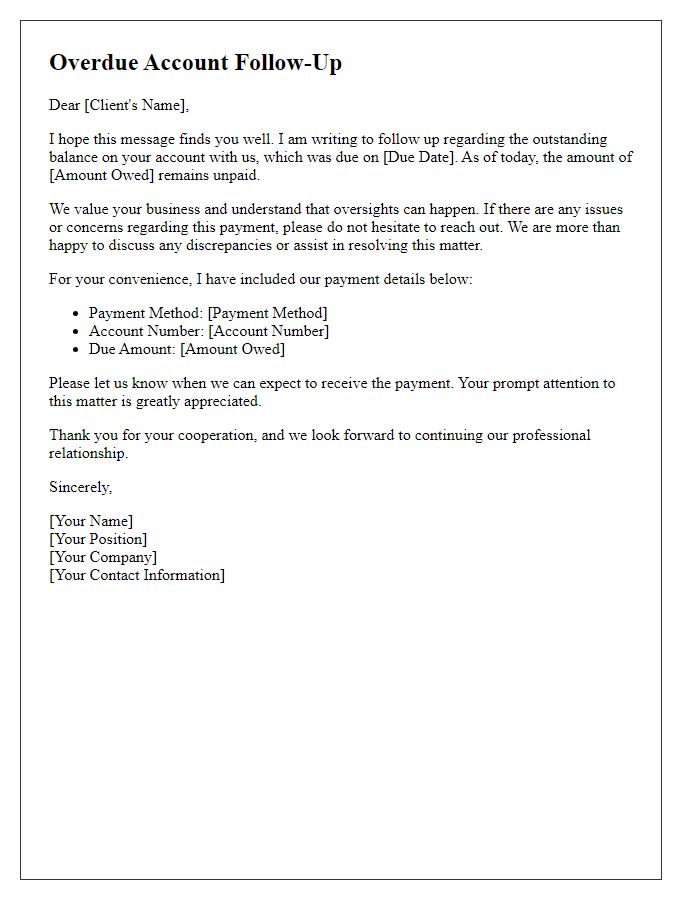

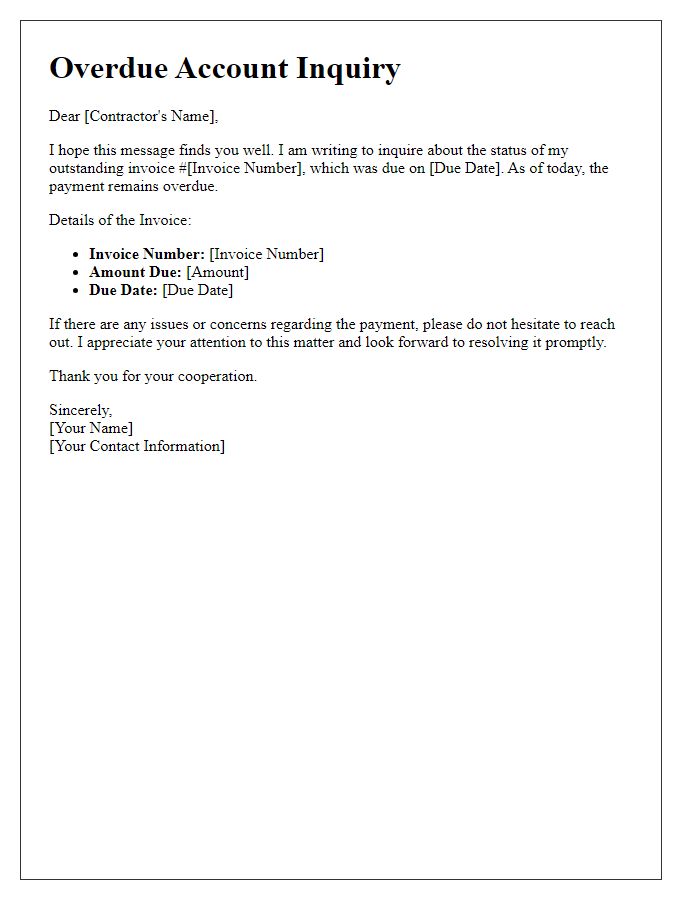

Account details

An overdue account notification typically includes specific account details that are critical for both the sender and recipient. The notification should prominently display the account number, such as 123456789, linked to the registered name of the account holder, e.g., John Doe. The total outstanding balance, for example, $150.75, must be clearly stated alongside the original due date, such as March 1, 2023. Payment instructions or methods accepted, like credit card payments processed through the secure payment gateway, could also be included to facilitate prompt resolution. Additionally, a contact number, such as 1-800-555-0199, for customer service inquiries should be provided for further assistance regarding the account.

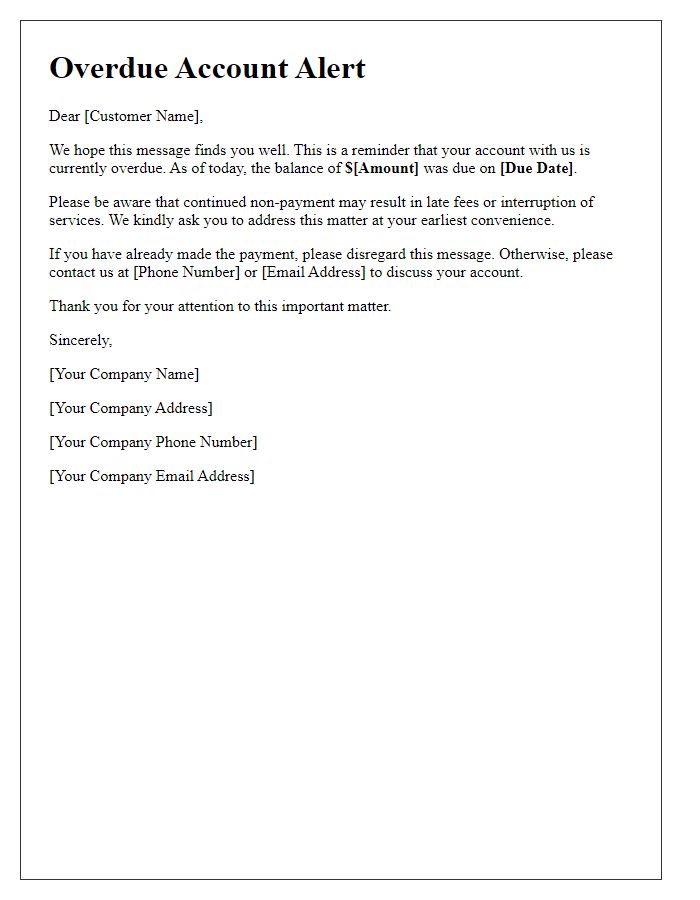

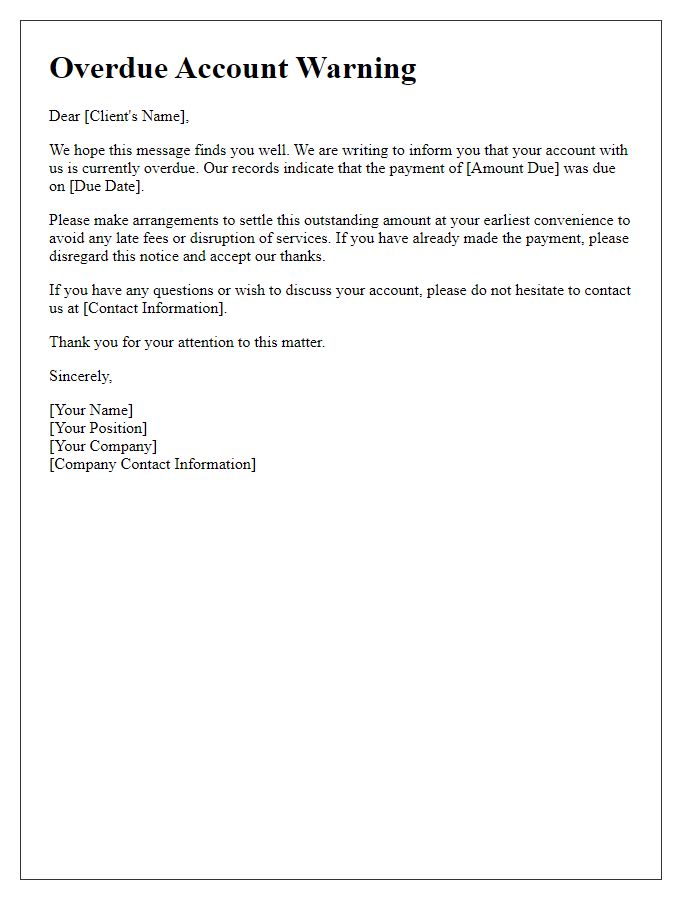

Payment instructions

Overdue accounts can significantly impact the financial health of businesses, especially if payments are outstanding beyond 30 days. Companies typically charge late fees, often around 1.5% of the overdue amount, to incentivize prompt payment. Payment instructions should clearly outline acceptable methods, such as wire transfers to specific bank accounts, online payment platforms like PayPal, or postal mail for checks, ensuring that customers are aware of deadlines to prevent further penalties. Clear communication, including account numbers and reference codes, is crucial for accurate processing and record-keeping by the accounts receivable department.

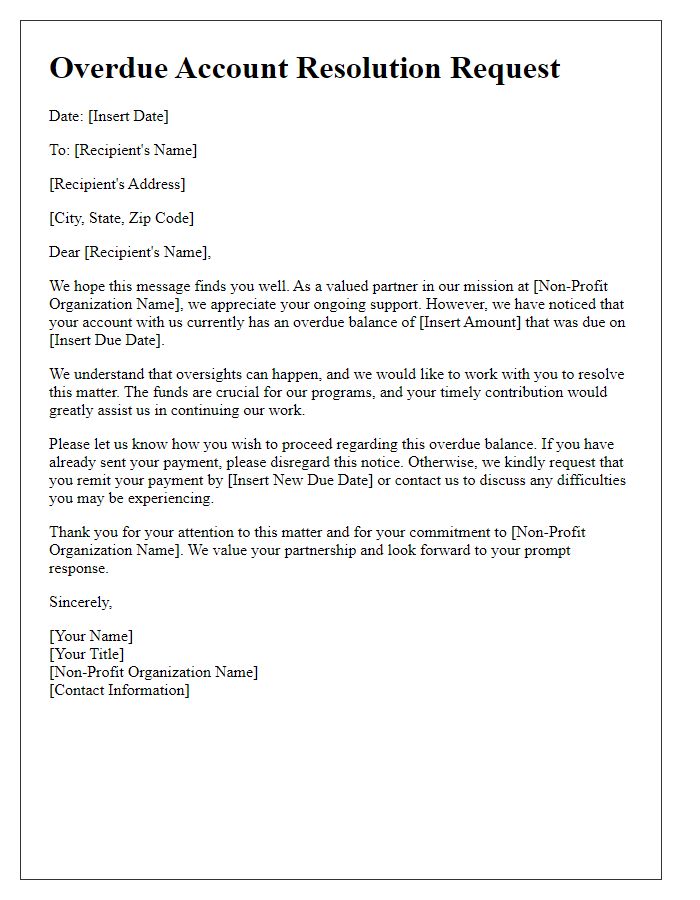

Contact information

Overdue accounts pose significant challenges for businesses, often resulting in cash flow issues and increasing the need for effective collection strategies. Companies must maintain accurate contact information, including phone numbers and email addresses, to facilitate prompt communication with customers. Delays in contacting clients about overdue payments can result in additional interest charges and late fees according to the terms outlined in contracts. Regular updates to customer records ensure the efficiency of collection efforts, allowing businesses to send notifications or reminders in a timely manner. Utilizing integrated accounting software can streamline this process, enabling businesses to generate reports that highlight overdue accounts for quicker follow-up.

Comments