If you're feeling overwhelmed by your current loan situation, you're not aloneâmany homeowners are seeking ways to ease their financial burden through loan modification. Negotiating a loan modification can seem daunting, but it's an opportunity to adjust your mortgage terms and regain control over your finances. With the right approach and a well-crafted letter, you can effectively communicate your needs to your lender and open the door to a more manageable repayment plan. Ready to learn how to write that essential letter and navigate the negotiation process? Let's dive in!

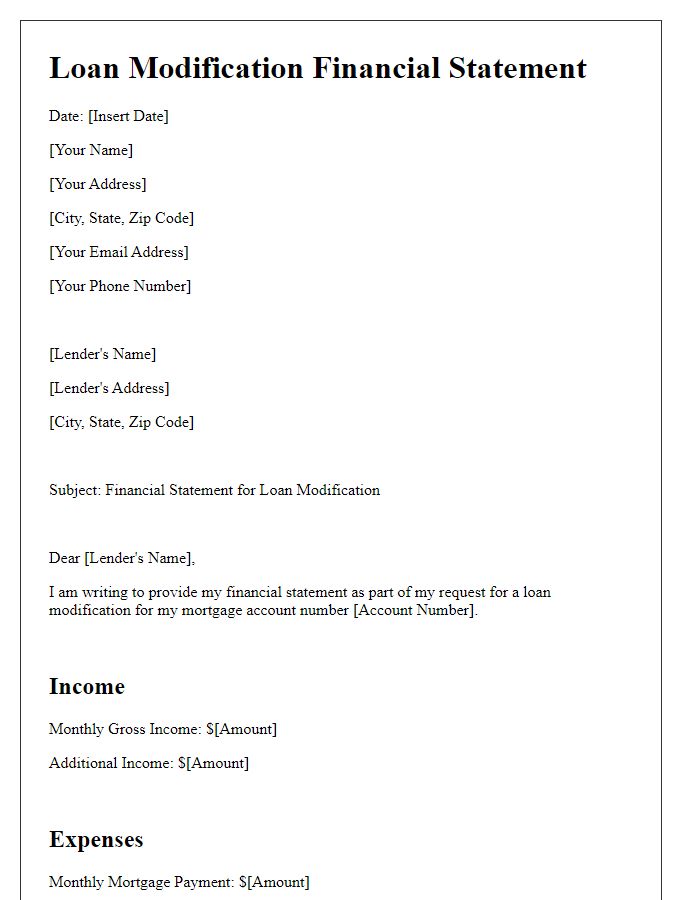

Borrower's Financial Situation.

A borrower's financial situation is a critical aspect of loan modification negotiations. Factors such as current income levels, employment status, and monthly expenses play a significant role in determining eligibility. Recent data from the Bureau of Labor Statistics indicates that average weekly earnings in the United States reached $1,025 as of August 2023, reflecting a fluctuating job market. For example, a borrower may face unexpected medical expenses (averaging $2,000 annually for families) and could experience a recent job loss affecting their ability to make regular mortgage payments. In addition, rising inflation rates, currently estimated at 3.7% in 2023, contribute to an increase in living costs, further straining financial resources. These factors combined highlight the importance of presenting a clear and detailed overview of the borrower's financial condition when negotiating with lenders for potential loan modifications.

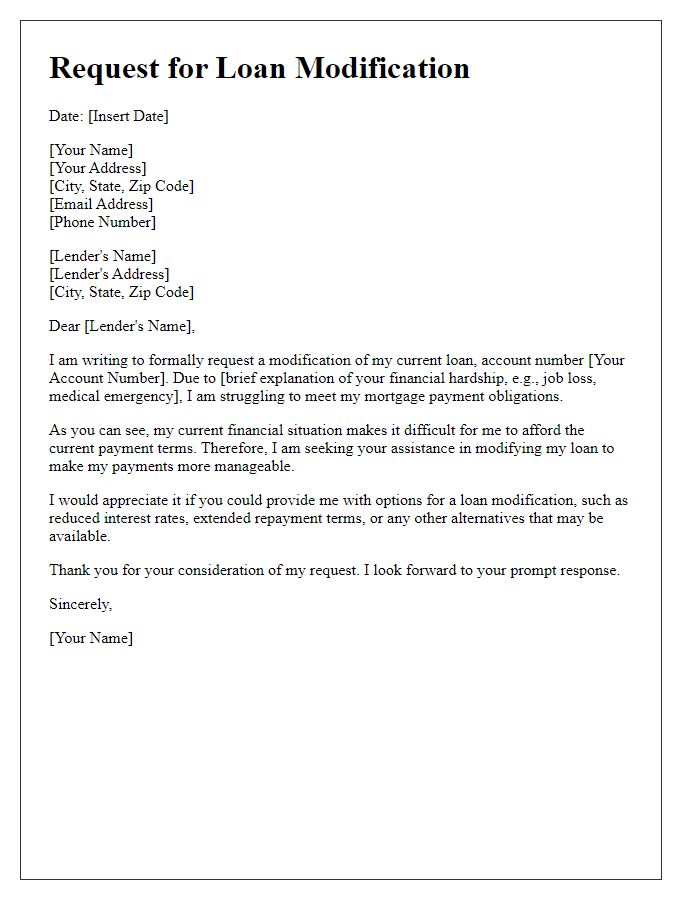

Loan Details and Modification Request.

Loan modification negotiations often revolve around critical factors such as outstanding loan balance (for example, $200,000 on a 30-year mortgage), interest rate (fixed at 5.5%), and current financial hardship due to unforeseen circumstances like job loss or medical expenses. Homeowners typically present their case to lenders, often citing changes in income (such as a 20% decrease) or rising living costs (such as a 10% increase in monthly utilities). The request may include adjustments to terms, such as a lowered interest rate (to 3% for improved payment affordability) or an extension of the loan term (to a 40-year period to reduce monthly payments). Supporting documents like income statements, bank account summaries, and hardship letters can provide additional context to strengthen the case, emphasizing the goal of maintaining home ownership while ensuring lender repayment security.

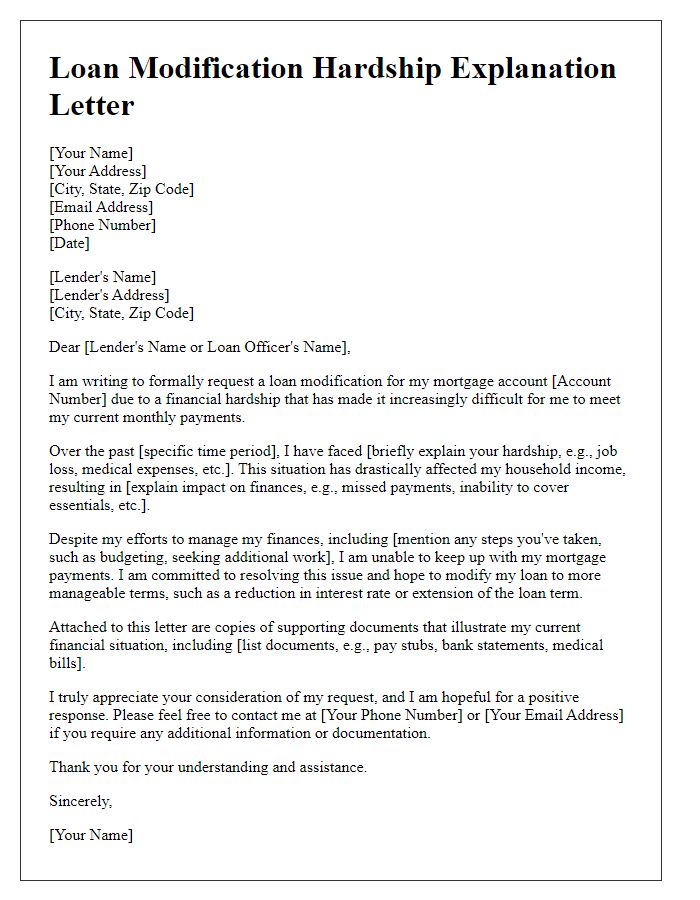

Explanation of Hardship.

Loan modification negotiations often arise during financial hardships experienced by individuals or families. A common scenario includes events such as job loss, medical emergencies, or significant income reduction impacting monthly expenses. Families in suburban areas, like those in Riverside, California, may struggle with the rise in living costs, particularly housing prices averaging $500,000 in 2023. This situation can create challenges in maintaining mortgage payments, especially for households with fixed incomes. Furthermore, unexpected repairs or medical bills averaging $3,000 can drain savings, making it difficult to keep up with mortgage commitments. These hardships necessitate open communication with lenders to adjust loan terms, alleviate immediate financial pressures, and prevent foreclosure, ultimately aiming to sustain homeownership and financial stability.

Proposed Repayment Plan.

A proposed repayment plan for loan modification outlines a structured strategy for homeowners facing financial difficulty, such as job loss or medical emergencies. This plan typically details monthly payment amounts, potentially reduced interest rates, and extended loan terms to enhance affordability. For example, a typical mortgage loan of $250,000 might see a reduction in interest from 5% to 3%, decreasing monthly payments from approximately $1,342 to around $1,054. The modification proposal emphasizes the borrower's commitment to maintaining property at a specific location, potentially in areas like Los Angeles or New York City, where real estate values fluctuate significantly. Additionally, this plan may include a request for the lender to temporarily suspend payments during periods of extreme hardship, fostering a collaborative approach between borrower and lender to achieve financial stability.

Contact Information for Further Discussion.

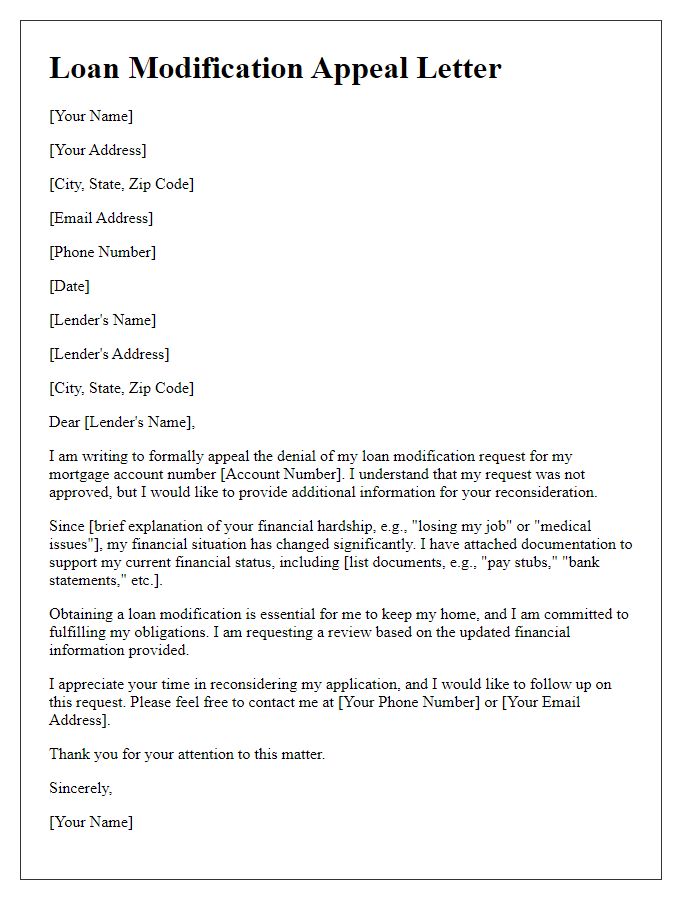

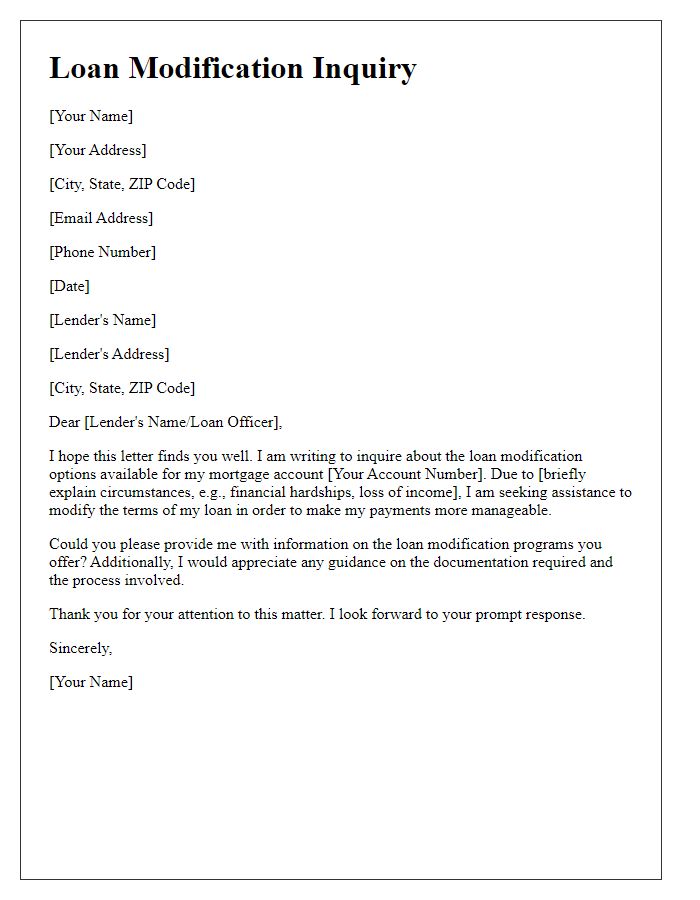

Loan modification negotiations can be complex, often requiring clear communication and documentation. Key entities include the lender (such as Bank of America or Wells Fargo), the borrower (the individual seeking modification), and terms related to the loan (interest rate, monthly payment amount, loan term). Detailed notes on the borrower's financial situation, such as income figures (like $4,000 monthly) and expenses (like $2,500 monthly), assist in illustrating the necessity for modification. Providing contact information, including a direct phone number, email address, and preferred times for discussion, facilitates smooth communication. Timely follow-up ensures all parties are aligned, improving negotiation outcomes and potential modifications to the loan agreement, which could lead to more manageable payment terms.

Letter Template For Loan Modification Negotiation Samples

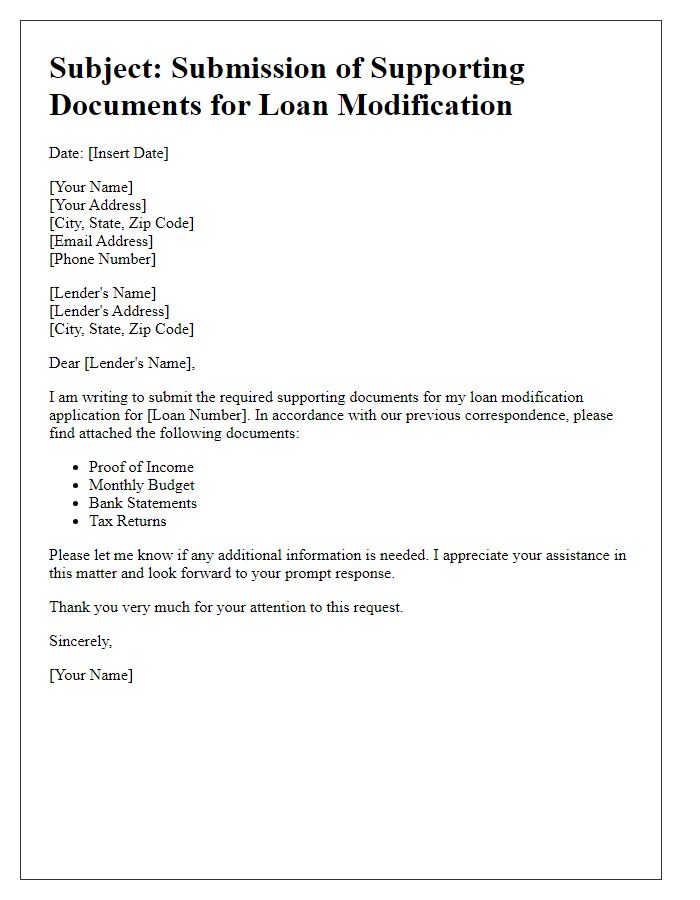

Letter template of supporting documents submission for loan modification

Comments