Navigating the complexities of a business merger can seem daunting, but it opens up a world of opportunities for growth and innovation. In this article, we'll break down the essential components of a successful merger proposal, highlighting key strategies that can foster collaboration and mutual benefit. From aligning company cultures to identifying synergies, understanding these elements can significantly enhance your proposal's effectiveness. Ready to dive in and explore the intricacies of crafting the perfect business merger letter?

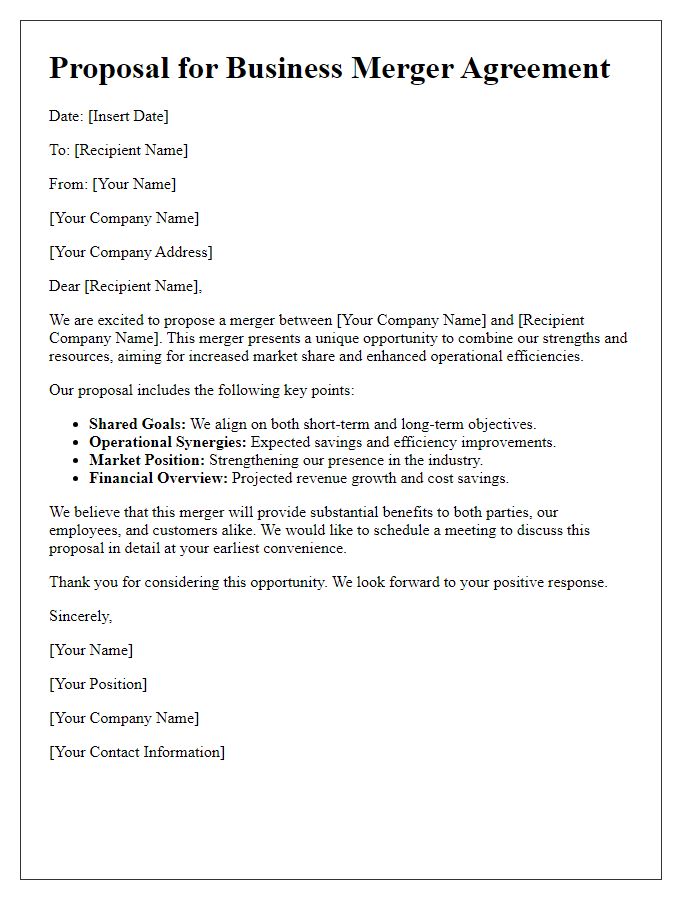

Clear Introduction

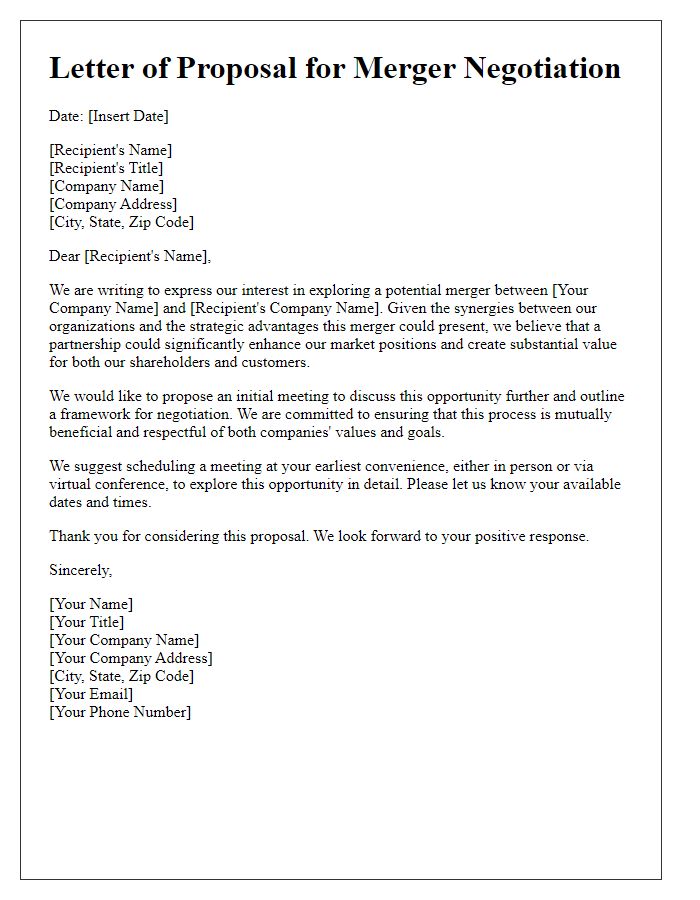

A business merger proposal serves as a formal document outlining the intent and rationale for merging two companies. This proposal typically begins with a concise introduction to both companies involved in the potential merger, including their names, locations, and industry sectors. For instance, Company A, headquartered in New York, specializes in software development, while Company B, situated in San Francisco, focuses on cloud computing solutions. The introduction should highlight the strategic advantages of the merger, such as enhanced market share, improved operational efficiencies, and access to new technologies or resources. The importance of collaboration in a rapidly changing marketplace is a key aspect to address, illustrating how the merger can leverage the strengths of both companies to achieve shared goals and sustainable growth.

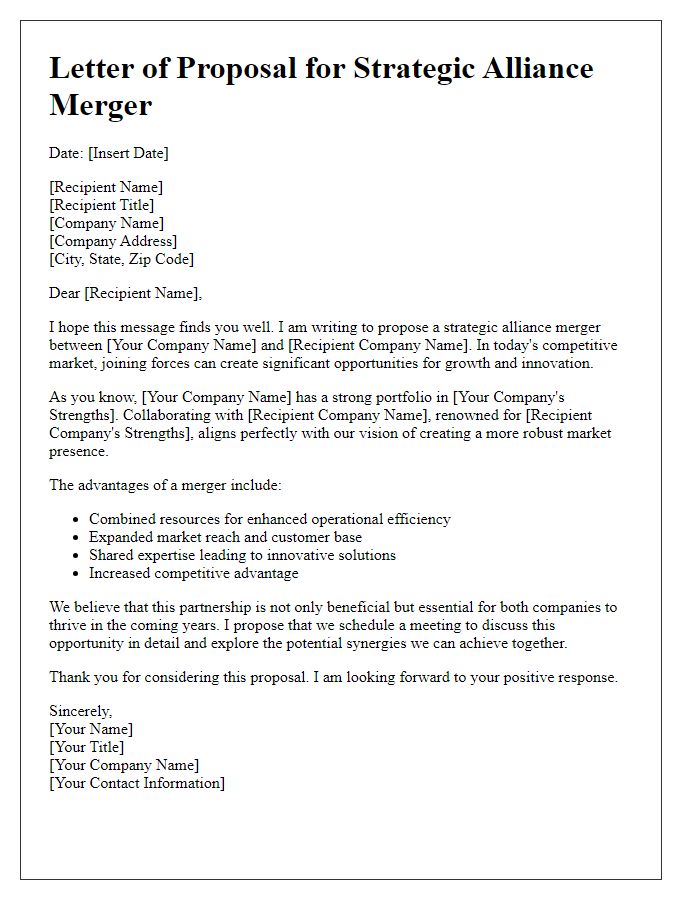

Strategic Synergy Explanation

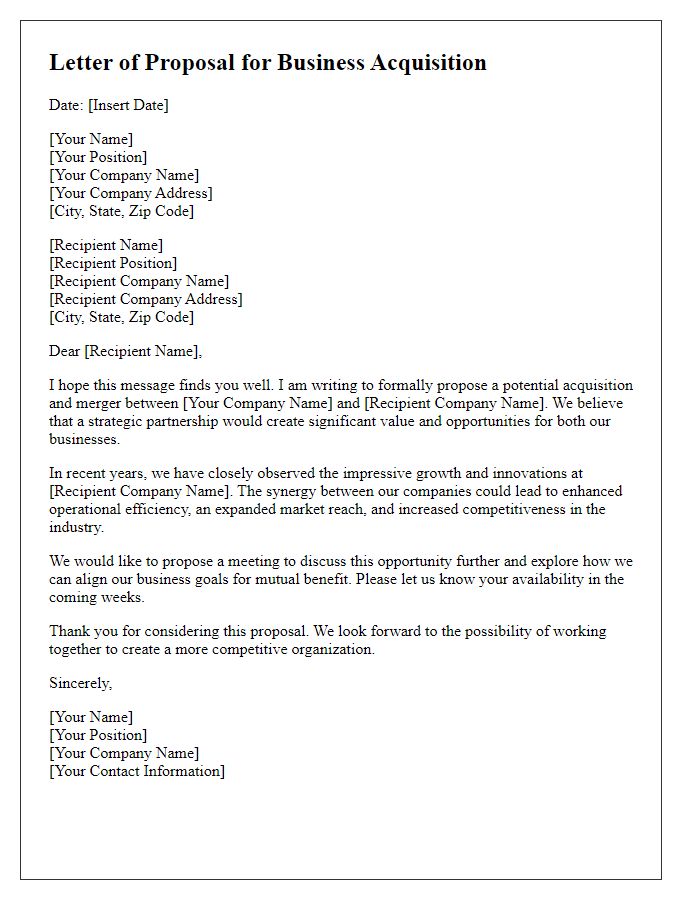

A business merger proposal often emphasizes the strategic synergy between the merging entities, illustrating how their combined strengths can lead to enhanced market presence. For instance, Company A, a leading software developer with a 25% market share in North America, may merge with Company B, an established hardware manufacturer known for its innovative products. This merger could result in the creation of integrated solutions, combining Company A's software expertise with Company B's cutting-edge hardware. Such collaboration could enable both companies to tap into the rapidly growing Internet of Things (IoT) sector, projected to reach a market size of $1 trillion by 2025. Additionally, the merger could optimize operational efficiencies, reduce costs, and enhance customer offerings, ultimately driving revenue growth and expanding the customer base.

Financial and Operational Benefits

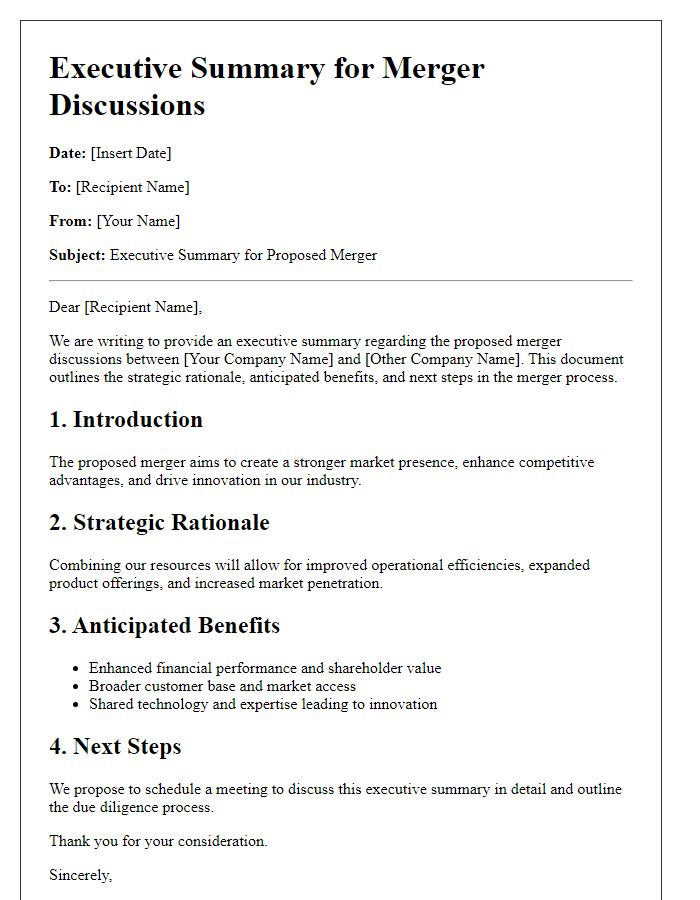

A business merger can lead to significant financial and operational benefits, creating a combined entity that capitalizes on shared resources and expertise. Increasing economies of scale can result in reduced costs, as organizations leverage their larger market presence to negotiate better deals with suppliers and enhance purchasing power. Operational efficiencies can emerge from streamlined processes and consolidated operations, reducing overhead expenses and enabling a more agile response to market demands. Shared technology platforms may enhance productivity, while cross-functional teams can drive innovation through diversified skill sets. Additionally, the consolidation can open new revenue streams, expanding market reach and customer bases across various geographic locations, ultimately leading to increased profitability. Mergers provide an opportunity for stronger brand positioning, driving long-term growth and sustainability in an increasingly competitive landscape.

Integration Plan Overview

The Integration Plan Overview is vital during the merger process of two companies, aimed at aligning organizational structures, cultures, and operations for smooth collaboration. Objective guidelines highlight key stages such as stakeholder engagement, resource allocation, and timeline establishment over a period, typically spanning six to twelve months. A detailed analysis focuses on merging financial systems, IT infrastructures, and human resources across both entities, ensuring compatibility and efficiency. Metrics for success, such as employee retention rates and revenue growth, will be established to evaluate integration effectiveness. Regular communication between leadership teams will facilitate transparency and address challenges, fostering a cohesive work environment post-merger.

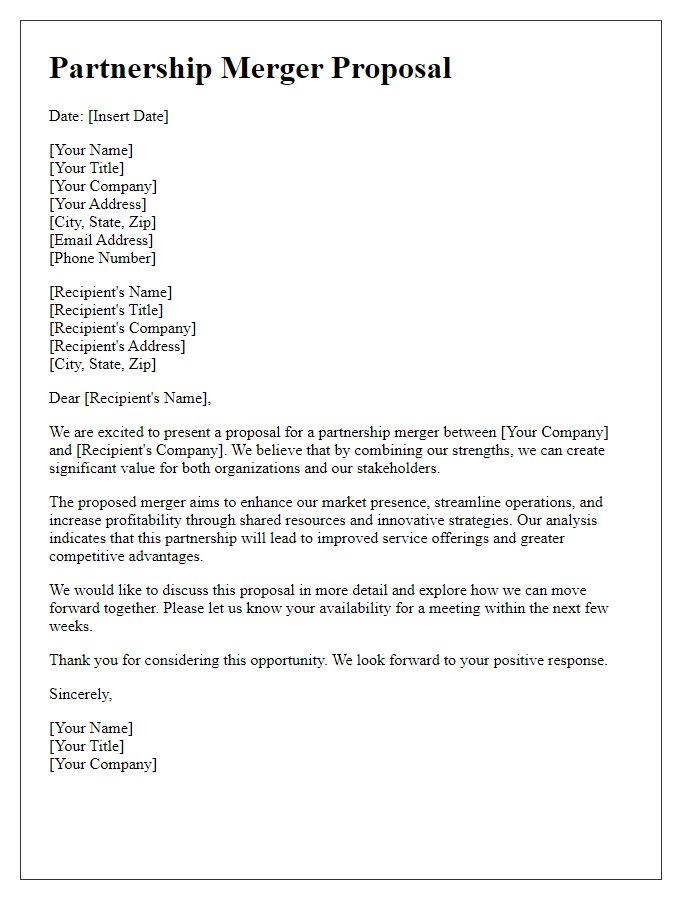

Call to Action and Next Steps

A successful business merger proposal requires a strategic approach, highlighting key benefits and steps for implementation. Initiating collaboration involves identifying synergies between both companies, showcasing how shared resources can enhance operational efficiency. Establishing clear goals, such as increased market share or enhanced product offerings, is essential. Proposing a timeline for due diligence, negotiations, and integration phases encourages proactive engagement. Designing a communication plan to inform stakeholders, including employees and customers, fosters transparency during the transition. Finally, suggesting a follow-up meeting to discuss feedback and refine the proposal solidifies commitment to the merger process, paving the way for a successful collaboration.

Comments