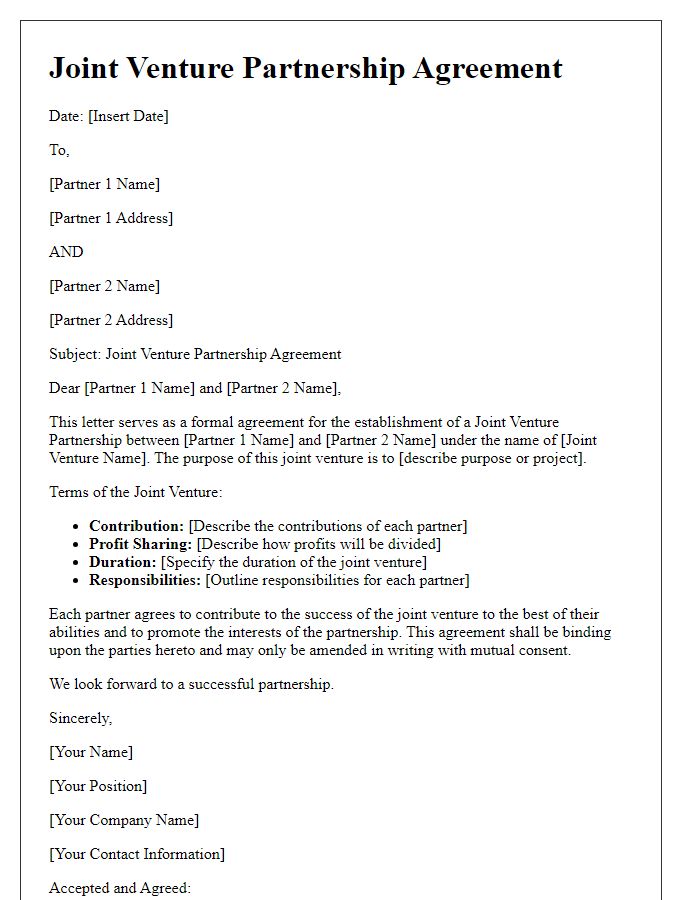

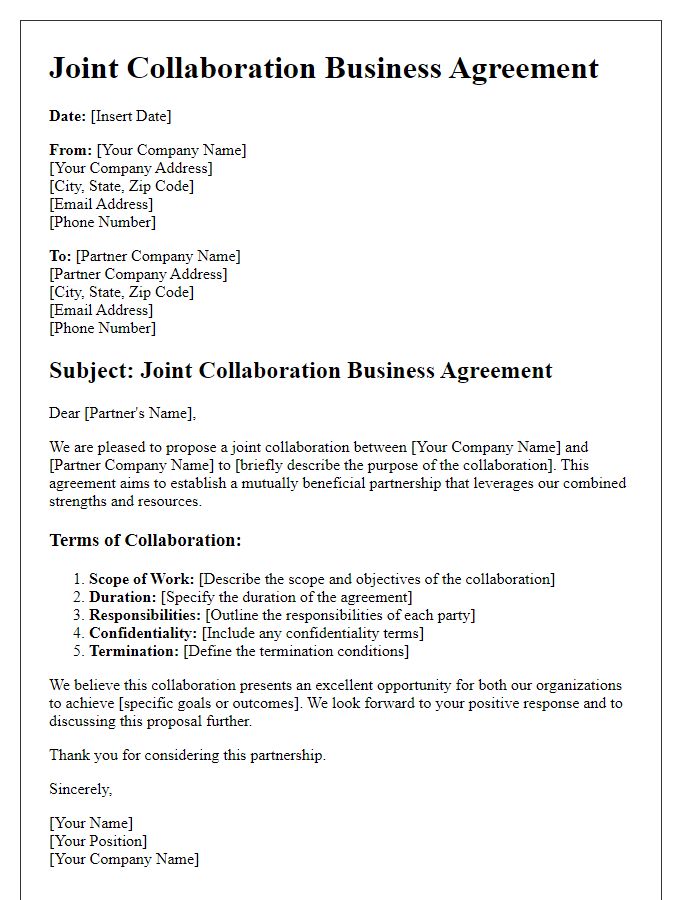

Are you considering entering into a joint venture agreement? It's an exciting opportunity that can lead to innovative collaborations and enhanced growth for your business. In this article, we'll guide you through the essential elements of a well-structured letter template for your joint venture agreement, making the process smooth and straightforward. So, grab a cup of coffee and let's explore how to craft a solid foundation for your partnership!

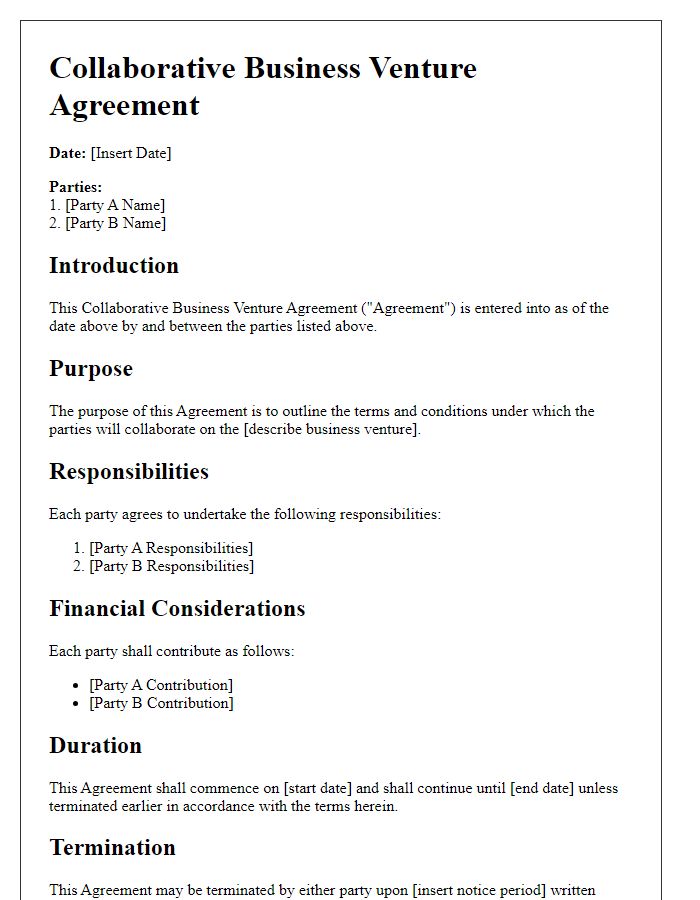

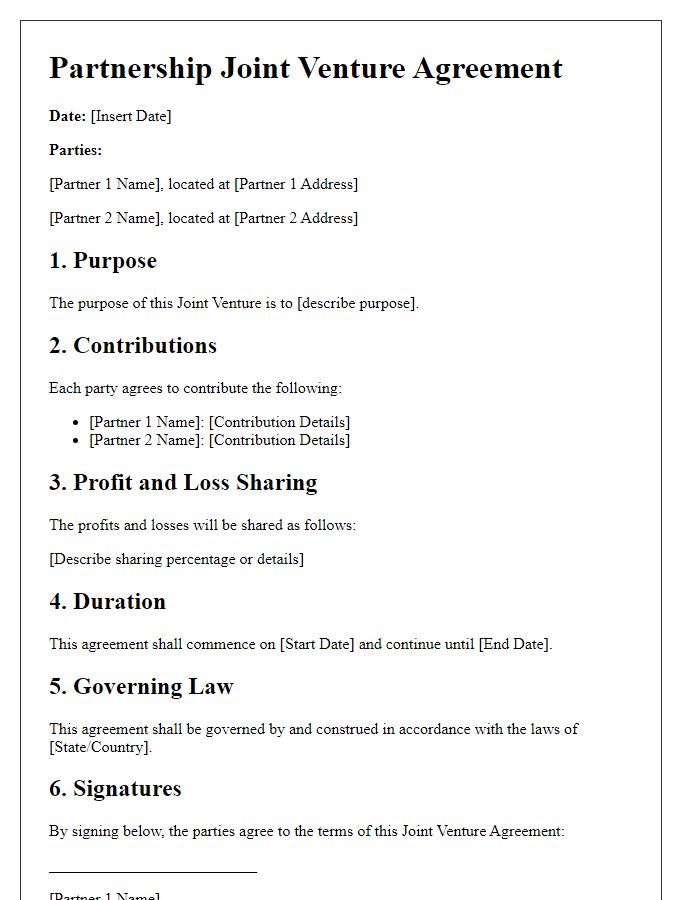

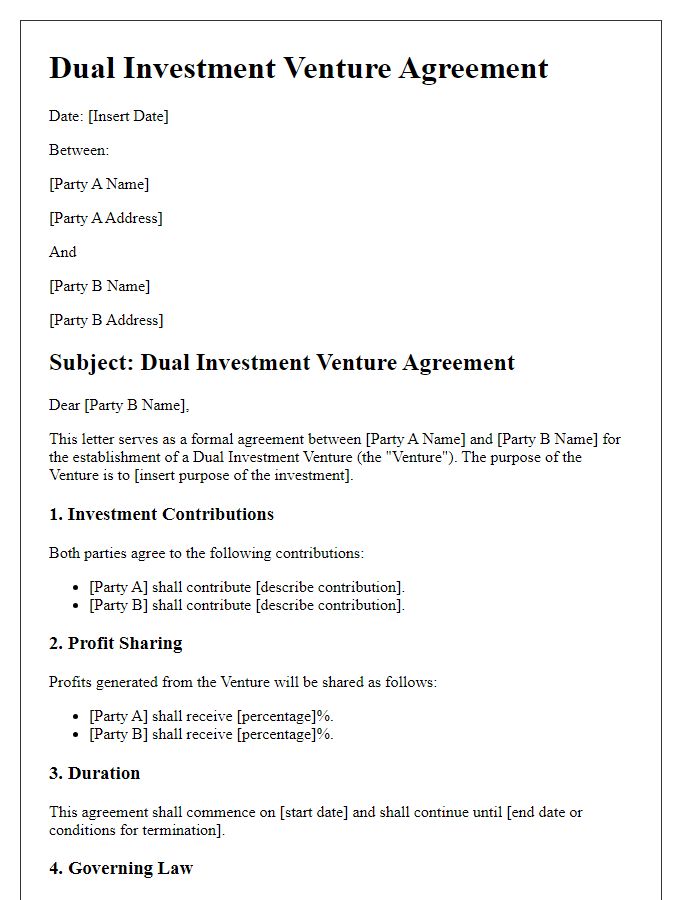

Purpose and Objectives

A joint venture agreement establishes a collaborative partnership between Company A (a technology firm specializing in software development) and Company B (a marketing agency with expertise in digital campaigns) to develop an innovative mobile application. The primary purpose includes pooling resources to create a product that integrates advanced analytics with user-friendly interfaces, targeting millennials (ages 25-40) seeking personalized experiences in lifestyle management. Key objectives encompass leveraging Company A's technical expertise to ensure robust software functionality while utilizing Company B's market insights to enhance user engagement and promotion strategies. This strategic alliance aims to achieve a successful product launch by Q4 2024, capturing at least 10,000 active users within the first six months, establishing a competitive edge in the mobile application market.

Roles and Responsibilities

A joint venture agreement outlines essential roles and responsibilities of each partner involved in collaborative projects aimed at mutual benefit. Defined roles ensure accountability and effective operation within the partnership. For instance, the managing partner may oversee daily operations and strategic planning, while financial partners handle budget management and funding allocation. Each partner's responsibilities should be clearly delineated, covering areas such as marketing initiatives, technology development, and human resources. Additionally, performance metrics must be set to evaluate progress and ensure alignment with business objectives, contributing to the overall success of the joint venture. Establishing a framework for conflict resolution will enhance collaboration and promote a healthy partnership dynamic.

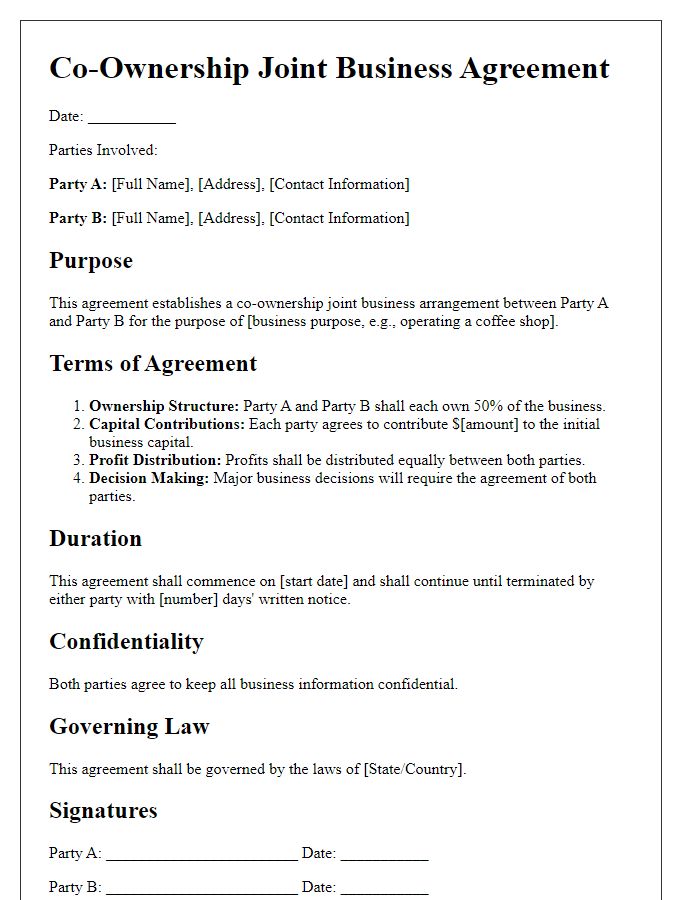

Capital Contribution and Resource Allocation

Joint venture agreements outline the framework for collaboration between parties in shared business endeavors. Capital contribution refers to the financial investment each party commits, which may vary greatly; for example, one partner could contribute $500,000 while another might contribute $300,000, impacting ownership stakes. Resource allocation includes the distribution of assets such as technology, personnel, or intellectual property; for instance, if the venture is in renewable energy, one partner may provide solar panel technology, while another contributes skilled engineers. Clear stipulations regarding profit sharing and decision-making powers are crucial, ensuring both parties understand their roles and responsibilities within the joint venture, potentially based in locations like Silicon Valley or Shanghai, known for their tech industries.

Profit and Loss Sharing

A joint venture agreement outlines the commercial relationship between two or more parties who collaborate on a specific project while sharing profits and losses. The agreement specifies the profit-sharing ratio, which may be equal or based on the capital contributions of each party. In a profit-sharing model, clear definitions of net profit calculation methods (after deducting expenses, taxes, and other liabilities) are essential. Loss-sharing provisions detail how losses will be borne by each partner, often proportionate to their initial investment or predefined ratios. Important elements also include roles and responsibilities of each partner in the management and operational phases, decision-making processes, and dispute resolution mechanisms. Jurisdiction, terms of exit, and duration of the joint venture should be distinctly articulated, ensuring mutual understanding and clarity in business operations.

Termination and Exit Strategy

A joint venture agreement requires a comprehensive termination and exit strategy to ensure all parties are prepared for potential dissolution. Key elements such as notice periods, typically 30 to 90 days, must be specified to inform parties about the intention to terminate. Evaluation metrics, including project performance indicators and financial benchmarks, aid in determining if the joint venture meets its objectives before exit. Conditions for termination, such as breaches of agreement or failure to meet goals, should be clearly articulated. Additionally, agreements on asset distribution, including intellectual property and physical assets in the joint venture, must be outlined to prevent disputes. Lastly, delineation of post-termination obligations ensures that all legal responsibilities, including confidentiality and non-competition clauses, are maintained to protect the interests of each party involved.

Comments