Are you feeling overwhelmed by your student loans and wondering if forgiveness might be an option for you? It's a common concern for many graduates, and the good news is that there are various programs available that could help lighten the financial burden. From Public Service Loan Forgiveness to income-driven repayment plans, understanding your choices can make a significant difference in your financial future. Keep reading to explore the ins and outs of student loan forgiveness and see how it may benefit you!

Personal Identification Information

Navigating student loan forgiveness programs requires precise personal identification information to facilitate the application process. Essential details include the borrower's full name (exactly as it appears on the loan documents), Social Security number (nine-digit identifier crucial for verification), and date of birth (to establish identity). Additionally, the address (current residential location, including city, state, and zip code) must be accurate, as this is often used for correspondence. Contact information, such as a phone number (preferably a mobile number for immediate communication) and email address (active account for digital communications), assists in streamlining the inquiry process. Documenting loan specifics, like the loan servicer's name (the company managing the loan), account number (to identify the specific loan), and the type of loans (such as Federal Direct Loans or Perkins Loans), enables a more efficient evaluation of eligibility for forgiveness programs.

Loan Details and Account Number

Student loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program, require specific loan details, including the loan balance, outstanding principal, and account number (a unique identifier for the loan). These details facilitate the verification process, allowing the Department of Education to assess eligibility and track application status. Additionally, borrowers must provide documentation of qualifying employment, such as pay stubs or W-2 forms, to ensure compliance with program requirements. Inquiry submissions should clearly outline the loan details to expedite consideration and avoid delays in forgiveness status.

Reason for Forgiveness Inquiry

Student loan forgiveness programs offer financial relief to borrowers facing burdensome debt. Many individuals seek forgiveness under programs like Public Service Loan Forgiveness (PSLF), which requires working full-time in qualifying public service jobs for at least ten years while making 120 qualifying monthly payments. Federal employees may inquire about forgiveness due to their commitment to serving their communities. Additionally, students with disabilities or those experiencing economic hardship can benefit from income-driven repayment plans that may lead to forgiveness after 20 to 25 years of consistent payments. Understanding eligibility criteria and the application process is essential for navigating this complex landscape of education financing.

Documentation Supporting Financial Hardship

Student loan forgiveness programs, designed to alleviate financial burdens on borrowers, often require documentation supporting claims of financial hardship. Essential documents may include recent pay stubs (last three months) indicating income levels, unemployment verification letters for those currently without a job, and tax returns from the past two years to establish financial status. Additionally, a detailed budget outlining monthly expenses (housing, food, transportation) can provide insight into living costs. If applicable, documents relating to medical expenses or other unexpected costs may also illustrate financial difficulties. Ideally, these submissions should be organized chronologically to streamline the review process for financial aid administrators.

Clear Request and Specific Forgiveness Program Mention

The federal student loan forgiveness program, particularly the Public Service Loan Forgiveness (PSLF), offers significant relief to eligible borrowers after making 120 qualifying monthly payments. Many individuals like teachers, nurses, and social workers often seek to understand their eligibility requirements and necessary documentation. It's important for borrowers to inquire about specific details of their loans, such as whether they are Direct Loans, as only these qualify for PSLF. Additionally, understanding the approval process and timeframe can alleviate uncertainties, allowing borrowers to effectively navigate the complex landscape of student loan forgiveness. For precise assistance, contacting a student loan servicer directly can provide tailored guidance on how to proceed with an application for forgiveness tailored to individual circumstances.

Letter Template For Student Loan Forgiveness Inquiry Samples

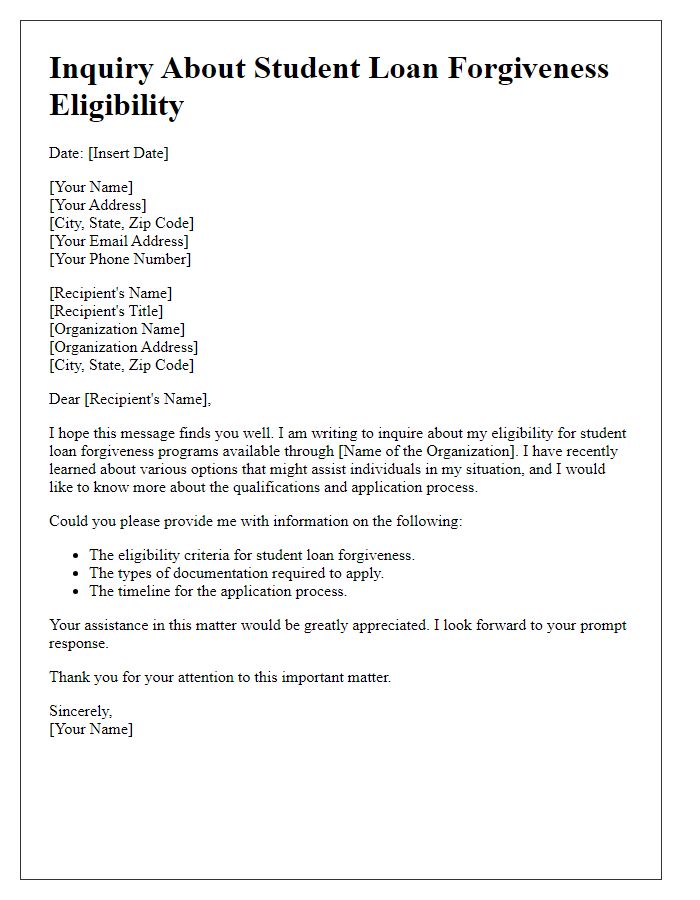

Letter template of inquiry about eligibility for student loan forgiveness

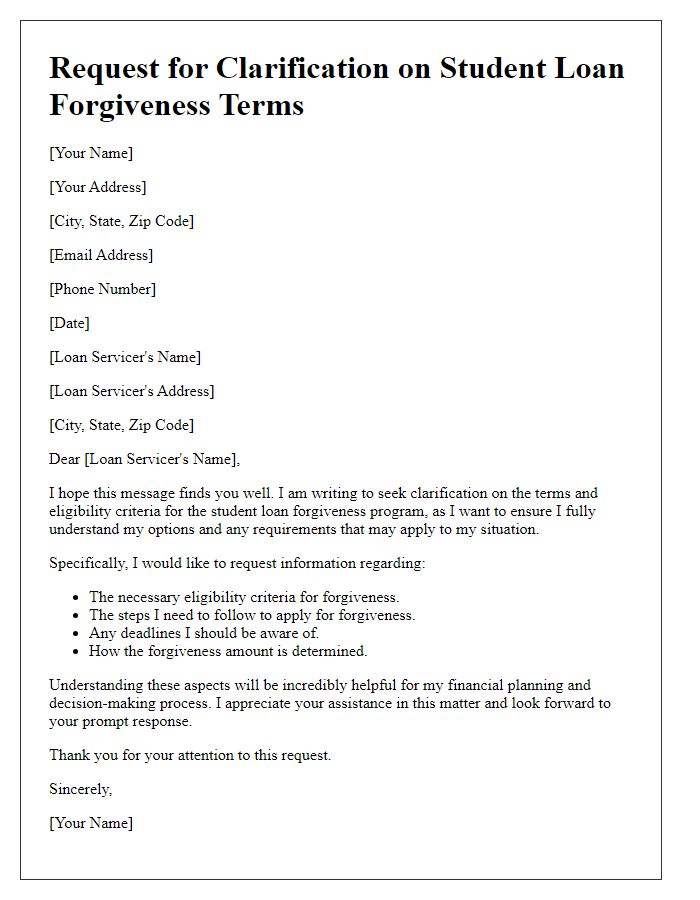

Letter template of clarification needed on student loan forgiveness terms

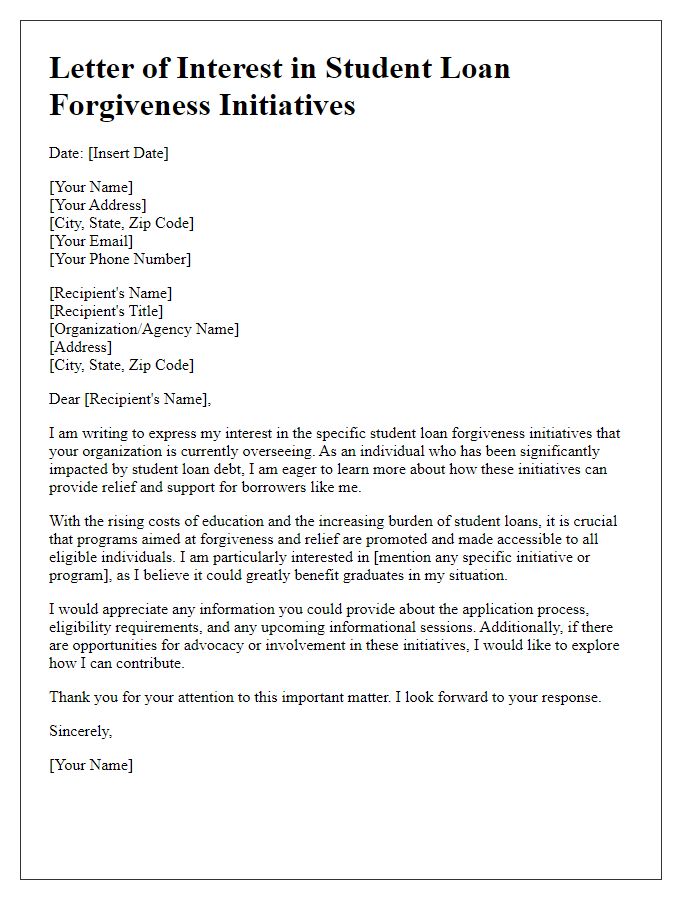

Letter template of interest in specific student loan forgiveness initiatives

Comments