Are you feeling overwhelmed by tax liens and unsure of how to request their release? You're not alone; many individuals find themselves in similar situations, faced with daunting paperwork and complex procedures. Thankfully, crafting a tax lien release request letter doesn't have to be a source of stress. In this article, we'll guide you through the essential steps, so you can take control of your financial futureâread on to discover how to simplify the process!

Accurate Taxpayer Information

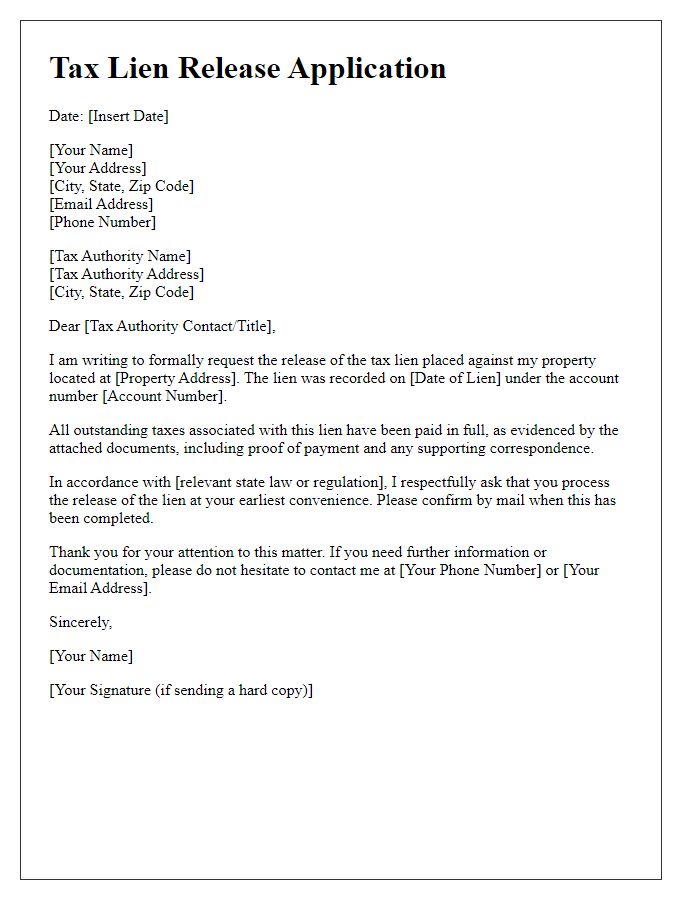

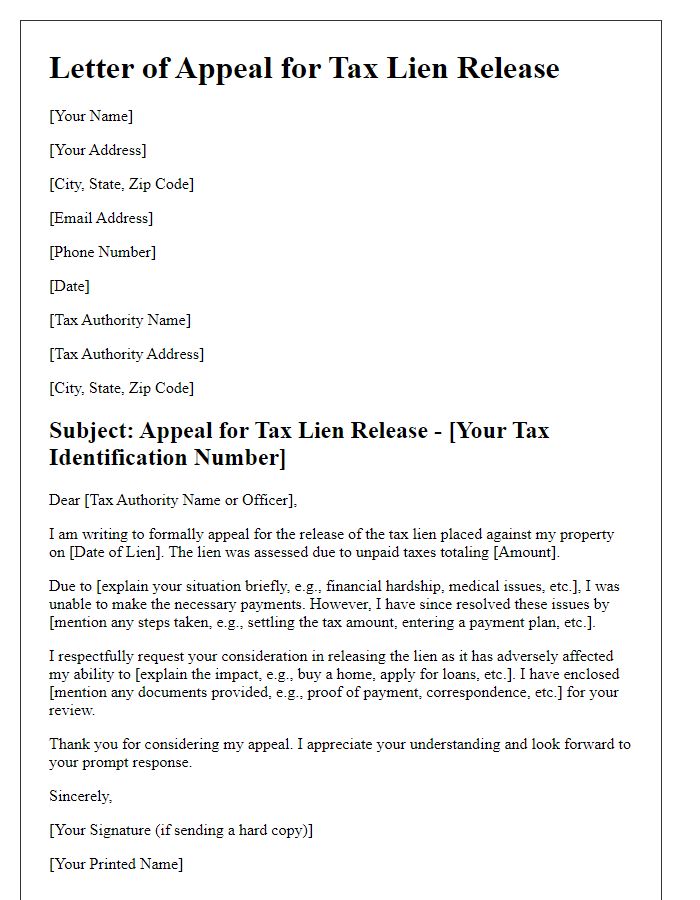

When requesting a tax lien release, it is critical to provide precise taxpayer information, including full name, Social Security Number (SSN) or Employer Identification Number (EIN), and current address. Accurate identification ensures the request is processed efficiently without unnecessary delays. Details regarding the tax lien, such as the lien reference number, the date it was filed, and the specific taxing authority (e.g., Internal Revenue Service or state department of revenue), should also be included. Properly formatting this information minimizes processing errors and enhances the likelihood of a timely tax lien release.

Clear Reference to Tax Lien Details

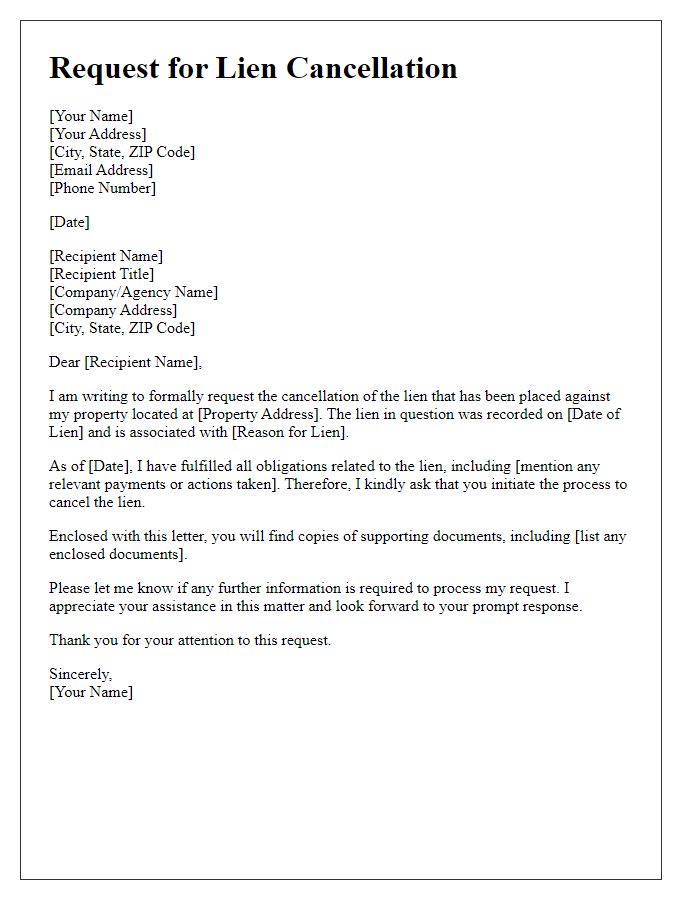

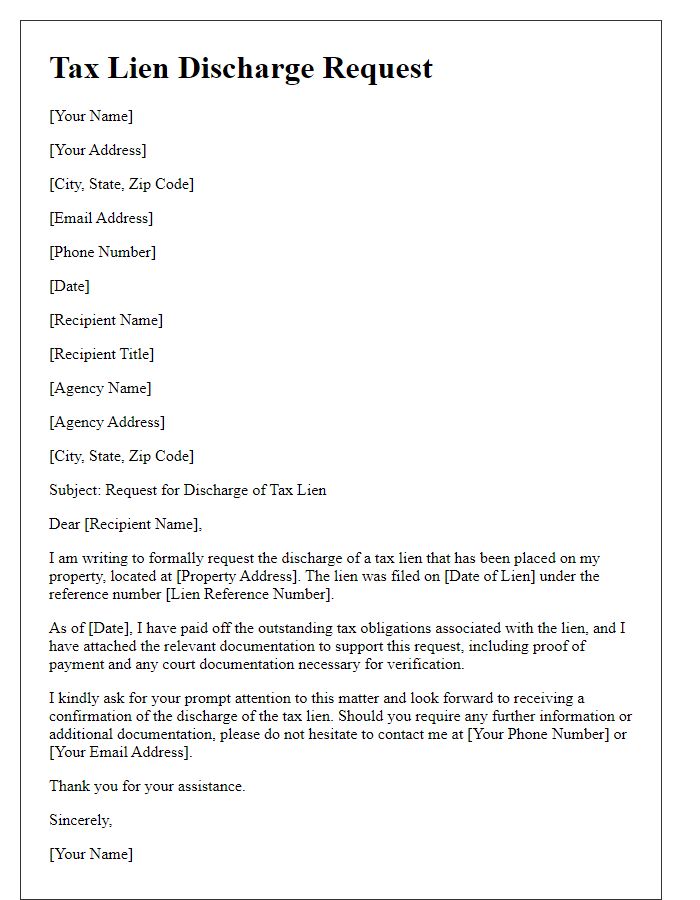

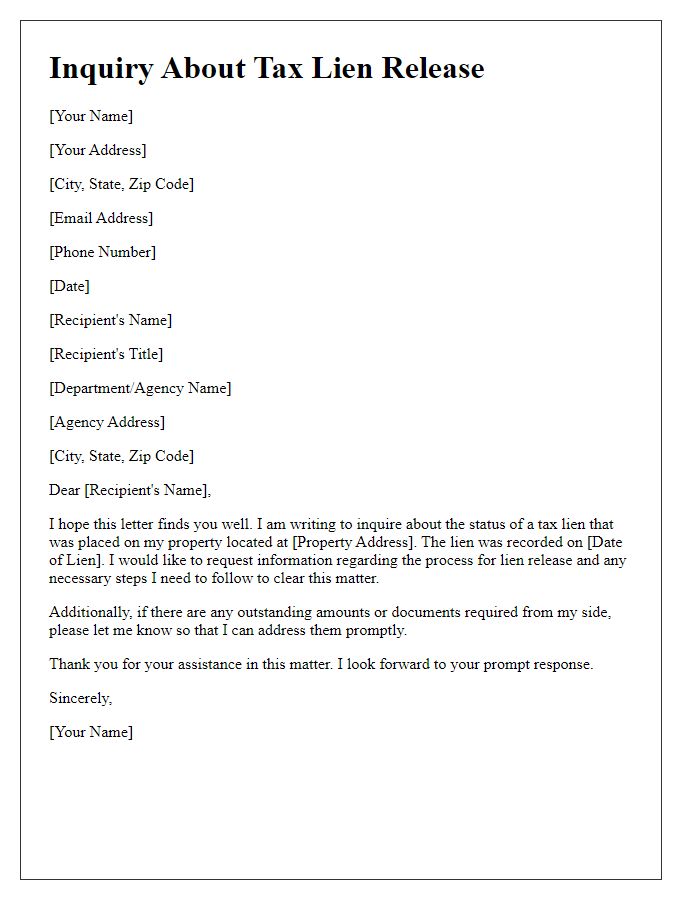

A tax lien represents a legal claim against an individual's property due to unpaid taxes owed to government entities, commonly issued by local, state, or federal authorities. Accurate identification of the tax lien is critical; details may include the lien reference number, usually a unique identifier, the date the lien was filed, and the specific jurisdiction, such as the county or state (e.g., Los Angeles County, California). The amount owed can also be significant, often including both the principal tax and accrued interest or penalties. Timely resolution of tax liens is essential to restore property rights and improve credit scores, especially considering the potential for property foreclosure and further legal complications if left unresolved. Requesting a lien release involves following procedures set by the relevant tax authority, often requiring documentation of payment or a settlement agreement.

Justification for Release Request

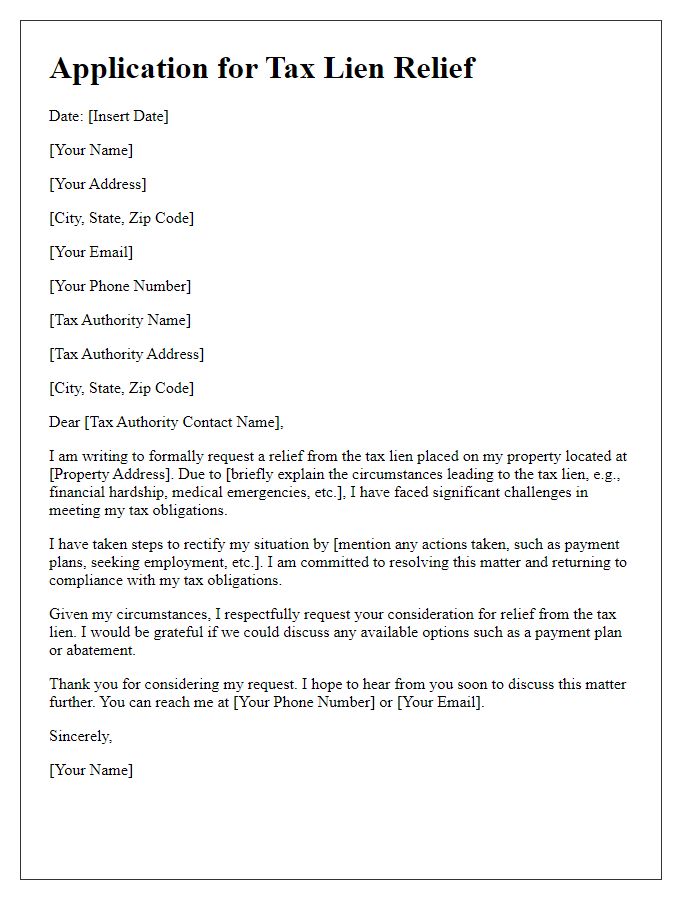

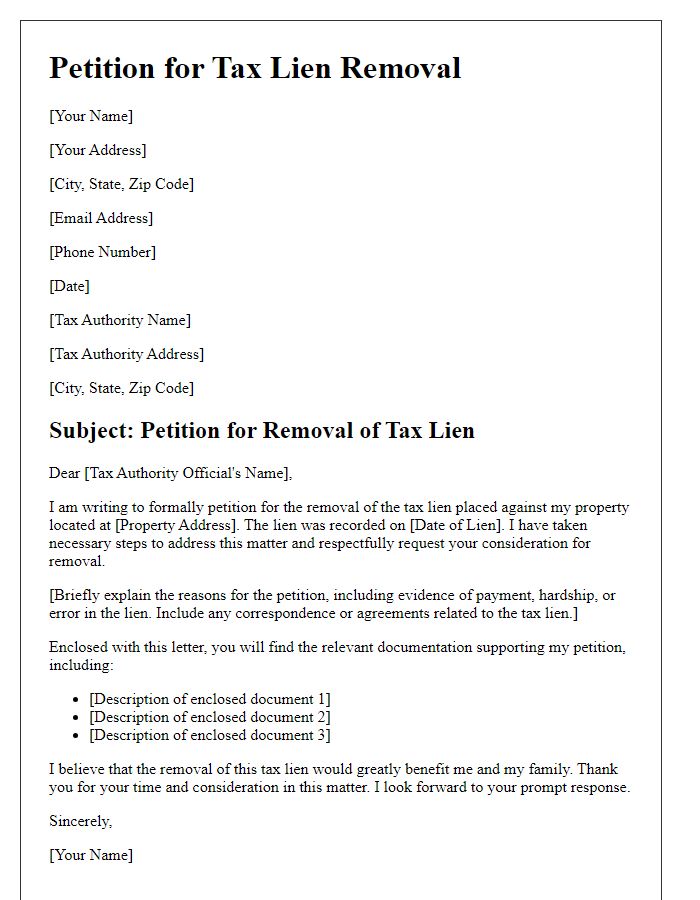

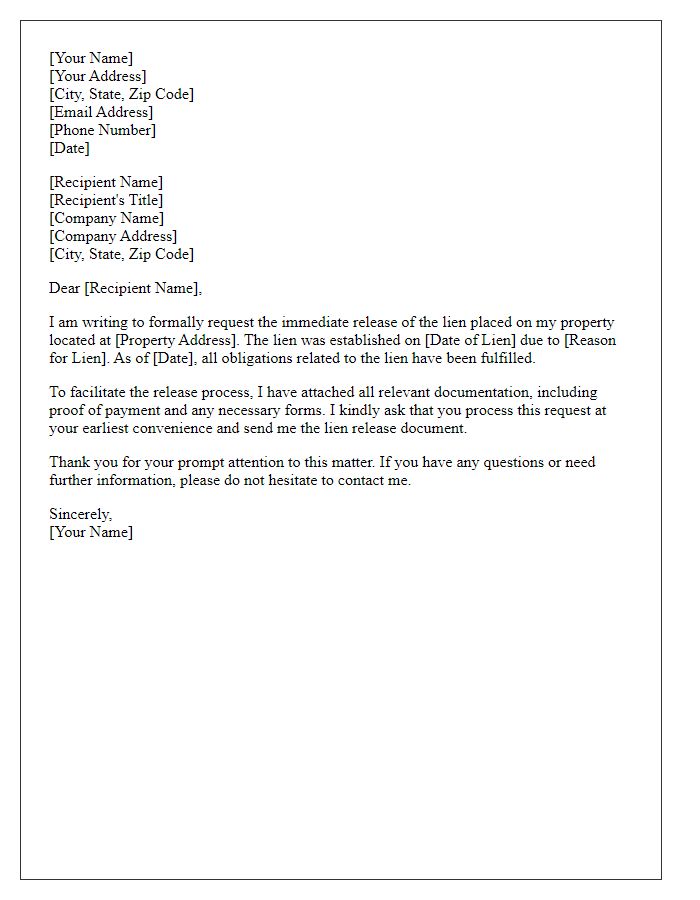

Tax lien release requests are vital for individuals seeking financial relief and improved credit status. A tax lien, such as those imposed by the Internal Revenue Service (IRS) or state revenue departments, represents a legal claim against property due to unpaid taxes. Individuals affected by these liens often face significant barriers, including restricted access to loans and diminished credit scores. For a successful release request, substantial justification must accompany the application, highlighting circumstances like timely tax payments since the lien was placed, changes in financial situations, or adherence to payment agreements. Additional support may include documentation from financial institutions or letters from tax professionals, emphasizing good faith efforts made to settle tax obligations. Fulfilling these criteria can pave the way for a favorable outcome and restore financial integrity.

Supporting Documentation

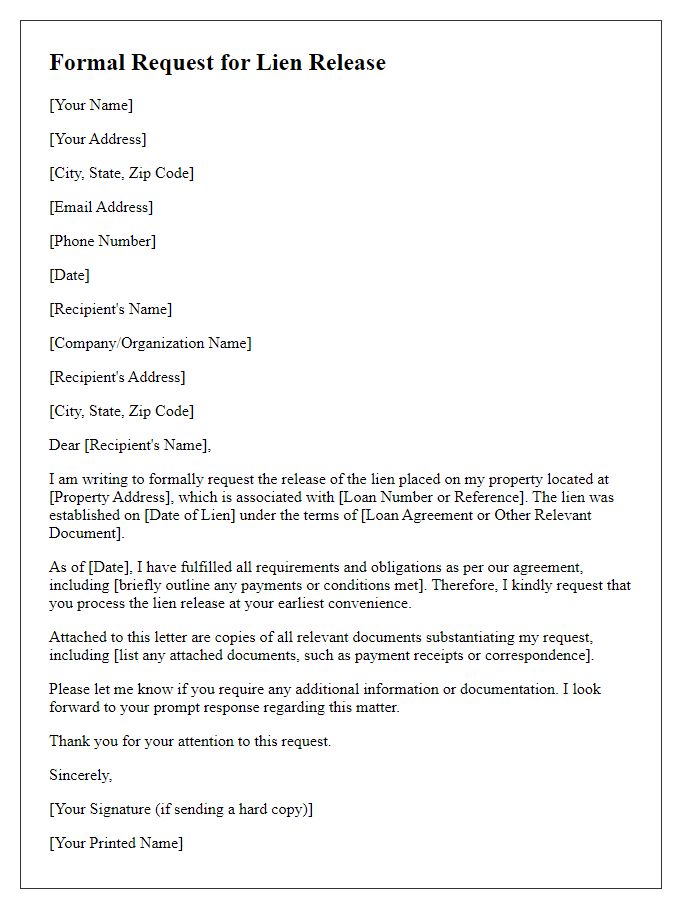

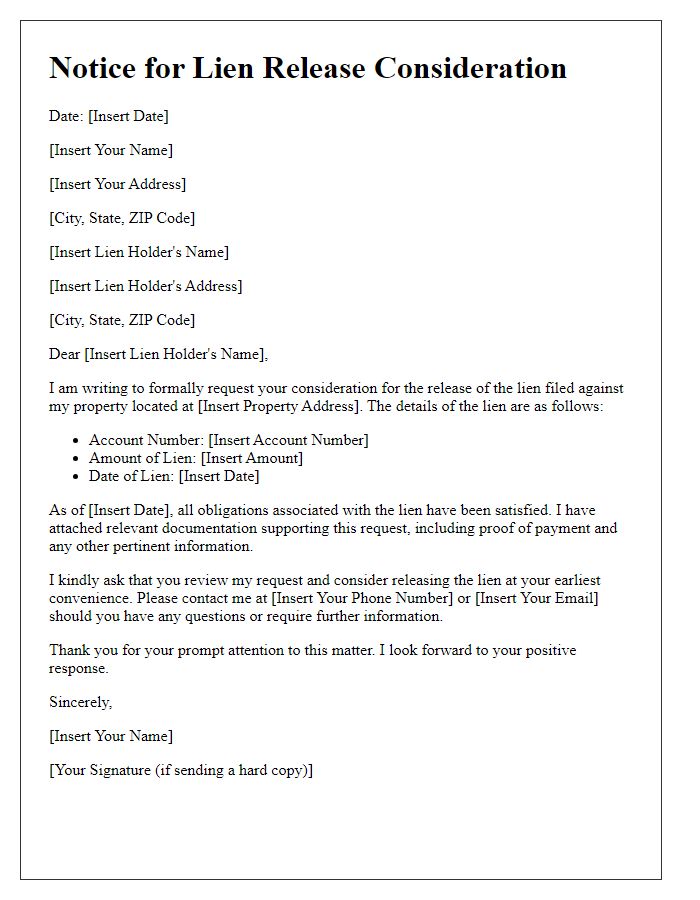

A tax lien release request requires precise supporting documentation to ensure a smooth process. Essential documents include a copy of the original notice of lien from the Internal Revenue Service (IRS) or state tax authority, which outlines the tax debt details, including identification numbers, the amount owed, and the property in question. Proof of payment, such as canceled checks, bank statements, or receipts, must be provided to demonstrate that the tax obligation has been satisfied. A completed Form 12277, Application for the Withdrawal of Filed Form 668(Y), may be necessary to formally request the release of the lien. Additionally, including identification verification documents, such as a government-issued photo ID or Social Security number, can expedite processing and confirm ownership. Finally, a written request clearly stating the reason for the lien release, including specific details about the taxpayer's account, is crucial for clarity and efficiency during review.

Contact Information for Follow-Up

A tax lien release request requires specific contact information to facilitate efficient follow-up. This includes the taxpayer's full name, ensuring accurate identification in tax records. The taxpayer's Social Security Number or Employer Identification Number (EIN) serves as crucial identifiers associated with tax liabilities. A current mailing address, preferably one where the taxpayer receives official correspondence, is essential for sending the lien release documentation. Additionally, providing a phone number offers a direct line for any follow-up inquiries or clarifications regarding the request. An email address might be included for expedited communication, given the increasing reliance on digital correspondence in official matters. These details collectively streamline the process of releasing a tax lien, ultimately easing financial burdens for the taxpayer.

Comments