When it comes to tying the knot, discussing a prenuptial agreement may not be the most romantic topic, but it's definitely one of the most important. Many couples overlook this essential step, thinking their love is enough to outweigh any financial concerns, but planning for the future is an act of love in itself. A well-thought-out prenup can protect both partners, ensuring peace of mind as you embark on this exciting journey together. Curious to know how to navigate the conversation and create a prenuptial agreement that suits both your needs? Read on for more insights!

Clarity of Terms

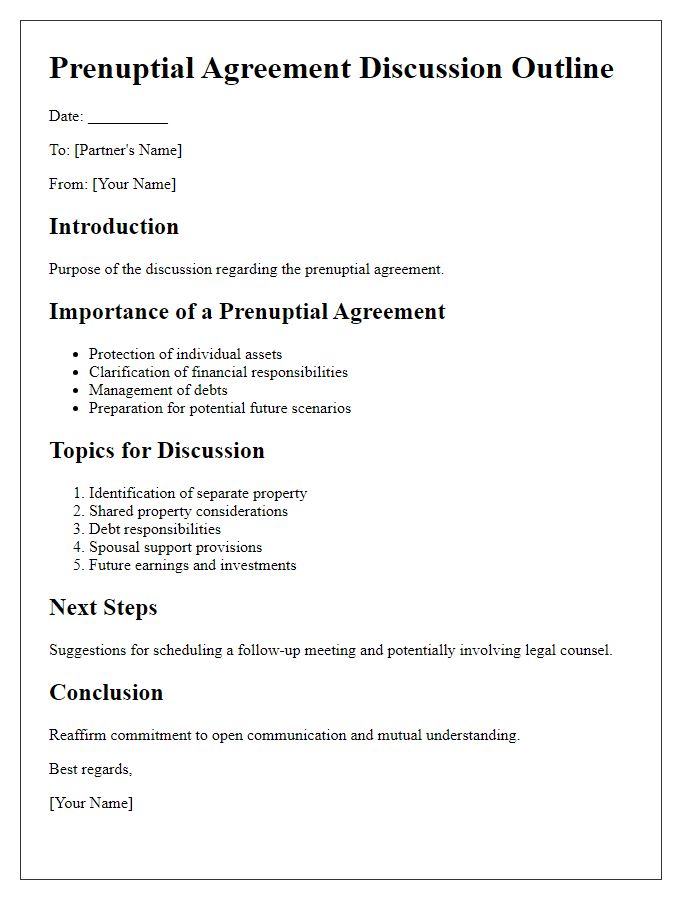

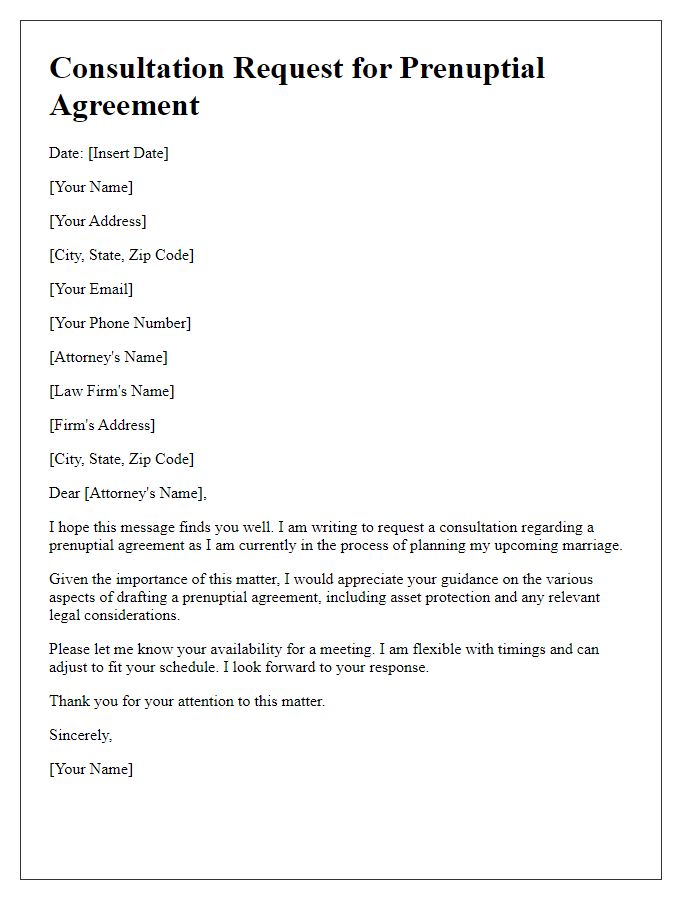

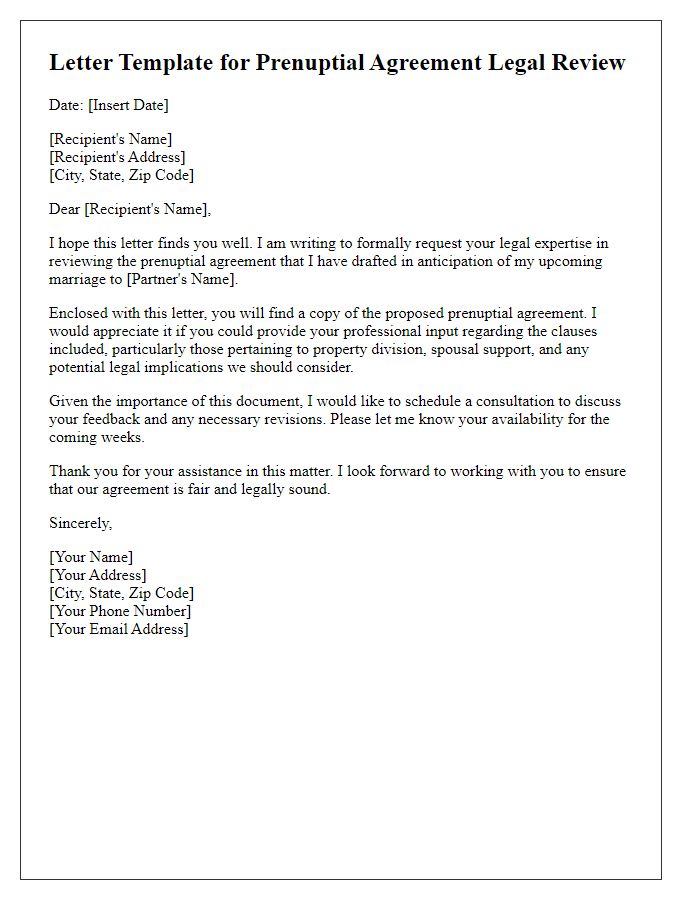

Clarity in the terms of a prenuptial agreement (often referred to as a prenup) is crucial for ensuring both parties understand their rights and responsibilities. A well-drafted prenup clearly outlines assets, debts, and other financial matters before marriage, minimizing potential disputes during a divorce. Legal terminology must be defined comprehensively; for example, "separate property" encompasses assets owned prior to marriage, while "marital property" refers to all assets acquired during the union. Clarity also extends to spousal support obligations, specifying amounts and duration contingent on factors like length of marriage and financial disparities. Furthermore, jurisdictions such as California enforce strict adherence to disclosure requirements during the negotiation phase, vital for both parties' consent and understanding. Engaging experienced family law attorneys ensures that the language is precise, reducing ambiguity and protecting individual interests.

Fair Distribution of Assets

A prenuptial agreement serves as a legal document outlining the fair distribution of assets between partners, particularly in the context of marriage. This agreement details how marital property, such as real estate valued at hundreds of thousands of dollars, investments in stocks, retirement funds exceeding six figures, and personal belongings collected over years will be divided in the event of divorce. Clarity on financial responsibilities, including debt management for mortgages or loans, is essential, and provisions can be made for future income and inheritance. Through thorough negotiation and legal guidance, both parties can ensure a mutually beneficial arrangement that protects individual interests while promoting harmony in their partnership.

Provisions for Spousal Support

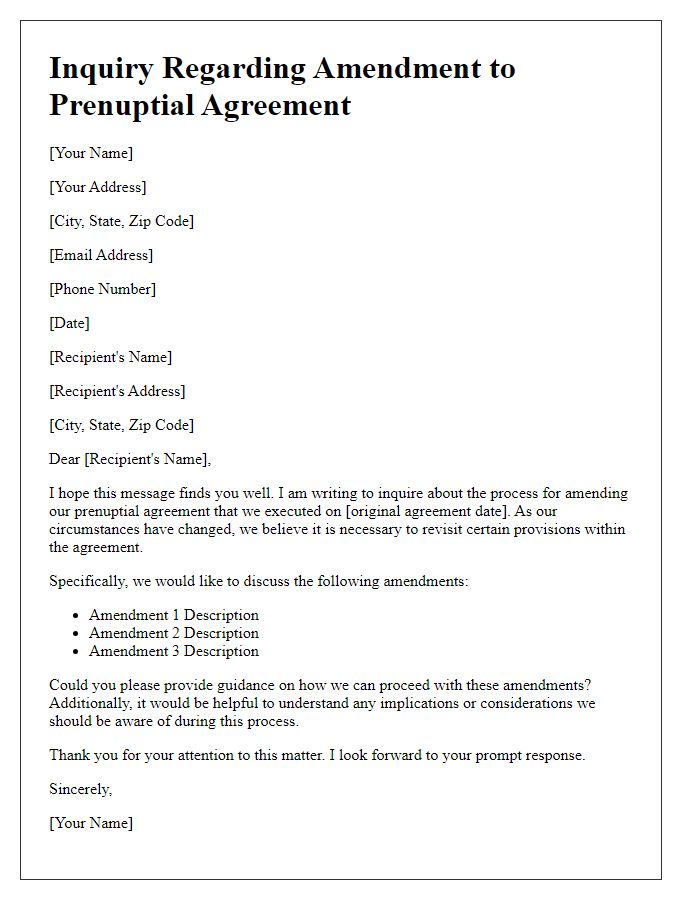

A prenuptial agreement serves as a legal document that outlines the terms related to spousal support in the event of a divorce or separation. Specific provisions should detail the duration of support, thresholds for eligibility, and the amount calculated based on factors like income disparities and duration of marriage. States like California have guidelines indicating a general formula (such as half the length of the marriage in years) to determine support duration. Additionally, any clauses regarding modifications based on changes in financial status or employment should be clearly defined. It is crucial for both parties to understand terms regarding waiving support or reaching mutual agreements to ensure enforceability and clarity after marriage. Each provision should reflect the couple's individual circumstances and intentions, reducing potential conflicts in the future.

Protection of Individual Property

Prenuptial agreements serve as essential legal instruments designed to protect individual property during marriage, particularly in jurisdictions like California. The document clearly defines ownership of assets accumulated prior to the union, such as real estate valued over $500,000 and retirement accounts exceeding $100,000. In cases of divorce, the prenuptial agreement stipulates that each party retains rights to their separate property, which includes inheritances and gifts received, minimizing disputes over marital property. The agreement is typically reviewed by legal experts to ensure compliance with state laws and enforceability, addressing potential issues such as disclosure of assets and fairness. Details about property division provide clarity and contribute to preserving financial stability, allowing both individuals to enter into the marriage with peace of mind regarding their financial interests.

Consideration of Future Changes

A prenuptial agreement serves as a crucial legal document that outlines the distribution of assets and responsibilities in the event of a divorce or separation. When considering this agreement, it's essential to evaluate potential future changes in circumstances, such as marriage duration, financial status, and familial responsibilities. Significant life events like the birth of children or career changes can greatly impact financial dynamics, necessitating adjustments in the preexisting agreement. Additionally, reviewing state laws regarding marital property, such as community property regulations in California, can influence terms and conditions. Regular reviews of the prenuptial agreement, ideally every few years or after major life events, ensure continued fairness and relevance, ultimately providing protection for both parties.

Comments