Are you navigating the often complex world of business liability insurance claims? Whether you're a seasoned business owner or just starting out, understanding how to properly structure your claim can make all the difference in ensuring you receive the compensation you deserve. This article will break down essential steps and provide a clear, easy-to-follow letter template that can streamline your claims process. So, grab a cup of coffee and let's dive in to learn how to effectively communicate your needs to your insurance provider!

Policy Information

Business liability insurance claims often revolve around key elements such as the insurance policy number, which uniquely identifies the coverage provided to a business. The effective date of the policy, typically listed as the starting point of coverage, is crucial for establishing claim eligibility. Additionally, the name of the insured business entity, along with its registered address, provides necessary identification for processing claims. Details of the specific coverage sections, such as general liability or product liability, can also influence the outcome of the claim, highlighting the importance of understanding which areas are protected under the policy. Furthermore, adding the contact information of the insurance agent can facilitate communication during the claims process. Addressing these components clearly within the claim documentation ensures that all relevant aspects of the policy are considered by the insurance provider.

Incident Description

On April 12, 2023, a significant incident occurred at ABC Retail Store, located at 45 Main Street, Springfield. A customer slipped on a wet floor near the entrance, resulting in a fall that caused a fractured ankle. The area had not been properly marked with caution signs, violating Occupational Safety and Health Administration (OSHA) safety standards. Emergency medical services were called, and the customer was transported to Springfield General Hospital for treatment. The incident report was filed with local authorities, detailing the lack of adequate safety precautions such as non-slip mats or warning indicators. Additionally, eyewitness testimonies corroborated the conditions leading to the accident, emphasizing the potential negligence in maintaining a safe shopping environment. This claim seeks to address the medical expenses incurred and potential damages for pain and suffering.

Damage and Loss Details

Business liability insurance claims often arise from incidents involving property damage or bodily injury occurring in a commercial environment. In these claims, it's essential to detail the extent of damage, including the estimated monetary loss attributed to the incident. For example, if a water leak leads to damage in office equipment, documenting the cost to repair or replace items such as laptops, printers, and furniture is crucial. Additionally, if the incident disrupts business operations, lost revenue figures should be included, detailing how many days were affected and any client contracts impacted. Precise dates of the incident, location of the business (e.g., Main Street, Springfield), and photographic evidence are vital in establishing a comprehensive account of the loss and supporting the claim.

Supporting Documentation

Business liability insurance claims require specific supporting documentation to validate incidents and demonstrate loss or damages. Essential documents include the insurance policy number (such as a commercial general liability policy) and a detailed incident report that outlines the circumstances of the event, including dates, times, and locations (such as businesses in downtown Seattle). Additional evidence like photographs of the damage, witness statements, invoices for repair costs, and any medical records related to injuries must be collected. Correspondence with involved parties, such as customers or contractors (e.g., a failed contracting job), and receipts for any related expenses bolster the claim. Ensuring the claim is accompanied by comprehensive documentation facilitates a smoother review process with the insurance company and increases the likelihood of a successful resolution.

Contact Information

Business liability insurance claims require detailed contact information for accurate processing. Essential details include the policyholder's name (for example, Smith Enterprises LLC), the business address (such as 1234 Main Street, Anytown, USA), and phone number (e.g., (555) 123-4567). Additionally, include the policy number (e.g., POL123456789) for reference. Email addresses (for example, claims@smithenterprises.com) provide a digital means for further communication. Accurate contact information ensures swift handling of the claim, potentially expediting the resolution process and facilitating any needed follow-ups.

Letter Template For Business Liability Insurance Claim Samples

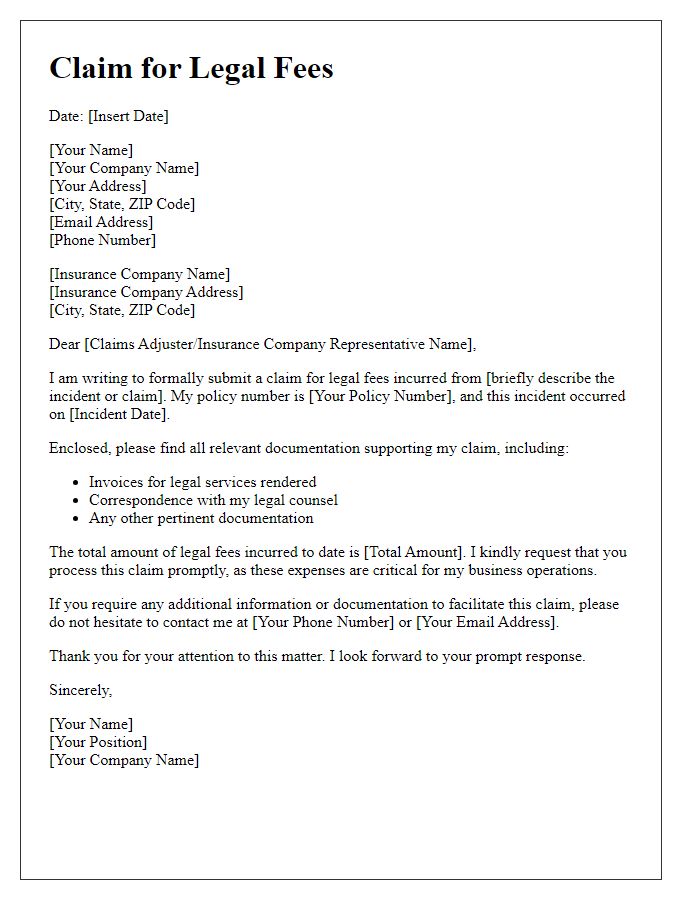

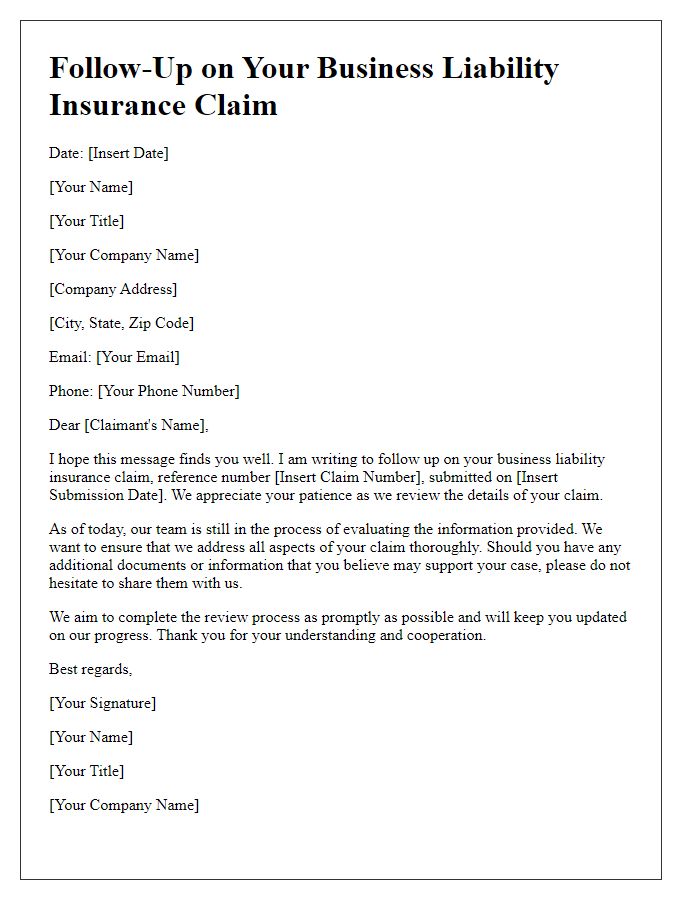

Letter template of business liability insurance claim for property damage.

Letter template of business liability insurance claim for bodily injury.

Letter template of business liability insurance claim due to negligence.

Letter template of business liability insurance claim for product liability.

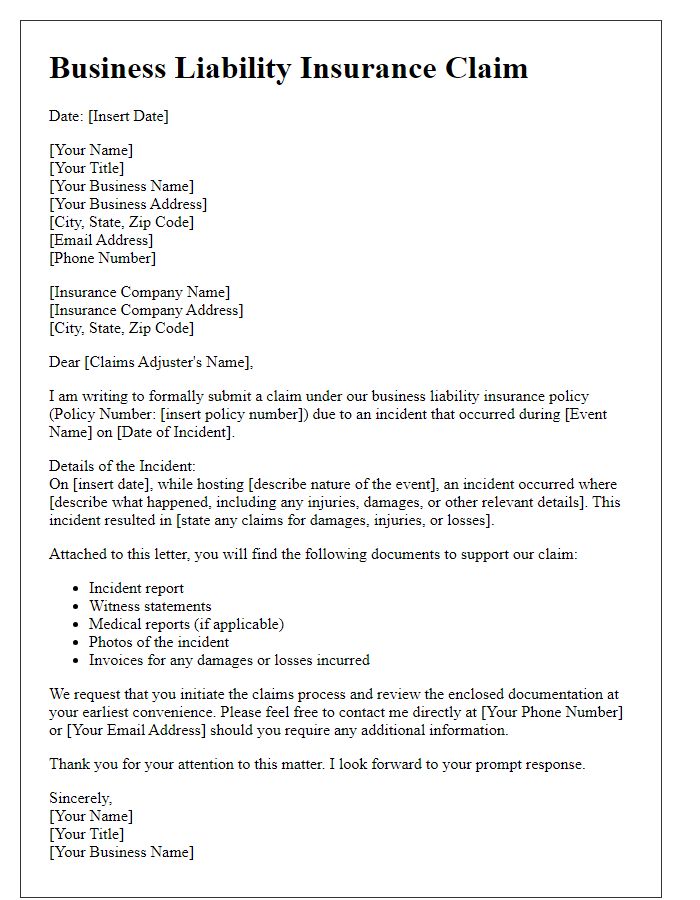

Letter template of business liability insurance claim for event-related incidents.

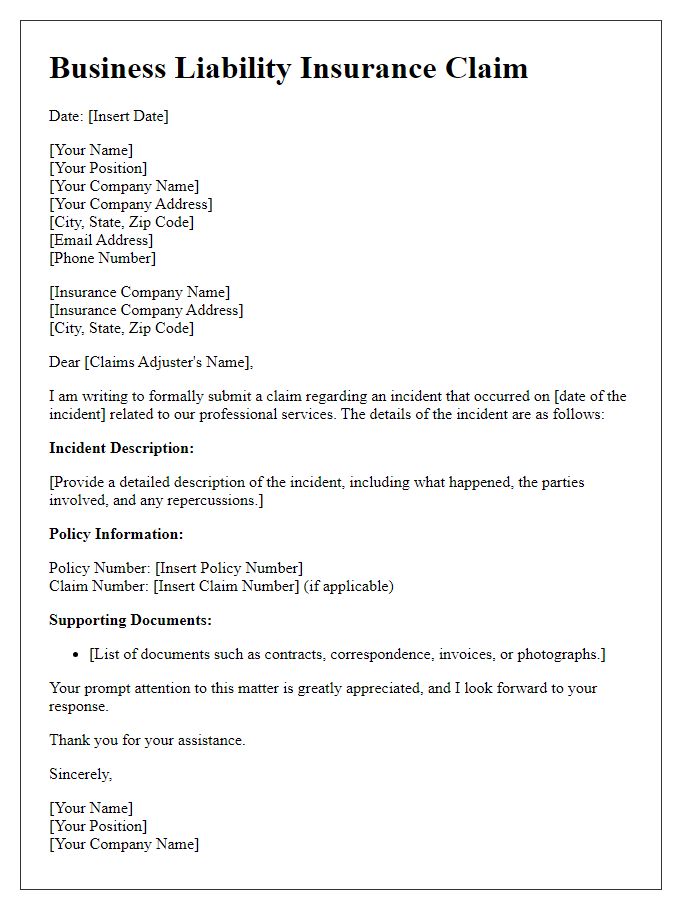

Letter template of business liability insurance claim for professional services.

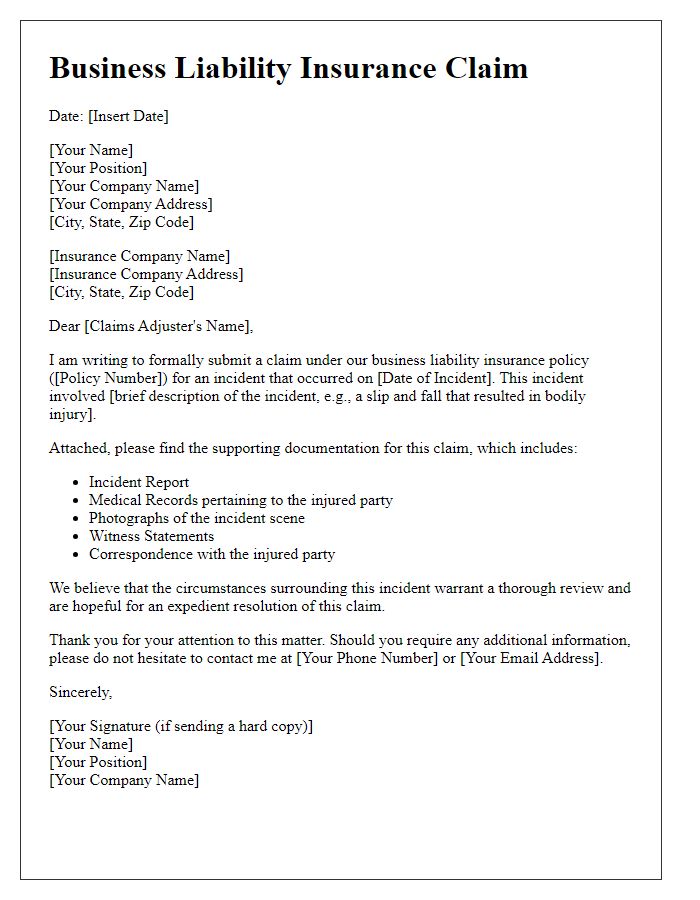

Letter template of business liability insurance claim with supporting documentation.

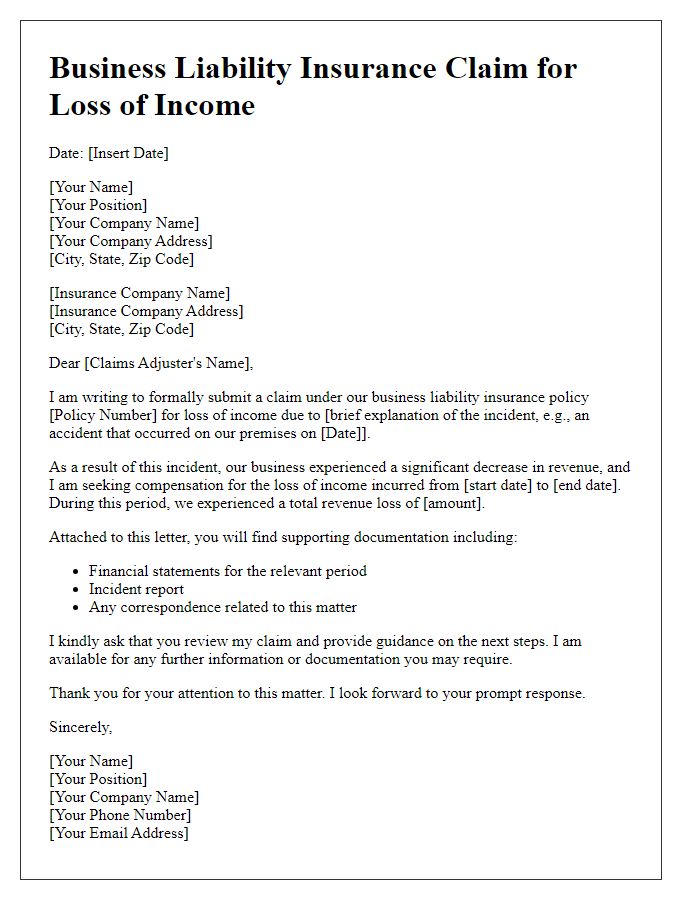

Letter template of business liability insurance claim for loss of income.

Comments