Are you feeling overwhelmed with your current mortgage payments? You're not alone, and that's why many homeowners are turning to mortgage loan modification as a viable solution. This process can potentially ease your financial burden, making it easier to manage your home while still maintaining a stable living situation. If you're curious about how to get started and what steps to take, read on for a detailed guide on crafting an effective mortgage loan modification request!

Borrower's Financial Hardship Explanation

Financial hardships often arise unexpectedly, affecting borrowers' ability to meet mortgage obligations. Circumstances such as job loss, medical emergencies, and urgent home repairs can create significant financial strain. For instance, a sudden layoff from a job in the manufacturing sector, leading to a 40% decrease in monthly income, can force individuals to choose between essential expenses like food and housing. Additionally, rising medical bills related to health issues can compound this problem, causing further financial instability. In this scenario, borrowers may experience the risk of foreclosure if financial relief options, such as a mortgage loan modification, are not considered. Addressing these challenges with lenders is crucial for maintaining homeownership and ensuring financial recovery.

Current Mortgage Details

Current mortgage details include principal amount of $250,000, with an interest rate of 4.5%, secured for a 30-year term beginning on March 1, 2015. Monthly payments total approximately $1,266, excluding property taxes and insurance. The property located in Los Angeles, California (zip code 90001) was purchased for $275,000. Due to recent financial hardships, including a job loss and unexpected medical expenses, there is a need for a loan modification to adjust the monthly repayment amount to a more manageable level. Current market conditions indicate a significant drop in property values, further stressing the need for this request.

Requested Loan Modification Terms

A loan modification request seeks to adjust mortgage terms to accommodate borrowers' financial situations, typically involving changes to interest rates, loan duration, or monthly payments. Potential new terms may include reducing the interest rate from 5% to 3% for a fixed period or extending the loan term from 30 years to 40 years, aimed at lowering monthly payments. Borrowers facing financial hardships, like unemployment or medical expenses, often submit such requests to their lenders, enabling the restoration of financial stability and continued homeownership. Documentation, such as income verification and a detailed hardship letter, may be required to support the request effectively, ensuring a comprehensive evaluation by the lending institution.

Supporting Financial Documentation

A mortgage loan modification request typically necessitates the submission of supporting financial documentation to demonstrate eligibility for changes in loan terms. Key documents include recent pay stubs (often from the last 30 days) verifying income levels, tax returns (for the past two years) reflecting overall financial health, bank statements (usually for the last two to three months) showing cash flow, and a detailed personal budget outlining monthly expenses. Additional information might involve a hardship letter explaining the reasons behind the financial difficulties, along with any relevant documentation such as medical bills or job loss notices. This comprehensive financial overview helps lenders assess the borrower's situation effectively, determining the feasibility of modifying the mortgage terms to provide relief.

Contact Information and Next Steps

A mortgage loan modification request typically involves a detailed process indicating the borrower's financial situation, the specific modification desired, and associated documentation. Key elements in this context include the borrower's contact information, such as full name, phone number, email address, and home address. Additional details about the specific loan, including the mortgage account number, lender's name (for instance, Wells Fargo), and loan type (like fixed-rate or adjustable-rate) are essential. The borrower should also highlight the reason for the modification request, such as a job loss or medical emergency. Next steps generally involve submitting required documentation (like recent pay stubs or tax returns) to the lender, waiting for a notification, and understanding potential options available based on the lender's evaluation. This meticulous approach ensures that the request is comprehensive and addresses necessary factors for mortgage modification assessment.

Letter Template For Mortgage Loan Modification Request Samples

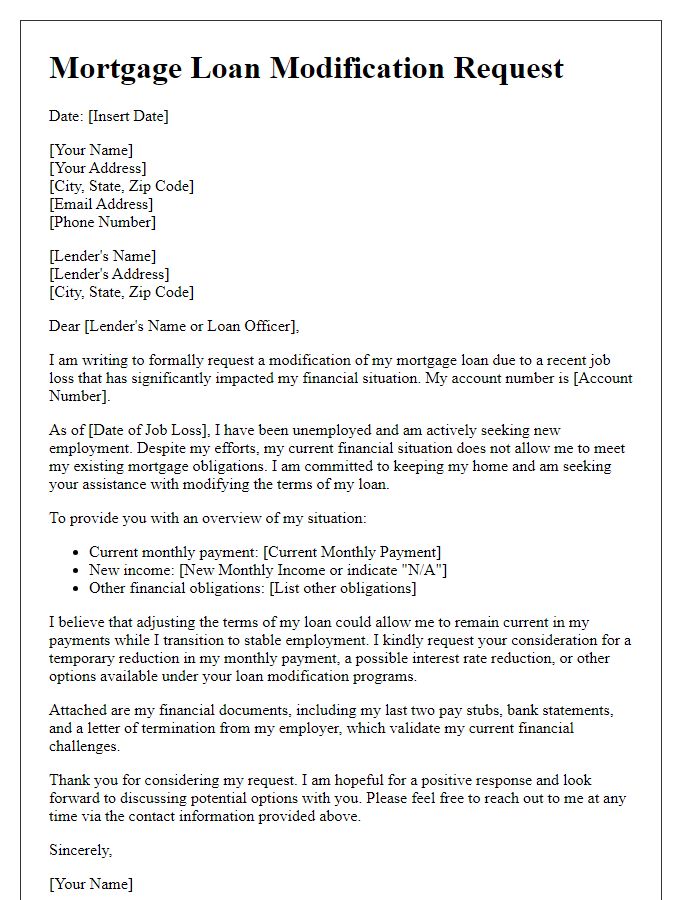

Letter template of mortgage loan modification request due to financial hardship.

Letter template of mortgage loan modification request for reduced monthly payments.

Letter template of mortgage loan modification request for interest rate reduction.

Letter template of mortgage loan modification request for medical expenses.

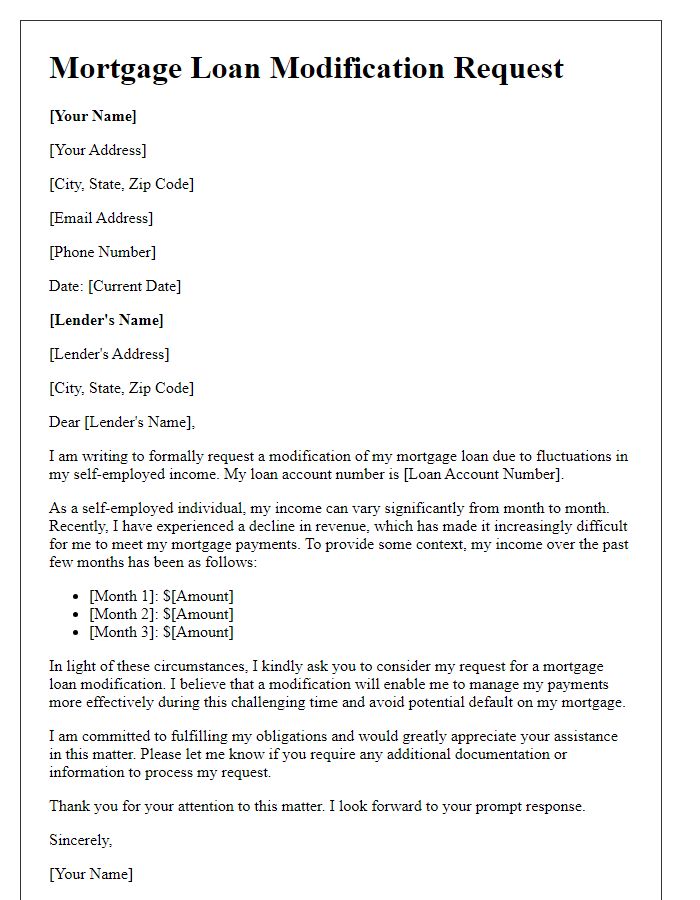

Letter template of mortgage loan modification request for temporary income reduction.

Letter template of mortgage loan modification request for a divorce situation.

Letter template of mortgage loan modification request for fixed-rate conversion.

Letter template of mortgage loan modification request for second mortgage assistance.

Comments