When it comes to managing your financial affairs, having a solid power of attorney is essential. Whether you're making changes to your current arrangement or establishing a new one, it's important to ensure that your decisions reflect your current wishes and circumstances. This update can provide clarity and protection for your assets while giving confidence to the person you trust to act on your behalf. Let's dive deeper into the specifics of crafting an effective financial power of attorney updateâread on for valuable insights!

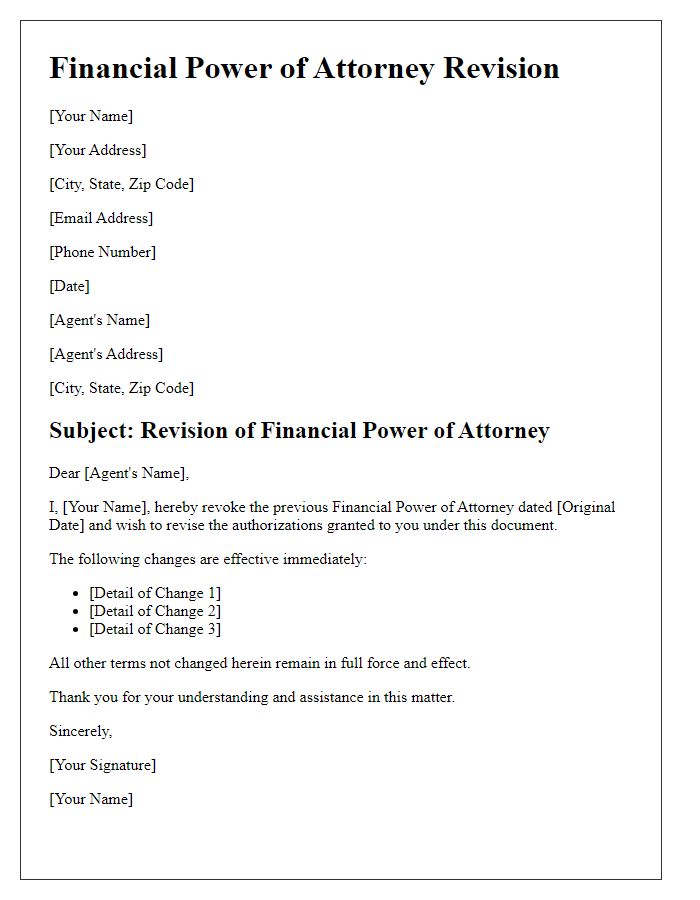

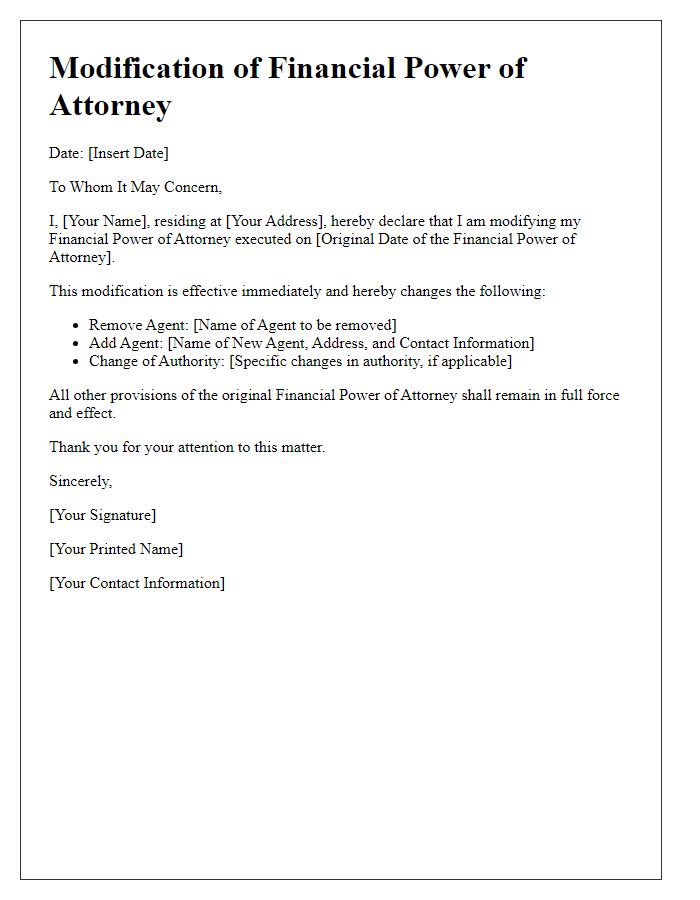

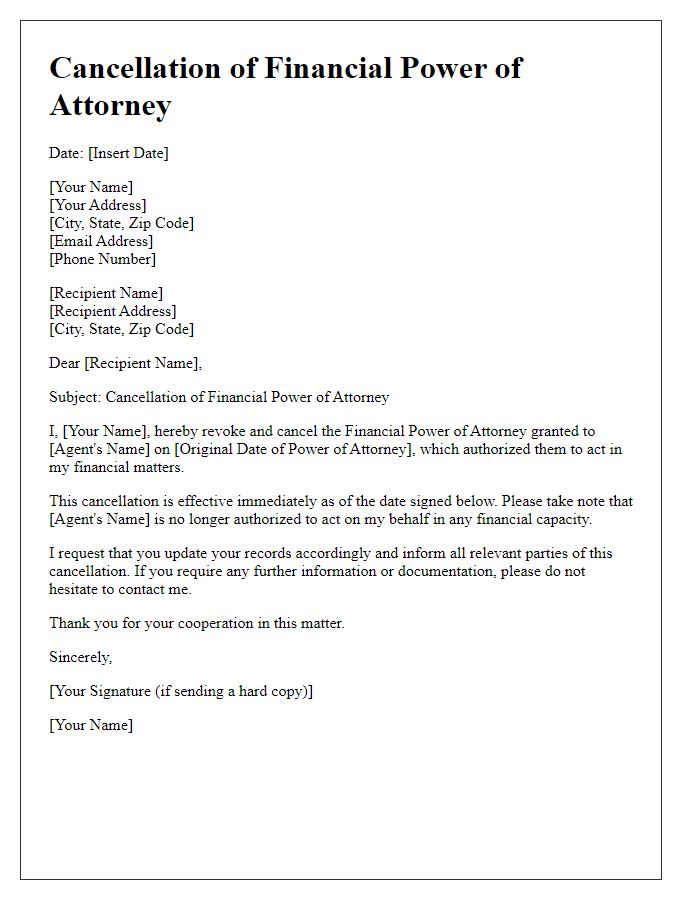

Header Information and Date

A financial power of attorney document update requires accurate header information and a specified date to ensure legal validity. The header typically includes the principal's full name, address (including city, state, and zip code), and contact number, ensuring identification. Next, the agent's (attorney-in-fact) full name, address, and contact number must also be listed for accountability. The date of the update is crucial, formatted as Month Day, Year, to clearly indicate when the changes are effective. This information establishes context and clarity for all parties involved, affirming the legitimacy of the financial decisions undertaken on behalf of the principal.

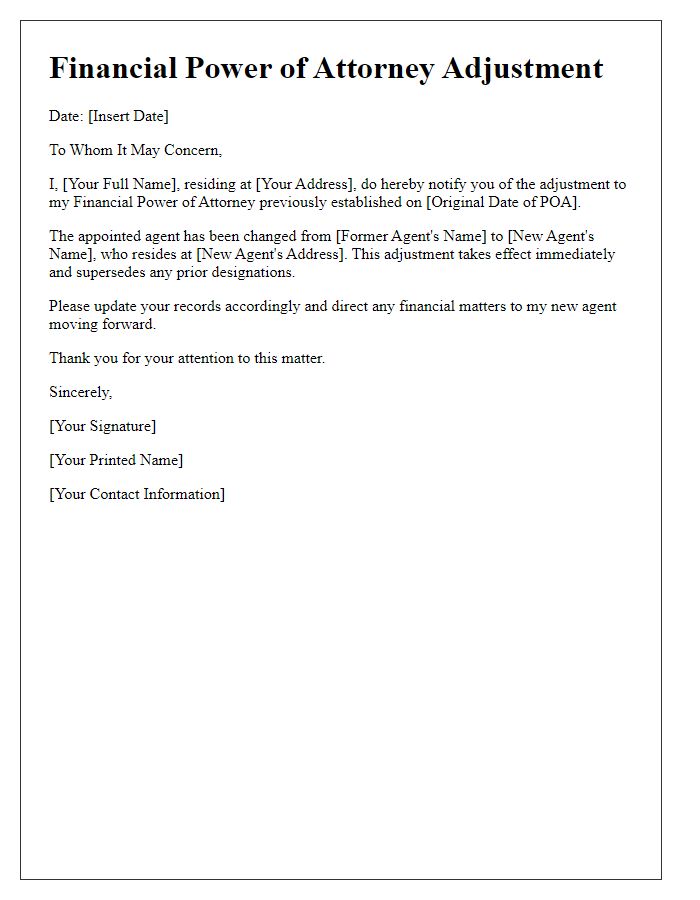

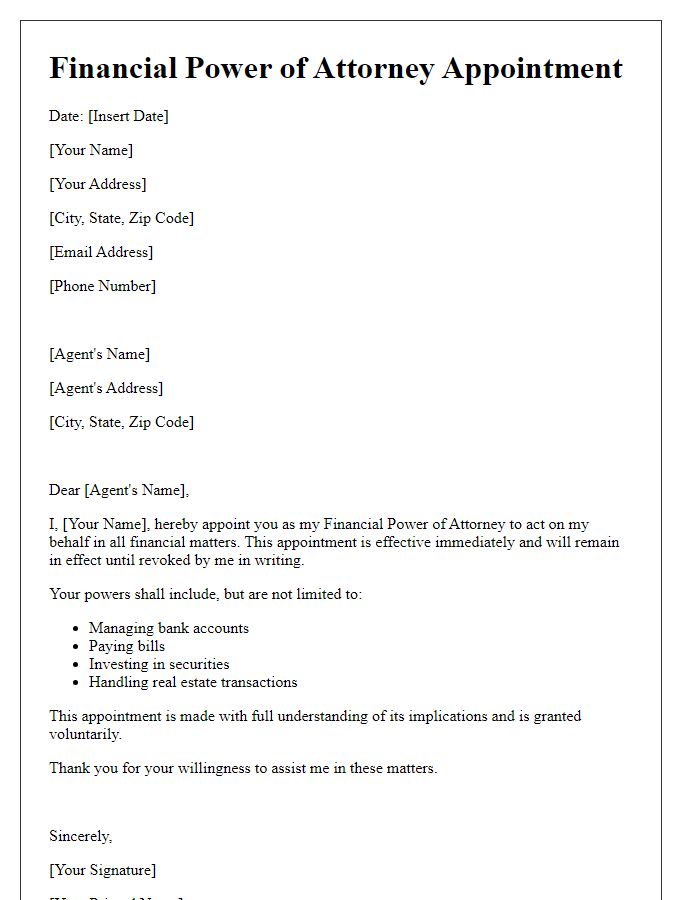

Principal's and Agent's Full Names and Contact Details

A financial power of attorney is a legal document that grants an agent (also known as an attorney-in-fact) the authority to make financial decisions on behalf of the principal (the person granting the power). The principal's full name, which includes their first, middle, and last names, along with their contact details (address, phone number, and email) should be clearly stated at the beginning of the document to establish identity. Correspondingly, the agent's full name, similarly encompassing first, middle, and last names, should also be included with their contact information to ensure clarity in identifying the appointed individual who will manage financial affairs, such as banking transactions, property management, and investment decisions. Both sets of details are crucial for legal identification and facilitate smooth communication during the agent's execution of their responsibilities.

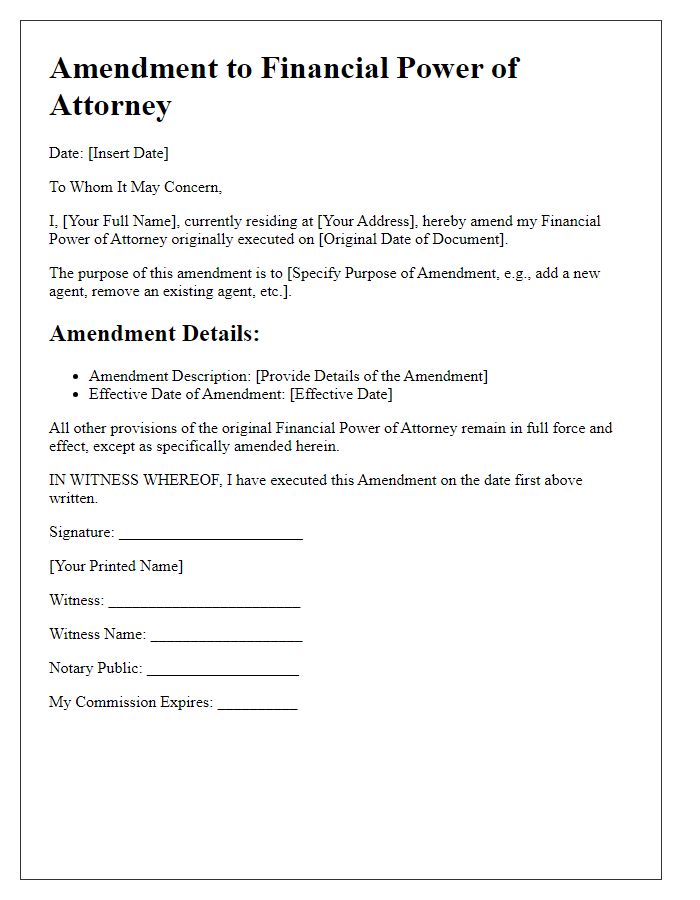

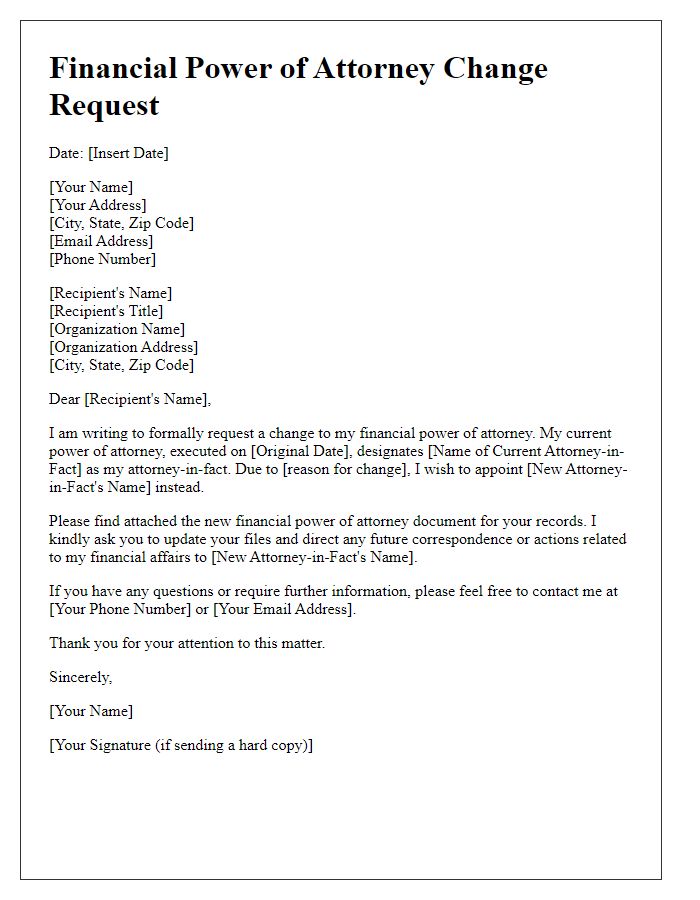

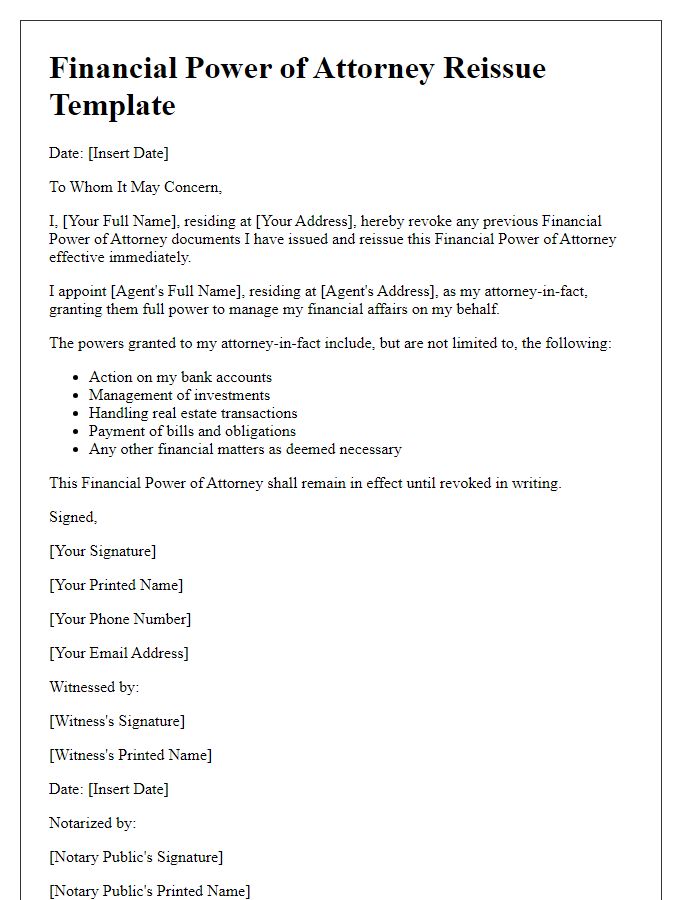

Specific Powers and Authorizations Granted

A financial power of attorney (POA) update involves specific powers and authorizations granted to the designated agent. Commonly assigned financial responsibilities include the management of bank accounts (checking, savings, investment accounts), real estate transactions (buying, selling, leasing property), tax matters (filing returns, making payments), and business operations (managing business accounts, signing contracts). This update may authorize access to safe deposit boxes and allow for decisions related to retirement accounts (401(k), IRA). Important limitations or instructions might clarify the extent of the agent's authority, ensuring that specific actions require prior approval from the principal. Clear identification of the agent (full name, address, relationship) is crucial for legal compliance. The effective date of the POA update should also be clearly stated, alongside any revocation of prior powers of attorney.

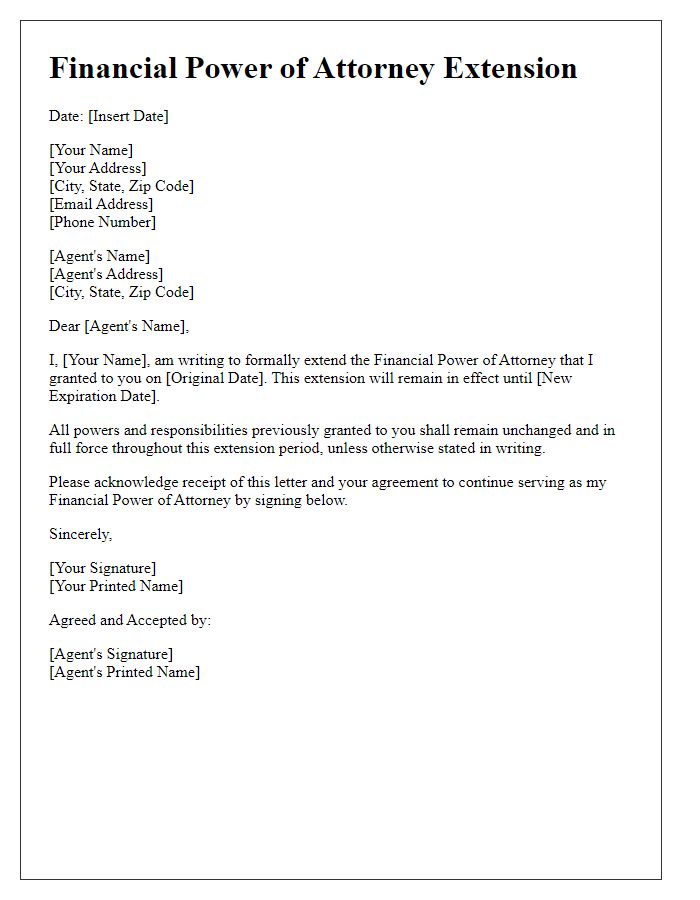

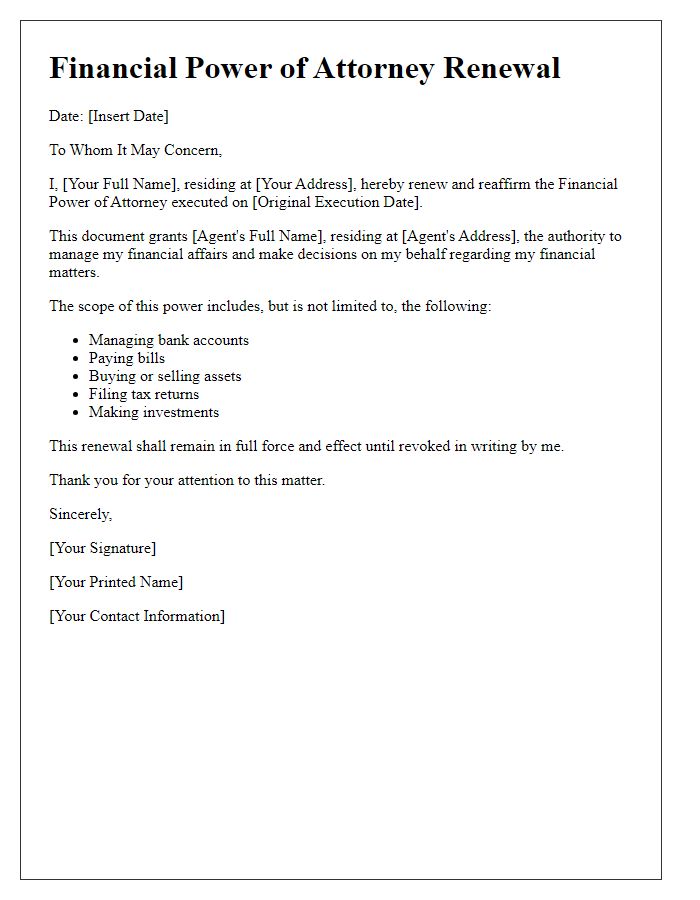

Duration and Expiration Terms

A financial power of attorney empowers a designated individual to act on behalf of another person regarding financial matters. By specifying duration and expiration terms, clear boundaries of authority are established. For instance, a financial power of attorney may remain effective for an initial period of one year, beginning on March 1, 2023, and expiring on February 28, 2024. Alternatively, the document could be structured to be durable, remaining in effect indefinitely unless revoked or until the principal becomes incapacitated. It's critical for the principal to communicate any expiration terms clearly, to ensure continuity of financial management during times of need, especially in situations like medical emergencies or long-term travel. Having specific terms can also prevent potential disputes with financial institutions or family members regarding authority limits and duration of the agent's powers.

Signature and Notarization Requirements

Financial power of attorney documents must adhere to specific signature and notarization requirements to ensure validity and protect the interests of all parties involved. Each U.S. state has unique legal stipulations regarding the execution of these legal instruments, commonly necessitating the principal's signature in the presence of a notary public. Some states further require witnesses, often two, who may need to affirm the principal's capacity to grant authority, which can vary based on jurisdiction. Notarization involves verification of identity and voluntary execution, creating a legally binding document that grants an agent the power to manage financial affairs, such as real estate transactions or bank account management, on behalf of the principal.

Comments