Thinking about your retirement plan can feel a bit overwhelming, especially when it comes to naming or changing your beneficiaries. It's a crucial step that ensures your hard-earned savings are directed to the people you care about most when the time comes. A well-structured letter can help simplify this process, ensuring everything is documented properly and communicated clearly. Ready to take control of your retirement plans? Let's dive deeper into how to create the perfect beneficiary change letter!

Beneficiary's Full Legal Name

To ensure a successful retirement plan beneficiary change, consider including the full legal name of the beneficiary, which should be precisely as it appears on their legal documents. This detail prevents any potential legal issues during the distribution phase. It's essential to also provide the relationship of the beneficiary to the plan holder, such as spouse, child, or sibling, to clarify the connection and establish priority according to beneficiary designation regulations. Additionally, include the Social Security Number (SSN) and date of birth of the beneficiary, as these identifiers can help to further confirm their identity and eligibility in the retirement plan documents. The address of the beneficiary, including city and state, is also critical for communication and distribution purposes. This comprehensive information facilitates a smooth transition during the retirement process and ensures that the plan holder's wishes are accurately reflected and executed.

Social Security Number or Identification Number

Retirement plans often require beneficiaries to be updated to reflect current wishes. When changing a beneficiary, important details must be included such as the Social Security Number (SSN) or Identification Number of the new beneficiary, ensuring proper identification. The change must be documented accurately to prevent potential complications in the future, especially regarding the distribution of assets. Furthermore, beneficiaries can include spouses, children, or other relatives, each requiring their specific identifiers and potentially, verification of eligibility. Such changes may impact tax considerations and estate planning, highlighting the importance of clear communication and legal guidance during this process.

Relationship to the Account Holder

When updating a retirement plan beneficiary, it is essential to clearly state the relationship to the account holder in order to ensure proper documentation and compliance with legal requirements. For instance, an account holder may choose to designate a spouse, child, or sibling as the primary beneficiary, which may influence tax implications and estate planning considerations. Understanding specific designations like "spouse" (legally married partner), "child" (biological or legally adopted), or "sibling" (brother or sister) is crucial for clarity. Retirement plans, such as 401(k) or IRA, often require this information to redirect funds according to the account holder's wishes upon their passing. Accurate and precise language in the documentation is vital to avoid potential disputes or misinterpretations regarding asset distribution.

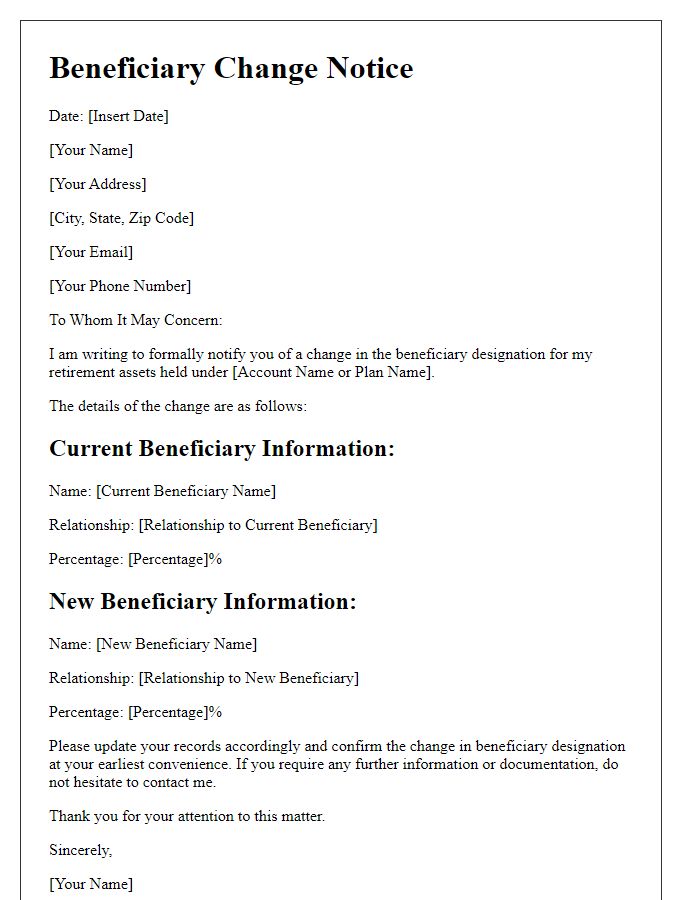

Percentage of Benefit Designation

Changing the beneficiary designation for a retirement plan involves notifying the plan administrator about the new percentages allocated to each beneficiary. For instance, one may specify that 50% of the benefits from a 401(k) retirement account go to the spouse, while the remaining 50% is allocated to a child. It's essential to ensure that the designated percentages add up to 100%. Clear communication is critical; including the account number, names, and addresses of the beneficiaries may streamline the process. Additionally, following the administrator's guidelines ensures compliance with federal regulations, particularly from the Employee Retirement Income Security Act (ERISA). Regularly reviewing and updating beneficiary designations ensures that the retirement benefits reflect current personal circumstances.

Contact Information of the Beneficiary

To facilitate an effective retirement plan beneficiary change, accurate contact information of the designated beneficiary is essential. This includes the beneficiary's full legal name, which should match official identification documents. Additionally, provide the beneficiary's current residential address, including the city, state, and ZIP code for precise identification. Phone numbers and email addresses are crucial for any future communication regarding the retirement plan. Ensure that the provided details are up-to-date to avoid complications during the claims process. This step ensures that the retirement benefits can be seamlessly transferred upon the account holder's passing.

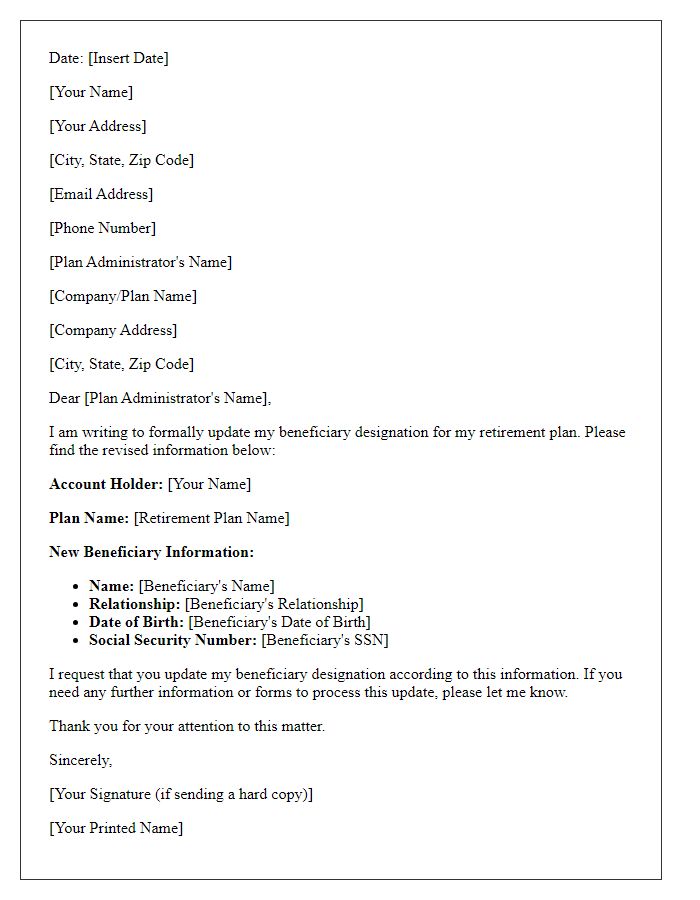

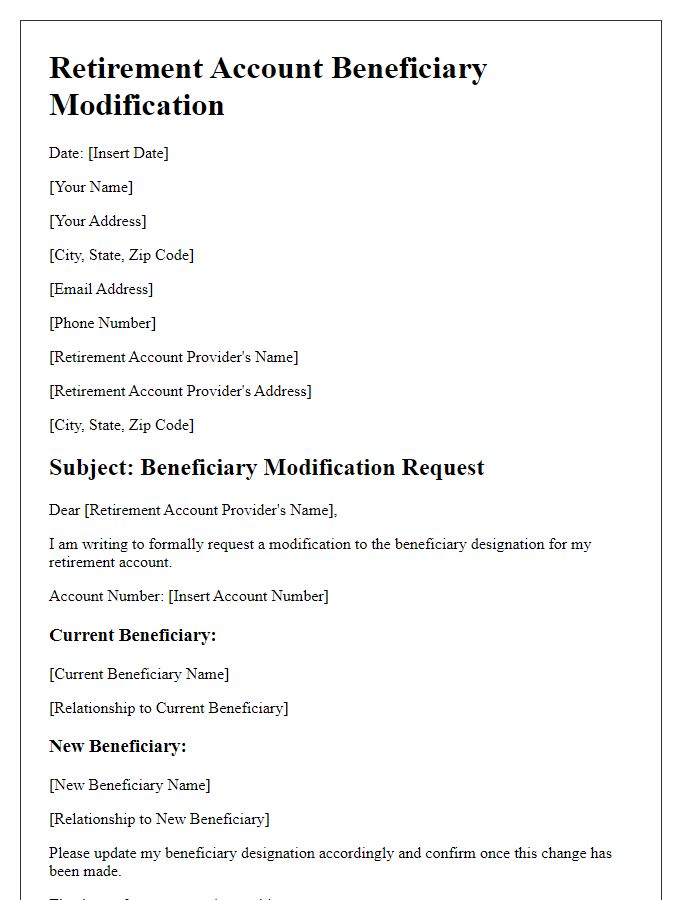

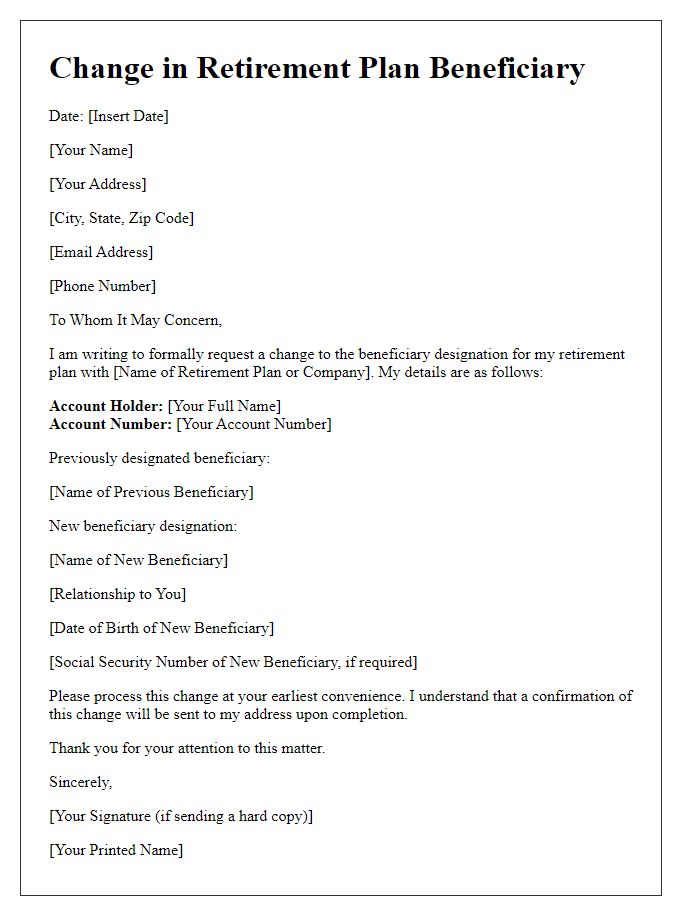

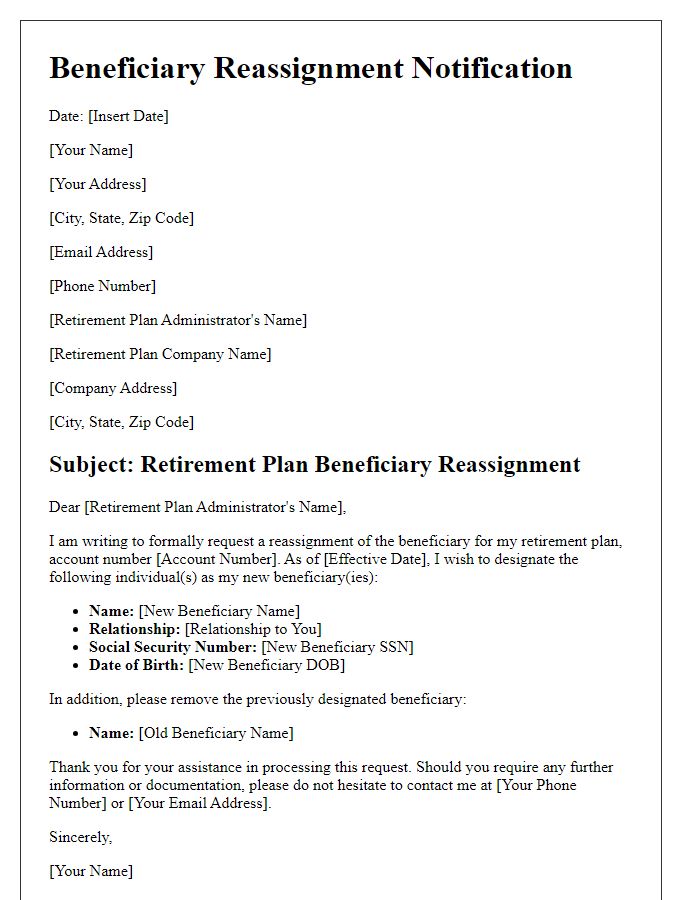

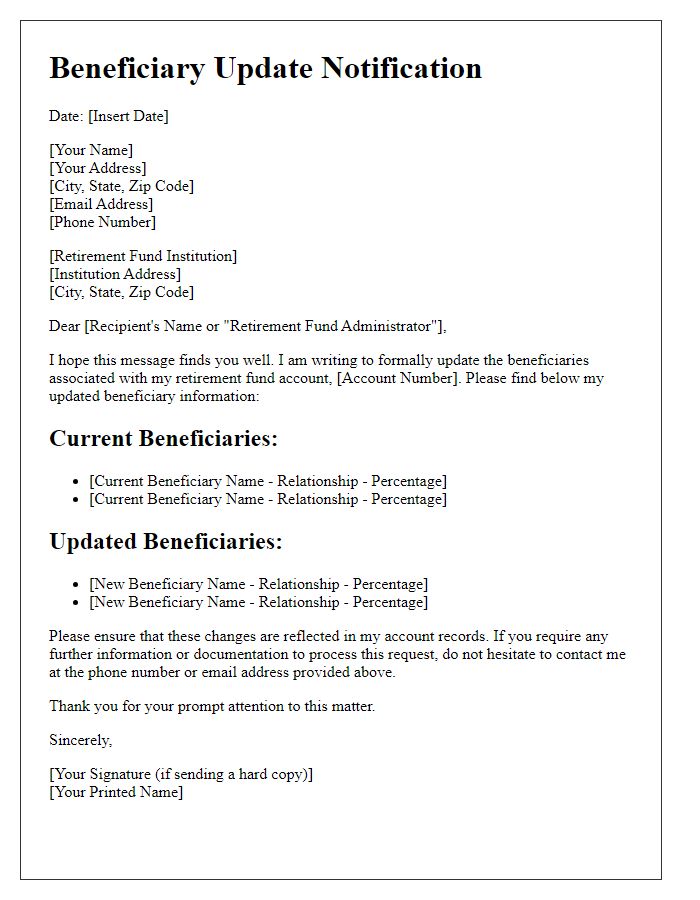

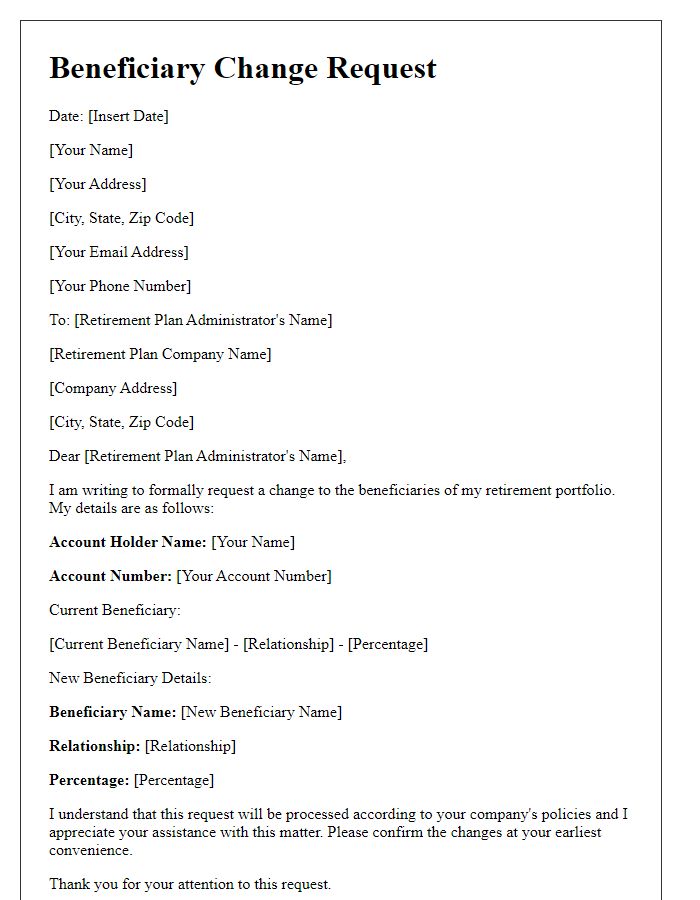

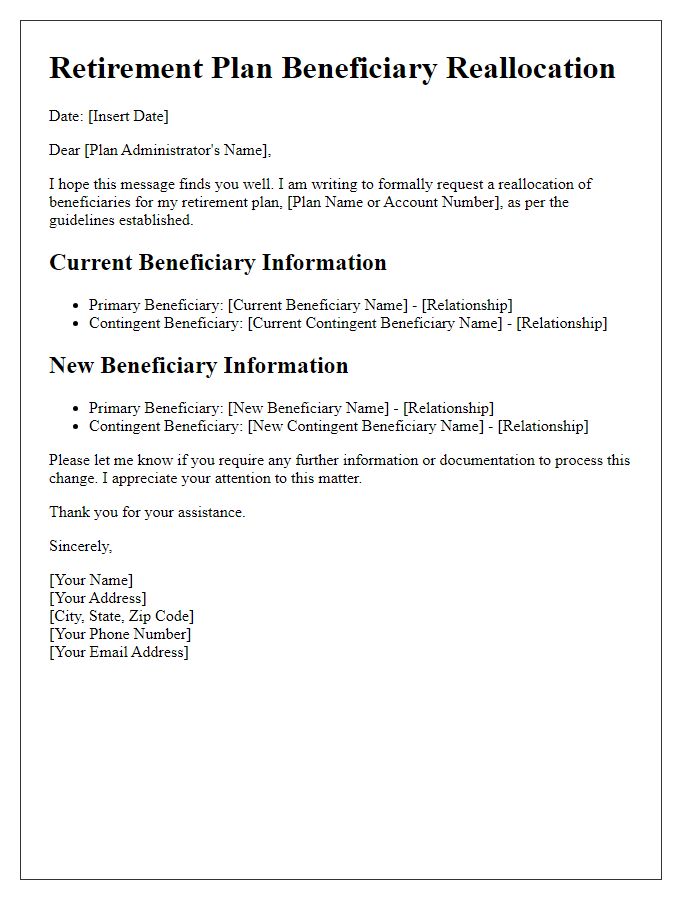

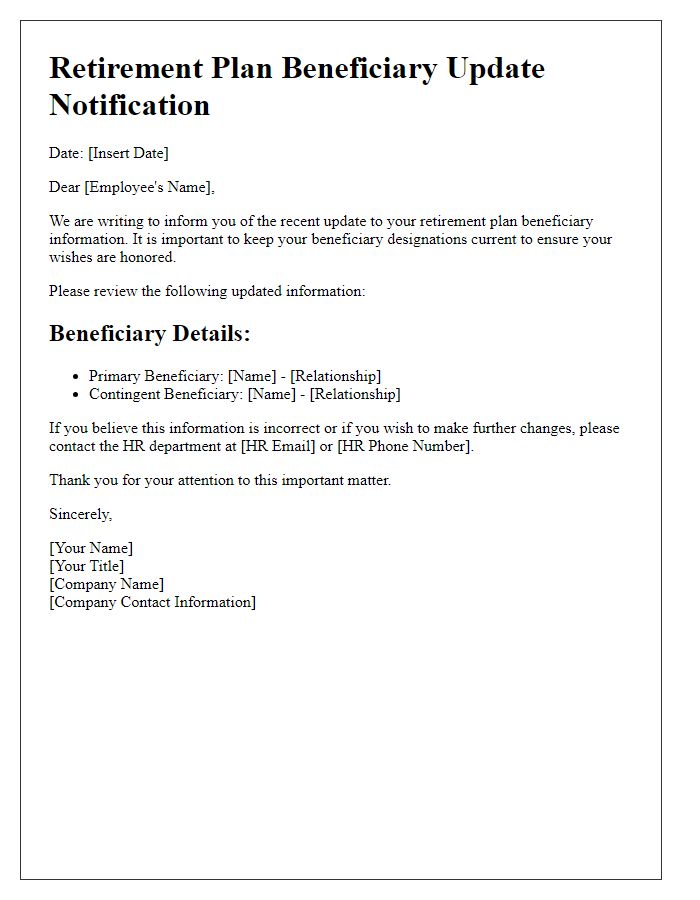

Letter Template For Retirement Plan Beneficiary Change Samples

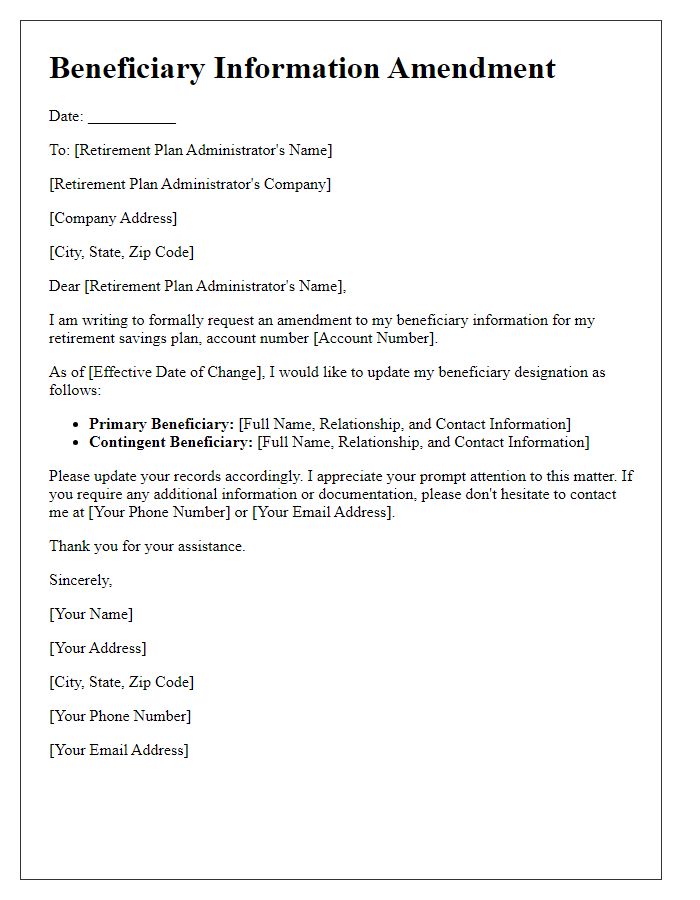

Letter template of beneficiary information amendment for retirement savings

Comments