Are you facing the daunting challenge of a home foreclosure? It can feel overwhelming and isolating, but it's important to remember that you're not alone in this fight. There are steps you can take to appeal the foreclosure and potentially save your home, and understanding the process is crucial. So, let's dive into some effective strategies and templates that can guide you through writing an impactful foreclosure appeal letterâread on to learn more!

Account Information and Details

Home foreclosure appeals require careful documentation of account information and details related to the property in question. The property address (including street, city, and ZIP code) must be clearly stated, highlighting the significance of the location within a specific neighborhood or community. The mortgage account number should be included for precise identification of the financial obligations tied to the property. A detailed timeline of events, including the original loan date, missed payment dates, and foreclosure notice dates, provides context for the appeal. Mentioning the total amount owed (including principal, interest, and any fees) delineates the financial situation, while also noting any attempts to communicate with the lender (including dates and outcomes) helps to illustrate proactive efforts to resolve the issue. Legal documents, such as the original mortgage agreement and any correspondence with the lender, strengthen the appeal's credibility.

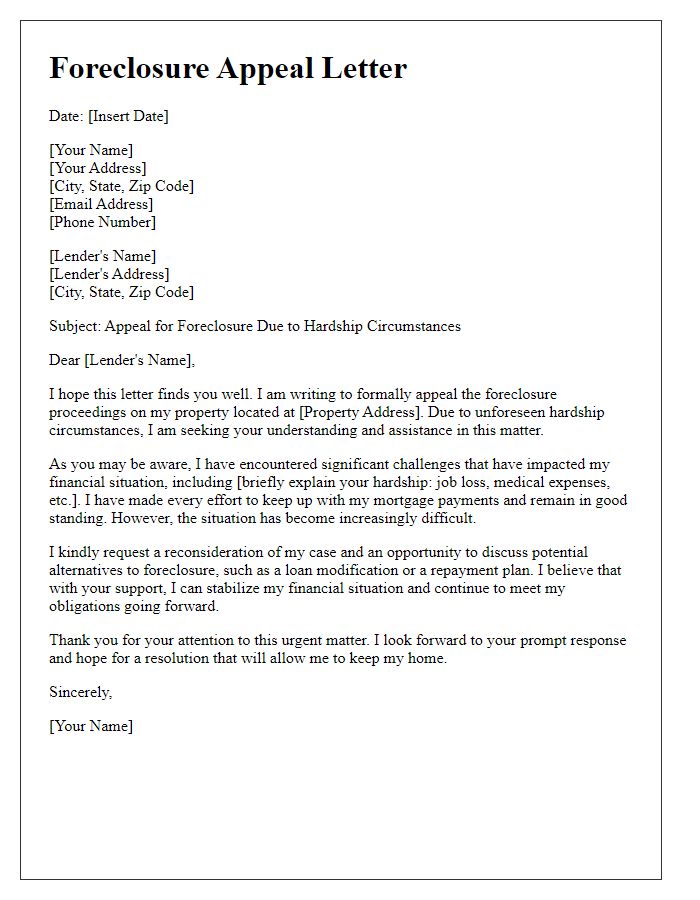

Explanation of Circumstances

Home foreclosure appeals often stem from difficult and unforeseen circumstances affecting homeowners. Major life events such as job loss, medical emergencies, or significant reductions in income can lead to missed mortgage payments, creating a chain reaction that results in foreclosure proceedings. Many homeowners in distress turn to their lenders for assistance through loan modification, seeking to adjust payment terms under programs like the Home Affordable Modification Program (HAMP), which aims to help those facing financial difficulties retain their homes. Additionally, local housing authorities or nonprofit organizations may offer counseling and negotiation aid to homeowners, providing resources and potentially mitigating the impacts of foreclosure. Providing a detailed account of circumstances, including dates, financial impacts, and steps taken to seek assistance, is critical to making a compelling appeal for reconsideration.

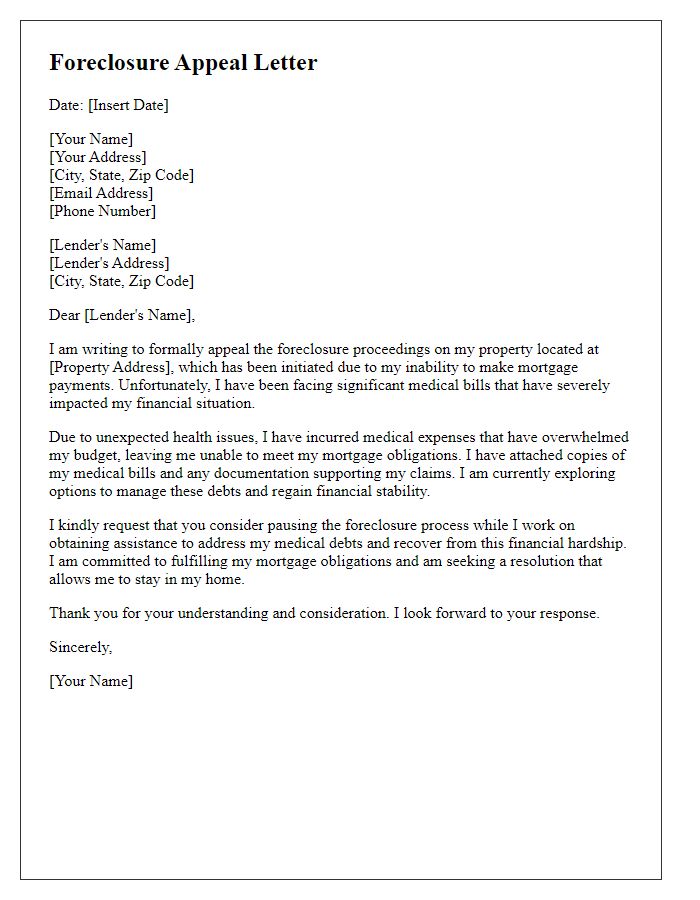

Financial Hardship Statement

Financial hardships often stem from unexpected events such as job loss, medical emergencies, or divorce. Many homeowners face difficulties that threaten their ability to keep up with mortgage payments, leading to foreclosure. For instance, a sudden layoff from a position in a major company can drastically reduce monthly income, making it impossible to cover essential expenses. Medical bills from a hospital stay may accumulate, further straining finances. In these situations, alternative options like loan modification, forbearance, or government assistance programs can offer relief. Additionally, non-profit organizations provide resources and counseling, guiding homeowners through the foreclosure process to find solutions and negotiate with lenders. These factors underscore the importance of addressing financial hardships proactively to avoid severe consequences, including asset loss and disruption of family stability.

Proposed Payment Plan

A carefully structured proposed payment plan can serve as a pivotal strategy for homeowners facing foreclosure. This financial roadmap outlines a clear path for addressing outstanding mortgage debts, typically involving monthly payments that fit the homeowner's budget. For instance, outlining an initial down payment of 10% of the overdue amount can demonstrate commitment to resolving the financial crisis. Following this, a structured payment schedule spread over 12 to 24 months can provide clarity; for example, a homeowner may suggest $400 monthly payments for a $4,800 debt. Simplifying the communication involves a detailed breakdown of the homeowner's financial situation, including income reports, expenses, and other liabilities, which can help lenders understand the feasibility of the proposed plan. It is essential for the homeowner to emphasize their intention to stay in the property, maintain communication with the lender, and adhere to future mortgage obligations, as these factors contribute to a more favorable consideration of the appeal.

Supporting Documentation

Home foreclosure appeals require comprehensive supporting documentation that highlights specific financial hardships and mitigating circumstances. Essential documents include the homeowner's current income statements, such as pay stubs or tax returns from the previous year, which collectively demonstrate ongoing financial struggles. Additionally, bank statements indicating unusual withdrawals or sudden decreases in savings can provide context for the inability to make mortgage payments. Communication records with the mortgage lender, such as payment plans or hardship letters, illustrate attempts to negotiate and seek assistance, reinforcing the case for reconsideration. Furthermore, any documentation of sudden financial burdens, such as medical bills or job loss notices, should be included to substantiate the claim. This evidence collectively paints a detailed picture of the homeowner's situation, increasing the chances of a favorable outcome in the appeal process.

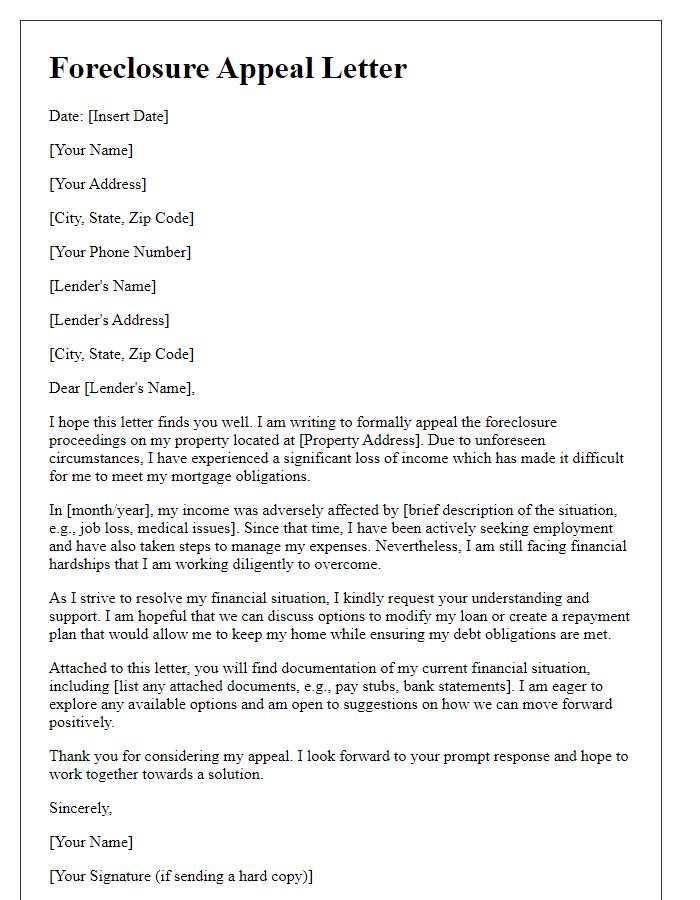

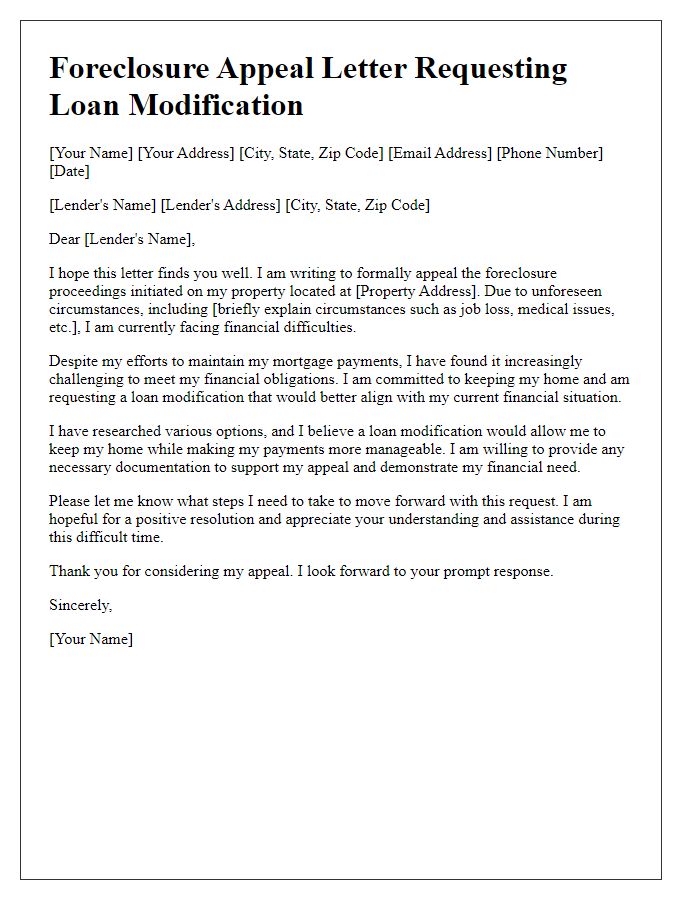

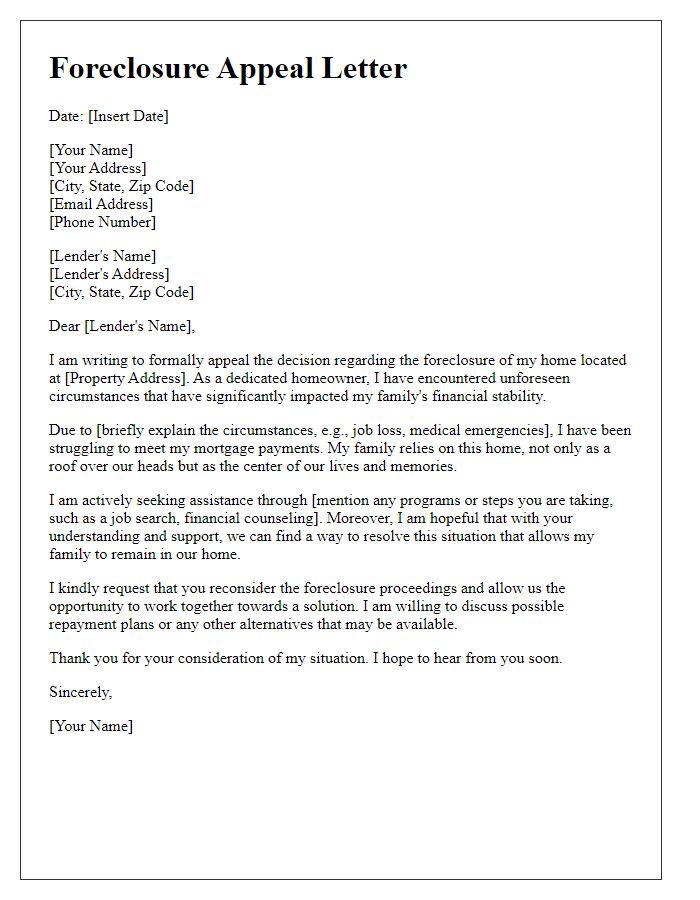

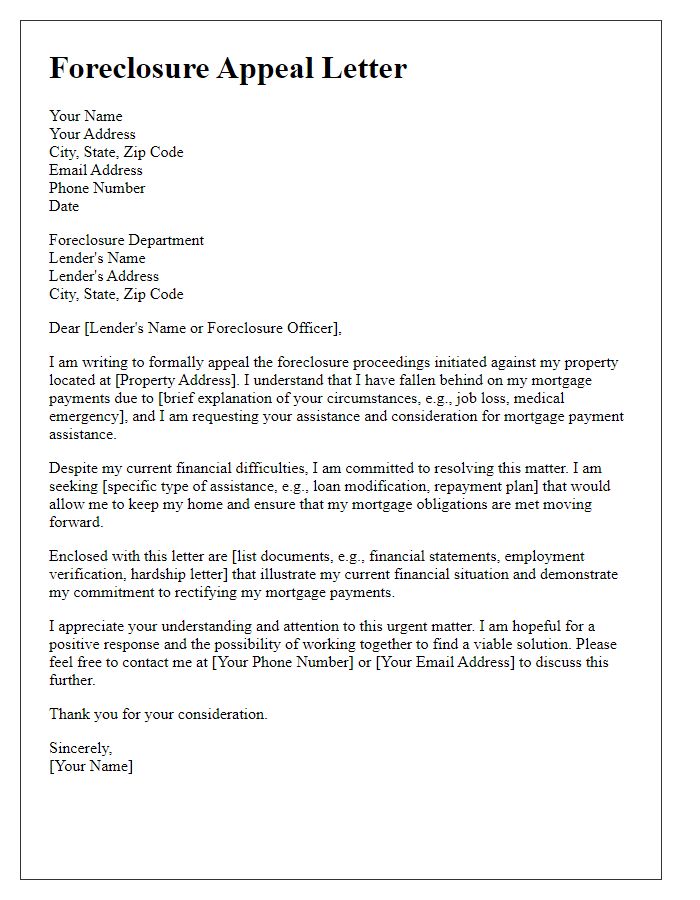

Letter Template For Home Foreclosure Appeal Samples

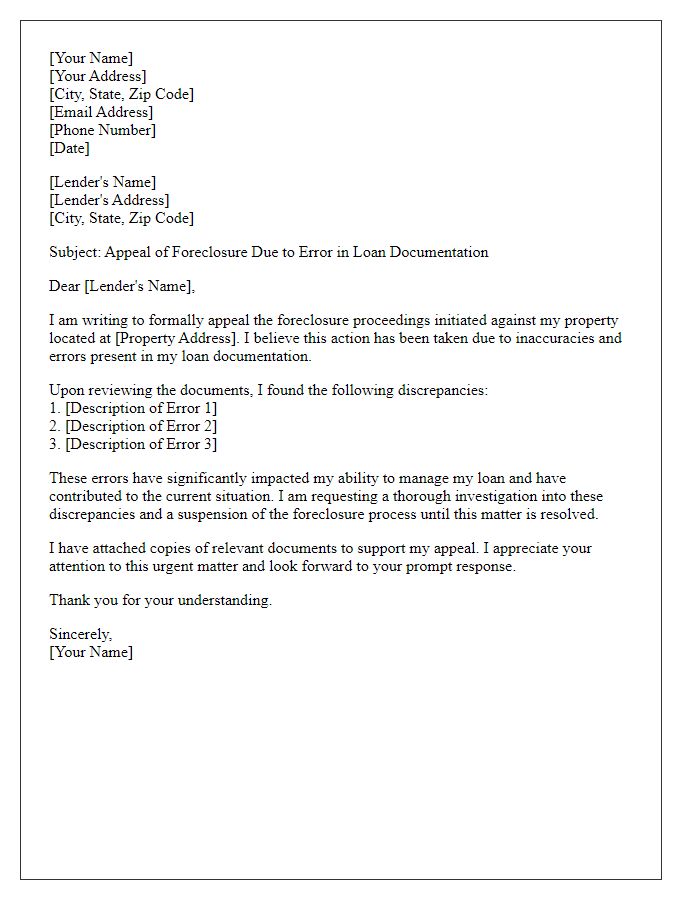

Letter template of foreclosure appeal due to error in loan documentation.

Comments