Are you looking to update your estate planning documents? It's an important step to ensure your wishes are honored and your loved ones are taken care of. Whether it's adding new beneficiaries or revisiting your powers of attorney, keeping your plans current is vital for protecting your legacy. Join us as we explore the essential elements of updating your estate plan and how to make the process smooth and straightforward!

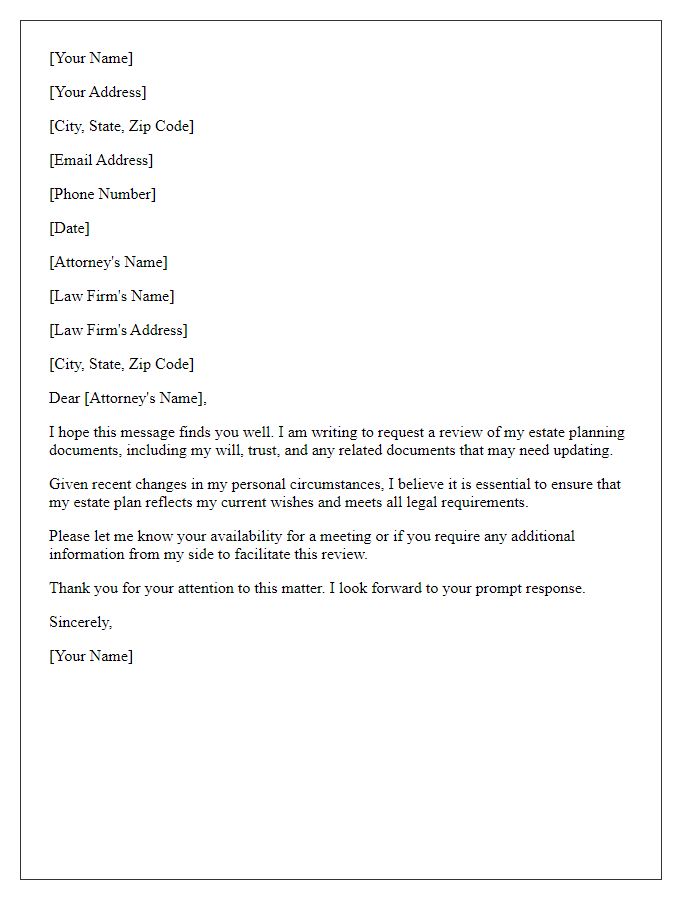

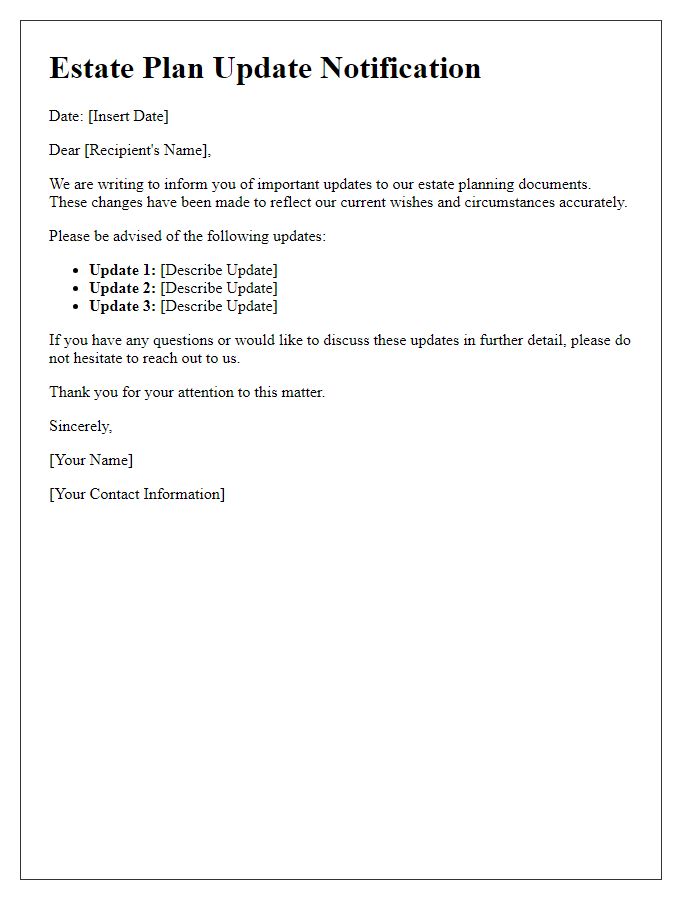

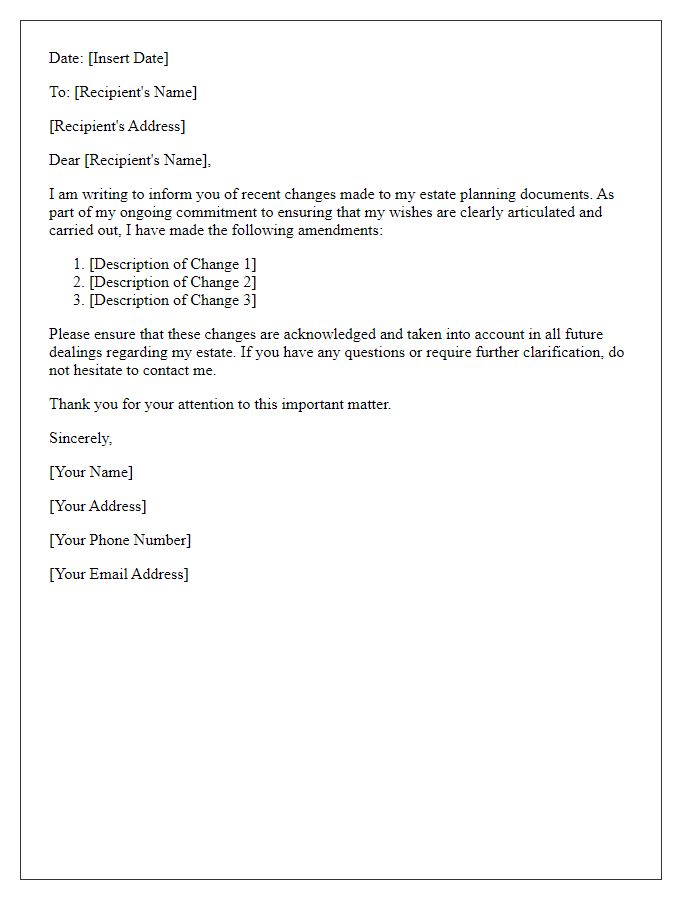

Personal Information Update

In estate planning documentation, updating personal information is critical for ensuring that legal documents remain valid and relevant. Individuals must maintain accurate records concerning details such as full names, birth dates, and Social Security numbers, particularly for immediate family members, beneficiaries, and executors. Notably, significant life events like marriage (which can relate to spousal rights in inheritance), divorce (which may disqualify an ex-spouse from receiving assets), or the birth of children (impacting guardianship designations) should prompt immediate review and updates of the estate documents. Changes to residence, particularly across state lines, can also necessitate modifications to ensure compliance with local laws and tax implications. Regular reviews, ideally conducted every three to five years or after major life changes, can safeguard the testator's intentions, minimize disputes, and enhance clarity for all parties involved.

Asset and Beneficiary Review

Estate planning documentation updates are essential for ensuring assets and beneficiaries are accurately reflected. A comprehensive review of assets, including real estate properties acquired in 2023 and investment portfolios managed by firms such as Vanguard or Fidelity, guarantees alignment with current wishes. Beneficiary designations, particularly for retirement accounts like 401(k)s or IRAs, require meticulous verification to prevent unintended inheritance issues. Reviewing relevant legal documents such as wills and trusts, especially those created in major financial centers like New York or California, ensures compliance with state laws that frequently change. Regular updates help mitigate potential disputes among heirs and ensure the timely transfer of assets according to the individual's wishes.

Legal Changes and Tax Implications

Estate planning documentation requires meticulous attention to legal changes and tax implications that may arise due to new regulations or updates in federal and state laws. Recent changes in the federal estate tax exemption limit (currently $12.92 million for individuals as of 2023) can significantly affect how individuals structure their wills and trusts. Additionally, state-specific tax laws must be considered; for instance, states like Massachusetts have lower exemption thresholds (only $1 million as of 2023), which can result in unexpected tax burdens for residents. Important legal structures, such as revocable living trusts, need to be updated to reflect current assets and changes in beneficiaries, ensuring they provide maximum flexibility and protection. Regular review of this documentation is crucial, particularly after significant life events like marriage, divorce, or the birth of children, which can necessitate alterations in asset distribution plans and guardianship decisions.

Executor and Trustee Confirmation

In estate planning, the roles of Executor and Trustee are critical in managing and distributing assets according to the deceased's wishes. The Executor oversees the probate process, ensuring debts are settled and assets are distributed to beneficiaries, while the Trustee manages any trusts set up, safeguarding the assets for beneficiaries. Regular updates to these responsibilities are essential, especially after significant life events such as marriage, divorce, or the birth of a child, which can shift priorities and intentions for asset distribution. Specific documentation, including wills and trust agreements, should be reviewed and modified to reflect current decisions accurately. Confirming these changes in writing provides clarity and reduces potential disputes among heirs and beneficiaries, facilitating a smoother transition of assets after death. Legal consultation can enhance the effectiveness of these updates, ensuring compliance with relevant laws in specific jurisdictions, like the Uniform Probate Code or state trust laws.

Emergency Contact and Medical Directive Verification

Emergency contact information plays a crucial role in estate planning, ensuring that designated individuals can make decisions in critical situations. Accurate details such as names, phone numbers, and relationships to the principal (the individual whose estate is being planned) are essential. These contacts may include immediate family members, trusted friends, or professional advisors. Medical directives specify healthcare preferences, indicating the principal's wishes regarding life-sustaining treatment and other medical decisions in case of incapacitation. Regular verification of these directives ensures alignment with current health conditions and personal beliefs. Notably, many jurisdictions require these documents to be updated regularly, ideally every few years or after significant life events such as marriage, divorce, or serious illness.

Comments