Hey there! If you've ever found yourself puzzled by a tax audit inquiry, you're not alone. Navigating through the complexities of tax regulations can be challenging, but having the right tools and templates can make all the difference. In this article, we'll explore a straightforward letter template to help you respond effectively to a tax audit inquiryâso stick around to learn more!

Clear and concise subject line

A tax audit inquiry response requires a clear and concise subject line to ensure effective communication. For instance, "Response to IRS Audit Inquiry - Tax Year 2022" immediately informs the recipient about the context of the message. Including relevant identifiers like tax year and agency name facilitates efficient processing and reference. This concise subject line sets the tone for a professional inquiry, allowing for streamlined correspondence concerning documentation and clarifications related to the audit process.

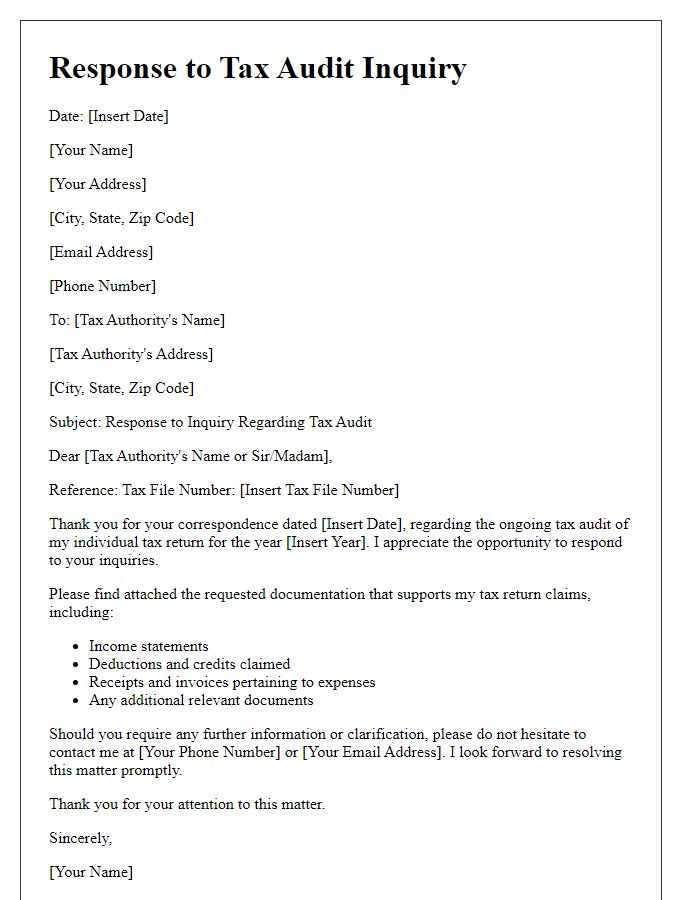

Accurate taxpayer identification information

Accurate taxpayer identification information is crucial during a tax audit, particularly for the Internal Revenue Service (IRS) audits, which often involve detailed scrutiny of financial activities from previous years. Each taxpayer must ensure that their Social Security Number (SSN) or Employer Identification Number (EIN) is precisely matched with the information provided on tax returns. Errors in identification can lead to delays or complications during the audit process, affecting compliance assessments for tax years, such as 2021 or 2022. Clear records from official documents, like W-2 forms or 1099 statements, are essential in assuring that the taxpayer's identity aligns with the reported income, ultimately facilitating a smoother audit experience.

Detailed response to each inquiry point

Navigating a tax audit inquiry requires addressing specific points methodically. Each inquiry point requires a detailed and organized response that reflects full compliance with regulations. For instance, providing accurate income records (such as 1099 forms or W-2 statements) for 2022 can clarify earnings discrepancies. Supporting documents like bank statements (reflecting transactions for the audit period) and expense receipts are essential for validating deductions. Tax returns (filed from 2019 to 2022) should be highlighted, emphasizing the accurate reporting of income brackets and tax credits utilized. Inquiries about business expenses might necessitate substantiating documentation, such as invoices from suppliers or service providers. Furthermore, addressing any discrepancies with legal references (such as IRS code) can enhance credibility. Lastly, maintaining a timeline of correspondence on the audit process ensures clear communication.

Relevant documentation and evidence copies

During a tax audit, timely response to inquiries with relevant documentation is crucial. Taxpayers must submit comprehensive evidence such as W-2 forms, 1099 statements, and complete tax returns for the previous audit year, ideally 2022. Supporting documents like receipts for deductible expenses, bank statements showcasing transactions, and detailed ledgers tracking income sources can substantiate claims made on filings. Compliance with specific requests from agencies such as the Internal Revenue Service (IRS) requires organized files and clarity in data presented. Additionally, maintaining a dialogue with the auditor, including schedules for meetings or phone calls, ensures transparency and cooperation throughout the auditing process.

Contact information for follow-up questions

Tax audits can be intricate processes requiring thorough documentation and clarity of communication. Respondents must provide comprehensive contact information, including full name, business name (if applicable), address, email, and phone number. Proper channels for follow-up inquiries should be outlined, ensuring that auditors can readily engage with the appropriate representatives. Clear structure and accessibility of this information are vital for expediting queries related to examination periods, such as the fiscal year ending December 31, 2022, or specifics regarding reported income discrepancies. Timely responses enhance the efficiency of audits conducted by entities like the Internal Revenue Service (IRS) or state taxation departments, fostering resolutions that are beneficial to both parties involved.

Letter Template For Tax Audit Inquiry Response Samples

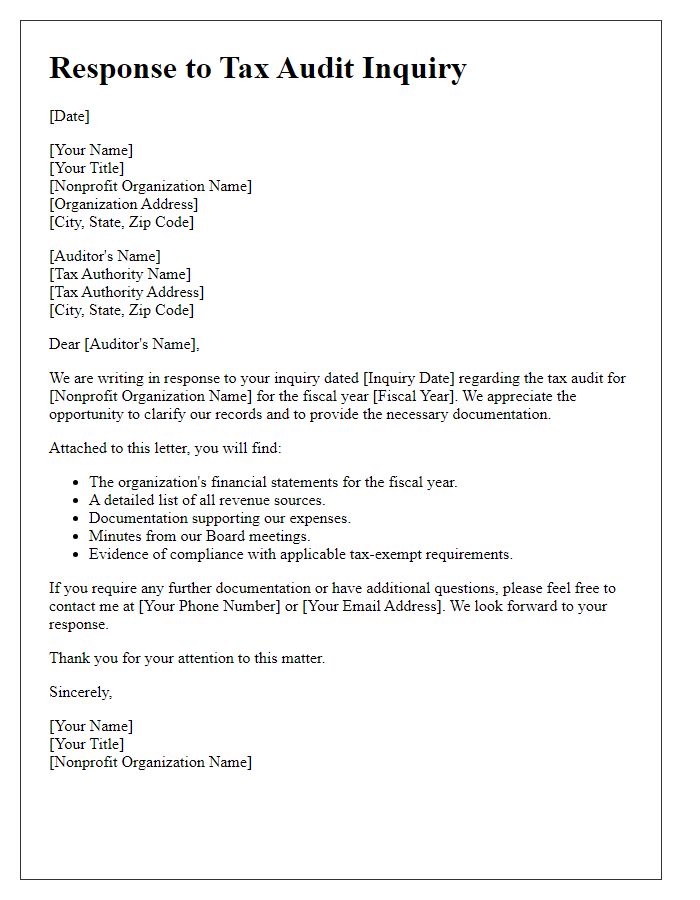

Letter template of tax audit inquiry response for nonprofit organizations.

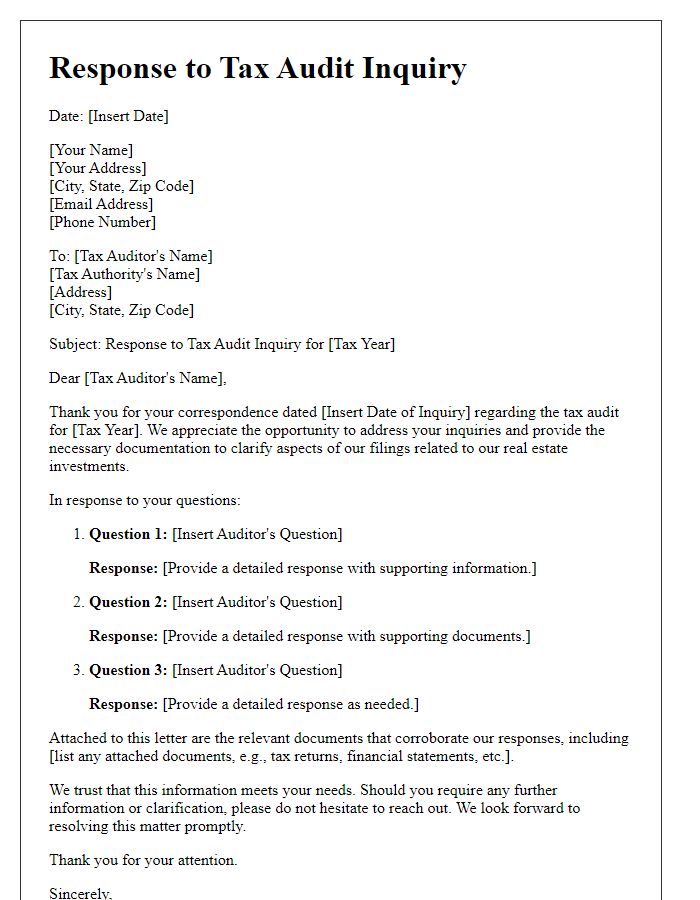

Letter template of tax audit inquiry response for real estate investors.

Comments