When your insurance claim gets denied, it can feel frustrating and overwhelming. Understanding the reason behind this decision is crucial, as it can guide you on the next steps to take. Whether it's due to missing documentation or a policy limitation, knowing the details can empower you to appeal the decision effectively. Interested in learning more about how to navigate this process? Read on!

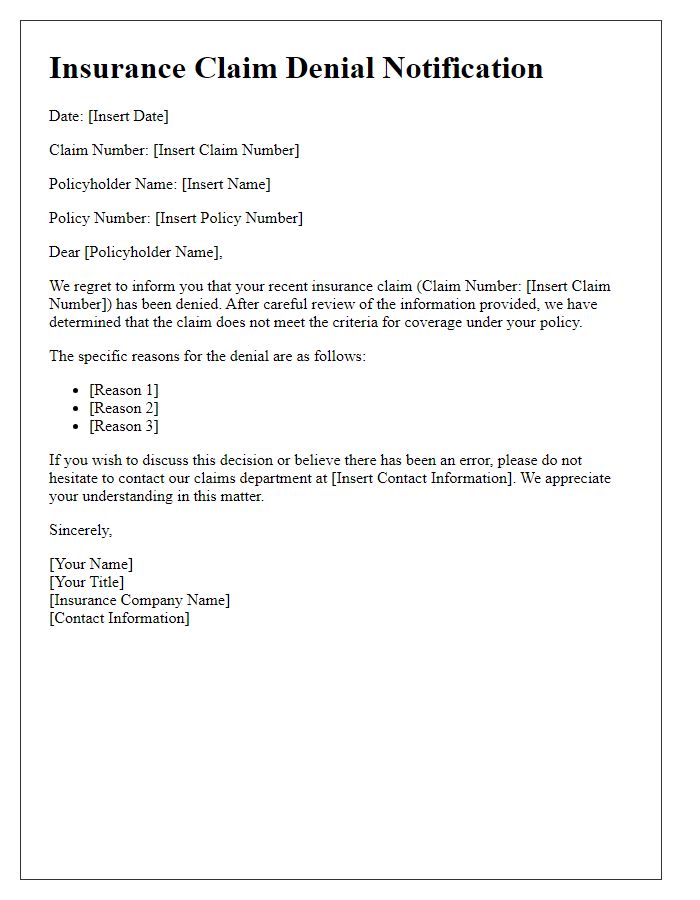

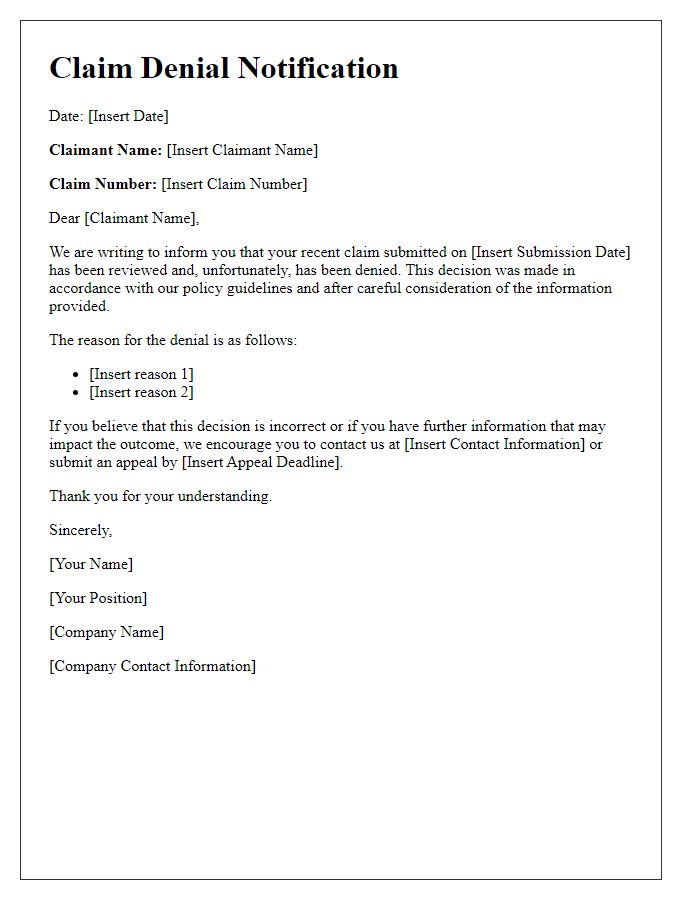

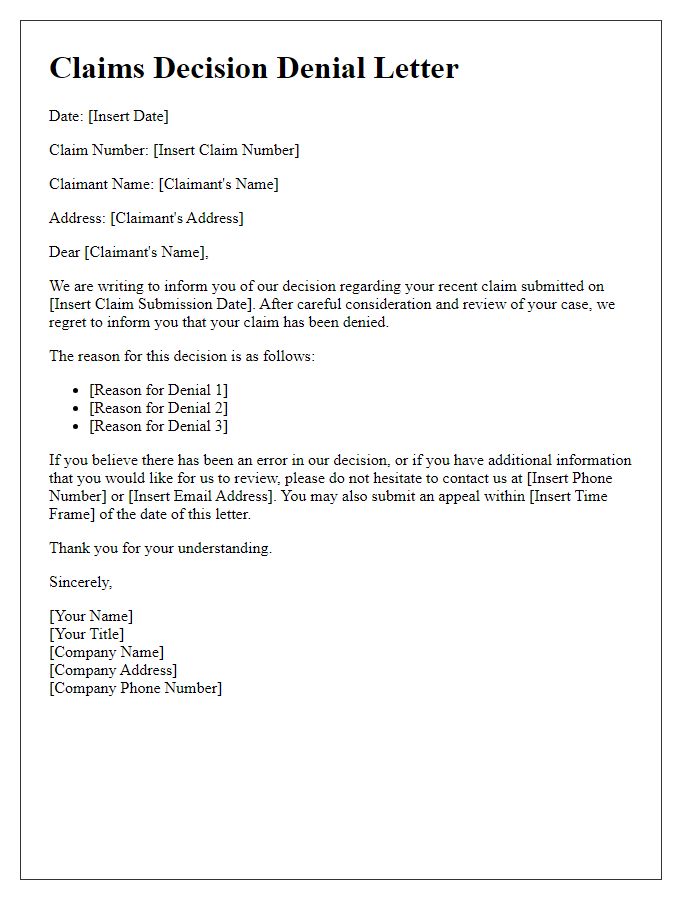

Claimant's Information

Claimants, individuals seeking financial reimbursement or compensation from an insurance provider for losses incurred, often face situations where their claims are denied. The denial notification typically includes vital information such as the claimant's name, policy number, and specifics of the denied claim, which may involve events like accidents, property damage, or health-related expenses. Reasons for denial can range from insufficient documentation at the time of the claim submission to non-coverage of specific incidents as outlined in the insurance policy terms and conditions. Additionally, claims related to high-value items or events occurring outside the coverage domain may receive particularly scrutinized evaluations, impacting the claimant's financial security. In the context of health insurance claims, denial might also occur due to pre-existing conditions or lack of prior authorization for specific treatments or medications.

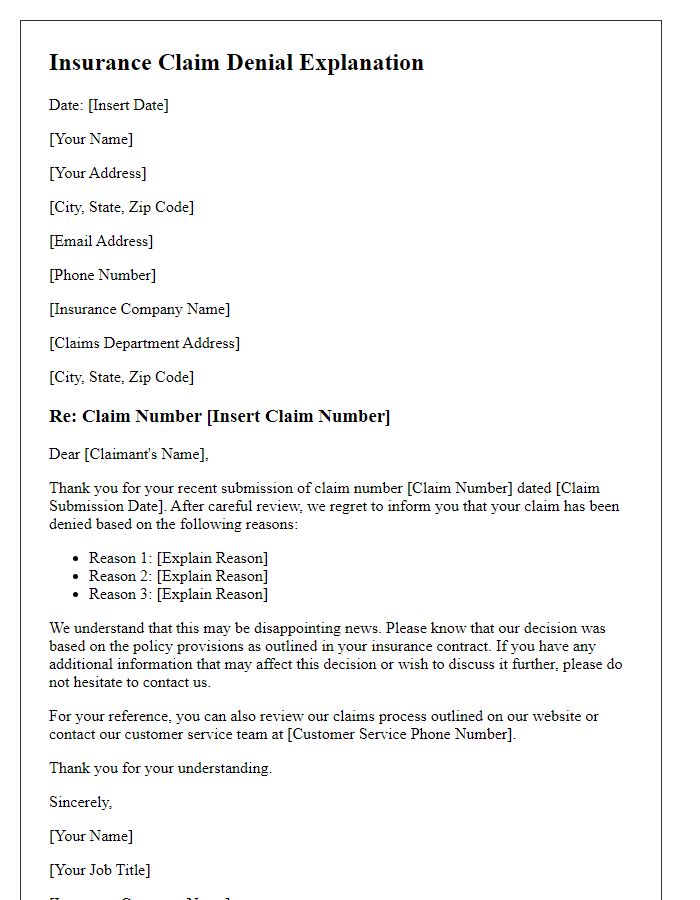

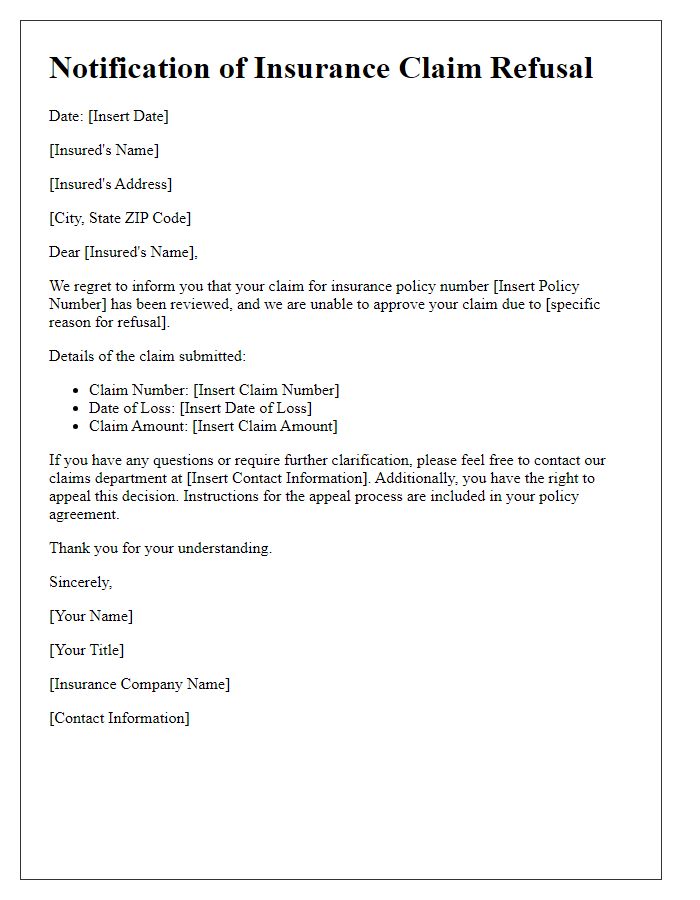

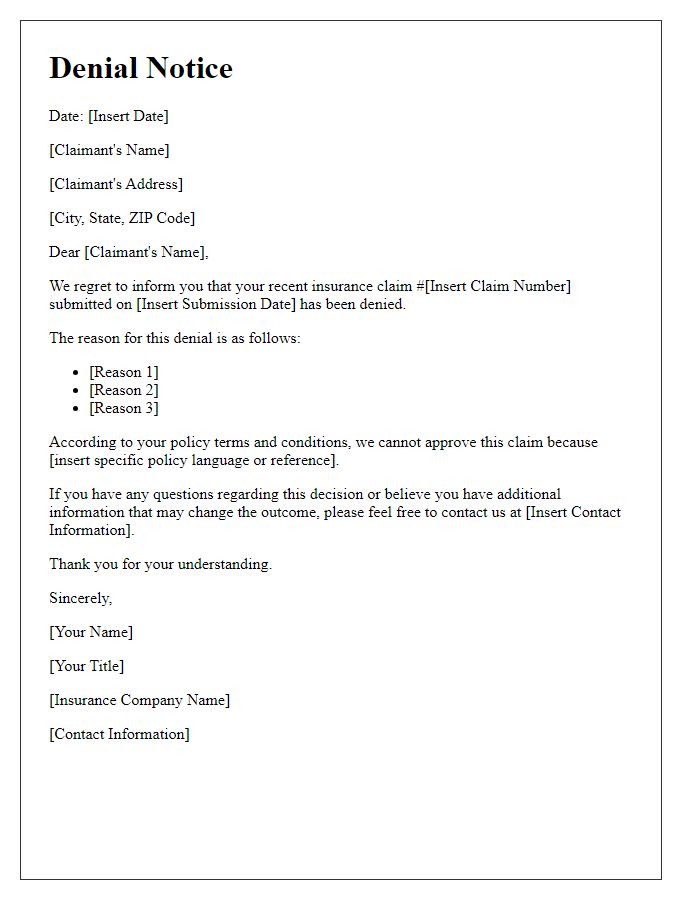

Claim Details

A notification of insurance claim denial can emphasize key elements such as the claim number and relevant policy details. The claim number (e.g., 123456789) designates the specific request for coverage submitted on March 15, 2023. The policy number (e.g., PL-987654321) indicates the insurance agreement, which outlines the agreed-upon terms and conditions for eligible claims. The denial reasons may reference specific policy clauses, such as exclusionary terms regarding certain losses or incidents not covered under the policy. This communication often includes instructions for potential appeals or additional documentation required for further review, adhering to the state regulatory guidelines (e.g., the Insurance Code of California, Section 790.03). Policies often dictate timelines for response, usually within 30 days of the denial notice, providing the insured party with a framework for reconsideration of their claim.

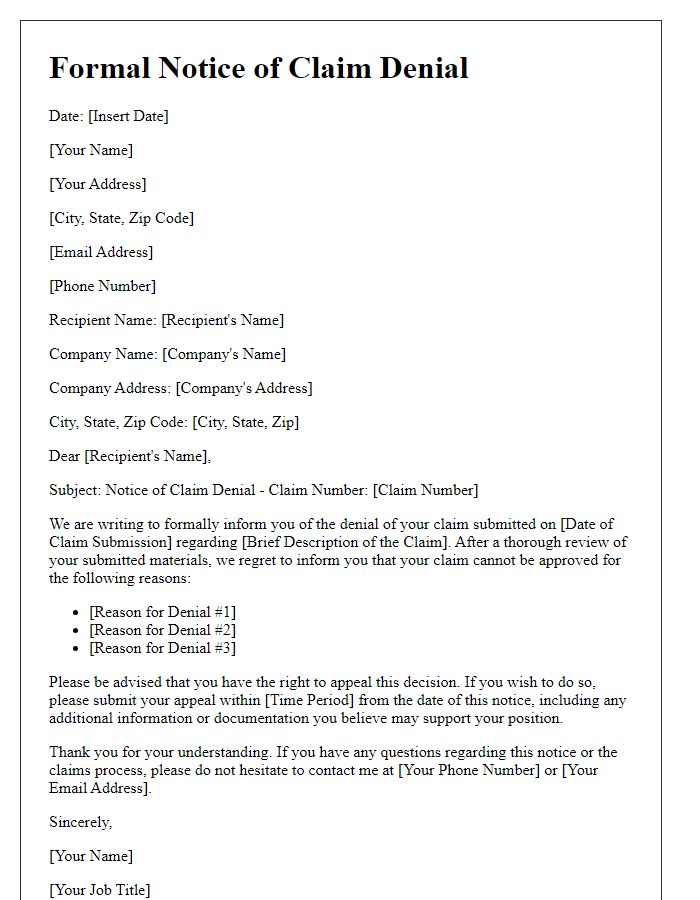

Reason for Denial

Insurance claims often face denial due to various reasons, such as insufficient evidence, policy exclusions, or late submission. An example of a specific reason could be lack of medical documentation, where necessary medical reports from healthcare providers are missing, diminishing the validity of the claim. Another potential reason for denial could include policy exclusions, which are specific circumstances or situations that the insurance policy does not cover, such as natural disasters in certain homeowners' policies. Timeliness plays a crucial role; a claim submission exceeding the required timeframe (often between 30 to 90 days from the incident) can lead to automatic denial. Understanding these common reasons helps claimants navigate the appeals process effectively.

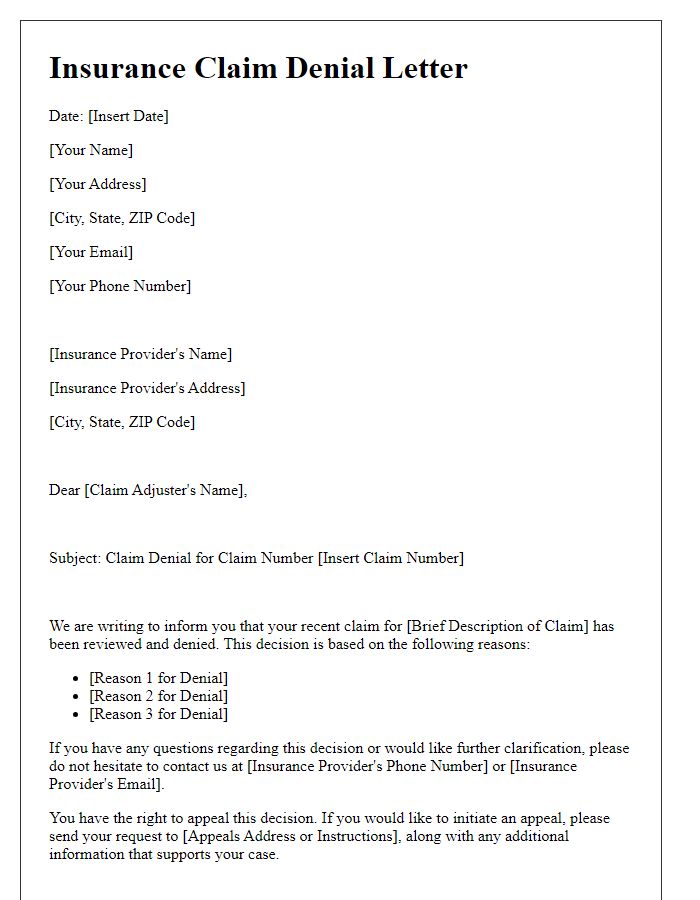

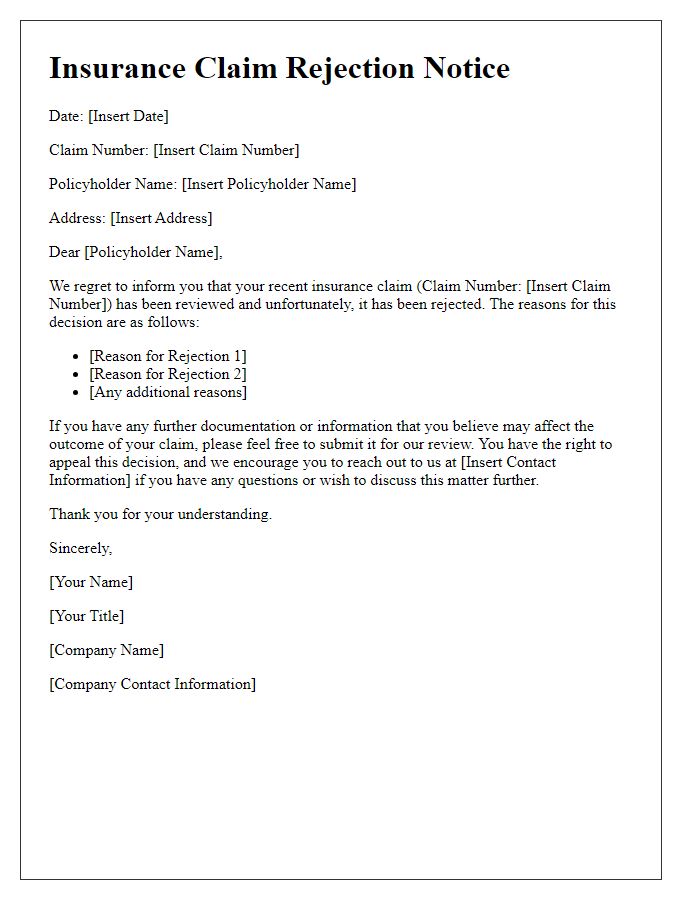

Policy Terms and Conditions

Insurance claim denials often result from specific policy terms and conditions that outline coverage limitations. Claimants should review their insurance policy document (typically provided upon purchase) for detailed information regarding eligibility criteria, exclusions, and necessary documentation. Denials may occur due to reasons such as policy lapsed dates, non-compliance with reporting procedures, or failure to provide required proof of loss (like police reports or medical records). Each insurance provider may have unique language delineating what incidents are covered under their policies, making it essential to understand phrases like "Acts of God" or "wear and tear." Familiarity with claims processes detailed in regulatory guidelines (e.g., the National Association of Insurance Commissioners' standards) could also aid in understanding the denial rationale.

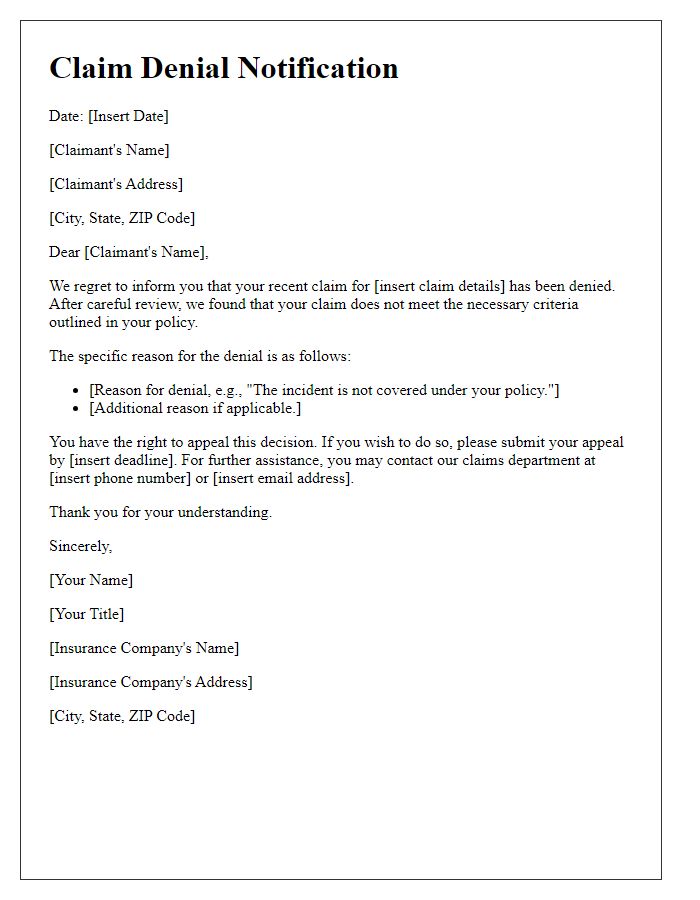

Appeal Process Information

Insurance claim denials can cause frustration for policyholders navigating the appeal process. In this context, a claim may be denied due to various reasons such as insufficient documentation, non-compliance with policy terms, or pre-existing conditions. Specific procedures define the appeal process, typically requiring policyholders to submit a written appeal within a designated timeframe, often ranging from 30 to 180 days after receiving the denial notification. Essential documents, including the initial claim form and any supporting evidence like medical records or repair estimates, must accompany the appeal. Each insurance company, such as State Farm or Allstate, may have unique guidelines and contact points, making it crucial for the claimant to consult their specific policy and follow outlined steps meticulously. Understanding the reasons for denial and gathering comprehensive evidence can significantly impact the likelihood of a successful appeal, ultimately influencing the outcome of the claim.

Comments