When it comes to the reading and distribution of a will, it's essential to ensure that the process is as smooth and respectful as possible for all parties involved. This not only helps in honoring the deceased's final wishes but also facilitates clear communication among heirs and beneficiaries. With the right letter template, navigating this sensitive situation becomes much easier, providing a structured approach to sharing important updates and information. So, let's dive deeper into what you need to include in your letter and how to make this process more manageable â you won't want to miss the valuable tips we have in store!

Clear identification of the deceased and beneficiaries

In a formal will reading, identification of the deceased is crucial, including full name, date of birth (e.g., January 1, 1940), and date of death (e.g., December 31, 2023). For clarity, details of the location of passing, such as the hospital name (e.g., St. Mary's Hospital, Springfield), may also be included. Beneficiaries must be clearly identified with their full names, relationship to the deceased, and contact information. For example, the estate may include beneficiaries such as Jane Doe (daughter, residing at 123 Maple Street, Springfield) and John Smith (son, residing at 456 Oak Avenue, Springfield). This identification establishes rightful heirs and ensures an organized distribution of assets, addressing potential disputes or confusion regarding claims.

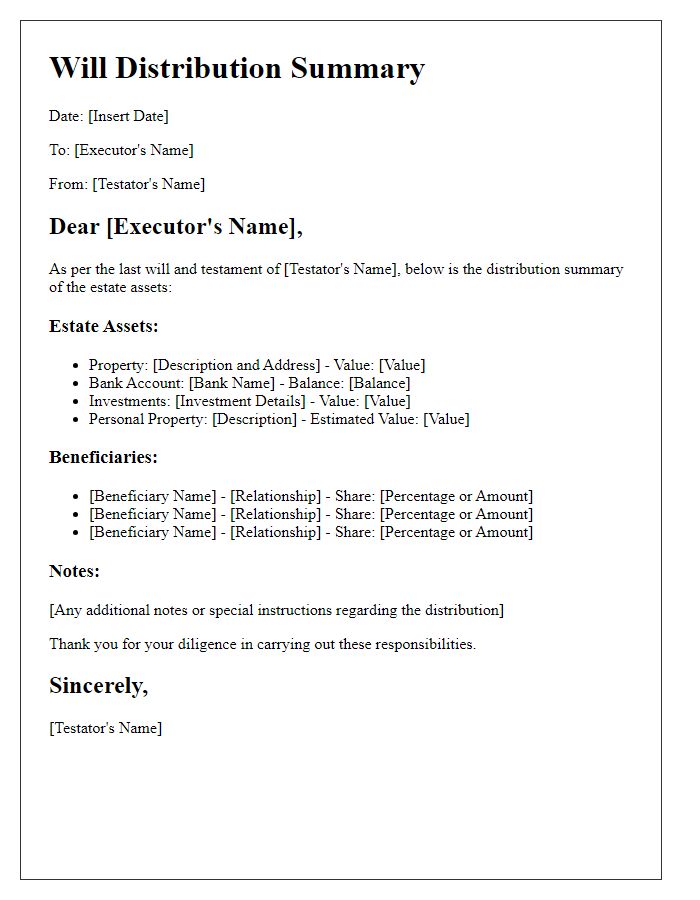

Comprehensive listing of assets and liabilities

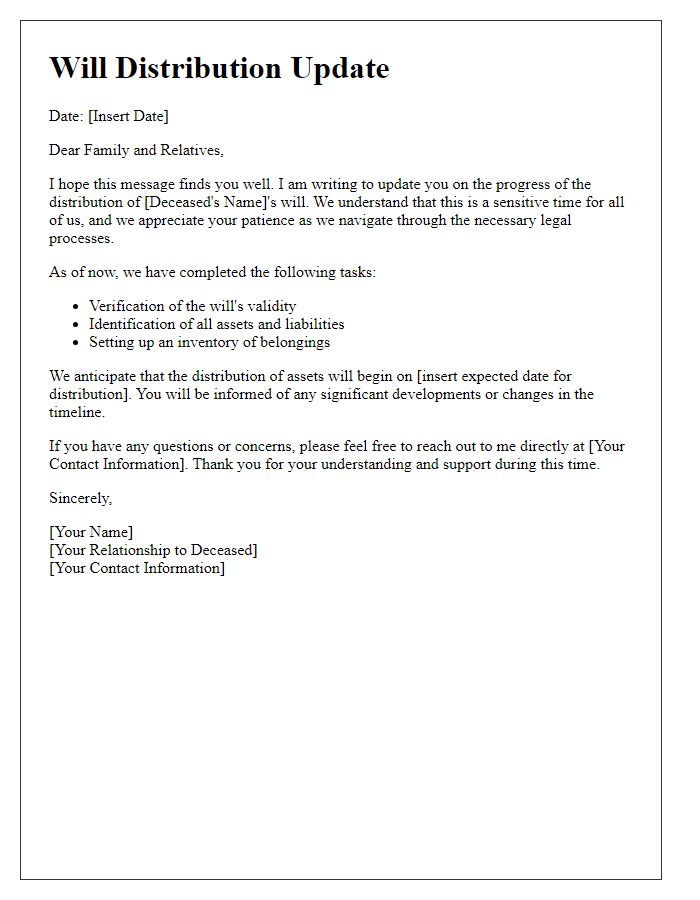

During the reading of a will, a comprehensive listing of assets and liabilities is essential for clear distribution among beneficiaries. Key assets may include real estate properties like the family home in Springfield valued at $350,000, stocks and bonds from various public companies totaling $150,000, retirement accounts such as a 401(k) with a balance of $200,000, and personal valuables like a vintage car appraised at $30,000. Liabilities should also be documented thoroughly, incorporating a mortgage balance of $200,000 on the home, credit card debts totaling $15,000, and personal loans which add another $25,000 to the obligations. This documented overview enables transparent discussions during the will reading, ensuring that all parties understand the financial landscape and the equitable distribution of the remaining estate.

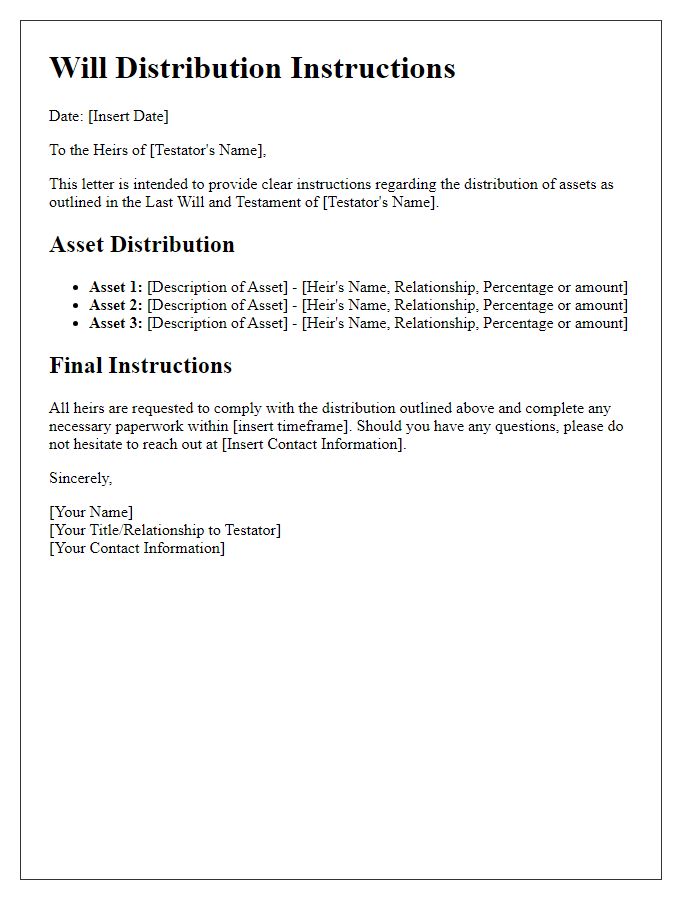

Detailed instructions for asset distribution

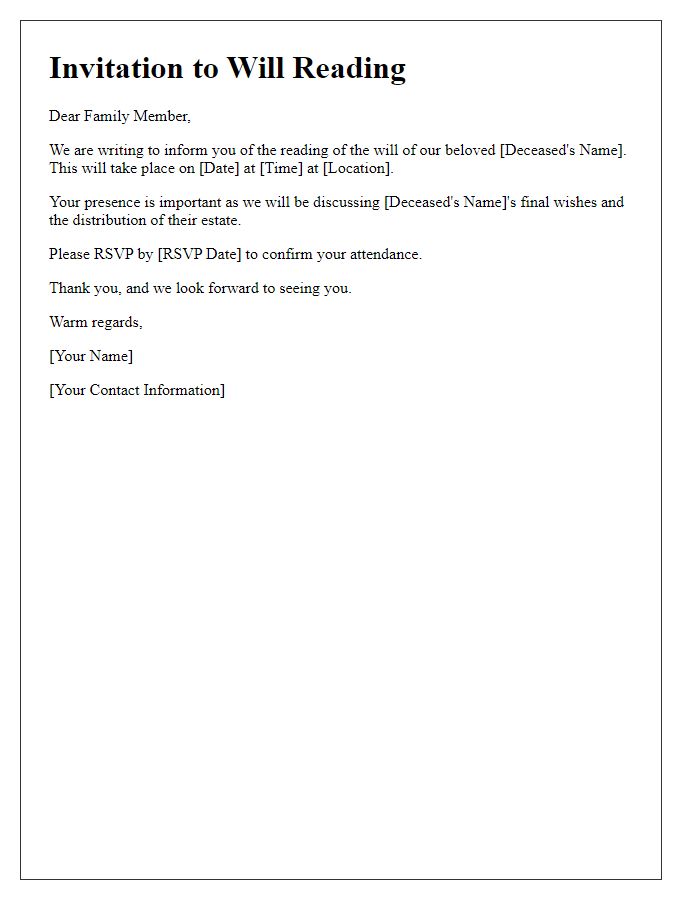

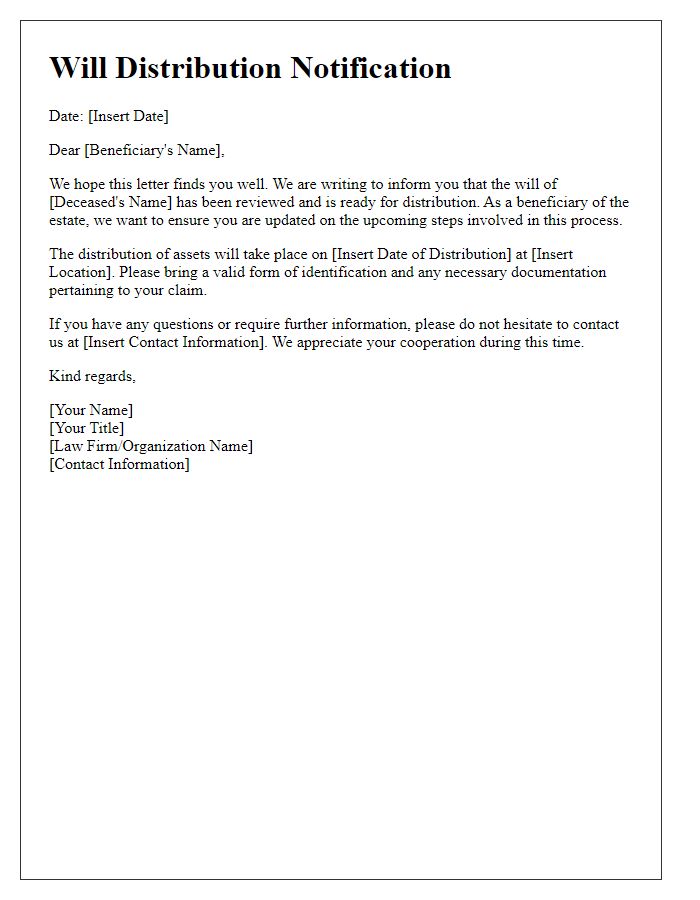

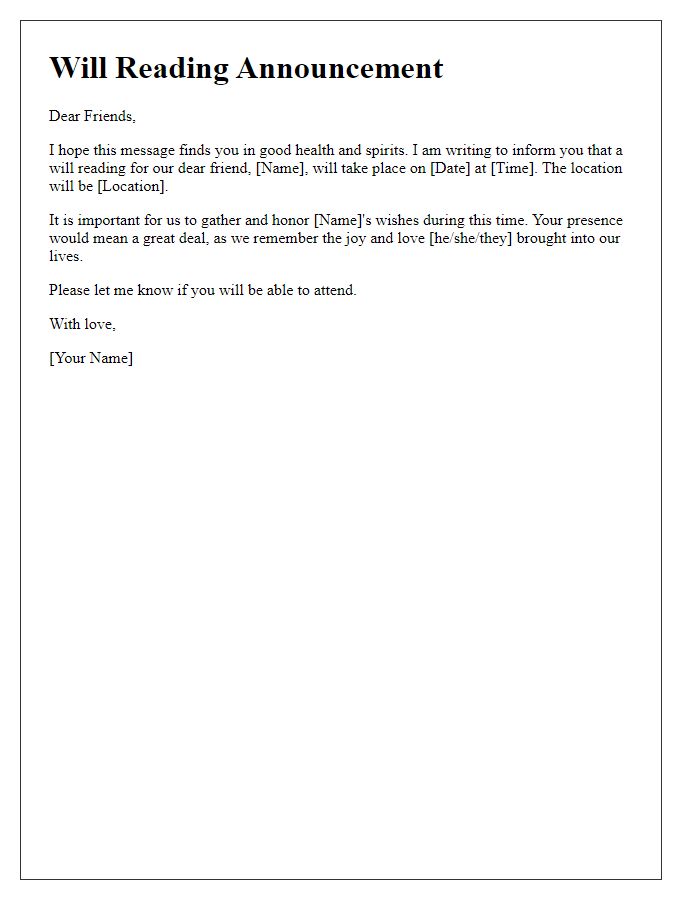

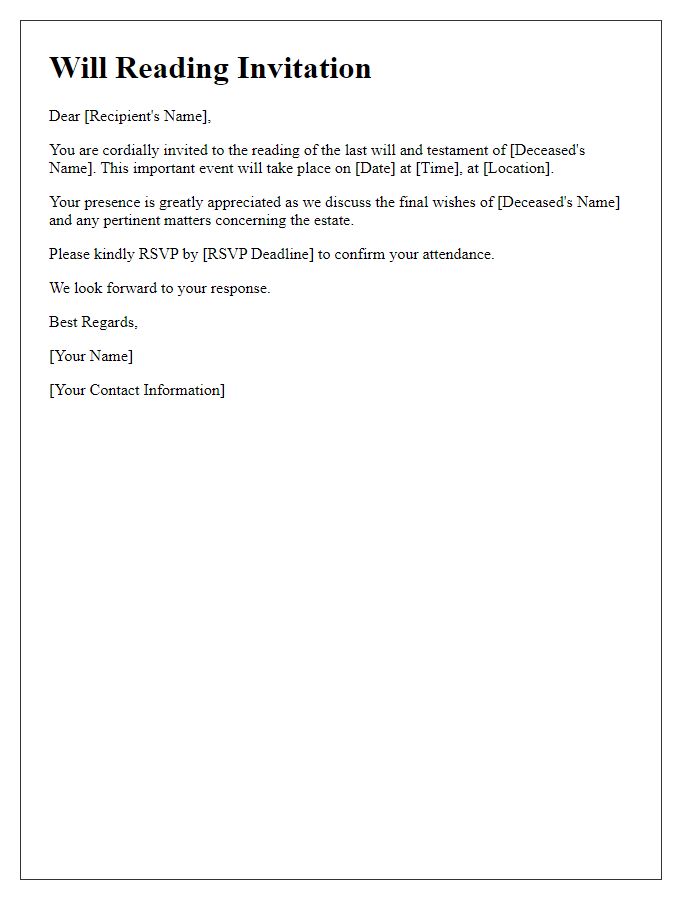

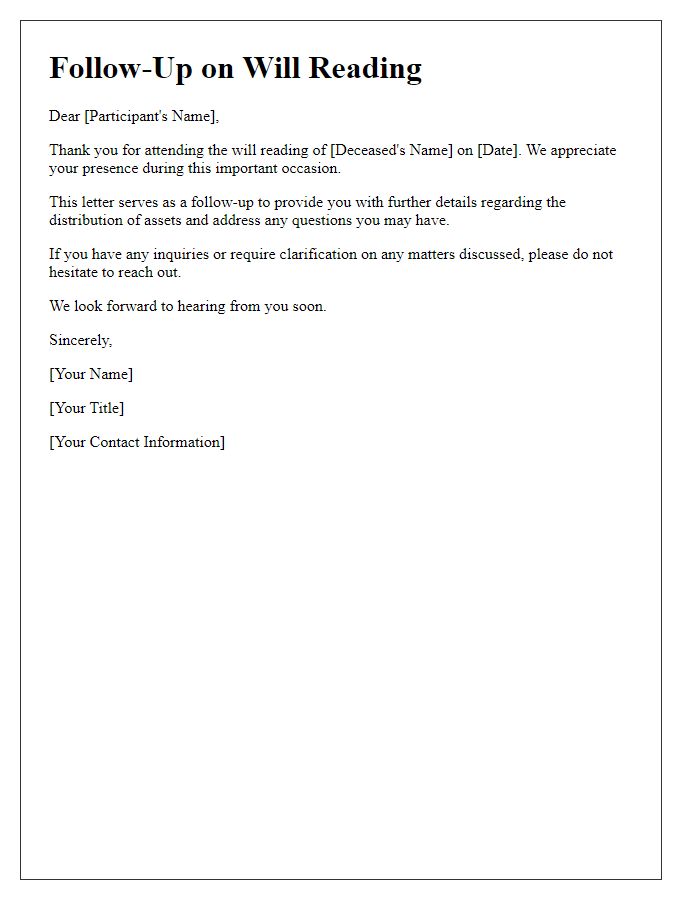

The reading of a will is a critical event that determines how assets will be distributed among beneficiaries. The document, typically drafted by a legal professional, outlines the deceased's final wishes regarding their estate, which may include real estate properties, bank accounts, investments, and personal belongings. During the will reading event, usually held at a law office or a family residence, the executor, appointed by the deceased, must present the will to all relevant parties. Detailed instructions are provided regarding the distribution timeline, including deadlines for beneficiaries to claim their inheritance. For complex assets, such as a family business or specific personal items of significant value, the executor should outline any additional steps required. This may involve obtaining appraisals or scheduling property transfer documents. Transparency and communication with all beneficiaries are crucial to ensure a smooth distribution process, minimizing potential disputes.

Appointment of executor or trustee

The appointment of an executor or trustee is a pivotal aspect of estate planning, ensuring the proper administration of a deceased individual's estate. Executors, often named in a last will and testament, bear the responsibility to manage the distribution of assets (valued in the hundreds of thousands to millions of dollars) in accordance with the deceased's wishes. Trustees oversee trusts, designed to benefit heirs or charities, managing investments and distributions over time. The appointed individual, whether an attorney with expertise in probate law or a trusted family member, must navigate complex legal procedures (such as filing probate documents in state courts) to fulfill their duties effectively. Accurate identification of assets, settlement of debts, and adherence to state laws (varying significantly by jurisdiction) are critical components in this role, impacting family dynamics and long-term financial stability.

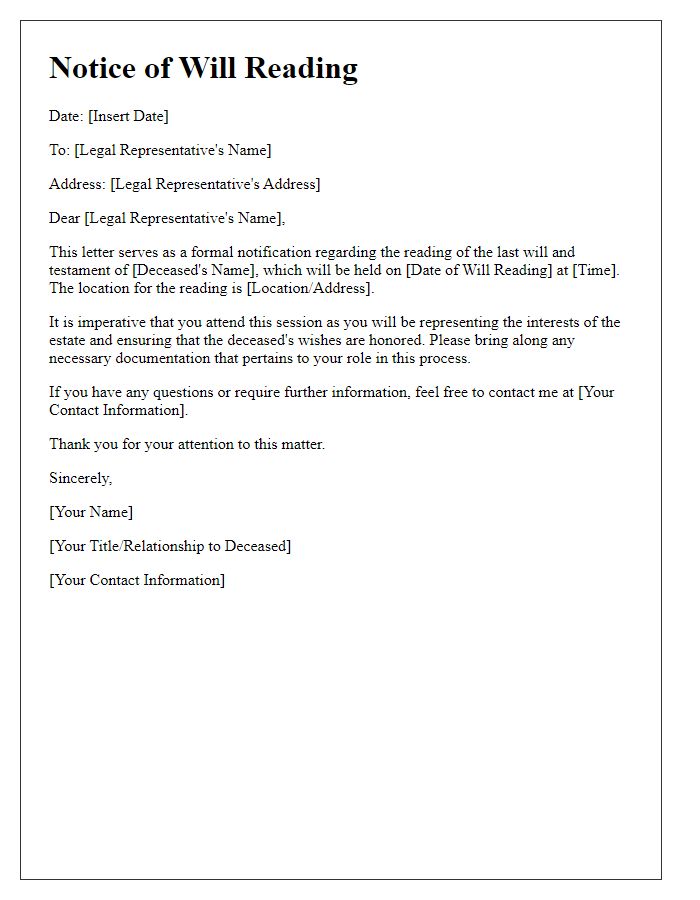

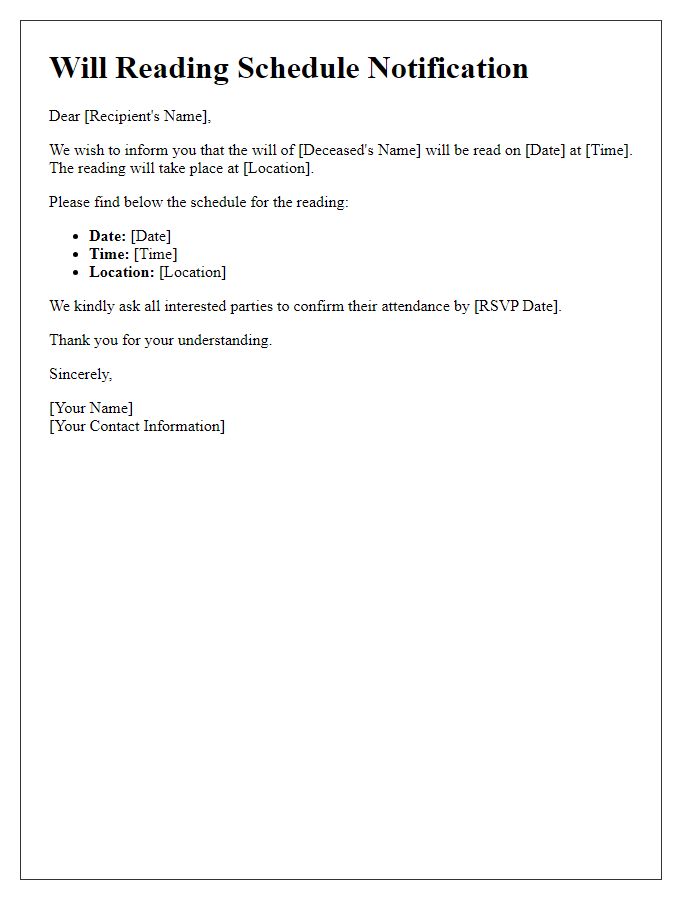

Legal compliance and authorization statements

Probate procedures, initiated by the Last Will and Testament, dictate the legal framework for reading and distributing a deceased individual's estate. The appointed executor, authorized by the probate court to manage the estate, must adhere to jurisdiction-specific laws such as the Uniform Probate Code. Prior to the reading, beneficiaries, including family members and acquaintances named in the will, should receive notices outlining the time and place of the reading, usually held in a legal office or a public meeting space. Legal compliance requires an accurate account of assets and liabilities, as well as documentation to validate the will, including signatures and witnesses. Authorization statements, signed by the executor, confirm their authority to distribute the estate's assets according to the deceased's wishes, while also addressing any outstanding debts to ensure a lawful distribution process.

Comments