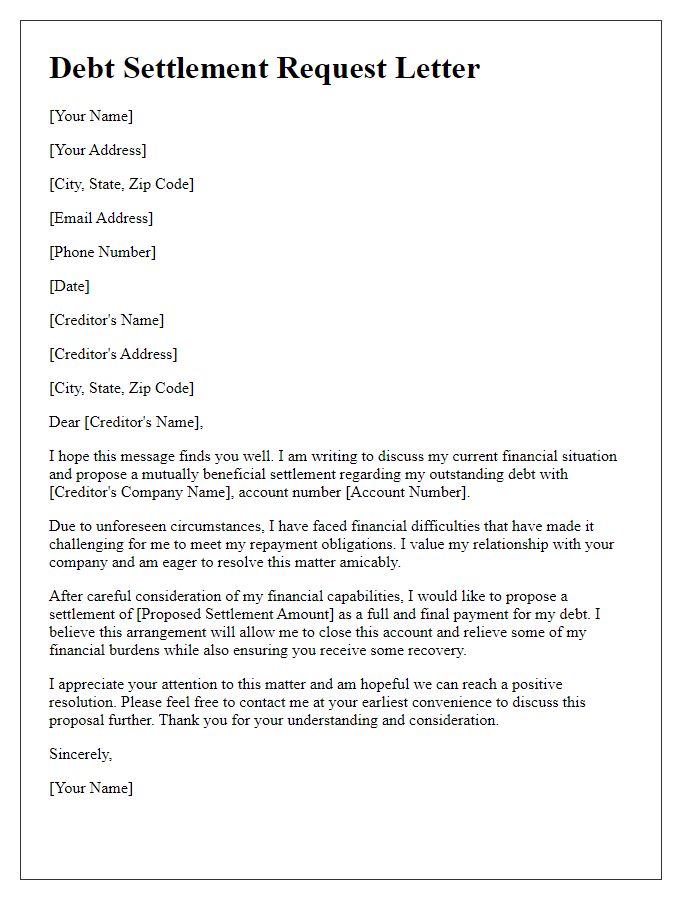

Are you tired of chasing down unpaid debts without a clear path forward? Sending a legal notice for uncollected debts can be an effective step toward reclaiming what's rightfully yours. This letter not only communicates the seriousness of the situation but also lays out your intentions in a professional manner. If you want to learn more about crafting the perfect debt collection notice, let's dive deeper into the details!

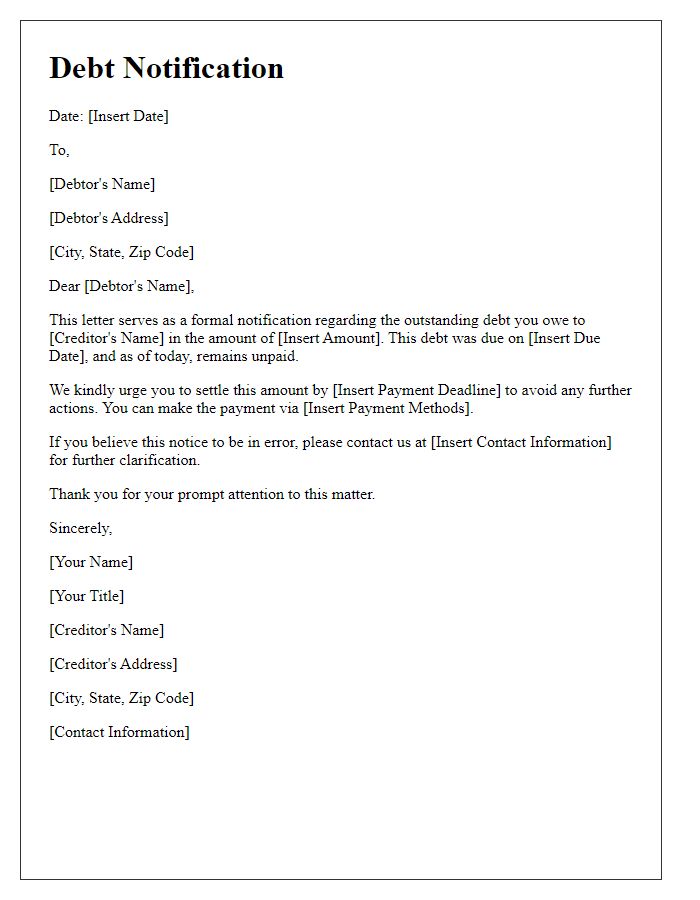

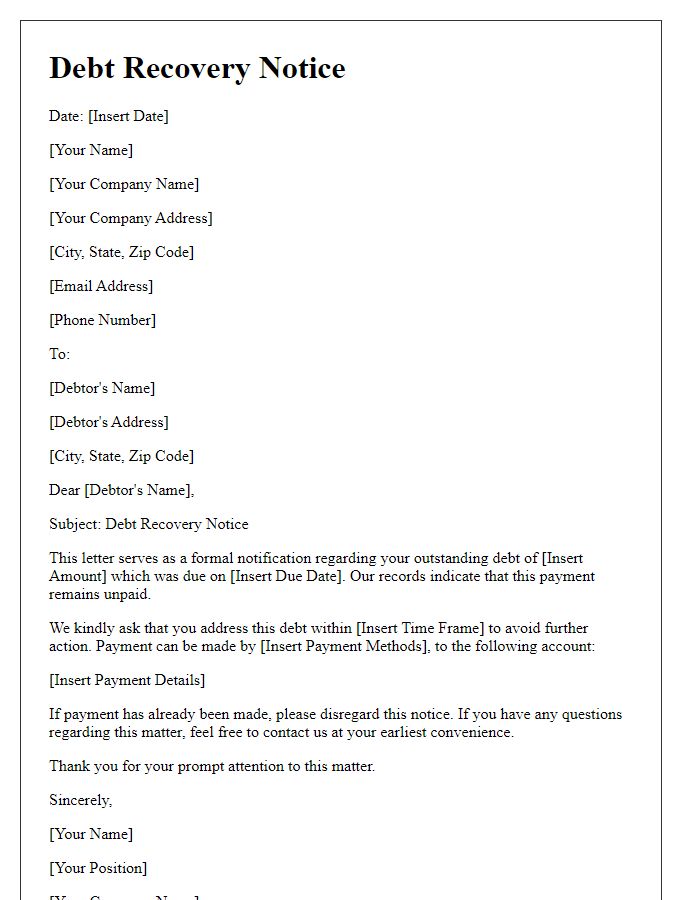

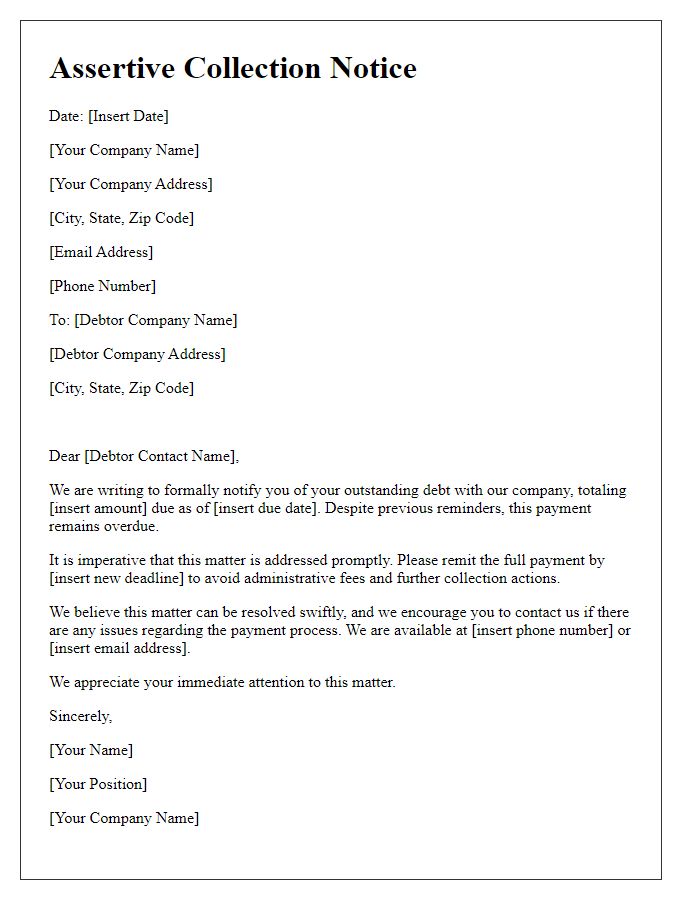

Clear identification of creditor and debtor

The creditor, ABC Financial Services, located at 123 Main Street, New York, NY 10001, has formally notified the debtor, John Doe, residing at 456 Elm Street, Brooklyn, NY 11201, regarding the outstanding debt totaling $5,000. This amount, incurred due to a personal loan agreement dated January 15, 2023, remains unpaid despite multiple reminders sent on March 1, March 15, and April 10, 2023. Per the terms outlined in the agreement, failure to settle this debt within 30 days from the receipt of this legal notice may result in further legal action. The debtor is advised to contact ABC Financial Services immediately to discuss repayment options or avoid escalation of the matter to the courts.

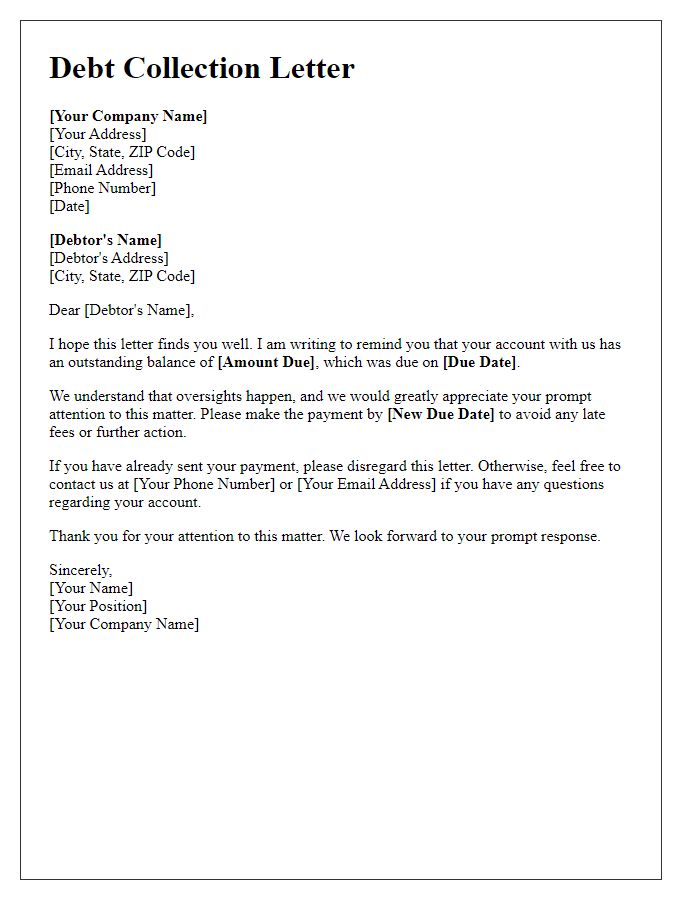

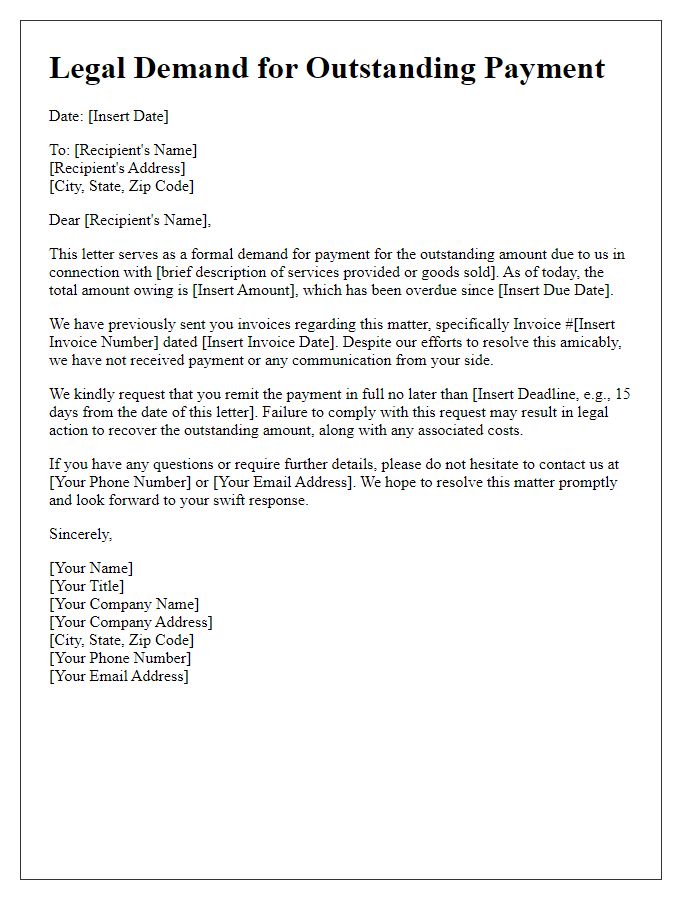

Detailed description of debt

A legal notice regarding an uncollected debt typically outlines specific details about the outstanding amount, the origin of the debt, and any relevant financial agreements. For instance, a business might issue a notice for an unpaid invoice of $5,000 dated February 15, 2023, for consulting services rendered in November 2022. The notice would reference the initial contract signed in October 2022, detailing the payment terms of net 30 days. This situation could involve a small business located in New York City seeking to recover funds from a client who has failed to respond after multiple reminders and has exceeded the payment deadline by over four months. Additionally, the notice might warn of potential legal proceedings that could incur further costs, including attorney fees, associated with the collection process.

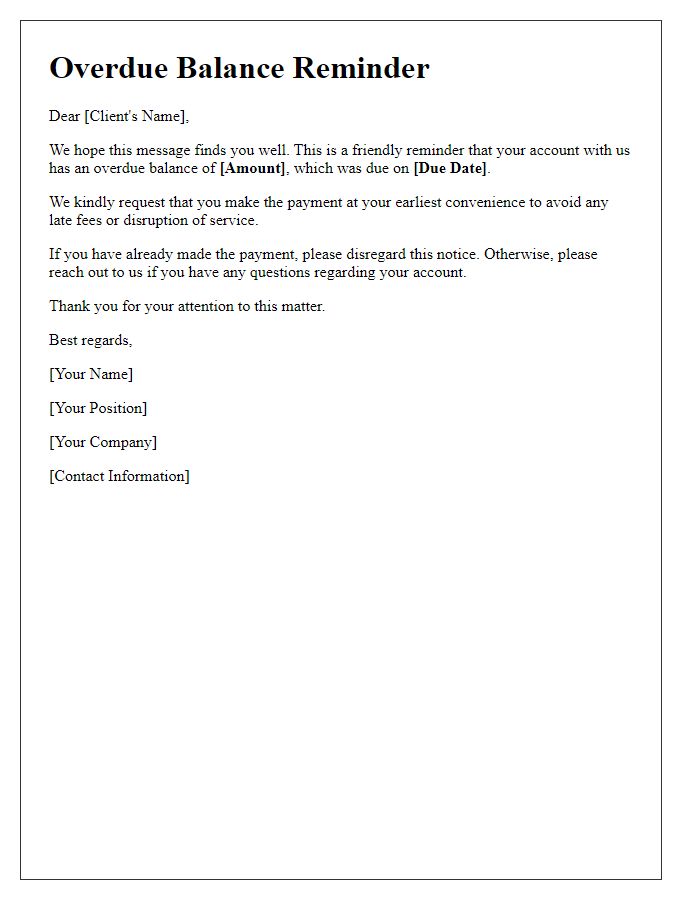

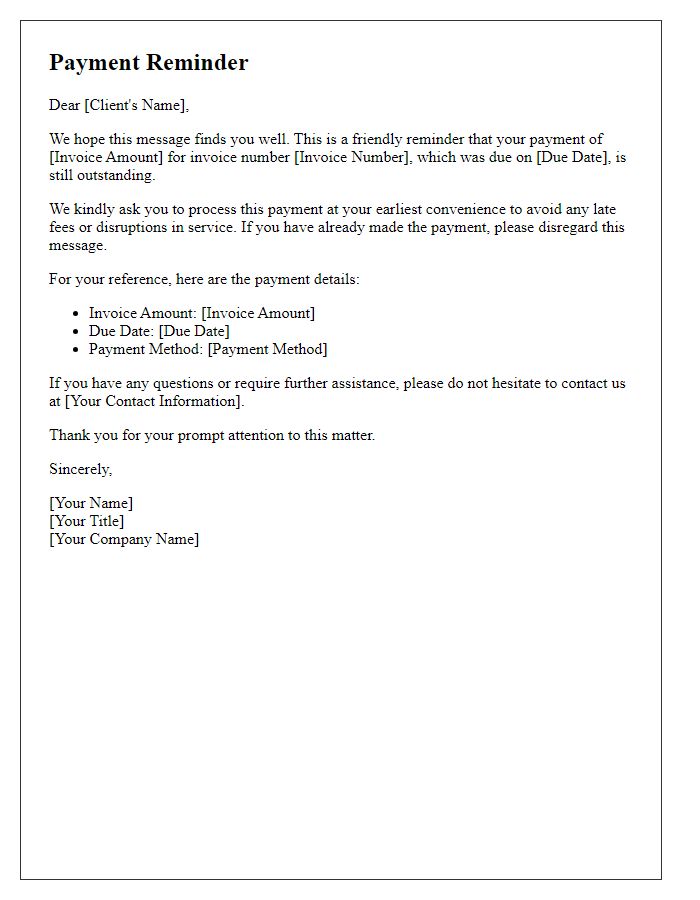

Payment deadline

A legal notice regarding uncollected debt emphasizes the urgency of repayment. Debt collection firms, like ACME Collections, often issue these notices after a payment deadline, commonly set at 30 days from the initial invoice date. The specific amount owed, for instance, $1,500 due from June 1, 2023, serves as a focal point in the notice. Recipients are usually individuals or businesses failing to meet their financial obligations, underscoring the importance of timely payments to avoid additional fees or legal consequences. Failure to address the notice could result in further actions, including court litigation and negative impacts on credit scores.

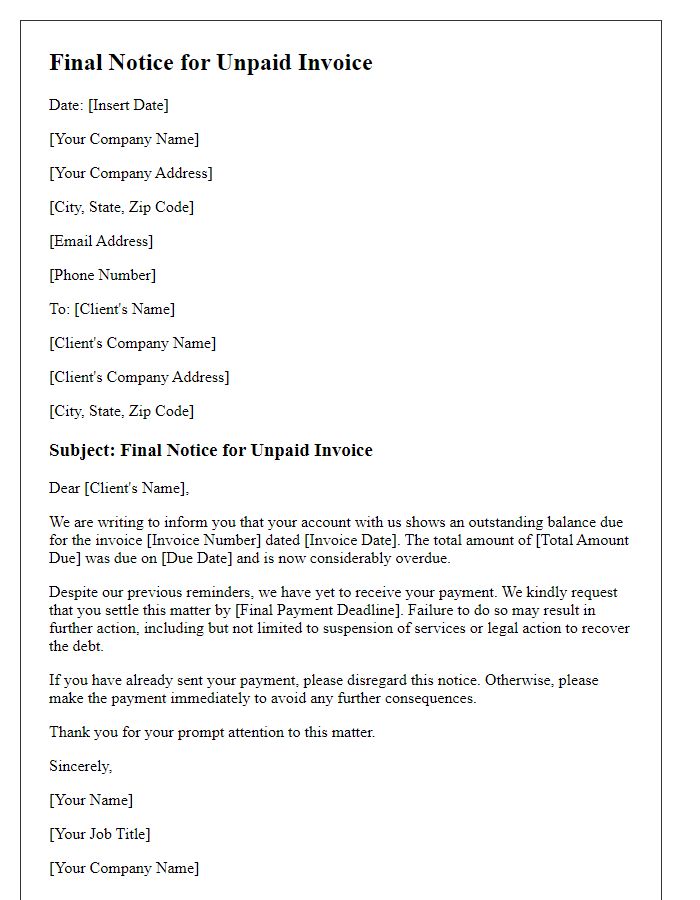

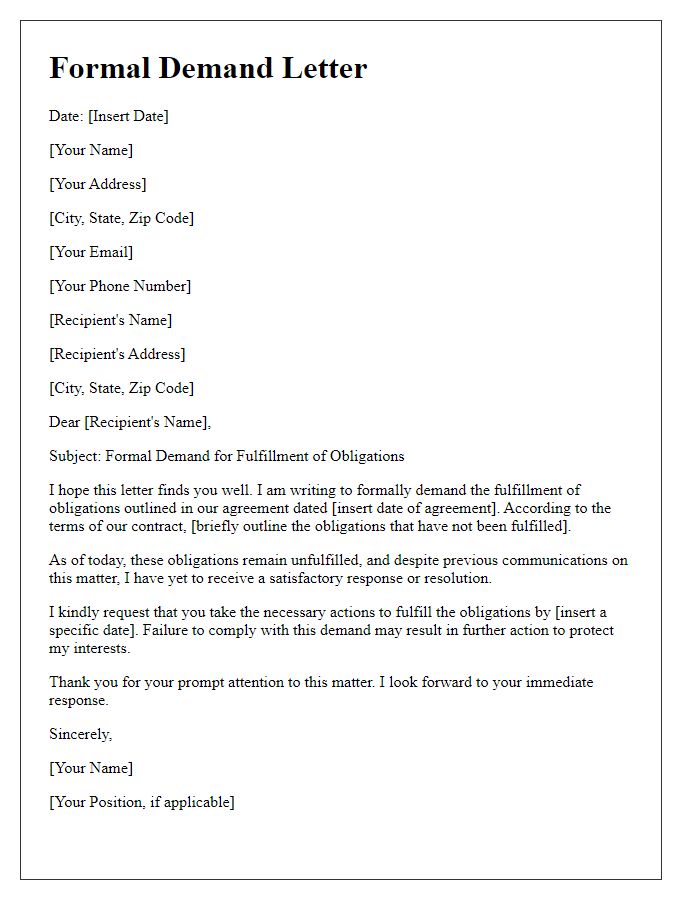

Legal consequences

Uncollected debt can lead to various legal consequences for individuals or businesses involved in the lending process. If a debtor fails to settle outstanding amounts, creditors may initiate legal actions, including small claims court proceedings in jurisdictions where the debt does not exceed specific limits, such as $10,000 in many states. Creditors often send a formal written notice, known as a demand letter, outlining the amount owed and providing a clear timeframe for payment, usually ranging from 30 to 60 days. Failure to respond can lead to further consequences, such as wage garnishment, where a portion of the debtor's earnings is directly deducted from their paycheck, or liens placed on property, giving creditors a legal claim against the debtor's assets. Additionally, unpaid debts can negatively impact the debtor's credit score, often resulting in lower credit ratings, which can affect loan applications and interest rates for years.

Contact information for queries

Uncollected debts often present significant challenges for businesses. In these situations, a legal notice serves as a crucial communication tool for asserting claims. This formal document typically includes essential elements such as the debtor's name, outstanding amount, and due date of the payment. Affected businesses should also provide contact information for queries, ensuring clarity in communication channels. Legal notices must adhere to state regulations, outlining consequences for non-compliance, which may include additional fees or escalation of debt collections. Timely issuance of such notices can motivate debtors to prioritize repayment, minimizing potential financial losses.

Comments