Hey there! If you've ever been in charge of ensuring that your organization adheres to all necessary regulations, you know how crucial a compliance audit is. It's not just a checklist; it's an essential step to uncover any potential gaps and bolster your operational integrity. In this article, we'll explore the key components of a letter template you can use to request a compliance audit report. Ready to elevate your compliance game? Let's dive in!

Recipient's contact information

A compliance audit report request requires specific recipient contact information, ensuring that communication remains streamlined. Essential details include the recipient's full name, company designation, and organization name, aiding clarity and professionalism. Furthermore, including a mailing address (street address, city, zip code) is crucial for formal documentation. Email addresses facilitate immediate communication, while phone numbers ensure direct contact for any follow-up inquiries. Accurate recipient information prevents delays and ensures that audits reach the appropriate personnel promptly.

Purpose of the request

A compliance audit report request aims to evaluate adherence to applicable regulations, standards, and internal policies within an organization. This assessment, crucial for maintaining operational integrity, requires a detailed examination of processes, documents, and records pertaining to compliance efforts. This request specifically targets areas such as financial reporting practices, safety protocols, and environmental regulations established by industry standards (for example, ISO 9001 for quality management). Key stakeholders, including regulatory bodies and internal governance teams, rely on the findings to ensure accountability and transparency, ultimately fostering trust with clients and minimizing legal risks. The report's insights can identify areas for improvement, align operations with legal requirements, and enhance organizational reputation in the market.

Specific documents or information needed

A compliance audit report request requires specific documentation to ensure comprehensive evaluation. Essential documents include the latest Financial Statements, typically covering the previous fiscal year, demonstrating income, expenses, and overall financial health. Policies and Procedures Manual detailing internal controls, compliance protocols, and risk management measures is vital. Employee Training Records should reflect compliance training sessions conducted within the past year, ensuring staff understands relevant laws and regulations. Additionally, examples of previous Compliance Reports from the past two years provide insights into past audit findings and corrective actions taken. Lastly, access to any Incident Reports or Compliance Violations documentation, including dates and resolutions, is crucial for assessing adherence to regulatory standards. This information collectively allows auditors to evaluate the organization's compliance effectively.

Deadline for submission

To ensure accuracy and thoroughness in the compliance audit, all departments must submit relevant documentation by the deadline. This deadline, set for April 15, 2024, requires timely collection and organization of records to assess adherence to internal standards and regulations. Documentation may include policies, procedures, training records, and previous audit findings, which are vital for a comprehensive evaluation. Ensuring all materials are submitted by this date will facilitate a smooth audit process and contribute to maintaining organizational accountability and transparency. Failure to comply may result in additional scrutiny or remediation efforts.

Compliance guidelines and standards

Compliance audits must adhere to specific guidelines and standards to ensure the integrity and effectiveness of the assessment process. Regulatory frameworks, such as ISO 9001 for quality management systems and Sarbanes-Oxley Act for financial reporting, serve as benchmarks for organizations. These guidelines outline protocols for data collection, assessment methodologies, and reporting structures. Timely submission of evidence, including transaction records and policy documents, contributes to a thorough evaluation. Compliance audit reports are essential for identifying discrepancies, providing corrective actions, and ensuring adherence to legal requirements. An effective compliance audit reinforces organizational accountability and enhances stakeholder trust.

Letter Template For Compliance Audit Report Request Samples

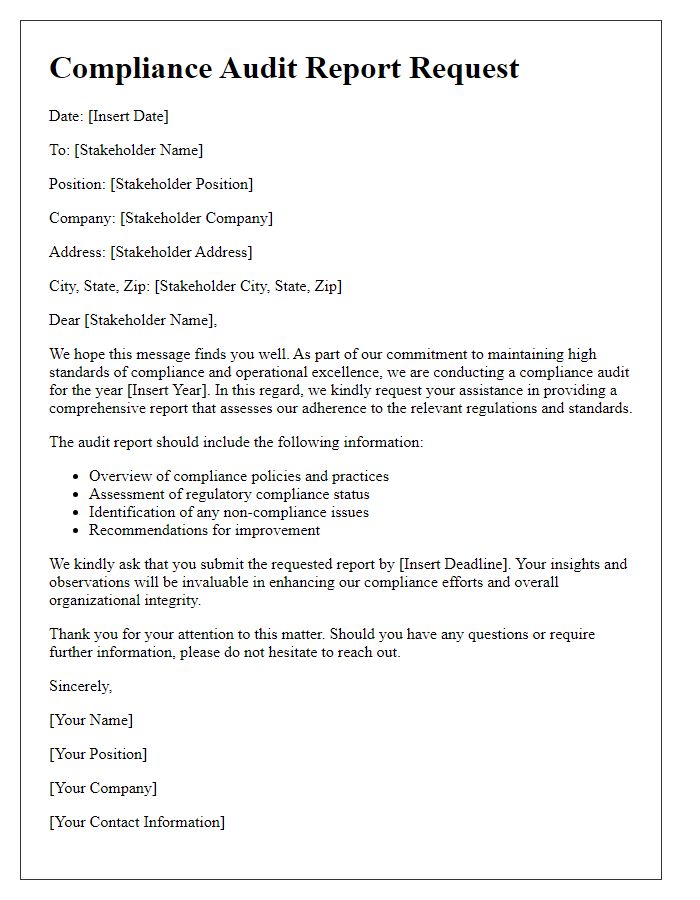

Letter template of compliance audit report request for external stakeholders.

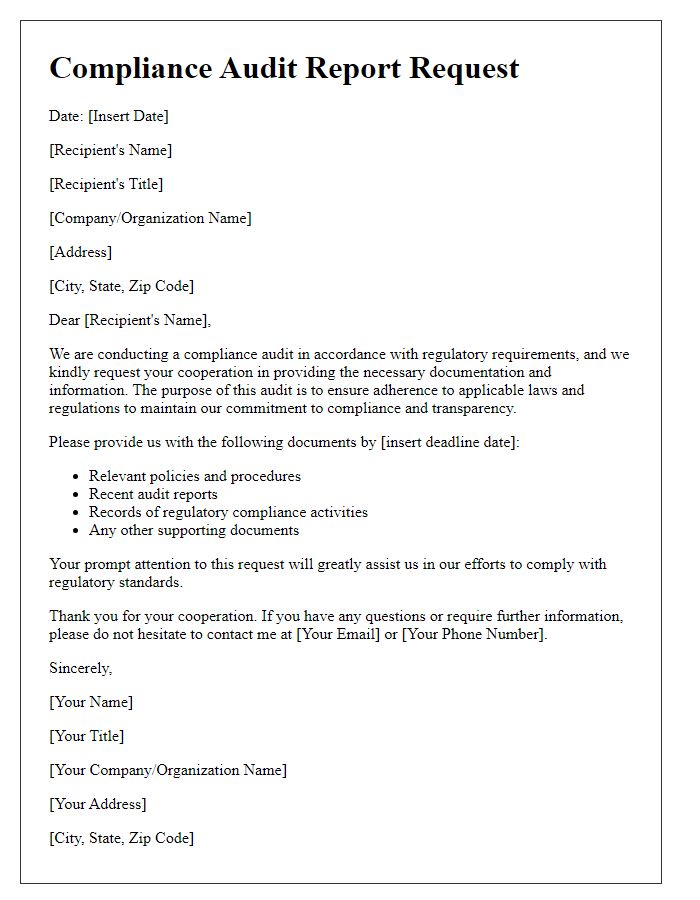

Letter template of compliance audit report request for regulatory purposes.

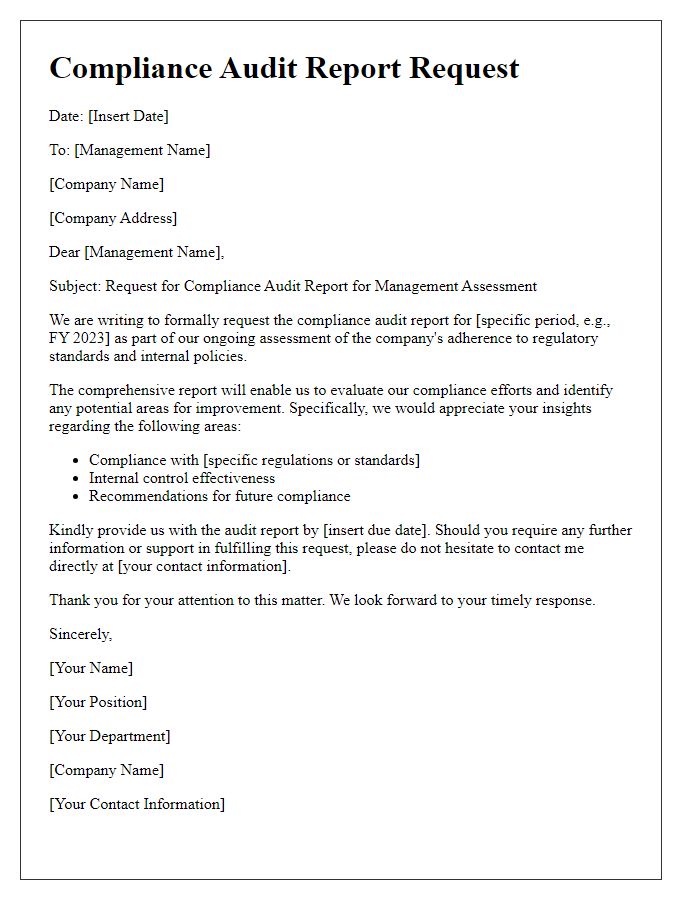

Letter template of compliance audit report request for management assessment.

Letter template of compliance audit report request for financial review.

Letter template of compliance audit report request for vendor evaluation.

Letter template of compliance audit report request for risk management analysis.

Letter template of compliance audit report request for operational review.

Letter template of compliance audit report request for quality assurance.

Comments