Are you ready to take control of your legacy? Estate planning might sound daunting, but it's simply a way to ensure that your wishes are honored and your loved ones are cared for after you're gone. Whether you're just starting out or revisiting your estate plan, it's essential to have the right tools and guidance in place. Join me as we explore the key elements of estate planningâread on to discover how you can secure your family's future!

Personal Information and Objectives

Estate planning involves considering key personal information, such as full name, date of birth, and social security number, to ensure accurate documentation. Goals may include distributing assets like real estate in California, valued at $500,000, or retirement accounts exceeding $200,000 to beneficiaries. Other objectives encompass minimizing estate taxes through strategic plans, such as establishing a family trust, and providing health care directives that outline medical preferences in case of incapacitation. Personal relationships also play a crucial role, as considerations for guardianship of minor children must be clearly articulated. Overall, a comprehensive understanding of individual circumstances and desired outcomes is essential for effective estate planning.

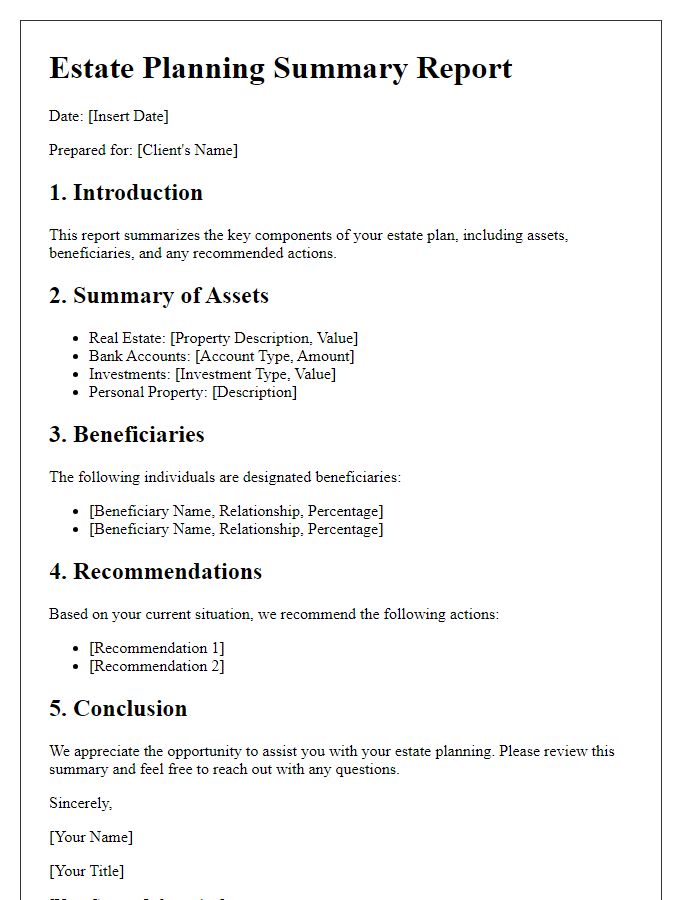

Asset Inventory and Evaluation

Creating a comprehensive asset inventory is crucial for effective estate planning. An asset inventory includes detailed information about possessions such as real estate (like a family home in San Francisco worth $1.5 million), financial accounts (including savings accounts, brokerage accounts totaling $500,000), retirement funds (such as a 401(k) valued at $250,000), and personal valuables (like jewelry assessed at $100,000). Evaluating these assets involves determining their current market values and any outstanding debts or liens associated with them. This process helps in establishing an accurate picture of the total estate value, which is essential for tax purposes and for ensuring that beneficiaries receive their intended inheritance. Key considerations include appraisals for high-value items and documentation of all assets, ensuring clarity and accuracy in the estate plan.

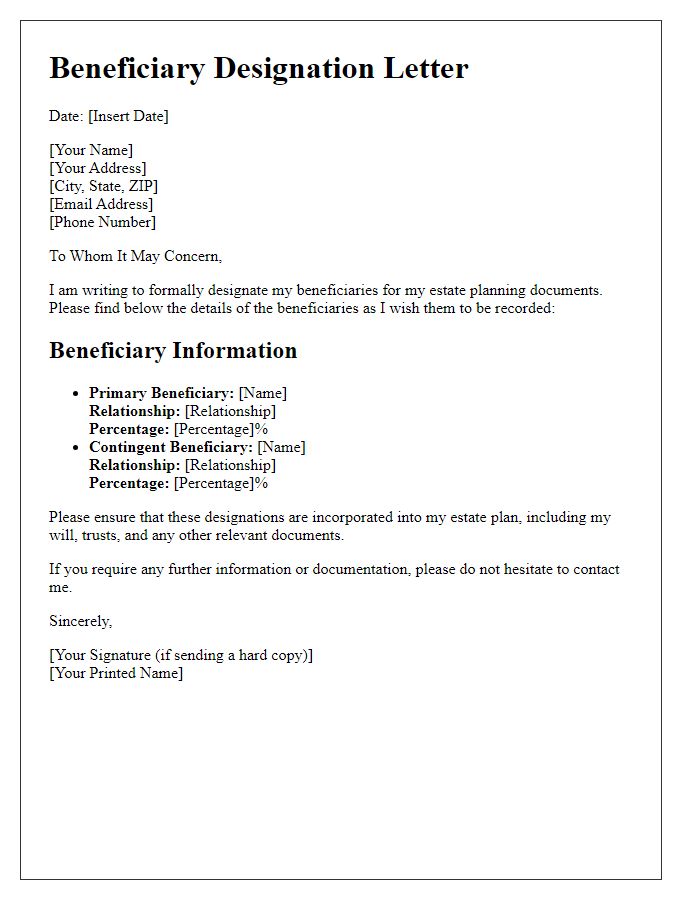

Beneficiary Designations

Beneficiary designations play a crucial role in estate planning, ensuring the intended individuals inherit specific assets following an individual's passing. Common assets subject to beneficiary designations include life insurance policies, retirement accounts (like 401(k) plans or IRAs), and bank accounts. Accurate designations keep assets out of probate, simplifying the transfer process. Regular reviews of these designations are necessary, particularly after major life events such as marriage, divorce, or the birth of a child. Legal entities, such as trusts, can also be named as beneficiaries, providing additional layers of control over the distribution of assets. Understanding the implications of beneficiary designations is vital for effective estate planning, ultimately impacting heirs in various ways.

Legal Documents and Instruments

Estate planning involves important legal documents and instruments that secure an individual's wishes. A will serves as a fundamental legal document outlining the distribution of assets after death, typically facilitating the probate process in courts such as the Superior Court. Trusts, including revocable living trusts, offer mechanisms to manage and streamline asset transfer, potentially bypassing probate. Health care proxies empower designated individuals to make medical decisions during incapacitation situations, ensuring compliance with preferences outlined in advance directives, sometimes called living wills. Powers of attorney grant legal authority to designated agents to manage financial affairs, ensuring continuity in decision-making during incapacitation events. Additionally, beneficiary designation forms, often associated with retirement accounts or life insurance policies, play a vital role in designating asset distribution without going through probate courts.

Tax Implications and Strategies

Estate planning involves critical considerations regarding tax implications and strategies for effective wealth transfer. When individuals prepare their estate plans, they must evaluate federal estate taxes, which can be as high as 40% on estates valued above $12.06 million as of 2022. Additionally, state-level estate and inheritance taxes can vary significantly; for instance, New Jersey imposes inheritance taxes that range from 0% to 16%, depending on the relationship between the deceased and their heirs. Utilizing strategies like gifting, where individuals can transfer up to $17,000 per recipient annually without incurring taxes, can significantly reduce the taxable estate over time. Establishing trusts, such as irrevocable life insurance trusts (ILITs), may protect life insurance proceeds from estate taxes, thus preserving wealth for beneficiaries. Understanding the implications of capital gains tax upon the sale of inherited assets further emphasizes the importance of thorough tax planning in an estate strategy.

Comments