Dealing with a loved one's estate after they've passed can feel overwhelming, but it's an essential process that can provide clarity and closure. Whether you're handling wills, assets, or debts, understanding the steps involved is crucial for a smooth transition. This article aims to guide you through the complexities of post-mortem estate handling, ensuring you're well-equipped to honor their wishes. So, let's dive in and explore the key elements that will help you navigate this sensitive journey.

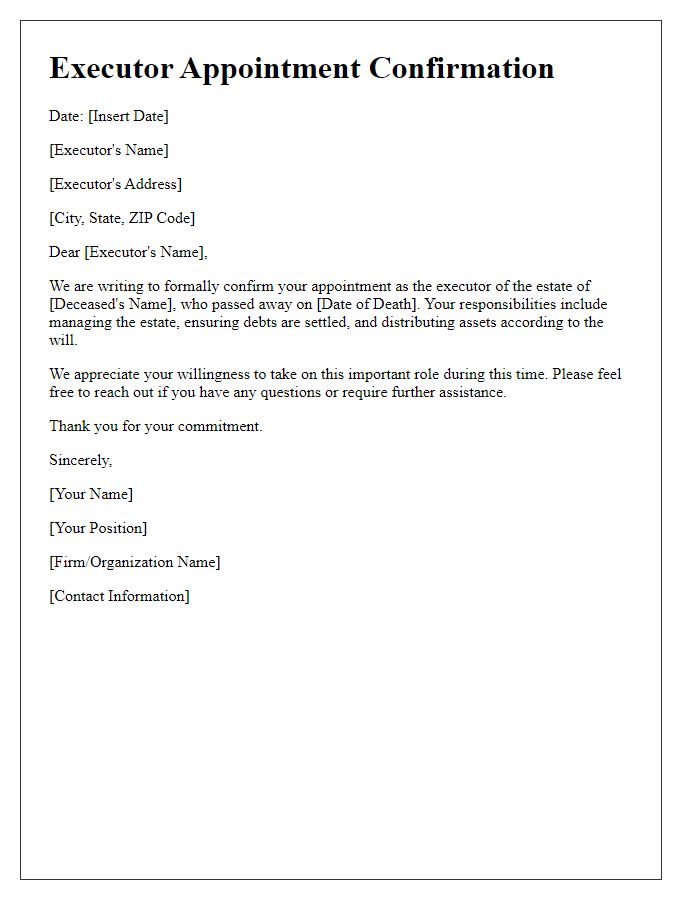

Executor Contact Information

Handling post-mortem estates requires effective communication. Executors, the appointed individuals responsible for managing the deceased's estate, must provide accurate contact information. This includes full name, mailing address, phone number, and email address. Notably, clarity in communication is vital during this sensitive process to ensure beneficiaries receive pertinent updates regarding asset distribution, debts, and taxes. Executors often deal with various entities, such as financial institutions, legal advisors, and government agencies, creating a need for organized contact channels. Proper documentation also aids in mitigating potential disputes among heirs, reinforcing the importance of transparency and accessibility throughout the estate handling period.

Estate Reference Number

Post-mortem estate handling requires meticulous organization and adherence to legal protocols. Estate Reference Number (ERN) serves as a unique identifier for the deceased individual's assets and liabilities, facilitating efficient management during probate processes. Executors must gather documents such as death certificates and wills, meticulously outlining the deceased's wishes. Furthermore, property appraisals, tax assessments, and outstanding debts must be documented to clarify the estate's net value. Timely communication with beneficiaries and creditors is essential to ensure a transparent distribution process. Asset management varies based on jurisdiction, potentially involving court interventions for disputes, especially in cases of contested wills or unresolved claims. Executors play a pivotal role in adhering to legal responsibilities, making estate handling a complex yet critical task for honoring the deceased's legacy.

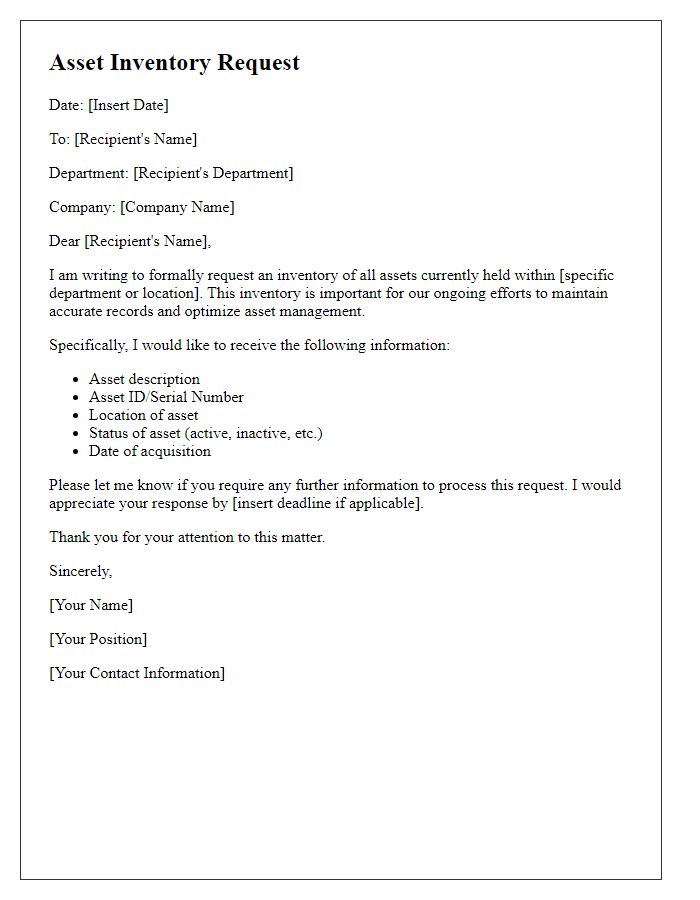

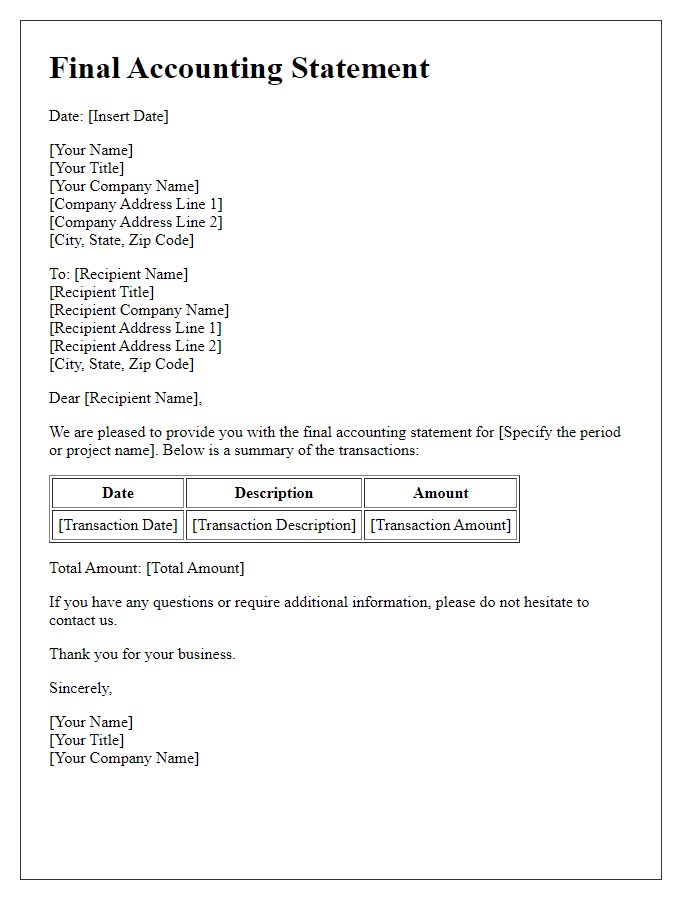

Detailed List of Assets and Liabilities

A comprehensive post-mortem estate handling involves creating a detailed inventory of assets and liabilities, critical for the estate's settlement process. The list of assets may include real estate properties, such as a family home located in Springfield valued at $350,000, a vacation condo in Miami worth $200,000, and a collection of vintage cars estimated at $80,000. Additionally, financial assets encompass bank accounts, investment portfolios containing stocks from major corporations, and retirement accounts amounting to approximately $250,000. On the liabilities side, outstanding debts such as a mortgage of $150,000 on the primary residence, credit card debts totaling $25,000, and any personal loans or medical bills must be documented. This detailed assessment assists in clarifying the overall estate value and ensuring smooth distribution to beneficiaries, adhering to legal obligations.

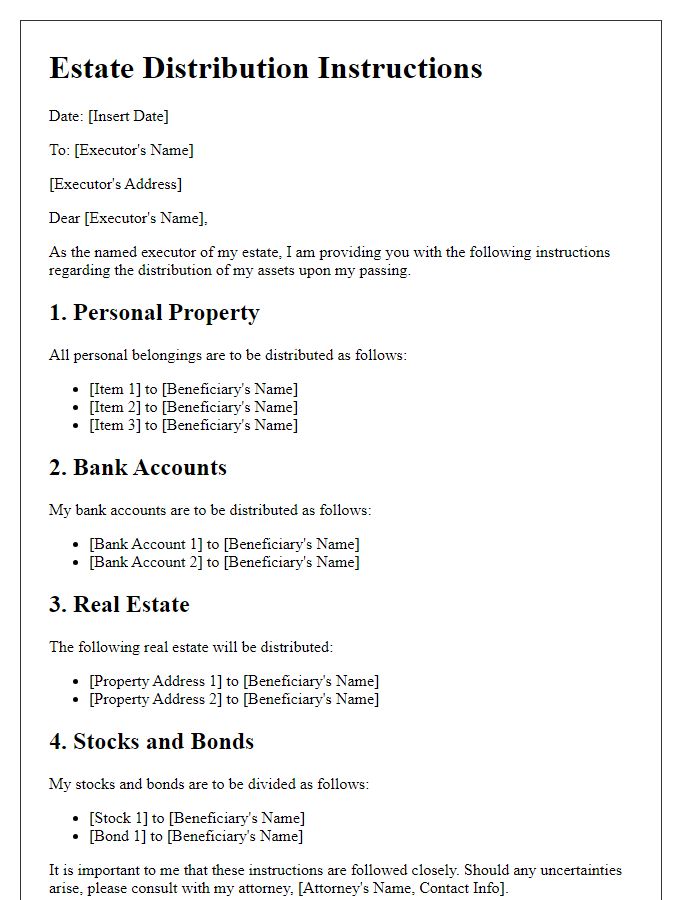

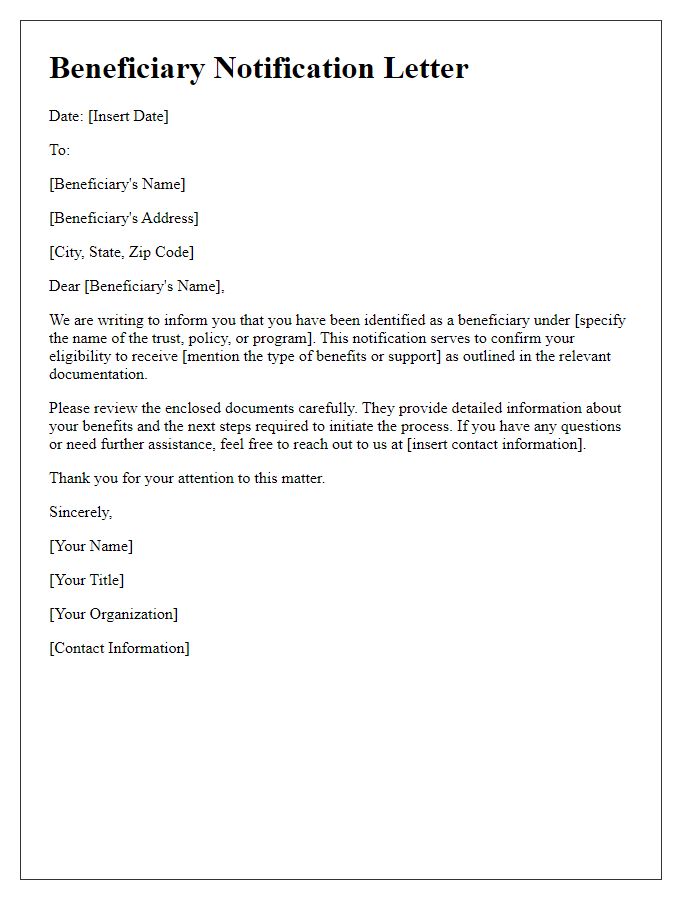

Beneficiaries and Distribution Plans

Beneficiaries of an estate play a crucial role in the distribution process following the death of an individual, often referred to as the decedent. Named in a legal document known as a will, these individuals or entities, like family members, friends, or charities, receive specific assets and properties from the estate located in jurisdictions such as California or New York. Distribution plans outline the method by which the estate's assets--ranging from financial accounts to real estate--will be allocated among beneficiaries. Executors or administrators, appointed by the court or designated in the will, oversee this process and ensure adherence to local laws, including probate regulations. The timeline for distribution can vary, often taking several months, depending on asset complexity and potential disputes among beneficiaries. Tax implications, such as estate taxes, also need to be considered, impacting the net value received by each beneficiary. Proper documentation and communication are essential during this process to prevent misunderstandings and ensure a smooth transition of assets.

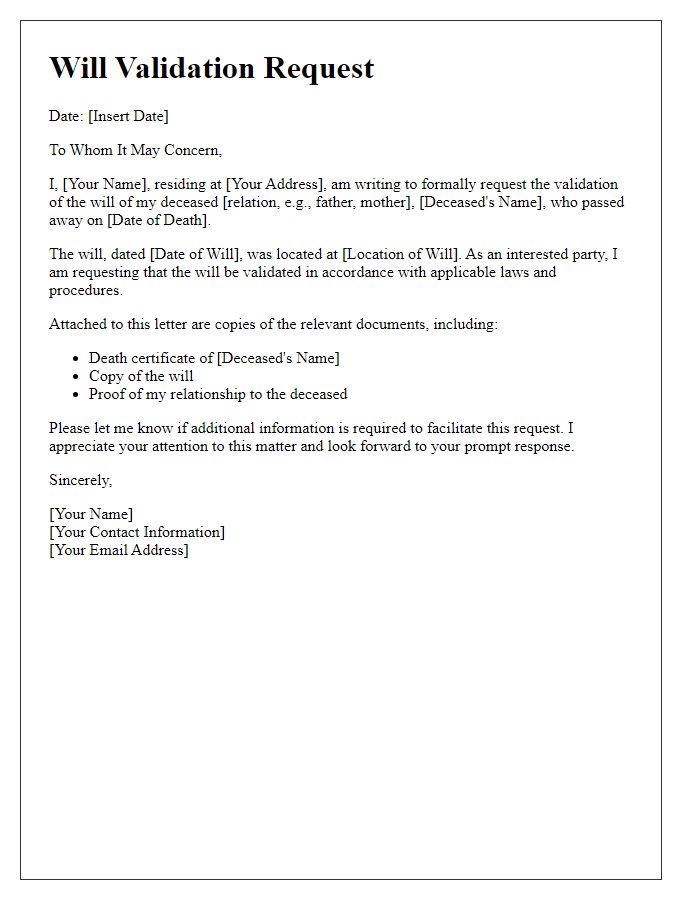

Legal Compliance and Documentation Requirements

Handling post-mortem estate processing involves meticulous legal compliance and thorough documentation requirements. The legal framework typically includes identification of the decedent's assets, such as real estate (property locations and values), bank accounts (institution names and balances), and personal belongings (valuables like jewelry or collectibles). Executors must gather essential documents, including a death certificate from local authorities, a will verifying the decedent's wishes, and a list of beneficiaries legally entitled to the estate. Various state laws dictate the probate process (legal verification of a will) and may require filing with specific court systems. Additionally, tax responsibilities, such as federal estate tax forms (IRS Form 706) and state inheritance taxes (state-specific forms), must be fulfilled within mandated timelines to avoid penalties. Proper record-keeping throughout is crucial to ensure transparency and compliance with legal standards.

Comments