Hey there! We all know that sometimes life gets busy and payments can slip our minds. That's why sending a friendly payment reminder is essential to keep everything on track. In this article, we'll provide you with a handy letter template that helps you craft the perfect reminder while maintaining a positive relationship with your client. So, let's dive in and explore some effective strategiesâread on!

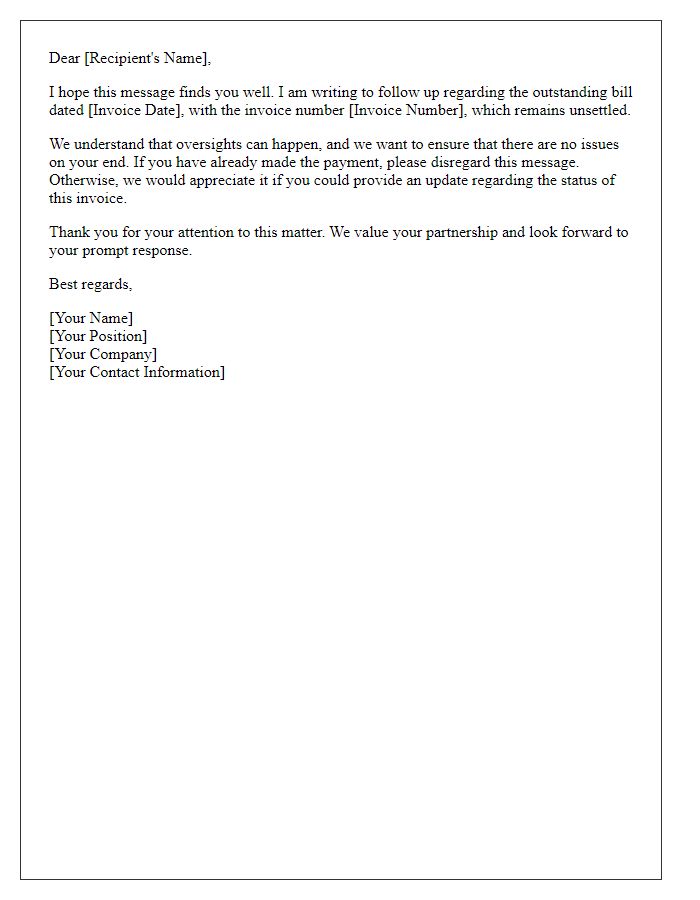

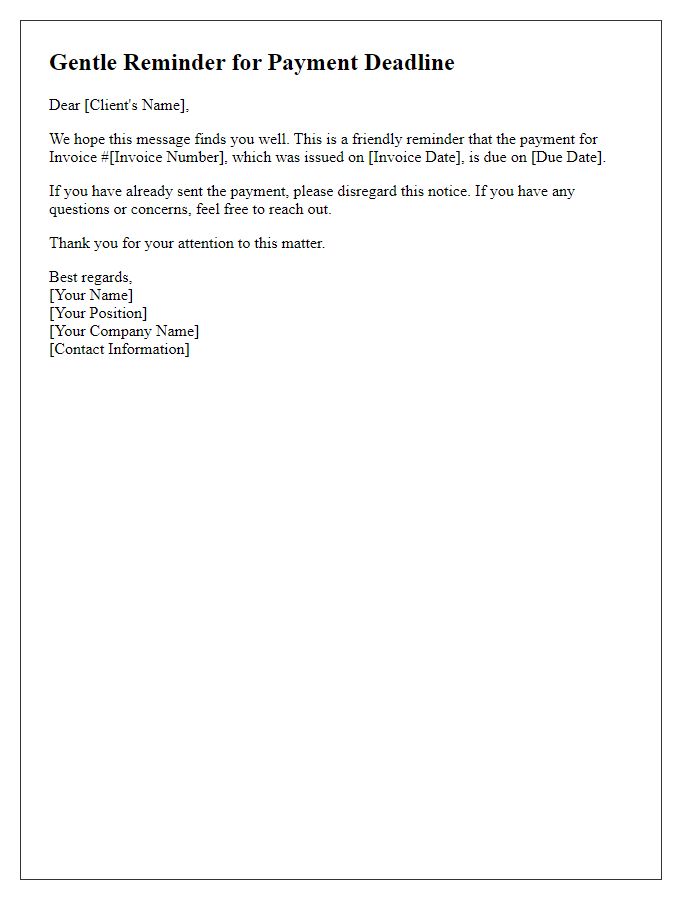

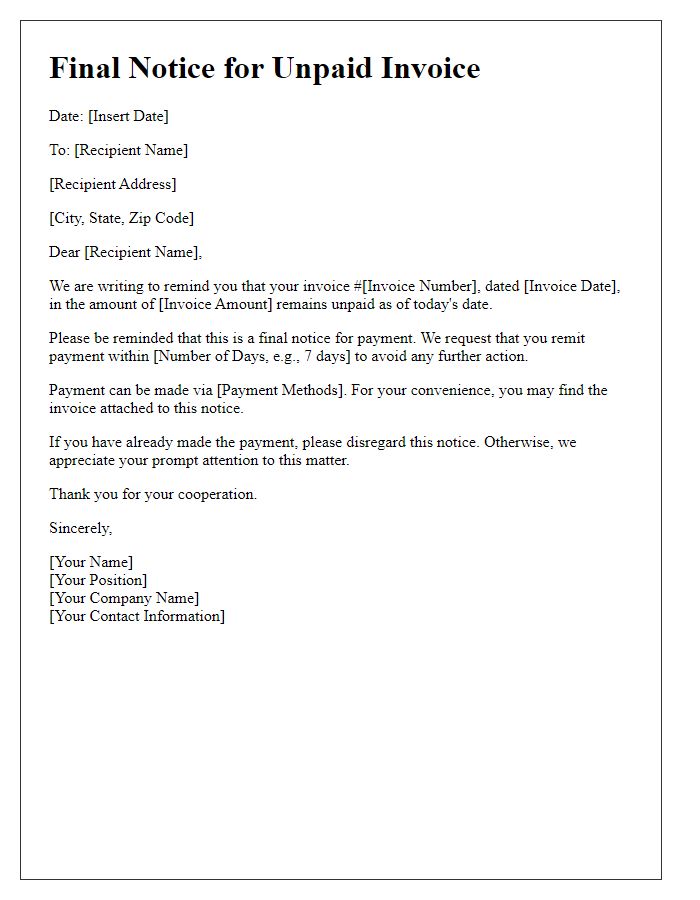

Professional tone and language

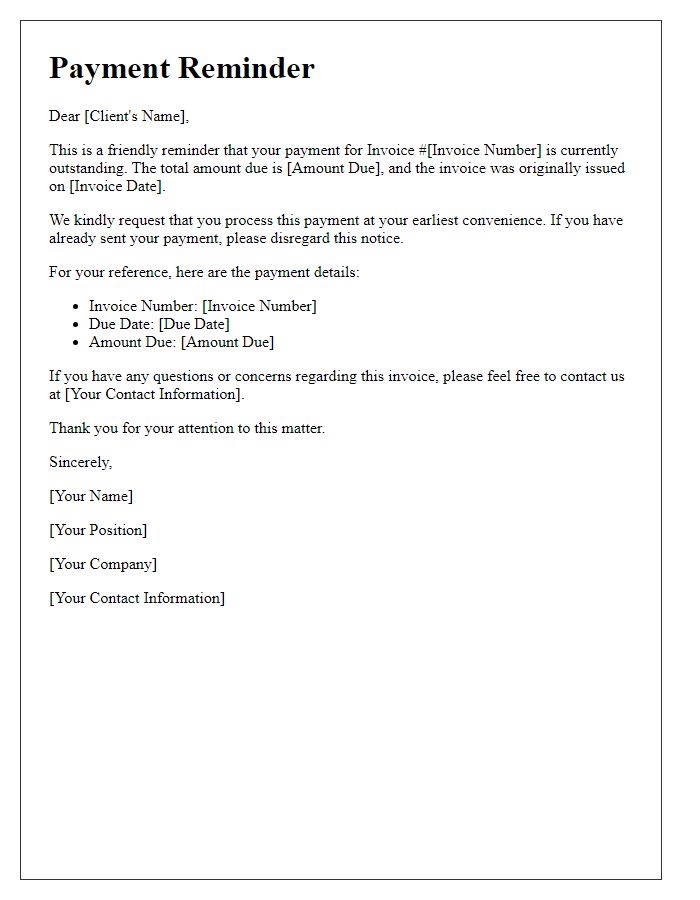

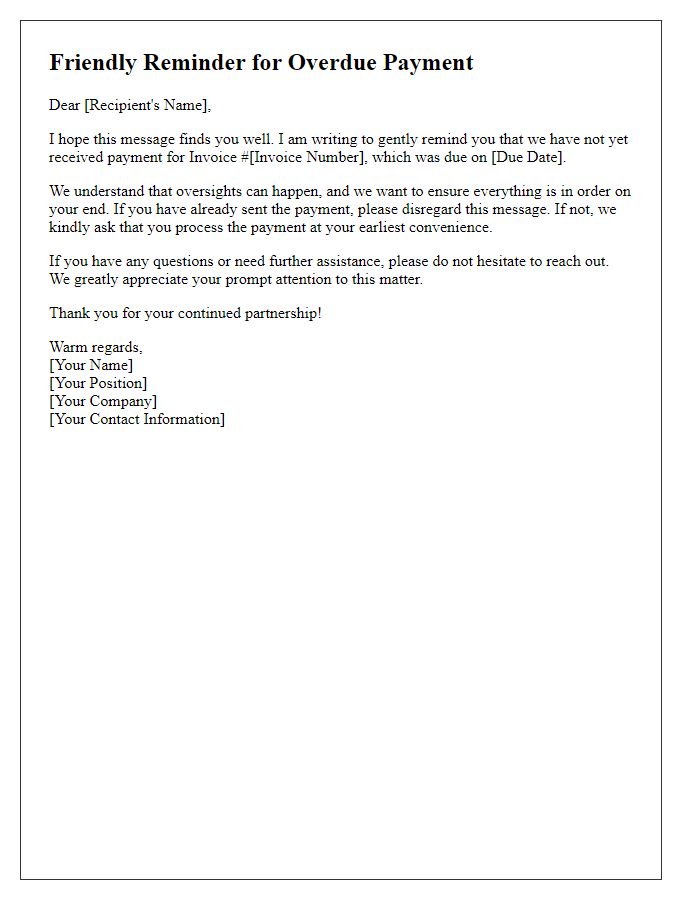

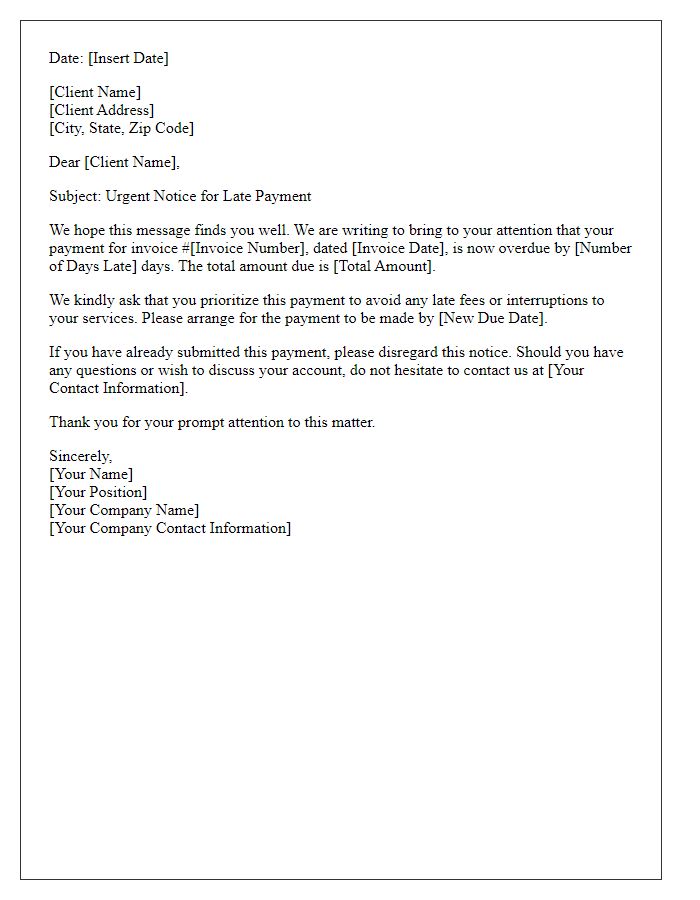

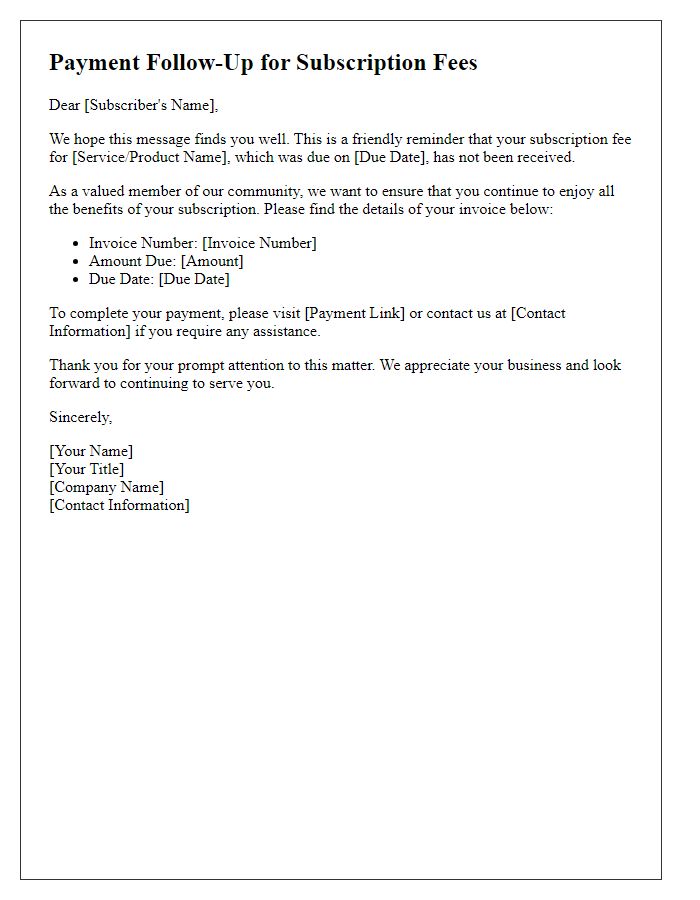

A payment reminder is essential for maintaining healthy cash flow in business operations. Timely payments ensure the continuity of services or products offered. For businesses in various sectors, including retail and services, issuing payment reminders fosters accountability among clients. A professional tone is vital for effective communication, enhancing relationships and minimizing potential conflicts. Clear details, such as invoice numbers, due dates, and specific payment amounts, should be included to avoid confusion. Polite language, along with a friendly reminder of the agreed terms within contracts, promotes professionalism while encouraging prompt payment. Utilizing tools like email or invoicing software can streamline this process, ensuring records are kept accurately for transparency. Effective follow-ups can improve overall financial management for businesses.

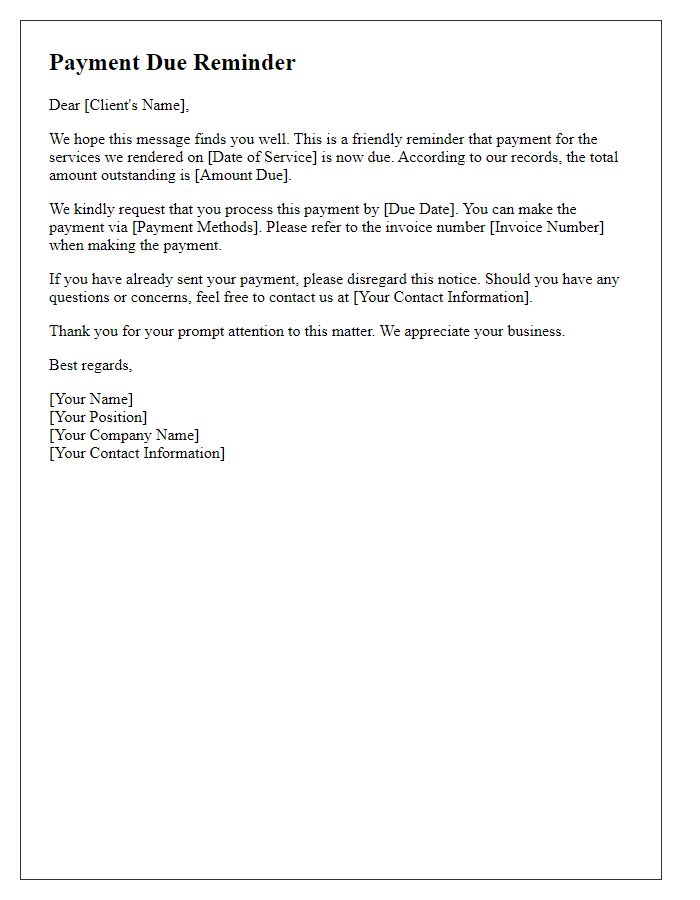

Clear subject line

A client payment reminder typically highlights overdue invoices clearly. Professional tone is essential. Include relevant details such as invoice number, amount due, and payment deadline. Specify payment methods accepted to facilitate prompt action. Adding a courteous note expressing appreciation for past business fosters positive relations. Clarity in communication ensures understanding, prompting timely payments. The use of reminders, sent at intervals (e.g., 30 days overdue), encourages adherence to payment schedules. Solutions for disputes or further inquiries should also be readily available.

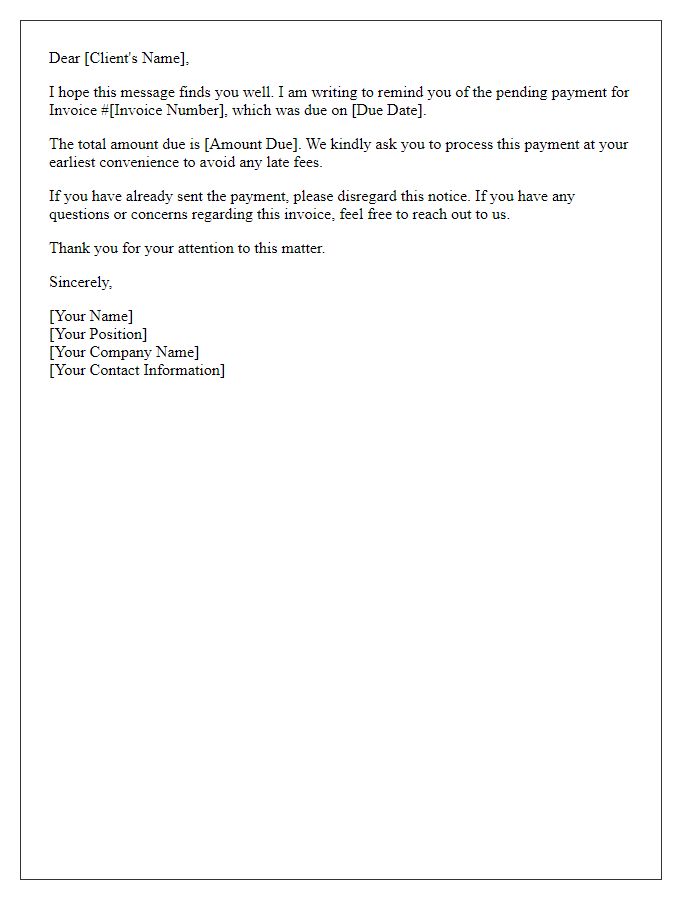

Specific due date and amount

A payment reminder is essential for maintaining healthy cash flow in business transactions. Payment reminders typically indicate a specific amount due, which highlights the importance of timely financial management. For instance, an invoice amounting to $2,500 due on October 30, 2023, needs prompt attention to avoid potential late fees. Regular reminders can alleviate misunderstandings and enhance client relationships, ensuring payments are received for services rendered, such as website development or consulting fees, which sustain business operations.

Payment methods and instructions

When managing client payments, clear communication regarding payment methods and instructions is essential to ensure timely transactions. Acceptable payment methods include wire transfers (notable banks such as Chase and Bank of America offer these services), credit cards (Visa, MasterCard, and American Express are widely accepted), and electronic payment platforms like PayPal or Stripe. Ensure to provide unique account details, such as bank routing numbers or email addresses for PayPal transactions, to facilitate accurate payments. Include a deadline for the payment submission, typically 30 days from the invoice date, to encourage prompt action. Emphasize the importance of including invoice numbers in any reference fields to streamline reconciliation processes.

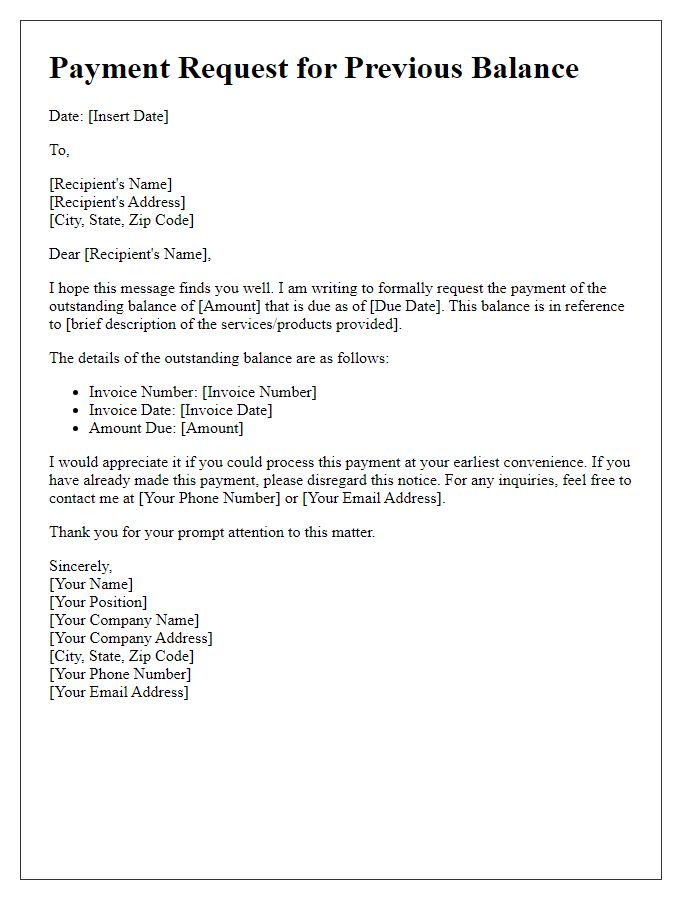

Contact information for queries

A payment reminder serves as a crucial financial communication tool for businesses. It often includes specific details about the outstanding invoice, such as the invoice number, total amount due, and the due date, which is typically found within 30 days of the invoice date. Businesses may list contact information for client queries prominently, ensuring clients know whom to reach out to for assistance. Common avenues for inquiries include email addresses (often part of the company's domain, providing a professional appearance) or dedicated customer service phone numbers available during business hours. This structured approach fosters clearer communication and improves the chances of timely payments.

Comments