Are you contemplating withdrawing your investment but unsure where to start? Crafting a well-structured withdrawal request letter can ensure a smooth process while clearly communicating your intentions. In this article, we will guide you through the essential elements to include, helping you articulate your request professionally yet warmly. Join us as we explore the steps to create an effective letter that meets your needs!

Account information verification

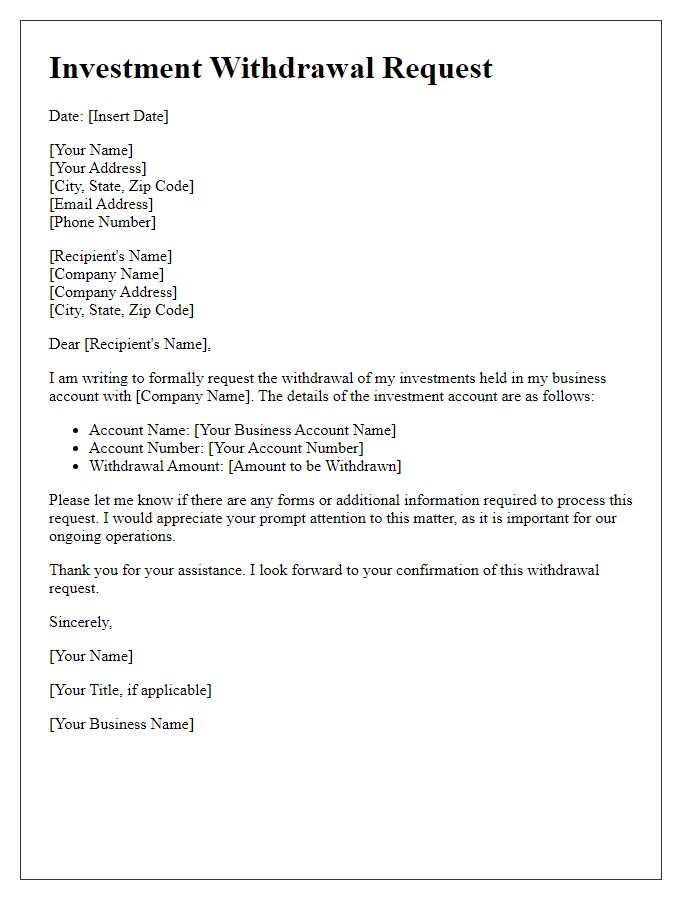

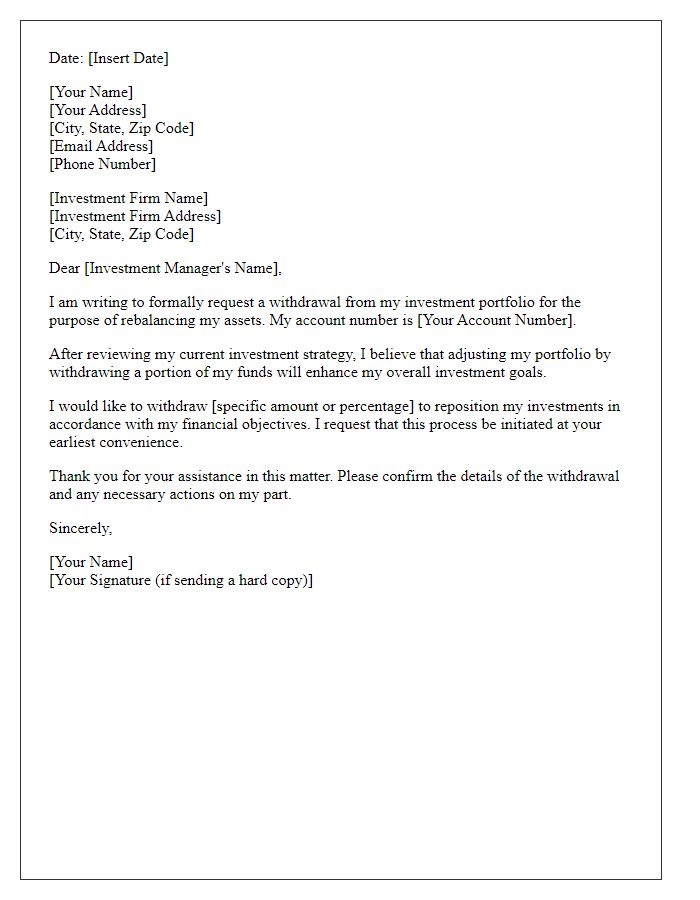

Requesting the withdrawal of investments requires a comprehensive verification of account information to ensure security and accuracy. Investors should provide specific details such as account number (e.g., 123456789), full name (e.g., John Doe), and registered email (e.g., johndoe@email.com). Additionally, including a reason for withdrawal, such as financial needs or market changes, can expedite the process. Documentation may be needed, such as proof of identity (e.g., government-issued ID) and potentially a withdrawal form specific to the financial institution. Clear communication with the investment firm, such as Fidelity Investments or Vanguard, is essential for successful processing. Timeframes for withdrawals vary, typically ranging from 3-10 business days, depending on financial policies. Accurate information submission ensures compliance with regulations and protects against fraud.

Withdrawal amount specification

Investors often need to specify withdrawal amounts when requesting funds from their investment accounts. Common scenarios include withdrawing a portion, such as $5,000 or a total balance of $20,000. This process typically involves filling out forms that detail personal identification information, account numbers linked to the investment firm, and withdrawal preferences. Depending on the financial institution or investment firm regulations, withdrawal methods may vary, including options for direct bank transfers or checks. Investors should consider fees associated with withdrawals, which can impact the overall amount received. Additionally, market conditions and investment performance may influence withdrawal timings and amounts, ensuring that investors are making informed decisions based on their financial needs and investment goals.

Contact details for confirmation

Investment withdrawal requests necessitate precise communication and confirmation, especially for financial institutions operating under regulations. Investors should clearly present personal contact details for efficient processing and security verification. Key information includes full name (as per investment records), account number (unique identifier for transactions), and a valid email address (for correspondence). Additionally, providing a mobile number (for real-time updates or required confirmations) can expedite the withdrawal process. Including a physical address (for formal correspondence) can enhance the security of the transaction and ensure that all parties have appropriate means of communication.

Signature for authorization

Investment withdrawal requests require precise documentation to ensure proper processing. An authorization signature is essential for these financial transactions to verify the requestor's identity and intent. Institutions typically need the account holder's full name, account number, and the withdrawal amount, along with the date and a clear statement of the request. The signature should match the one on file to maintain security and prevent unauthorized withdrawals. This process ensures compliance with regulatory standards and protects both the investor and the financial institution from potential fraud.

Processing timeline and acknowledgment

The investment withdrawal request process involves several critical steps to ensure accurate and timely transactions. Investors, upon submitting their requests, typically receive an acknowledgment confirmation within 1 to 3 business days, depending on the investment firm's protocols. The processing timeline may vary across different investment entities, with some completing withdrawals within 7 to 14 business days, considering factors such as the nature of the investment and withdrawal methods. For example, a mutual fund withdrawal might take longer due to necessary redemption processes. Additionally, detailed verification procedures are in place to confirm the client's identity and ensure compliance with relevant regulations, minimizing potential fraud. Investors can monitor their request status through the firm's online platform or by contacting customer service directly for updates.

Letter Template For Investment Withdrawal Request Samples

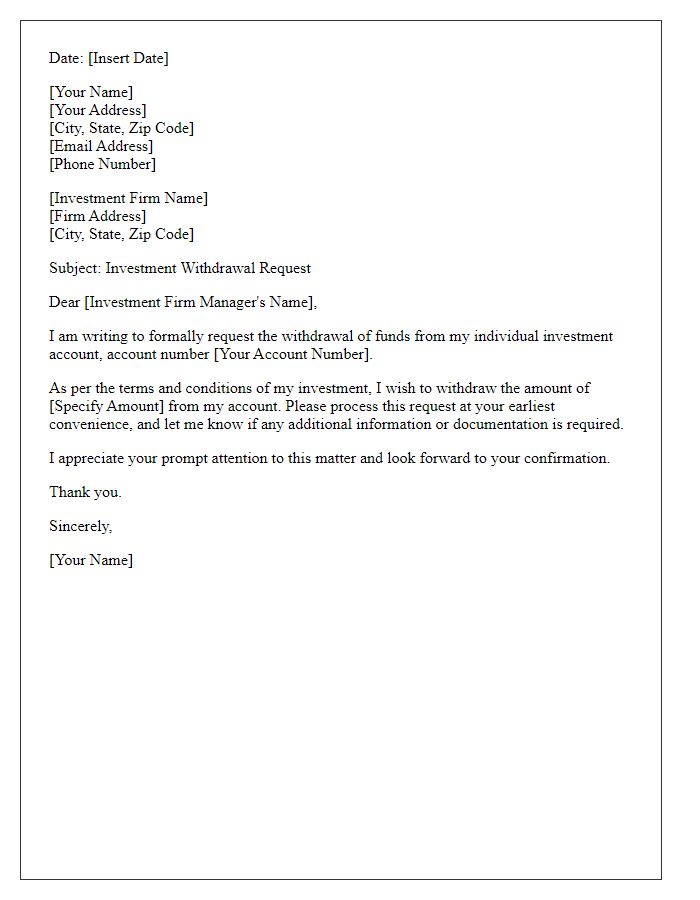

Letter template of investment withdrawal request for individual account holders

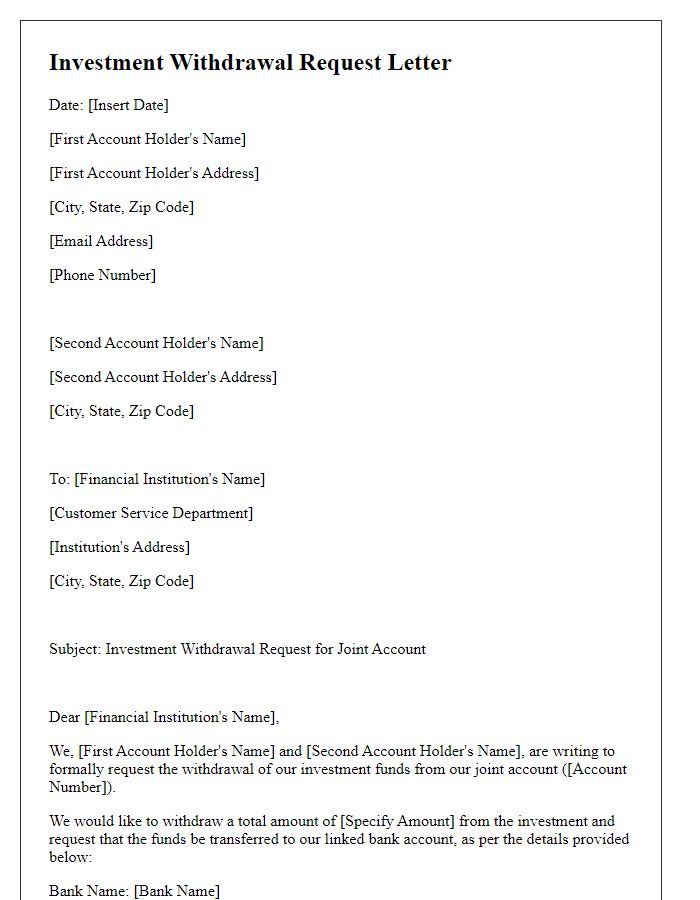

Letter template of investment withdrawal request for joint account holders

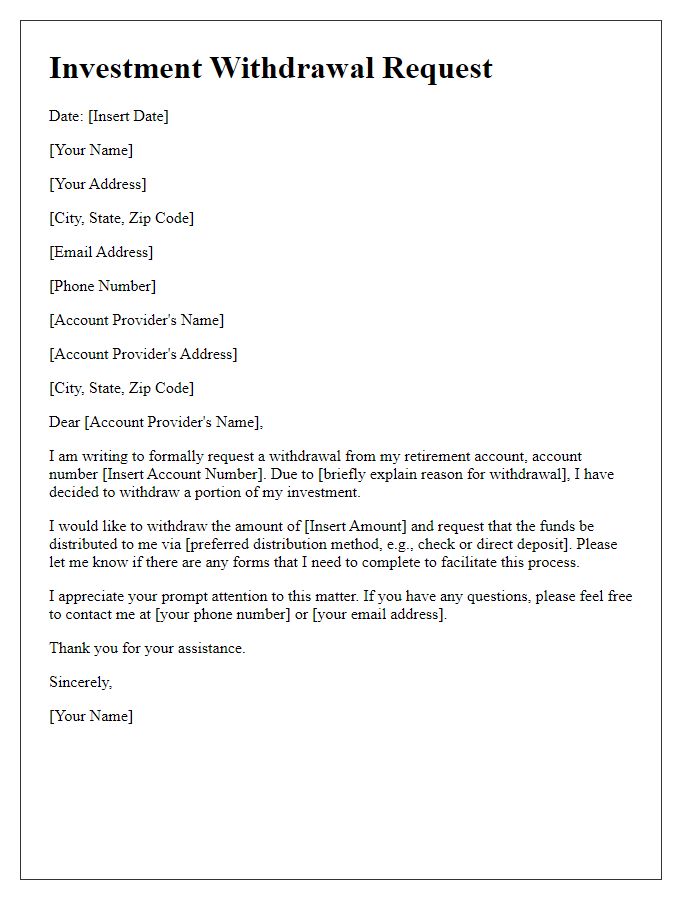

Letter template of investment withdrawal request for retirement accounts

Letter template of investment withdrawal request due to financial hardship

Letter template of investment withdrawal request for educational purposes

Letter template of investment withdrawal request for health-related issues

Letter template of investment withdrawal request for unexpected emergencies

Comments