Are you curious about exploring the world of bond investments? You're not aloneâmany people are looking for stable, low-risk options to diversify their portfolios. Bonds can provide you with fixed income over time while playing a key role in wealth preservation. If you're eager to learn more about how to get started and what to consider when investing in bonds, let's delve deeper into this exciting opportunity!

Subject line optimization.

Optimizing subject lines for bond investment inquiries can enhance open rates and capture attention effectively. Suggested subject lines include: "Inquiry About Current Bond Investment Opportunities", "Exploring Bond Investment Options for Optimal Returns", "Request for Information on Bond Investment Strategies", "Interest in Diversifying Portfolio with Bonds", and "Seeking Insights on Latest Bond Market Trends". Each subject line highlights a clear purpose, creating an expectation of relevant financial content and engaging the recipient promptly.

Recipient and sender details.

The bond market offers a variety of investment opportunities, including government bonds, corporate bonds, and municipal bonds, each with distinct risk profiles and return potentials. Investors, like individuals or institutional entities, can explore options such as U.S. Treasury bonds, which are considered low-risk, or high-yield corporate bonds, which may carry greater risk but offer higher interest rates. The interest rates, typically expressed as yield, can fluctuate based on market conditions, economic indicators, and monetary policy decisions. Additionally, factors such as bond maturity dates (ranging from short-term to long-term) and credit ratings assigned by agencies like Moody's or Standard & Poor's can significantly impact investment choices. Understanding these components is crucial for making informed decisions in the bond investment landscape.

Clear purpose statement.

Investors seeking to maximize returns through fixed-income securities may find bond investments appealing. Certain bonds, such as U.S. Treasury bonds, are known for their low risk and stable yields, typically ranging from 1% to 3% annually. Corporate bonds, on the other hand, offer higher interest rates, often between 3% and 7%, depending on the issuer's creditworthiness. Understanding bond ratings from agencies like Moody's or Standard & Poor's can inform investment decisions regarding risk assessment. The bond market, valued at over $46 trillion globally, offers various options, including municipal bonds, which provide tax advantages. An inquiry into specific bond offerings may yield insights into maturity dates, coupon rates, and the overall economic factors influencing bond prices.

Request for information or clarification.

Bond investment options often include a variety of financial instruments, such as government bonds, corporate bonds, and municipal bonds, each with unique risks and returns tailored to investors' preferences. Investors should consider key factors such as yield percentages (expressed as a fixed rate or variable rate), maturity dates (ranging from short-term, under five years, to long-term, over ten years), and credit ratings (assigned by agencies like Moody's or S&P) to assess the bond's creditworthiness. Additionally, understanding market conditions, such as interest rate fluctuations and inflation rates, are critical in determining the overall impact on bond value and investment strategy. Potential investors may seek clarification on the bond's liquidity (ease of buying or selling), tax implications (tax-exempt status for certain municipal bonds), and associated fees (management fees or brokerage commissions) to make informed decisions before proceeding with their investment plan.

Contact and follow-up options.

Bond investment inquiries often require detailed communication methods and follow-up strategies. Investors seeking information about specific bond offerings, such as U.S. Treasury bonds or municipal bonds, might contact financial institutions like Goldman Sachs or JPMorgan Chase. Preferred communication channels include email, phone calls, or online chat systems on the investment firm's website. Investors should consider establishing a timeline for follow-up, typically within seven to ten business days after the initial inquiry, to ensure timely responses. Additionally, maintaining records of all communications, including dates, names of representatives, and information discussed, will aid in tracking the progress of investment inquiries.

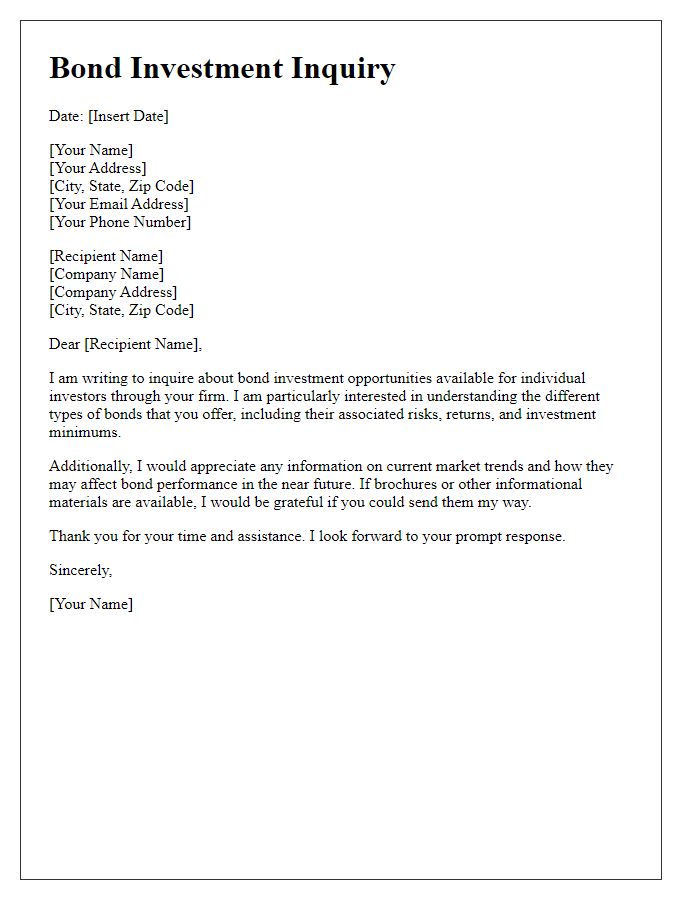

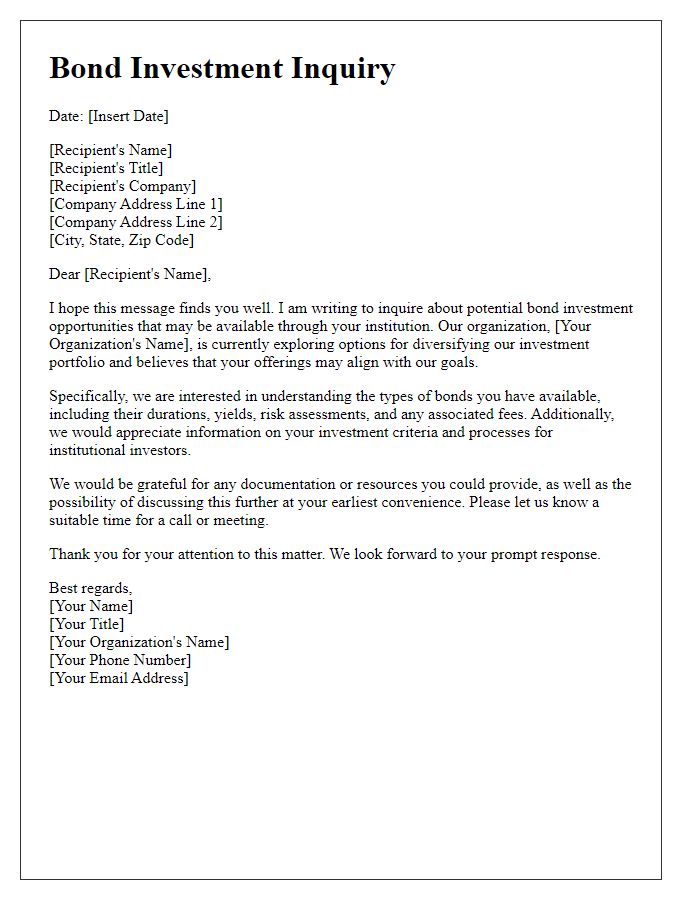

Letter Template For Bond Investment Inquiry Samples

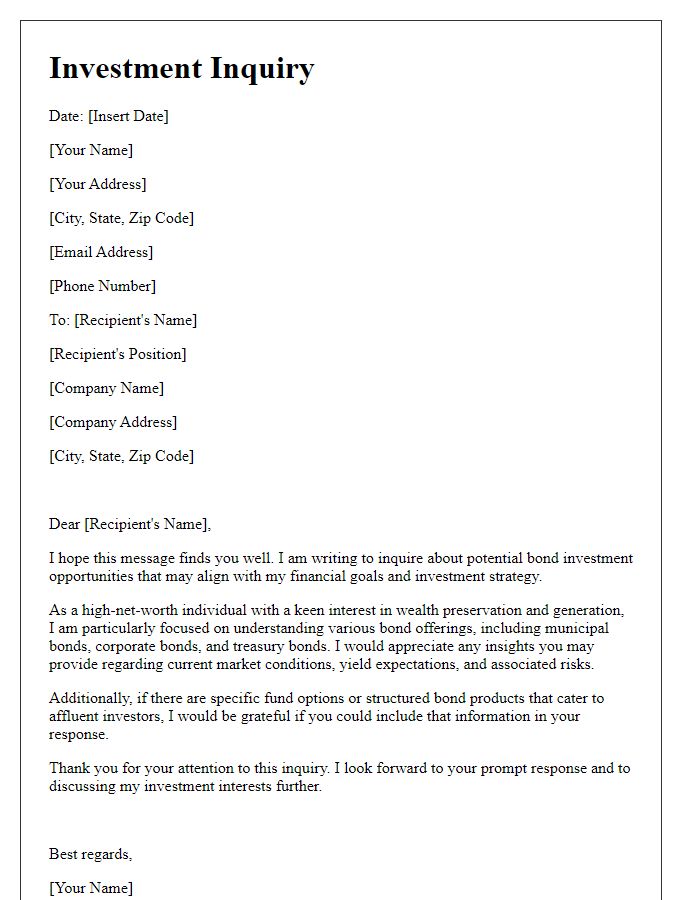

Letter template of bond investment inquiry for high-net-worth individuals

Comments