Are you looking to connect with like-minded impact investors who share your passion for creating positive change? In a world where financial growth can go hand in hand with social responsibility, building a strong network is essential for driving meaningful impact. Whether you're an experienced investor or just starting your journey, understanding how to craft the perfect introduction letter can open doors to valuable partnerships and collaboration. So, let's dive in and explore how you can effectively engage with fellow impact investors!

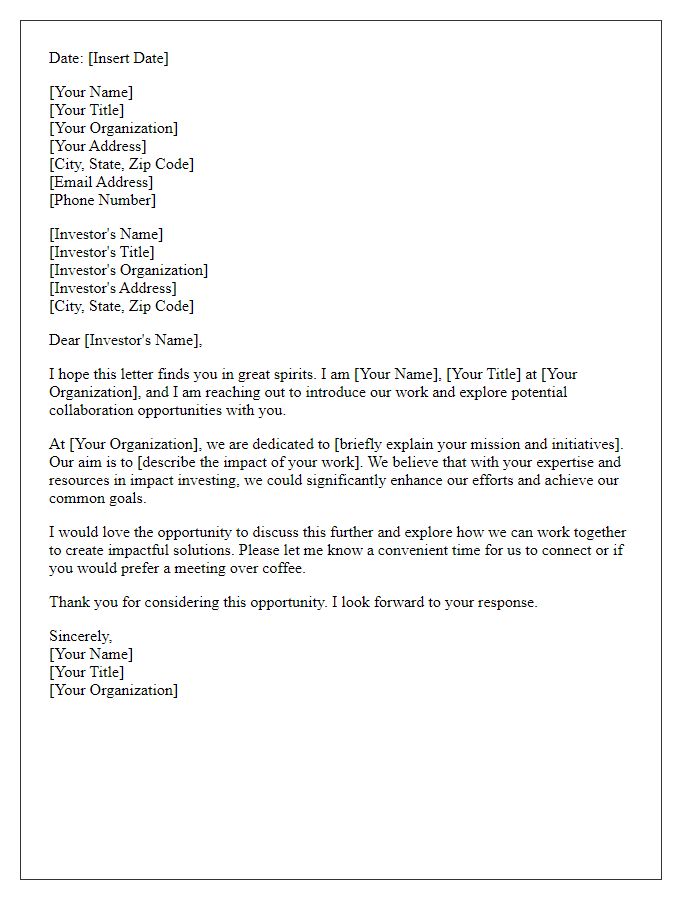

Clear introduction and purpose

Impact investing opportunities have gained significant traction in recent years, with investors increasingly seeking to generate measurable social and environmental benefits alongside financial returns. Networking events, such as the Global Impact Investing Network's (GIIN) annual conference held in New York City, provide a platform for stakeholders to connect, share insights, and explore collaborative ventures. Engaging with like-minded individuals and organizations that prioritize sustainability can enhance one's investment portfolio while contributing to impactful change in communities worldwide. By facilitating partnerships, these networking opportunities foster the exchange of innovative ideas, best practices, and potential investment strategies focused on addressing pressing global issues, such as climate change and poverty alleviation.

Alignment of values and mission

Impact investors prioritize generating social and environmental benefits alongside financial returns. These investors often align with organizations that focus on sustainable development goals, such as poverty alleviation, climate action, and gender equality. Networking events highlight the importance of shared values, bringing together individuals and institutions, such as venture philanthropy funds and non-profit organizations, who seek synergy in their missions. In these settings, discussions often center around innovative solutions, measurable impact metrics, and collaborative approaches to drive change in communities worldwide. Understanding the significance of due diligence in impact measurement can enhance relationships between investors and organizations, fostering long-term partnerships that advance mutual objectives.

Highlight of successful projects and impacts

Successful impact projects have demonstrated significant contributions to sustainable development across various sectors. One such initiative, the Solar Empowerment Program in rural India, installed over 10,000 solar panels, providing electricity access to approximately 50,000 individuals, thus reducing reliance on fossil fuels. Additionally, the Clean Water Initiative in sub-Saharan Africa implemented advanced filtration systems in 200 communities, improving water quality for 200,000 residents and decreasing waterborne diseases by 30%. The Urban Green Spaces Project in New York City transformed 15 underutilized lots into vibrant community parks, enhancing air quality, fostering biodiversity, and increasing local property values by 10%. Each project not only addresses critical social and environmental issues but also creates pathways for economic growth and community resilience, showcasing the potential for scalable impact investments.

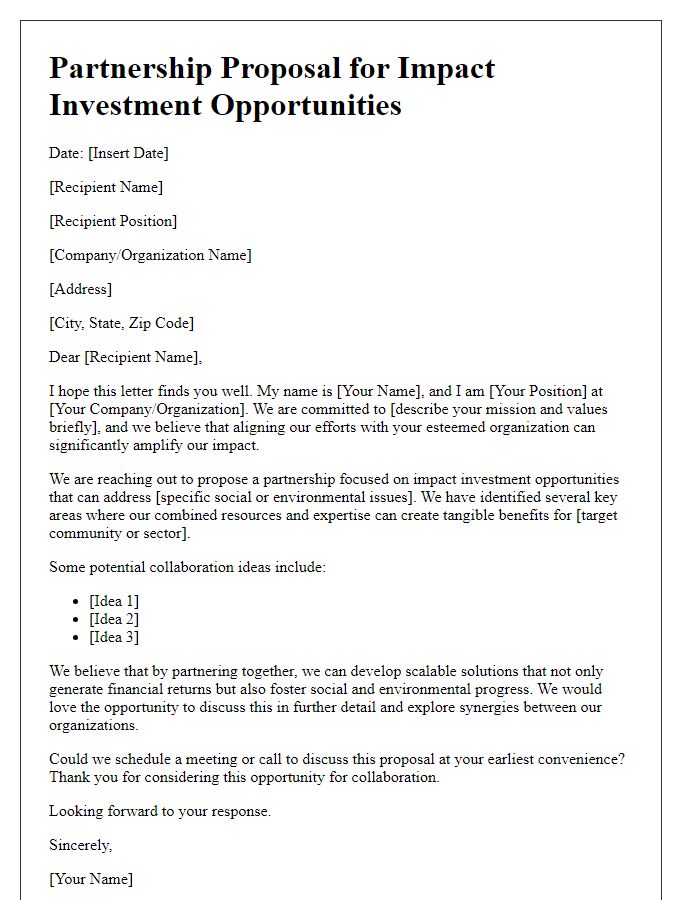

Specific call to action or collaboration proposal

Impact investors often seek opportunities that align with their values and generate measurable social or environmental benefits. By proposing a collaboration centered around sustainable projects such as renewable energy initiatives, social entrepreneurship ventures, or community development programs, organizations can attract attention. Engaging stakeholders in discussions about innovative financing solutions and equity investments in areas like clean technology or affordable housing can pave the way for impactful partnerships. Formulating specific metrics for success and articulating a clear vision for positive societal change are crucial for gaining traction among potential collaborators in the investment landscape.

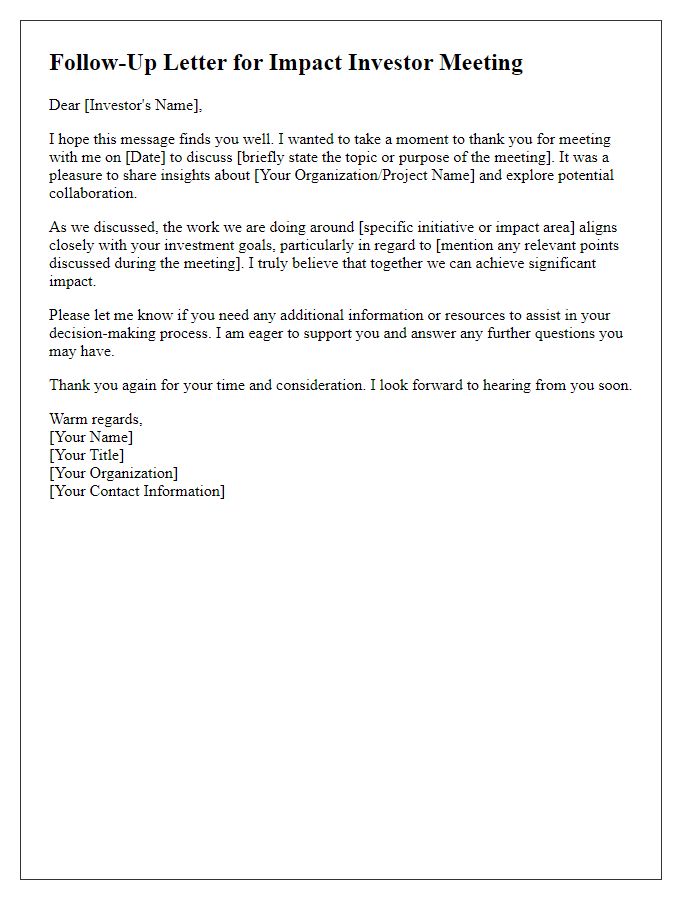

Contact information and follow-up plan

Impact investors seek to generate positive social and environmental outcomes alongside financial returns. Effective networking can enhance relationships and opportunities within this sector. Contact information should include professional titles, organization names, phone numbers, and email addresses to facilitate communication. A follow-up plan is crucial, encompassing timelines (such as one week), preferred communication channels (like email or LinkedIn), and specific topics of discussion (such as shared investment interests or previous discussions) to ensure relevant engagement. Additionally, noting any upcoming industry events, such as conferences in cities like New York or San Francisco, can provide motivation for timely follow-ups. This structured approach establishes a clear strategy for sustainable connections within the impact investing ecosystem.

Letter Template For Impact Investor Networking Samples

Letter template of partnership proposal for impact investment opportunities

Comments