Are you seeking the perfect template for an international insurance request letter? Crafting a clear and concise letter can make all the difference in getting the coverage you need while traveling abroad. In this article, we'll explore key components that should be included to effectively communicate your needs to insurance providers. So, let's dive in and discover how to make your request stand out!

Sender's contact information

International insurance requests often require specific sender information for effective communication. This includes full name (first and last), address (street, city, state, postal code, country), email address (providing a reliable method for correspondence), and telephone number (essential for urgent inquiries or clarifications). Documentation should clearly present the sender's information at the top, ensuring it's easily identifiable by the insurance provider. Including a date is also crucial for record-keeping and tracking the timeline of the insurance request process.

Specific insurance coverage needed

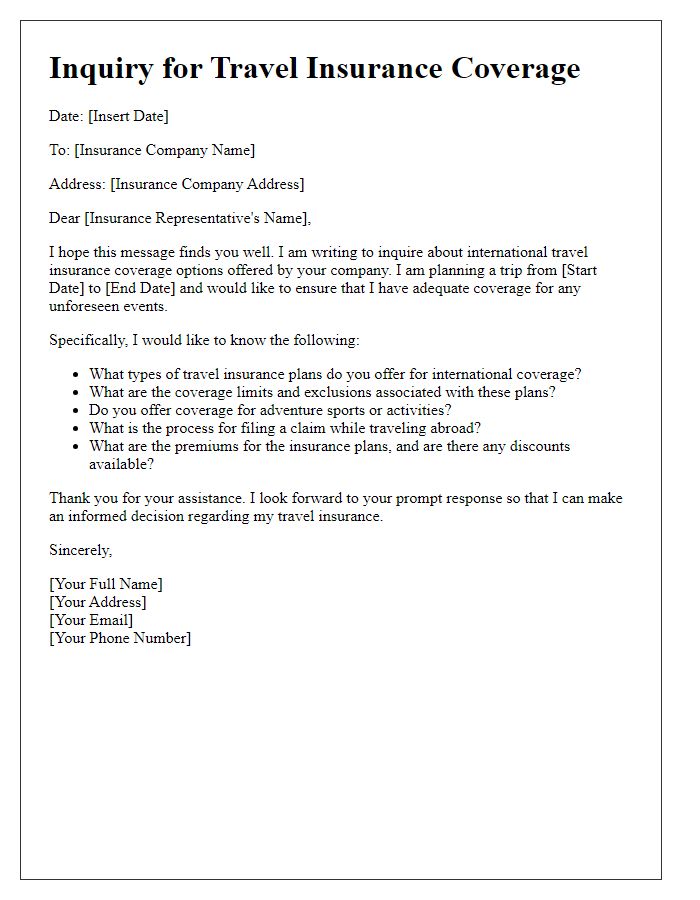

Requesting international insurance coverage often necessitates clarity regarding the specific policy needs and geographical considerations. International travelers might require health insurance that meets or exceeds local regulations in destinations like the European Union or specific countries like Japan, while also accommodating emergency medical evacuation and repatriation provisions. In addition, businesses engaging in overseas operations might seek liability insurance to cover potential legal claims arising from their activities. Such insurance plans should incorporate worldwide coverage, ensuring protection against natural disasters, theft, or loss of property in diverse locations like South America or Southeast Asia. Understanding the nuances of policy terms, including coverage limits and exclusions, is crucial when selecting suitable international insurance options.

Details of the insured item/person

The comprehensive insurance request form requires precise information regarding the insured item, such as item type (like a luxury vehicle, valuable artwork, or commercial property), designated value (monetary worth proven through appraisals), and unique identifiers (VIN, serial numbers, or provenance certificates). Furthermore, if applicable, details of the insured person (age, profession, and location) must be included to assess risk factors properly. Additionally, include the insurance policy number, coverage dates (start and expiry), and any previous claims history to facilitate a thorough review of the request. Each piece of detailed data aids in ensuring adequate coverage for international contexts.

Duration and geographical scope of coverage

International insurance requests require clarity regarding the duration and geographical scope of coverage. Standard coverage durations range from short-term travel policies (up to 90 days) to long-term international health insurance plans (for periods exceeding a year). Geographical scope often includes distinct regions, such as worldwide coverage, which offers protection across all countries, or specific areas like Europe, Asia, or North America. Key factors influencing these aspects include travel itinerary, duration of stay in each location, and potential risks associated with certain regions, such as political instability or health concerns. Premium rates typically vary based on duration and geographical restrictions, impacting the overall policy costs. Understanding these elements is crucial for tailored insurance solutions that meet individual travel or expatriate needs.

Attaching relevant documentation or records

When filing an international insurance request for coverage, attaching relevant documentation is crucial. Essential documents include proof of identity such as a government-issued ID or passport, claim forms clearly outlining the nature of the claim, medical records detailing the treatment received or the incident that occurred, and invoices from healthcare providers or service suppliers reflecting costs incurred. For travel-related claims, attaching boarding passes, itineraries, and any police reports filed can strengthen the request. Additionally, documentation such as photographs of the incident or loss can provide further evidence to support the claim. Ensuring that all records are clear, legible, and organized will facilitate a smoother claims process with the insurance provider.

Letter Template For International Insurance Request Samples

Letter template of international insurance application for expatriate health.

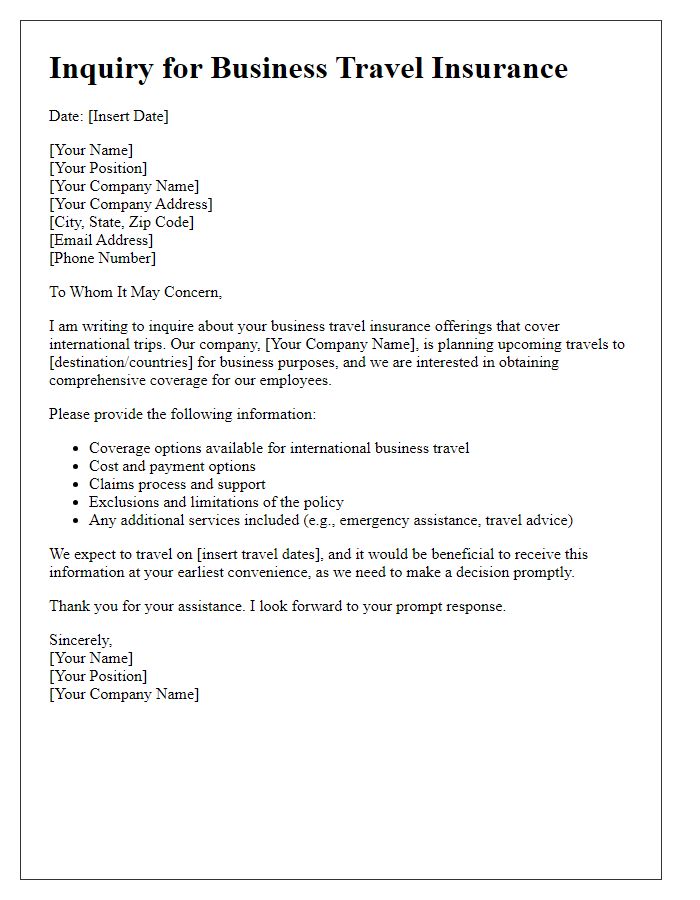

Letter template of international insurance request for student travel insurance.

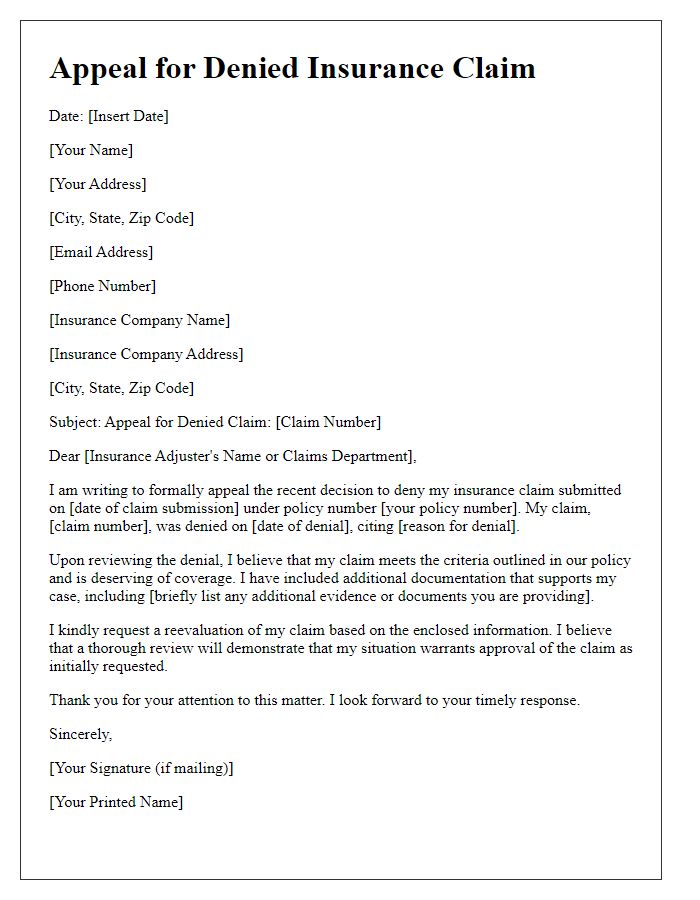

Letter template of international insurance claim submission for overseas incidents.

Letter template of international insurance renewal notification for policyholders.

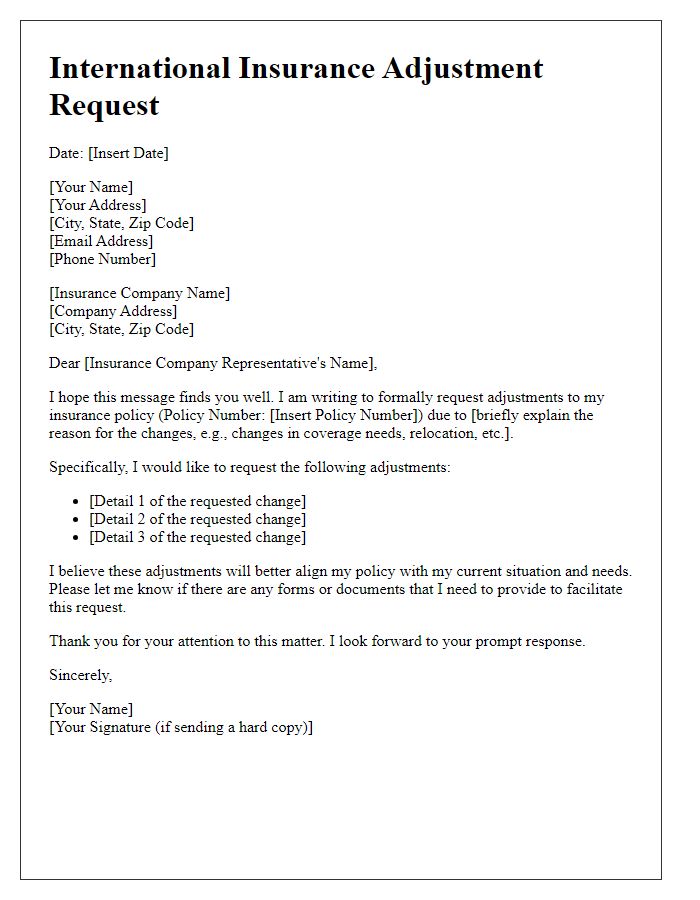

Letter template of international insurance adjustment request for policy changes.

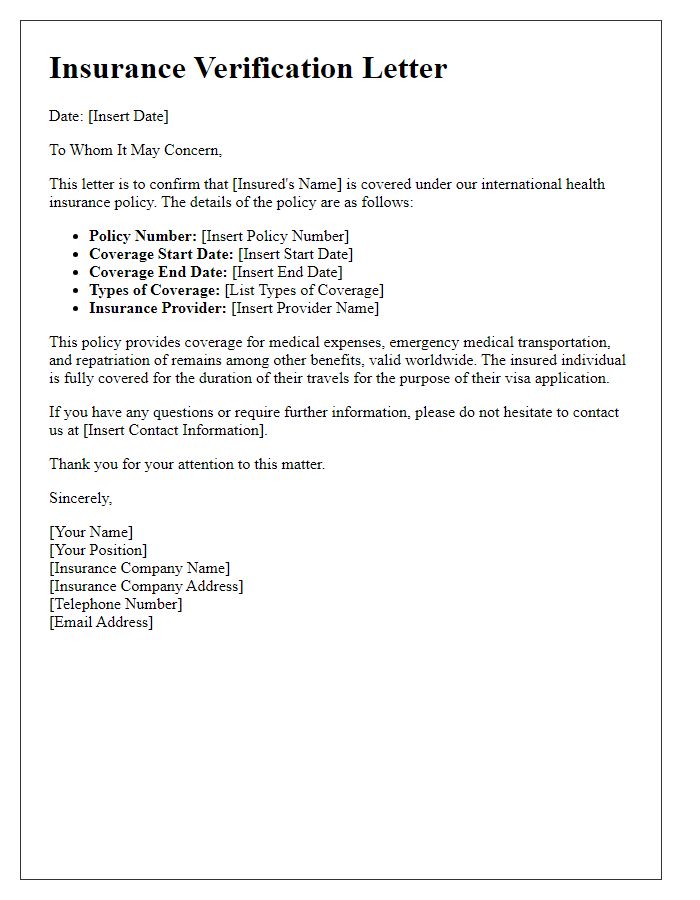

Letter template of international insurance verification for visa applications.

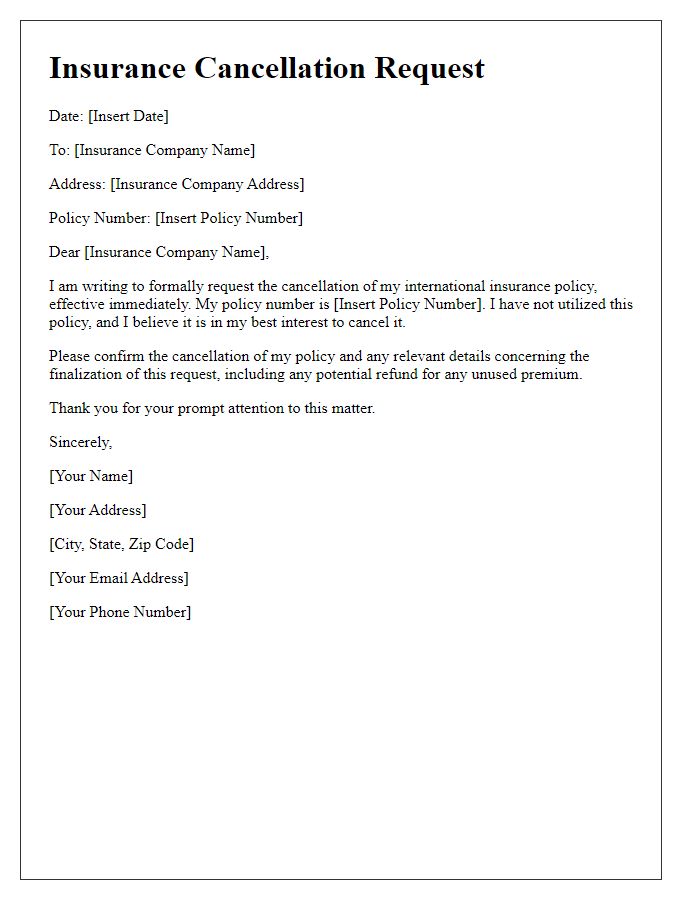

Letter template of international insurance cancellation request for unused policies.

Comments