Hey there! We understand that receiving a notice about a premium increase can be a bit concerning, but we're here to shed some light on why this may happen. Factors like changes in the industry, healthcare costs, or adjustments in benefits can lead to adjustments in your premium. We're committed to being transparent and ensuring you feel informed, so we invite you to read more about the details and what this means for you.

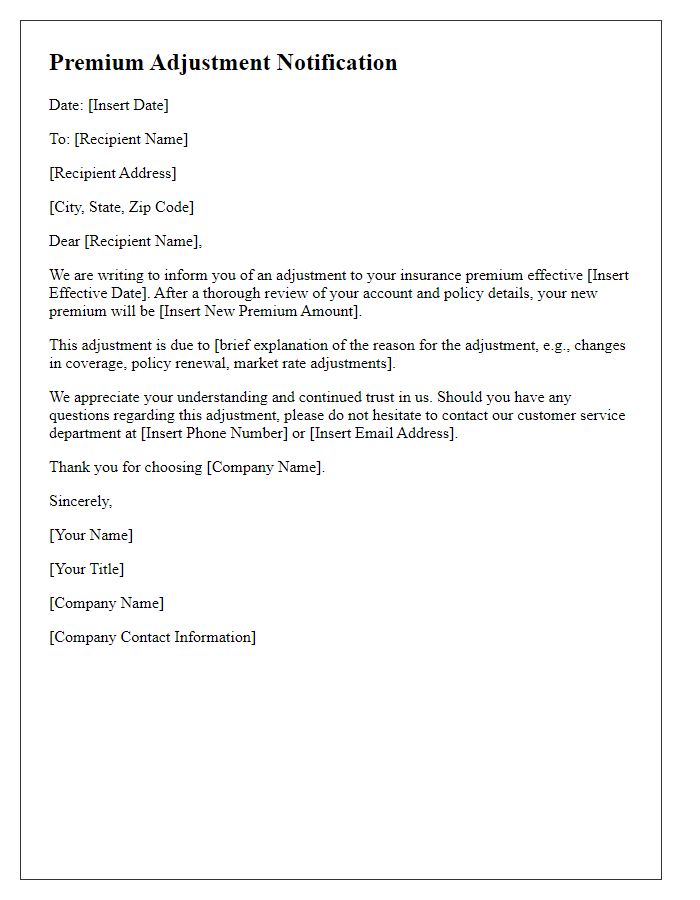

Personalization and Recipient Details

A premium increase can significantly impact policyholders, particularly in comprehensive insurance plans such as auto or health coverage. Insurers often determine premium adjustments following detailed analyses of claims data, risk assessments, and market trends. Factors influencing these changes include rising medical costs, accident frequency rates, and regional risk evaluations in specific geographical areas, such as urban environments with higher crime rates. Timely communication regarding premium adjustments is essential, often conducted through personalized letters that explain the reasons behind the increase, thereby fostering transparency and trust between the insurer and the insured. This correspondence typically includes recipient details, such as policy numbers and coverage specifics, providing clarity about the policyholder's unique situation.

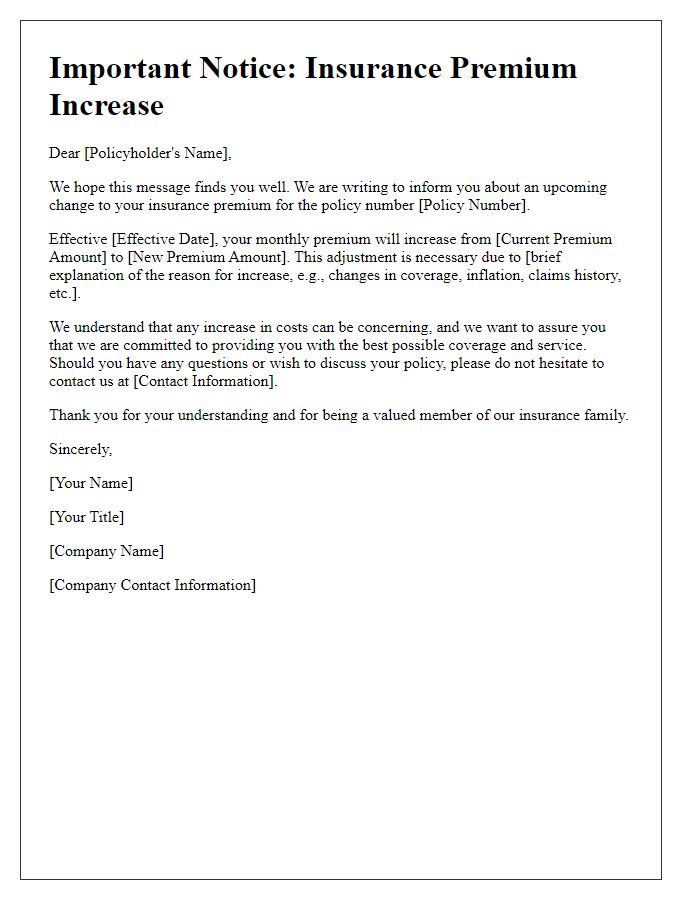

Clear Explanation for Increase

Insurance premium increases often result from various factors impacting the overall risk landscape. Claims data shows significant rises in natural disasters, especially hurricanes and wildfires, which have surged by 30% over the past decade. Insurers analyze trends, such as rising replacement costs for homes in California's wildfire-prone areas, contributing to adjustments in policy pricing. Regulatory changes may require higher reserves to ensure financial stability, influencing overall premium calculations. Additionally, increased fraud cases reported nationally have led to heightened security measures and risk assessment protocols, ultimately affecting premiums. These elements combined necessitate periodic adjustments, ensuring policyholders receive comprehensive coverage aligned with evolving risks.

Justification and Value Proposition

Homeowners insurance premium increases often stem from various factors that affect overall insurance costs. For instance, inflation rates can lead to higher rebuilding costs after a disaster, impacting coverage amounts. Additionally, regional risks, such as a rise in natural disasters (hurricanes, wildfires) in specific areas like California or Florida, can contribute to premium adjustments. Furthermore, insurer losses during catastrophic events may necessitate a premium increase to maintain financial stability. Enhanced coverage options or additional services, such as 24/7 claims assistance or access to disaster recovery experts, can provide added value to policyholders. Staying informed about these changes ensures homeowners understand the reasons behind premium adjustments and the benefits they continue to receive.

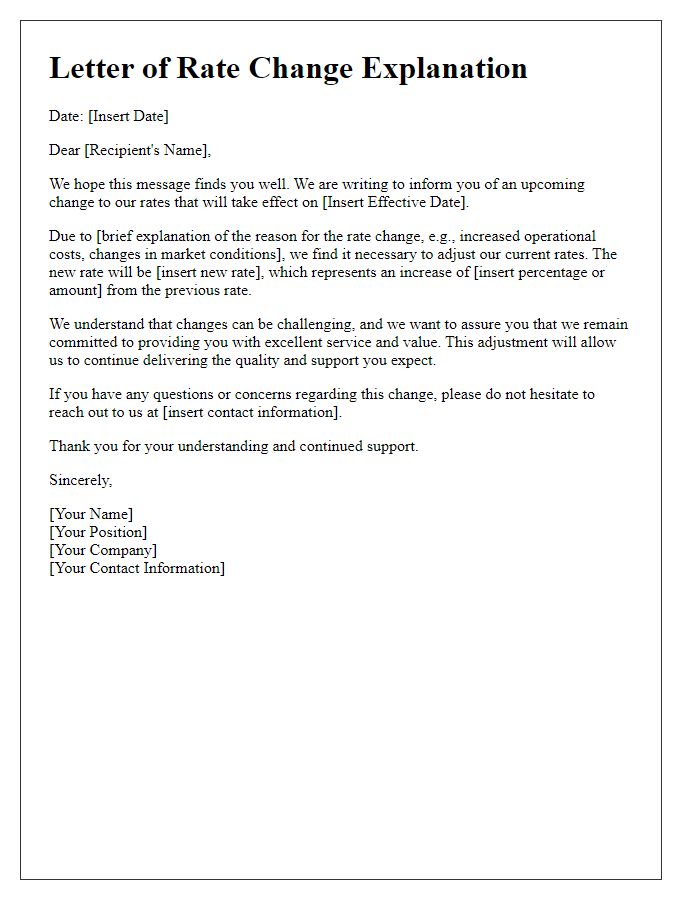

Transparency and Trust-Building

Insurance premium increases can arise from various factors, including changes in risk assessment, claims history, and market conditions. Customers must understand the rationale behind adjustments in their premium rates to maintain transparency and trust. Effective communication should outline specific reasons for the increase, such as rising repair costs in automotive insurance or higher medical expenses in health plans. Detailing statistical data, such as national claim trends and inflation percentages, fosters confidence in the company's policies. Providing personalized examples, like changes in local crime rates affecting homeowner's insurance premiums, can illustrate the direct impact of these factors. Ensuring clear channels for customer inquiries also enhances satisfaction and reinforces reliability in service.

Call to Action and Support Information

Premium increases often arise due to various factors impacting insurance companies, such as rising claim costs or changes in state regulations. It is essential for policyholders to review their insurance policies regularly and understand how factors like personal circumstances, location, and market trends influence coverage costs. For assistance, consider reaching out to customer support at your insurance provider, where knowledgeable representatives can guide you through your options. Additionally, utilizing online resources or forums dedicated to insurance-related queries may provide valuable insights and advice. Taking proactive steps to evaluate your coverage can help ensure that you maintain adequate insurance while managing costs effectively.

Comments