Are you feeling a bit confused about overlapping coverage in your insurance policies? You're not alone! Many people find it tricky to decipher what it means and how it could impact their financial protection. Dive into the article to uncover valuable insights and tips that will help you navigate this complex topic with ease!

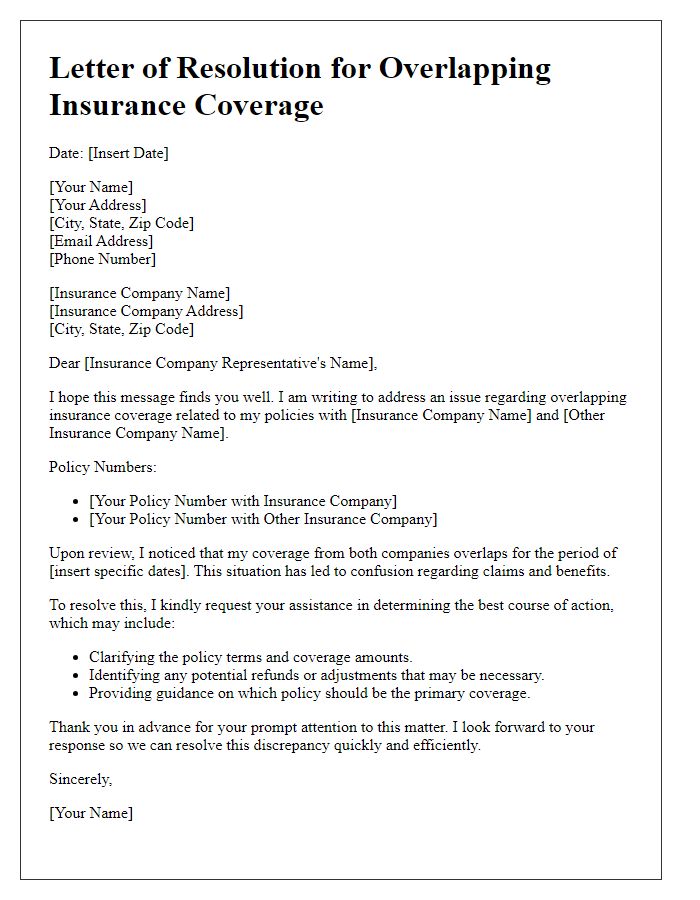

Policy Details and Identification Information

Overlapping coverage refers to insurance policies that provide redundant protections for the same risk, such as home or auto insurance. For instance, if two policies cover a specific asset (e.g., a vehicle valued at $20,000), both insurers may respond in case of a loss, leading to potential disputes over liability in claims. This situation could evolve when multi-policy discounts (common in comprehensive packages) create confusion over which coverage is primary, often complicating claims adjustments. It's essential for policyholders to be aware of their policy limits (amounts covered) and exclusions (specific situations not covered) to evaluate their insurance costs efficiently. Additionally, identifying which insurer (e.g., State Farm, Allstate) provides primary coverage can streamline the claims process and mitigate delays caused by overlapping policies.

Explanation of Overlapping Coverage

Overlapping coverage occurs when a policyholder possesses multiple insurance policies that provide similar protection for the same asset or risk, typically leading to redundancy. This situation often arises in health insurance, where individuals may have coverage from both an employer-sponsored plan and a private policy. In such cases, the primary coverage is used first, with any expenses that exceed coverage limits potentially addressed by the secondary policy. However, specific coordination of benefits rules (often dictated by insurers or state regulations) can determine which policy pays first, ensuring no entity pays more than the overall loss amount. Understanding overlapping coverage minimizes the risk of denied claims and maximizes the benefits received. Furthermore, evaluating policies thoroughly avoids unnecessary premium payments and ensures that viable coverage aligns seamlessly with primary needs.

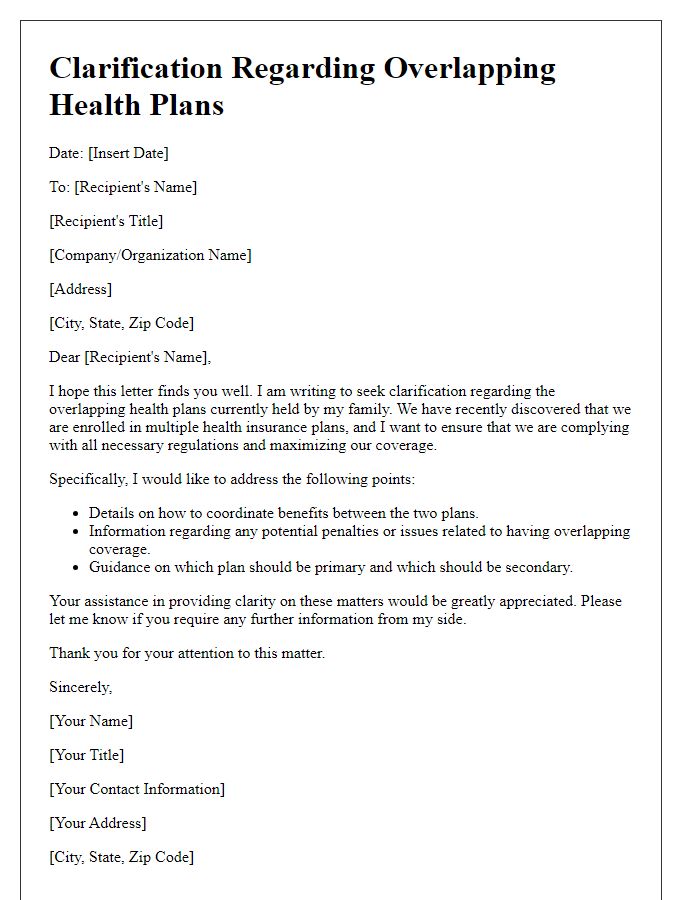

Impact on Benefits and Claims

Overlapping insurance coverage can significantly impact the benefits and claims process for policyholders. When individuals possess multiple policies covering the same risks, such as health insurance plans, homeowners insurance, or auto insurance, coordination of benefits becomes essential. For example, if a policyholder has two health insurance plans that both cover hospital visits, the primary insurer may pay a portion of the claim, while the secondary insurer covers additional costs. Specific protocols dictate the sequence in which claims are filed and paid, potentially leading to delays in reimbursement. Additionally, limitations or exclusions may arise from one policy affecting the overall benefits received. Understanding the implications of overlapping coverage helps policyholders navigate the complexities of insurance claims and ensures they maximize their benefits efficiently.

Specific Dates and Duration of Overlap

The overlap of insurance coverage can significantly affect policyholders, especially during specific periods. For example, if an individual holds two health insurance policies from January 1, 2023, to March 31, 2023, the overlap spans three months. In such scenarios, the primary policy, often the one active longest, may cover most expenses, while the secondary policy can supplement costs. The duration of this overlap is crucial when understanding co-pays, deductibles, and out-of-pocket maximums. Accurate documentation of both policies during this overlapping period can ensure proper claims processing and maximize benefits for the insured.

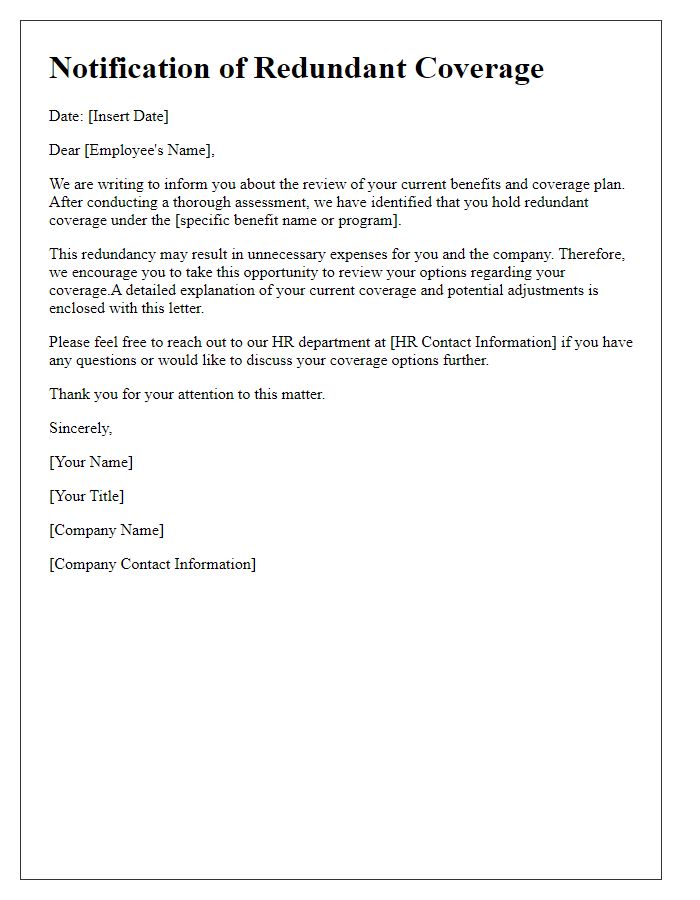

Contact Information for Further Assistance

Overlapping insurance coverage can lead to confusion for policyholders regarding benefits and claims processes. Policyholders should carefully review their insurance agreements, such as homeowner's insurance or auto insurance, which may provide similar coverage. In instances of overlapping policies, understanding coordination of benefits is crucial to ensure that claims are processed efficiently without duplication. Seeking assistance from customer service representatives can clarify any misunderstandings and provide necessary support. Contact numbers for insurance providers are often found on official websites or policy documents, facilitating direct communication for resolution of coverage issues.

Comments