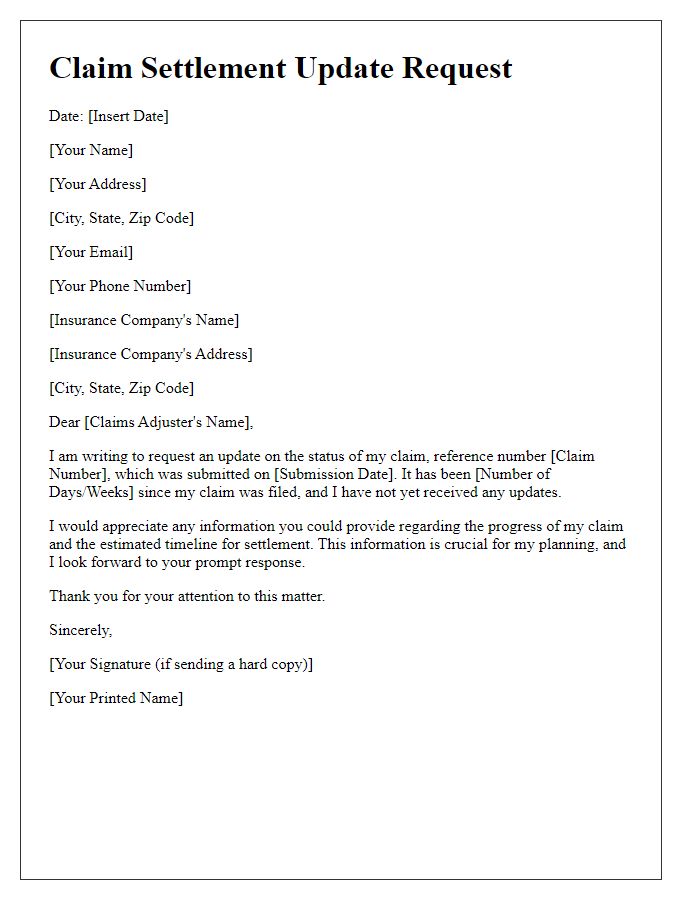

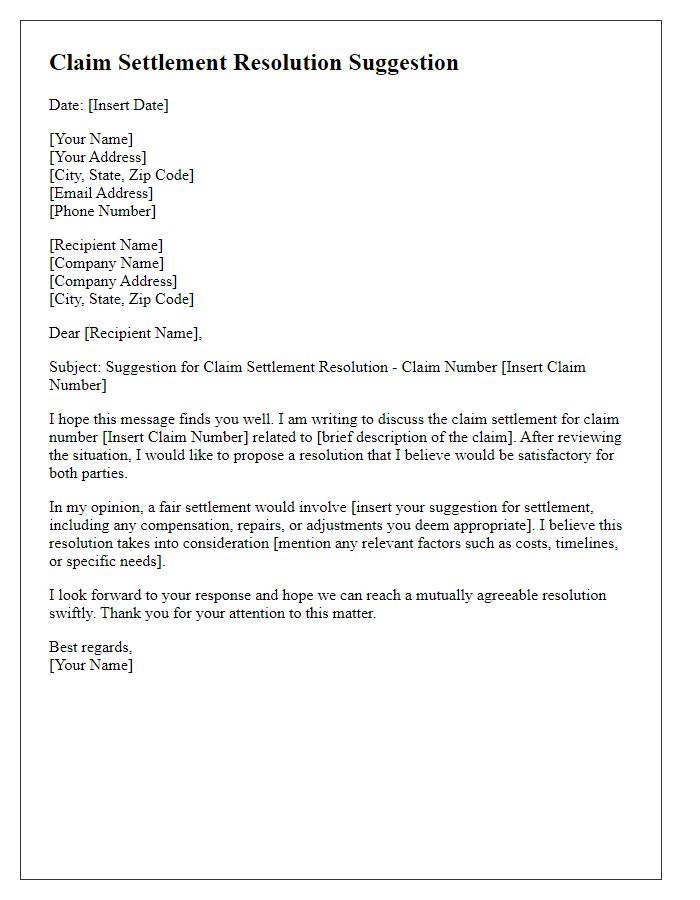

Navigating the world of claim settlements can feel overwhelming, but having a solid letter template on hand can make the process much smoother. This simple yet effective tool not only allows you to clearly articulate your position but also helps you maintain a professional tone throughout your negotiations. Whether you're seeking a resolution for an insurance claim or a contractual dispute, a well-crafted letter ensures that your points are communicated effectively. Ready to learn how to create your own negotiation letter? Keep reading!

Claim Reference Details

In insurance negotiation processes, claim reference details serve as a vital communication tool for consumers seeking reimbursement or compensation. Claim reference numbers, typically unique alphanumeric codes assigned by insurance companies upon filing a claim, facilitate efficient tracking and management of claims. These identifiers enable both parties--policyholders and insurers--to quickly locate pertinent information regarding the claim, including dates of loss, incident reports, and claim amounts. For instance, a claim involving property damage due to a natural disaster, such as Hurricane Katrina in 2005, would require meticulous documentation to support the settlement negotiations. Detailed information such as policy limits, coverage specifics, and associated timelines greatly enhance the chances of a favorable claim settlement outcome. Ensuring clarity in communication regarding claim reference details is pivotal for establishing a mutually agreeable resolution between the claimant and the insurer.

Description of Incident

The incident occurred on September 15, 2023, when a severe thunderstorm struck downtown Chicago, Illinois, leading to significant property damage in various locations, especially in the financial district. High winds exceeding 60 mph uprooted trees and damaged several commercial buildings, resulting in broken windows and compromised roofs. This intense weather event also caused widespread flooding, particularly affecting the basement areas of multiple businesses including the historic State Street retail corridor. In total, an estimated 250,000 residents lost power, exacerbating the urgency of damage assessments and repairs. The aftermath revealed structural integrity concerns, necessitating immediate inspections by licensed contractors to ensure safety for residents and employees alike.

Supporting Documentation

The claim settlement negotiation process necessitates robust supporting documentation to ensure a smooth and transparent evaluation. Essential documents may include incident reports (detailing circumstances surrounding the claim), photographic evidence (showing damage, such as vehicle impacts or property destruction), and medical records (if injuries are involved, highlighting the extent and treatment). Additionally, invoices or receipts (confirming costs related to repairs or loss) are critical for establishing financial impact. Insurance policy documents (outlining coverage terms) should accompany the evidence to clarify the validity of the claim. Correspondence records (between parties) documenting communications are also vital for demonstrating timelines and mutual agreements. These supporting elements create a compelling case for claim approval during the negotiation process.

Compensation Request

A compensation request for a claim settlement negotiation often arises after an incident resulting in financial loss. This process typically involves discussions between the claimant and the insurance company or responsible party, aiming to reach an amicable agreement. The claimant must present documentation, including incident reports, medical bills, property damage assessments, and any relevant photographs. The amount requested should be clearly outlined, often based on a detailed calculation of losses incurred, which may include lost wages, repair expenses, and medical costs. It is crucial to maintain a professional tone throughout the negotiation to facilitate a constructive dialogue aimed at fair compensation.

Contact Information for Further Communication

In the process of claim settlement negotiation, providing clear contact information is essential for enhancing communication efficiency. Key details include the representative's name and title (such as Claims Adjuster), company name (e.g., XYZ Insurance Co.), and direct telephone number (including area code, for example, (123) 456-7890). Additionally, the email address (e.g., claims@xyzinsurance.com) should be included for digital correspondence. Specifying availability hours (for example, Monday to Friday, 9 AM to 5 PM) can facilitate timely responses. Retaining a professional tone and confirming the mailing address for physical documents, such as 123 Main Street, Springfield, IL 62701, supplements the clarity and accessibility of communication channels.

Comments