Are you a homeowner looking to protect your assets and secure peace of mind? Homeowner liability insurance is a crucial aspect of safeguarding your property from unexpected incidents. This coverage not only protects you against potential lawsuits but also ensures that you can confidently welcome friends and family into your home. Curious to learn more about how you can effectively manage your homeowner liabilities?

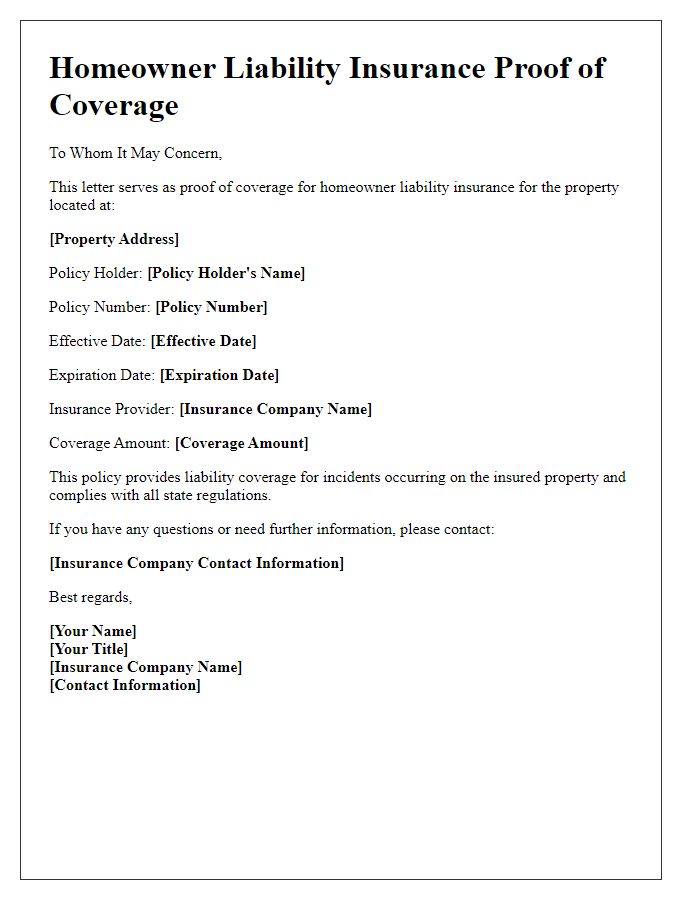

Policy Coverage Details

Homeowner liability insurance provides essential financial protection for property owners against legal claims for injuries or damages occurring on their premises. Coverage typically includes bodily injury protection, which may cover medical expenses and legal fees resulting from accidents involving visitors or trespassers. Additionally, personal property damage protection covers repairs or replacements needed due to accidental incidents, vandalism, or natural disasters like hurricanes. Coverage limits can vary widely, with many policies offering limits between $100,000 and $1 million. Homeowners should consider endorsements for additional coverage, such as higher limits for specific risks like dog bites or swimming pool accidents. Furthermore, liability coverage extends beyond the property itself, offering protection for incidents that occur off-premises, such as a guest injured during a party hosted at a public park. Understanding the nuances of one's policy is crucial for ensuring comprehensive protection against unexpected liabilities.

Liability Limits and Terms

Homeowner liability insurance provides financial protection against claims of bodily injury or property damage occurring on your property. Standard liability limits often start at $100,000, with many homeowners opting for $300,000 or $500,000 to ensure adequate coverage for potential legal expenses and settlements. Specific policy terms usually include exclusions such as intentional damage, business activities conducted on the premises, and certain types of dog breeds. Additionally, the coverage may extend to incidents occurring beyond the property boundaries, such as injuries sustained by guests when you are hosting events like parties or barbecues. Understanding these limits and terms is crucial for ensuring peace of mind as a homeowner, safeguarding both your assets and financial well-being against unforeseen accidents and legal claims.

Exclusion Clauses

Homeowner liability insurance offers crucial protection for property owners against potential legal claims arising from accidents or injuries on their premises. However, exclusion clauses delineate specific scenarios where coverage may not apply, highlighting potential gaps. Common exclusions include incidents involving intentional acts, injuries sustained by residents, or damage resulting from neglect in property maintenance. Certain high-risk activities, such as operating a home-based business or owning exotic pets, may also fall outside the policy's protection. Understanding these exclusions is vital for homeowners to ensure adequate coverage and anticipate potential litigation risks.

Premium Payment Instructions

Homeowner liability insurance provides essential financial protection against property damage and personal injury claims. Annual premiums for policies typically range from $300 to $1,000, depending on the coverage amount and property location. Payments can usually be made through various methods, including online payment portals, automatic bank drafts, or traditional checks mailed to the insurance provider's headquarters, often found in key cities like Chicago or New York. Policyholders should ensure timely premium payments to avoid lapses in coverage, which can expose them to potential financial risks from accidents or damages occurring on their property. Additionally, some insurers may offer discounts for bundling policies or having a claims-free history.

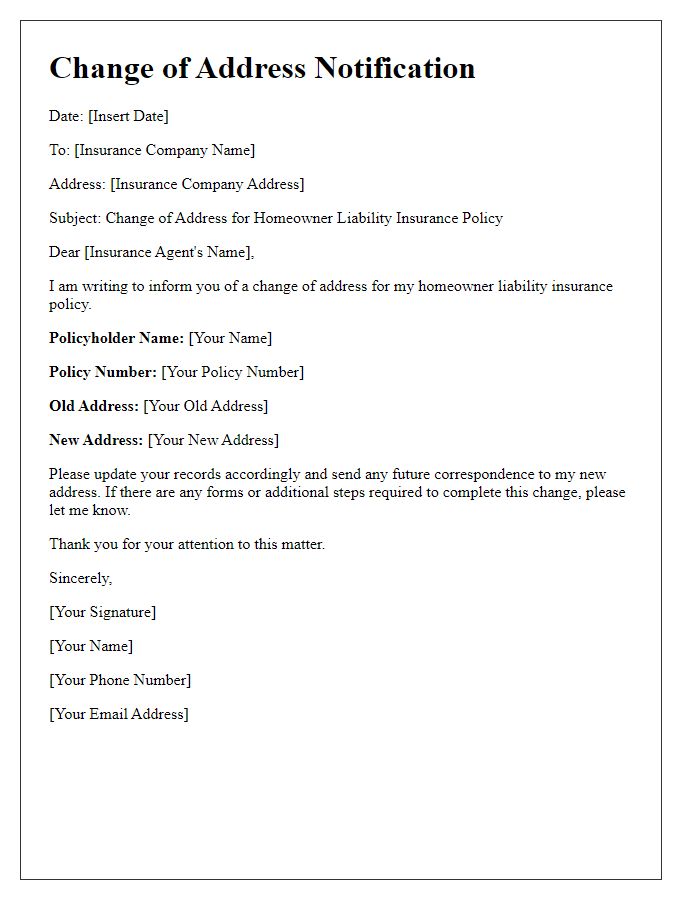

Claims Process and Contact Information

Homeowner liability insurance provides essential protection against potential claims arising from injuries or damages that occur on a policyholder's property, such as slip-and-fall accidents or dog bites. The claims process generally involves notifying the insurance provider promptly after an incident, documenting details such as the date, time, location (address specifics), and nature of the accident. Most major insurers, including State Farm or Allstate, have dedicated claims departments that can be reached via phone or their official websites. Essential contact information typically includes 24-hour helplines and online claims submission portals, allowing for efficient communication. Gathering supporting evidence, such as photographs and witness statements, is crucial in building a strong claim. Coverage limits vary significantly based on the policy, often ranging from $100,000 to $1 million, making it necessary for homeowners to understand their specific terms and conditions.

Comments